Phemex Analysis #99: PENGU Explodes 480%!Will the Hype Continue?Pudgy Penguins (PENGU), a playful and increasingly popular meme coin, has recently made waves in the crypto market due to its rapid price movements and strong community support. Originally inspired by the beloved Pudgy Penguins NFT collection, PENGU has rapidly transitioned from niche interest to broader market phenomenon.

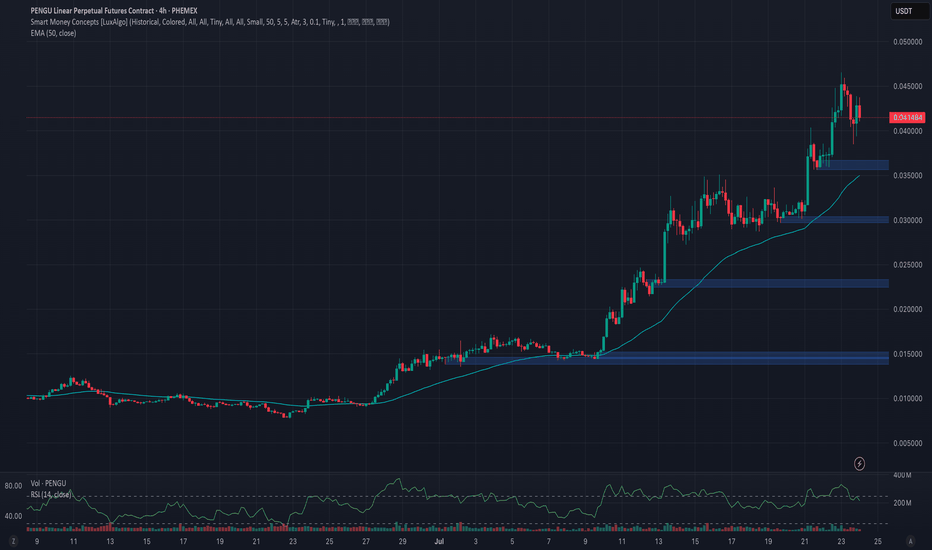

In recent trading, PENGU surged impressively by nearly 480%, primarily fueled by major exchange listings and growing influencer endorsements. Currently trading around $0.041, PENGU has caught the attention of both meme-coin enthusiasts and seasoned crypto traders, sparking debates over its next big move.

With significant market attention and notable volatility, traders now face an essential question: Is PENGU poised for further explosive growth, or should traders brace for a potential pullback? Let's carefully evaluate several likely scenarios.

Possible Scenarios

1. Bullish Breakout (Continuing the Hype!)

PENGU’s recent price action suggests bullish momentum may persist, especially if the community-driven hype continues. A decisive breakout above recent resistance at $0.046—particularly if supported by increasing trading volumes—could accelerate the bullish trend, targeting next levels at $0.05 and possibly the psychological level of $0.08.

Pro Tips:

Entry Strategy: Consider entering positions only after confirmation of a high-volume breakout above $0.046.

Profit-Taking Targets: Plan partial profit-taking around next key resistance zones at $0.05 and $0.08 to manage risk effectively.

Risk Management: Set tight stop-losses just below recent support levels around $0.035.

2. Short-Term Correction (Healthy Retracement)

Given PENGU’s recent rapid rise, a short-term retracement to retest support levels around $0.035 or lower ($0.03) is likely. If this pullback happens on low volume, it could indicate a healthy consolidation rather than a full trend reversal.

Pro Tips:

Buying the Dip: Closely watch support at $0.035 and $0.03; a low-volume test of these levels might provide excellent entry points for traders who missed earlier rallies.

Volume Monitoring: Ensure low-volume retracements—high volume during declines might signal deeper bearish pressure.

3. Bearish Reversal (The Hype Fades)

As is typical with volatile meme coins, sudden reversals can occur if market sentiment swiftly changes. A high-volume drop below critical support around $0.035 could trigger more significant bearish sentiment, potentially targeting deeper support around $0.022 or even $0.0135.

Pro Tips:

Caution on Reversal Signals: Consider exiting or reducing positions if PENGU decisively breaks below key support levels with strong selling volume.

Accumulation Opportunities: Long-term believers might use significant pullbacks toward $0.022 or $0.0135 as strategic accumulation opportunities after price stabilization occurs.

