NVSEF trade ideas

NVS retracingI can see this scenario playing out. A full ABC correction bringing us to a .5 retrace then a nice push up back toward 90. This one seems to be running up on news along in the short term. I am still holding my Fall expiring call options at a $100 strike. in the red right now, but no reason to dump yet.

Holding for now, and might even rebuy once i see the correction waves complete an we start heading back up.

NVS Gaps UPGapped up over the weekend. We tend to have flat days after gap ups overnight. Likely to do the same today. Earnings tomorrow, so that might change things..

Still in Call options right now up a few bucks as of Friday nothing crazy. Confident this thing will break $100 before the end of summer.

Happy with the finish to the weekVery Happy with NVS at the end of trading today getting back above 89. The bounce off of the .618 Fib line looks solid. Earnings come out next week, and in case anyone thought NVS only did COVID19 bullshit.. they do other stuff too. Look at their recent RMAT designation of their drug Kymriah

There are other things happening in the world other than COVID..

Holding Call options for Fall.

Earnings INCOMINGI like this stock.. Front lines of Covid testing so has good name recognition right now which generally causes retail investors to buy driving pricing up. Earnings report comes out in a few days which i am thinking should be higher than anticipated. (beat every quarterly estimate in 2019)

Long long long..

Trading the News on this one.. No real charting on this one.. Grabbed some of this after reading the news about them running the FDA approved study for COVID 19 solutions..

www.bloomberg.com

Also earning come out in about a week which should be up from hydroxychloroquine sales..

Grabbed some June and July Call options here.. Looking for it to carry up towards $95+

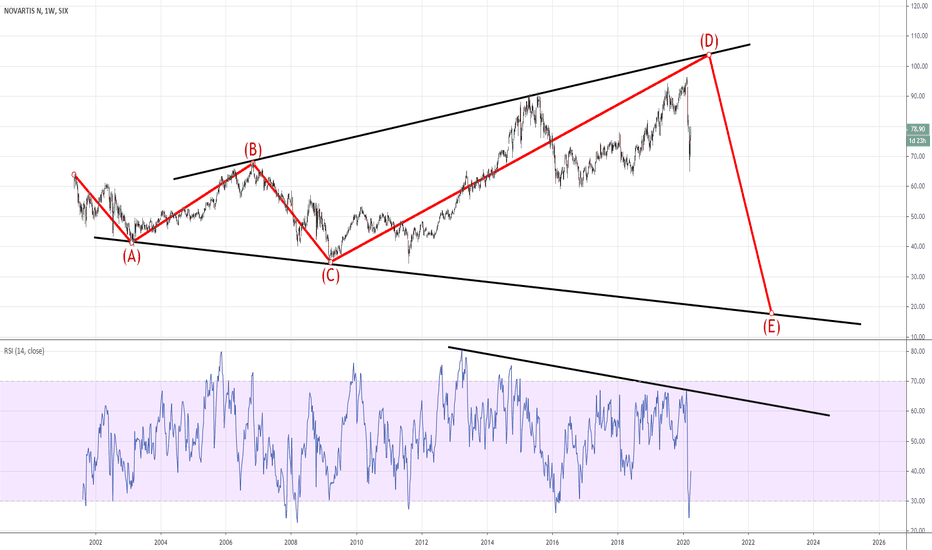

Novartis: Buy opportunity with split entry.NVS was among the high cap losers yesterday on the renewed coronavirus tensions and pulled back dramatically (-6.90%). This however can be the buy opportunity of the next several months as it hit the 1D MA200 (orange line) and is approaching the Higher Low trend line of the 1W Channel Up (RSI = 45.378, MACD = 1.640, ADX = 65.865).

Even though the MACD indicated the possibility of a deeper pull to the 84.00 1W Support before a meaningful rebound, we give equal probabilities for the rebound to start within the Higher Low zone. Our Target zone is 98.00 - 100.00.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.