INKW trade ideas

inkw chart analysisif we get more news about the sports drink acquisition this could run pretty explanation is charted.

The Barchart Technical Opinion rating is a 100% Sell with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

The market is approaching oversold territory. Be watchful of a trend reversal.

AI Rating-

INKW closed up 1.81 percent on Friday, August 20, 2021, on 23 percent of normal volume.

The stock exhibited some range contraction during this trading session as price made an NR7 -- narrowest range of the last seven sessions.

Note that the stock is in oversold territory based on its Slow Stochastic indicator (14, 3, 3) -- sideways movement or a bounce should not be unexpected.

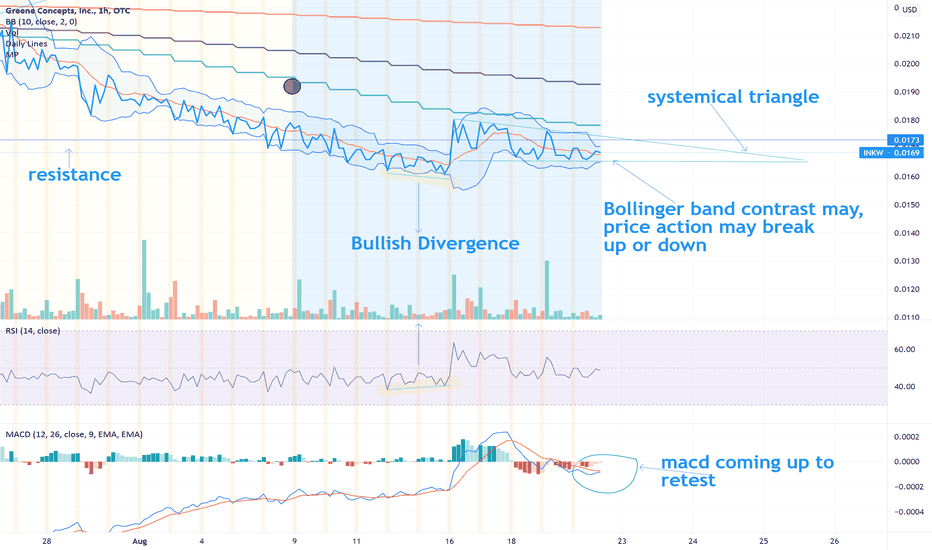

$INKW Chart AnalysisUpon review bullish divergence can be seen when combing rsi with price action which may signal a reversal.

Price action is breaking above Bollinger bands which may signal bullish trend.

ema is coming over sma signaling trend change.

cup pattern is spotted as well

has gone through a healthy pull back, much more to come

The Barchart Technical Opinion rating is a 56% Sell with a Average short term outlook on maintaining the current direction.

be careful trading against trends

INKW - Be Water Gamble Be Water - artisan water. I have personally seen it sold out on Amazon with people screaming for more. Water is a fine commodity and these guys have the source. We live in a world where people will pay for water...the liquid that you can drink out of puddles and probably have the same effect on your body (you might get some shits from it but who cares, we are all fat anyways...)

It literary is less than .02 cents. What if you buy 100,000 shares and it goes to $1/share?

We are all degenerate gamblers so why not gamble with an artisan water source that has perfect Ph levels?

Don't gamble your hard earned cash away unless you really really want to. and always remember - the person click on that buy and sell button is you!

INKW Chart AnalysisUpon review 2 signs of divergence can be seen when combining rsi with price action, both outside and in the overbought/oversold region of the rsi

due to this their should be a change in trend following, this may consolidate due to bear market conditions

-price action is also rising back up to 20sma, a good sign

The Barchart Technical Opinion rating is a 40% Sell with a Average short term outlook on maintaining the current direction.

The market is in highly oversold territory. Beware of a trend reversal.

Be careful trading against trends

Some recent news from a PR source: seeking aplha

Lenny Greene, CEO of Greene Concepts, states, "We are happy to retain the services of Slack & Company CPAs, LLC. We signed an agreement with them to provide a fair and unbiased review of our financial documents from the past three years. This includes our fiscal year balance sheets along with our income, retained earnings and cash flow statements. Their company operates under PCAOB oversight standards to ensure high-quality auditing and professional practice audit standards. This is a significant step for Greene Concepts as we position ourselves for trading on the NASDAQ to provide us with greater awareness, exposure, stability, capital and growth."

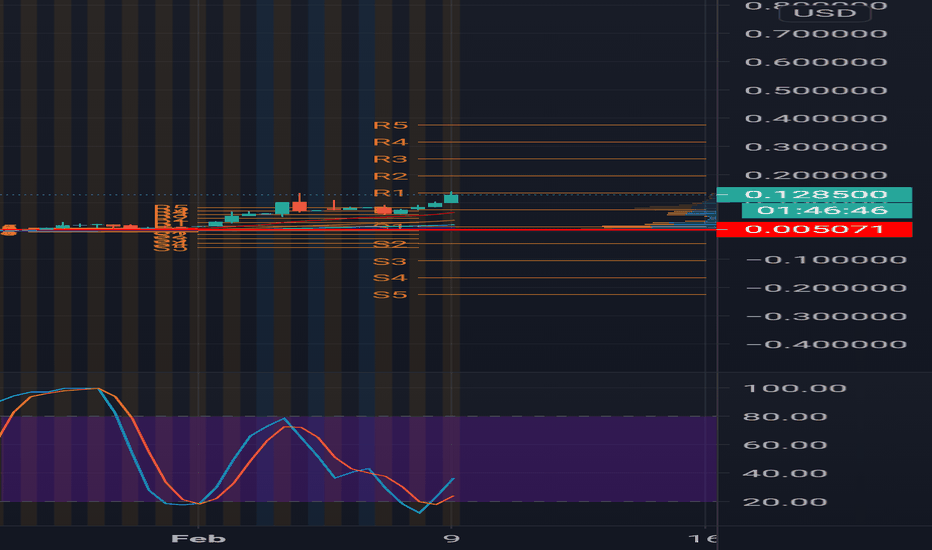

$INKW Bull Pennant (Log) Comes to a Head as Trend BeckonsINKW is sitting in a constructive lateral consolidation following an explosive upward breakout in January. The MA's are rising and RSI is pointing to a bullish relative signal as the bull pennant comes to a head.

Greene Concepts, Inc. (www.greeneconcepts.com) is a publicly traded company.

Through its recently acquired wholly owned subsidiary, Mammoth Ventures Inc., the Company has entered the specialty beverage and bottling business and is an emerging leader in the global scientifically formulated beverage industry.

Through its subsidiary Water Club, Inc. we intend to pursue subscription-based delivery of water and scientifically formulated beverages directly to the consumers home and market the convenience of this service thru social media affiliate marketing partners.

INKW BullishINKW in my opinion is way undervalued. It looks like the correction is over and support found on upward trendline putting in a higher low. The MACD looks to be getting ready to cross back over to continue this uptrend. INKW has placed application in to be up listed to the OTCQB. Their goal is for NASDAQ listing, the CEO knows what he is doing and is making all the right moves.