Conclusion

Pudgy Penguins (PENGU) currently sits at an intriguing juncture, offering traders both opportunities and risks. Traders should carefully watch the outlined scenarios, particularly breakout signals above $0.046 and support levels around $0.035 and $0.03. Through disciplined entry and exit strategies, attentive volume analysis, and vigilant risk management, traders can navigate PENGU’s volatility and potentially profit from its next big move.

🔥 Tips:

Armed Your Trading Arsenal with advanced tools like multiple watchlists, basket orders, and real-time strategy adjustments at Phemex. Our USDT-based scaled orders give you precise control over your risk, while iceberg orders provide stealthy execution.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

PENGUUSDT.P trade ideas

PENGUUSDT 50%-150% potentialBINANCE:PENGUUSDT is showing a classic cup and handle breakout on the daily chart, supported by a strong upward move and a bullish structure. Price has successfully broken out of key resistance around 0.0173, and volume is picking up. If momentum continues, the projected target points toward the $0.045 level, suggesting a potential upside of 50%-150%. The setup remains valid as long as price stays above the handle low around 0.0141.

Regards

HExa

$PENGU: Taking Profit and Watching for a TurnIf you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

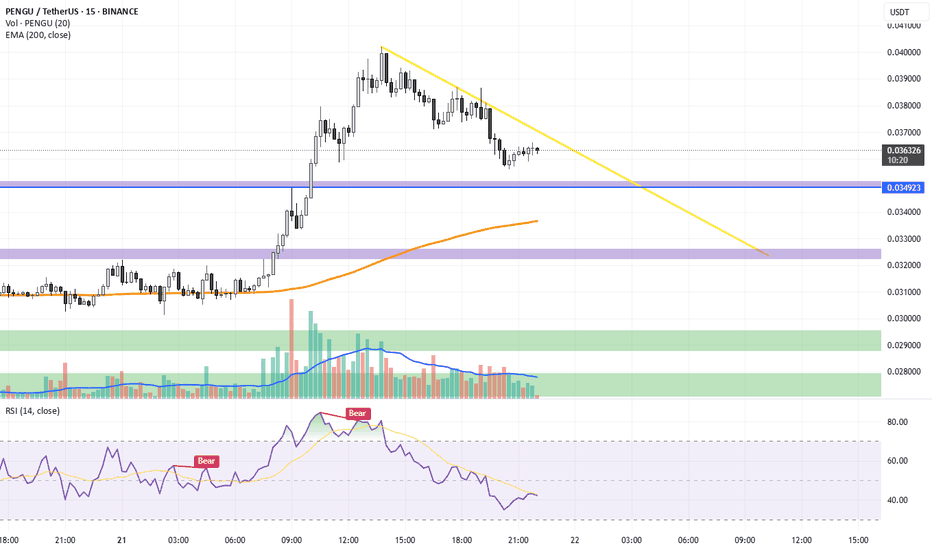

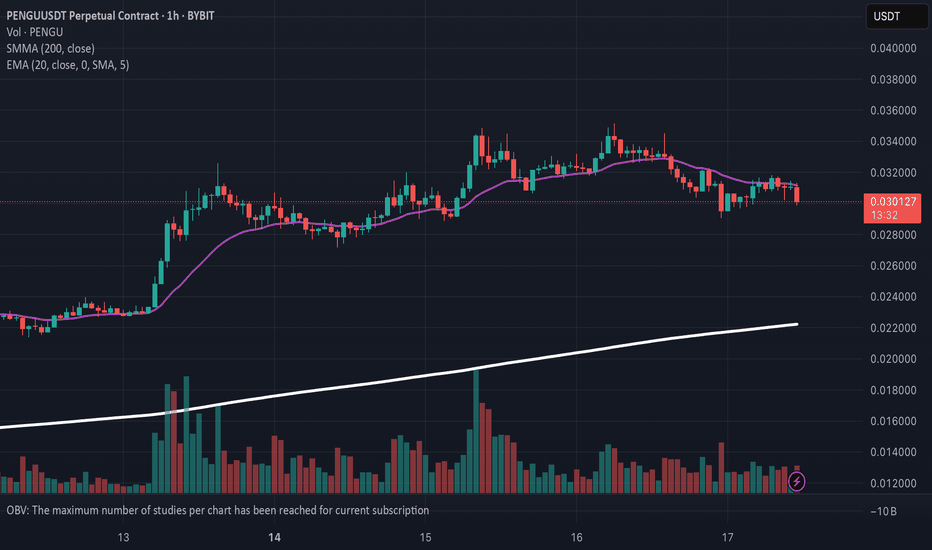

PENGU has made a strong move off the 0.007 level, now it just popped cleanly out of consolidation beneath the key LOI at 0.032. That break gave us the signal we needed for continuation, and so far, the price has followed through nicely.

But now, we’re approaching a zone where things could get a bit trickier.

This advance is starting to look like a classic wave 3 impulse, and while there’s no clear confirmation of a top yet, signs are beginning to flash caution. That means it’s time to start watching for potential topping behavior—especially if we move into a broader consolidation phase.

Here’s what’s on my radar:

• Wave 3 Exhaustion?

Still unconfirmed, but this could be the final leg of the wave 3 structure.

• AOI or Key Level Rejection

A stall or strong reaction near resistance could be a red flag. Channel parallel being reached.

• Bearish Divergence on the EWO

Momentum isn’t keeping pace with price. That’s often a precursor to a deeper pullback.

No need to force the next move here. This thing could just keep ripping up, but I am being extra cautious here. Not only to look for a potential top, but if a retrace is given, a potential long add to my current trade. Taking profit at these levels makes sense, especially given the early entry from 0.012 and my trade plan.

As always, trade what’s printed, not what’s hoped for. Stay nimble.

Trade Safe!

Trade Clarity!

#PENGU #PENGUUSDT #PENGUINS #LONG #AMD #PO3 #Analysis #Eddy#PENGU #PENGUUSDT #PENGUINS #LONG #AMD #PO3 #Setup #Analysis #Eddy

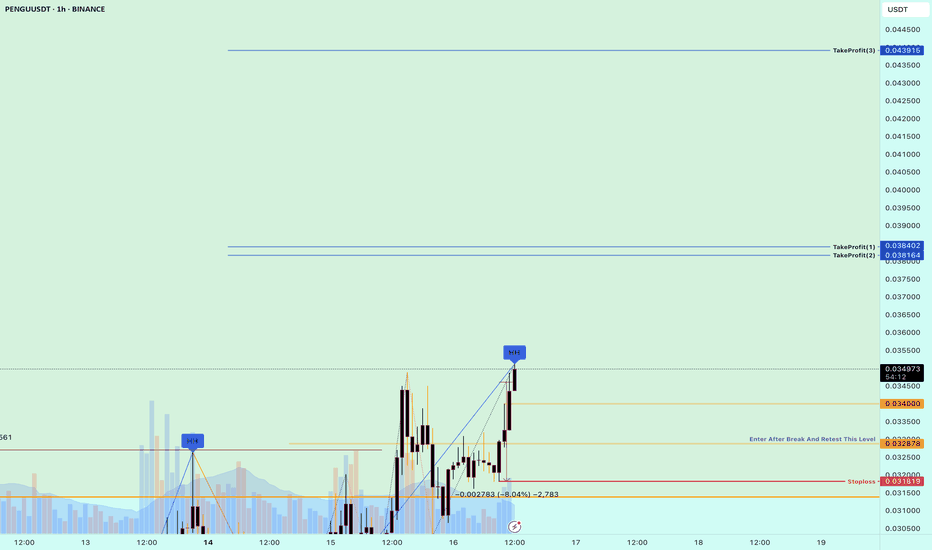

PENGUUSDT.P Scalping Long Setup

This Setup & Analysis is based on a combination of different styles, including the volume style with the ict style. (( AMD SETUP )) "PO3"

Based on your strategy and style, get the necessary confirmations for this scalping setup to enter the trade.

Don't forget risk and capital management.

The entry point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

Note: The price can go much higher than the specified target and have a very good pump.

Be successful and profitable.

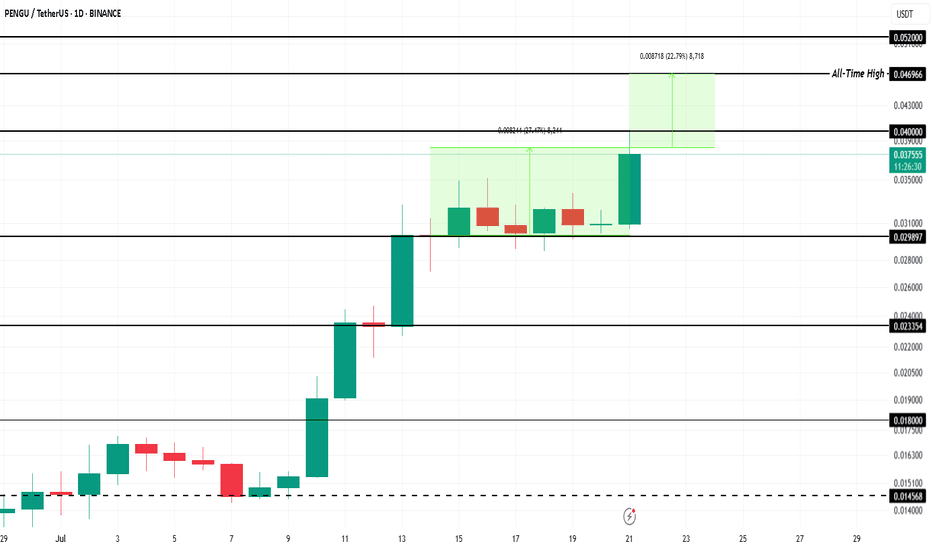

Meme Coin To Watch This Week - Pudgy Penguin (PENGU)BINANCE:PENGUUSDT price has surged 27% in the past week , currently trading at $0.038. The meme coin is inching closer to its all-time high of $0.046 . Strong bullish sentiment and market participation are fueling this rally, signaling that PENGU could soon retest resistance levels if momentum remains intact.

The meme coin is now just 22% away from hitting its record high . A Golden Cross pattern formed last week adds to the bullish outlook. If BINANCE:PENGUUSDT successfully flips $0.040 into a stable support level, the rally could continue, pushing the altcoin higher toward reclaiming its historical peak.

However, downside risks remain. If investors begin booking profits, selling pressure could drag BINANCE:PENGUUSDT lower . The critical support level of $0.029 will come into play. Losing this support could halt the upward trend and invalidate the optimistic price projection in the near term.

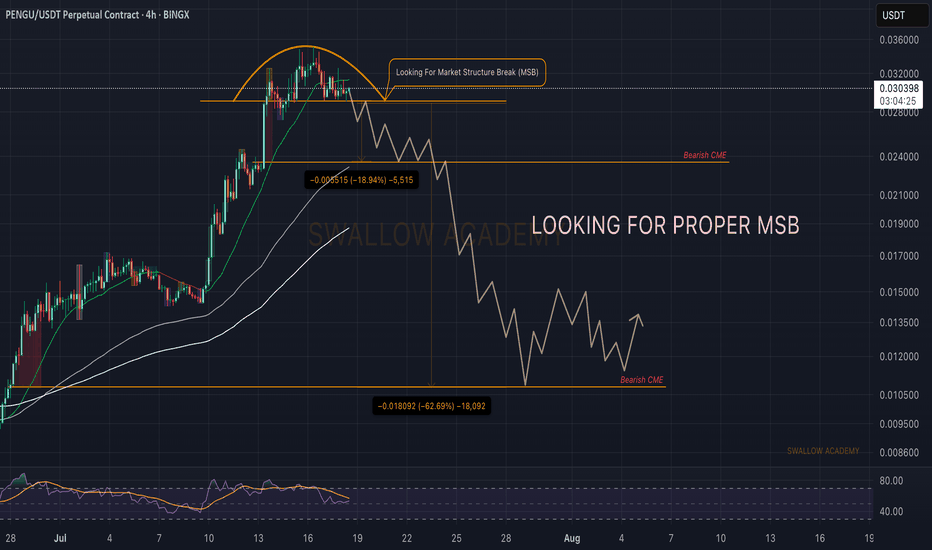

Pudgy Penguins (PENGU): We Might Go For Correction | Be CarefulPengu has had a good rally to upper zones, where we are almost near ATH, but this upward movement left behind 2 big bearish CME gaps, which we might be filling if we see one proper MSB to form.

So that's what we are looking for, a proper MSB, which would give us a good opportunity for short here!

Swallow Academy

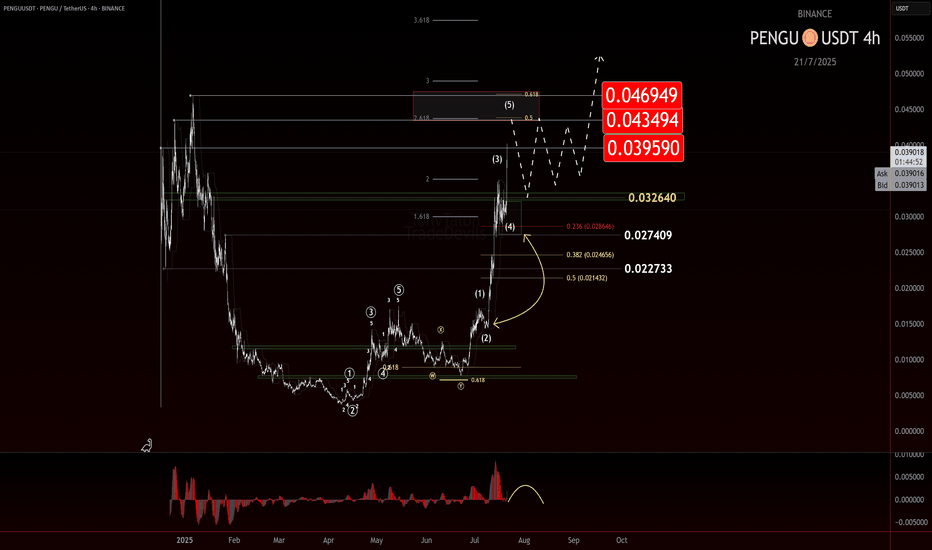

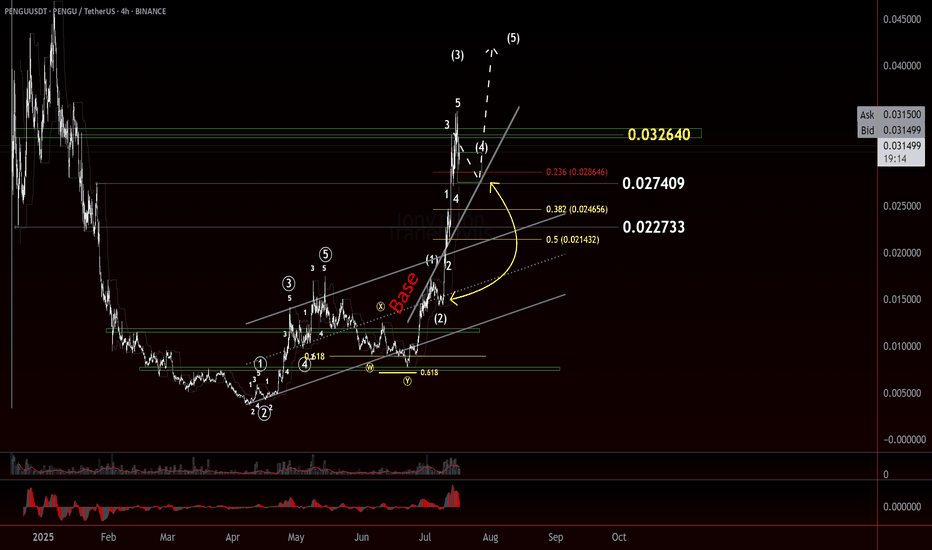

$PENGU Taking a Breather? CSECY:PENGU Taking a Breather? Wave 4 May Be Brewing

After a strong move, CSECY:PENGU looks like it might be pausing for breath. The recent action suggests we may have just wrapped up a small-degree Wave 3, with price now struggling to clear a key resistance level from earlier in the structure.

That hesitation could mark the early stages of a Wave 4 correction...Conservatively.

Here’s the zone I’m watching for a potential W4 pullback:

- .236 to 50% retracement of Wave 3, measured from the Wave 2 low

- Most Likely Target (MLT) sits right around the .382 fib

- Keep an eye on time symmetry—Wave 4 may offset the time duration of Wave 2

- Price could react off the base channel as a support guide

If this is a W4, it could give us a clean continuation setup into Wave 5—provided it holds structure and doesn’t overlap the Wave 1 territory. Stalking the pullback as it plays out, and am ready to react if we see support step in at the expected fib levels or the base channel.

Trade Safe!

Trade Clarity!

Buy Trade Strategy for PENGU: Tapping Into Meme Culture and UtilDescription:

This trading idea centers on PENGU, a meme-based cryptocurrency that has gained attention not only for its viral appeal but also for its effort to introduce real utility into the meme coin space. Unlike many short-lived meme tokens, PENGU combines strong community engagement with ambitions for ecosystem development, including NFT integrations, staking mechanisms, and cross-platform use cases. Its fast-growing community and increasing social media traction position PENGU as a potential breakout project in the ever-evolving world of digital assets driven by online culture.

Despite its popularity, it’s important to understand that meme tokens like PENGU carry high levels of risk due to their speculative nature and susceptibility to rapid price swings influenced by hype, sentiment, and limited fundamental data. As always, a cautious and informed approach is essential when engaging with these assets.

Disclaimer:

This trading idea is provided for educational purposes only and does not represent financial advice. Meme coins such as PENGU are highly speculative and involve significant risk, including the potential loss of your entire investment. Always conduct your own research, evaluate your financial situation carefully, and consult a licensed financial advisor before making any investment decisions. Past performance does not guarantee future results.

PENGU | Time for a PullbackPENGU has experienced a parabolic rally, but the technical setup suggests a pullback is imminent. The RSI is approaching overbought territory, indicating exhausted bullish momentum. I think it will go way higher in the long term but now it's time for a pause.

Key Technical Observations:

Price has broken above the red resistance zone around $0.029

RSI nearing overbought conditions signals potential reversal

Parabolic move lacks healthy consolidation patterns

Strong gap between current price and support levels

Expected Pullback Target:

Primary support: Green zone around $0.024

Risk Factors:

Meme coin volatility can extend moves beyond rational levels

Strong momentum could push price higher before correction

Market sentiment can override technical indicators

The technical structure favors a retracement to retest previous resistance as support, providing a healthier base for future moves.

Pudgy Penguins PENGU price analysis🪙 It seems that #PENGU is being sold off, and the price of OKX:PENGUUSDT has been stuck in consolidation at conditional highs for several days now, where positions are likely being redistributed.

Nevertheless, if at the beginning of the year, after listing, the price of the #PudgyPenguins token was released into not even “free float,” but simply into “free fall,” now, for several months, it has been “held” in a controlled manner.

🐻 If our assumption is correct, then the price of #PENGUUSDT should adjust to $0.01 or, in the worst case, to $0.0065-0.0070

📈 And if we are wrong, then the price of #PENGU has every chance of breaking out through to $0.02 in the coming days. With a global target of $0.03

⁉️ What is your opinion

Is this a fundamental project that is doomed to grow, or just a manipulative memecoin toy?

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

PENGU Just Triggered a Massive Breakout! Key Levels to WatchYello, Paradisers! Are you watching what’s unfolding with #PENGU after months of quiet accumulation? Because this chart is finally waking up, and it’s happening right now.

💎After a prolonged bottoming phase that lasted approximately 162 sessions, PENGU has completed a classic cup and handle formation, and we’re now seeing the start of what could be a powerful breakout.

💎#PENGUUSDT has surged above the neckline resistance at $0.01680, and—more importantly, this breakout is backed by strong volume, giving the move real credibility. It’s not just a wick; it’s a genuine push.

💎Now that the neckline is broken, PENGU has room to push higher. But let’s be clear, price is likely to face moderate resistance at the $0.02280 level. That’s a spot where some short-term profit-taking can’t be ruled out, especially from early entries. It’s a natural reaction zone and a moment to watch for how price behaves under pressure.

💎Still, if momentum holds, the pattern suggests a potential move toward the $0.02820 to $0.03200 region. That zone is no joke. It includes the 61.8% and 78.6% Fibonacci retracement levels, two of the most powerful technical resistance points in any market cycle. This makes that area a major decision zone and one that should be approached with caution.

💎On the other side, support is now established between $0.01680 and $0.01500. This is the previous resistance zone, and any retest into this range is likely to see strong demand stepping in. It would not be surprising to see buyers defend this area aggressively, especially if the retest is clean and orderly.

Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. This is the only way you will make it far in your crypto trading journey. Be a PRO.

MyCryptoParadise

iFeel the success🌴

PENGU still has room!?If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

The move off the low looked like a clean, completed impulse—sharp, decisive, and well-structured. After that, we got a double zigzag retracement. It ran a bit deeper than the textbook version, but still landed right in the normal range you’d expect for a healthy correction. From there, we saw another smaller-degree impulse form off the .007 pivot, suggesting bullish momentum was building again.

Since the last update, PENGU has come a long way—more than doubling in price and now hovering around a most likely target for a wave 3. What’s notable is how it got there: not just by breaking above the 0.017 resistance, but by blowing through multiple base channels on solid momentum and healthy volume.

We didn’t get the ideal depth for a retrace for a wave 2 before that breakout, but that doesn’t disqualify the larger count. In fact, from an Elliott Wave perspective, I still believe we haven’t seen a proper wave 4 to balance out the earlier wave (2). So I’m holding off on calling a top to this wave 3 just yet.

Here’s what we’re watching closely now:

The secondary impulse off .007 continues to build structure

Ideally, the next pullback holds above the 0.027 or .022 region, signaling respect for previous support and AOIs

That pullback needs to unfold correctively, not impulsively, to confirm bullish continuation

The next trade setup I’m eyeing is that wave 4 into wave 5 move. I’ll be stalking this ticker closely as structure unfolds.

Trade safe.

Trade clarity.

PENGU Crypto Futures Trade Plan 2025-07-13PENGU Crypto Analysis Summary (2025-07-13)

Comprehensive Analysis of PENGU Cryptocurrency Trading Models

1. Summary of Each Model's Key Points

Grok/xAI Report:

Technical Indicators: Price above key moving averages indicating a bullish trend. However, the RSI is at 85.84, suggesting overbought conditions, and the price is touching the upper Bollinger Band. Resistance at $0.03 and support at $0.02. Market Sentiment: Bullish sentiment with recent price changes but signaling potential exhaustion. Direction: Moderately Bearish, recommending a short trade at $0.03, stop-loss at $0.031, and take-profit at $0.02.

Claude/Anthropic Report:

Technical Indicators: Similar to the Grok/xAI report, emphasizing the overbought RSI and position at the upper Bollinger Band. The price trend is recognized as unsustainable due to parabolic movement. Market Sentiment: Acknowledges extreme euphoria in recent gains and anticipates a potential correction. Direction: Moderately Bearish, suggesting a short position with entry at $0.03, stop-loss at $0.032, and a take-profit level targeting $0.025.

Gemini/Google Report:

Technical Indicators: Consistent with other reports, highlighting decent bullish momentum yet extremely overbought indicators signify imminent pullback risks. Market Sentiment: Observation of speculative rationales driving prices, highlighting risk factors in liquidity and broader market sentiment. Direction: Moderately Bearish; recommending a short trade with entry price at $0.03, stop-loss at $0.032, and take-profit at $0.025, sharing similar parameters with previous reports.

DeepSeek Report:

Technical Indicators: Emphasizes overbought conditions with a risk of a 20-40% correction. The current price is significantly above key averages, indicating parabolic action. Market Sentiment: Low funding rates indicate lopsided long positioning, foreseeing potential liquidation events. Direction: Strongly Bearish, supporting short position ideas with similar entry, stop-loss, and take-profit recommendations.

Llama/Meta Report:

Technical Indicators: Highlights resistance at the current price point and overbought indications based on RSI and Bollinger Bands metrics. Market Sentiment: Recognizes caution due to lack of news and low funding rates, suggesting potential for a reversal. Direction: Moderately Bearish; recommending a short position with similar parameters to the other reports.

2. Areas of Agreement and Disagreement Between Models

Agreement:

All models identify the price as overbought with an RSI above 85, signaling an imminent potential correction. A collective sentiment of caution prevails, leading to a recommendation for short trades given the exhaustion of the current bullish momentum. They recognize the price level at $0.03 as key resistance, along with suggesting a stop-loss around $0.031 to $0.032 and a take-profit around $0.025.

Disagreement:

The Grok/xAI report emphasizes a “Moderately Bearish” sentiment where others like DeepSeek classified the trend as “Strongly Bearish.” Some reports recommend modest leverage (50x), while others suggest higher leverage (up to 100x).

3. Conclusion

Overall Market Direction Consensus: The consensus among all models is a Moderately to Strongly Bearish outlook for PENGU, backed by overbought technical indicators and recent rapid price increases without fundamental support.

Recommended Trade:

Trade Direction: Short Entry Price/Range: $0.03 Stop Loss Level: $0.0315 (offering a buffer against outlier volatility) Take Profit Level: $0.025 Position Size Recommendation: Based on account size, aiming for a maximum risk of 1% per trade (e.g., 1 contract for a $100 account). Adjust size appropriately for larger accounts. Confidence Level in Recommendation: 0.70 (overall strength of indicators). Key Risks and Considerations: Risks include further bullish momentum despite technical indicators, potential slippage in volatile conditions, and market liquidity constraints. High leverage could amplify losses. Trade Entry Timing: Enter at market open.

TRADE_DETAILS (JSON Format)

{ "instrument": "PENGU", "direction": "short", "entry_price": 0.030, "stop_loss": 0.0315, "take_profit": 0.025, "size": 1, "confidence": 0.70, "entry_timing": "market_open" }

This concise trade plan consolidates insights from various analyses, aligning on key indicators and market sentiment to create a robust trading strategy for PENGU.

📊 TRADE DETAILS 📊 🎯 Instrument: PENGU 📉 Direction: SHORT 💰 Entry Price: 0.03 🛑 Stop Loss: 0.0315 🎯 Take Profit: 0.025 📊 Size: 1 💪 Confidence: 70% ⏰ Entry Timing: market_open

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

PENGU = ETF Catalyst + Whale Accumulation = +30% More Upside?Today, on the weekend, I want to analyze the Pudgy Penguins project with the PENGU ( BINANCE:PENGUUSDT ) token from a fundamental and technical perspective .

Please stay with me.

Why did PENGU surge nearly 40% in just 48 hours? Here’s what’s driving it:

------------------------------------------

Fundamental Analysis:

1. ETF Momentum via Cboe:

On June 26, Cboe officially filed a 19b-4 form for a new ETF that includes Pudgy Penguins and PENGU as major components.

Although not yet approved, this single move has fueled strong institutional anticipation, similar to what happened with Bitcoin ETFs in early 2023.

The market often prices in future narratives — and this ETF storyline has been a powerful one.

2.Whale Accumulation Signals

According to Nansen data, large holders have increased their balances by 11.37%, and notable wallets linked to public figures by 7% over the last 30 days.

Such coordinated accumulation often precedes major price moves, and that pattern seems to be repeating here.

3.NFT Ecosystem Boost

The Pudgy Penguins NFT collection saw a 400%+ surge in sales volume.

This sharp increase in NFT activity has reignited attention toward the broader Pudgy ecosystem, which naturally benefits its native token, PENGU.

Risk Note:

The ETF is not yet approved — we're still in the hype phase.

Volatility remains high, and strong pullbacks are common in low-liquidity tokens like PENGU.

If whale activity continues and institutional narratives grow, the upside potential remains — but so does the downside risk.

------------------------------------------

PENGU token started to rise from the Support zone($0.01-$0.0076) . One of the signs of a continuation of the uptrend was the break of the upper line of the descending channel .

Educational Note: One of the price targets after a channel break can be as wide as the width of the broken channel.

In terms of Elliott Wave theory , it seems that the PENGU token has completed the Double Three Correction(WXY) , and we can wait for the next impulsive waves .

I expect the PENGU token to attack the Resistance zone($0.0128-$0.0118) again, and if this zone is broken , it can increase to at least $0.0137(+30%) .

What is your idea about the Pudgy Penguins project?

Note: If the PENGU token drops below $0.01, we can expect a break of the Support zone($0.01-$0.0076).

Please respect each other's ideas and express them politely if you agree or disagree.

Pudgy Penguins Analyze (PENGUUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

$PENGUUSDT: Bullish trend with solid catalystsCSECY:PENGU is about to stage a sharp advance from here. The chart is coiling up and looks ready to send it.

If you still haven't acquired your 88,888+ CSECY:PENGU bag to get the multiplier for the Abstract Chain airdrop, you might as well do it now before it costs a lot more. The airdrop isn't a direct handout; holding the tokens gives you an XP boost, so you've still got to get on-chain and play the game, but it's a critical edge. Most users minted 6 badges, if you can mint more, you're ahead of the pack, still quite under-farmed in my opinion.

Just recently, we got news about progress on a CSECY:PENGU ETF listing. This is a massive development and could seriously add fuel to the fire as well.

Abstract Chain stats are looking solid. The chain is already pulling in over $30M in TVL and doing nearly $6M in daily volume. People are actively using it, and dapps are generating real revenue.

For example, the highly successful scratch card game, Gacha, pulled in over 1.6mm in fees so far.

It just makes sense. Look at Robinhood launching their own L2 with Arbitrum tech. If you have an app with a real user base, you own the chain. The Pudgy Penguins team is a force of nature when it comes to real-world adoption and building a brand people love. They've already managed to attract a bunch of interesting apps that are bringing in solid numbers. It's a smart play by a team that knows how to win.

The whole setup looks incredibly bullish and with Ethereum's trend turning bullish vs CRYPTOCAP:BTC and CRYPTOCAP:USDT , these are the plays that have my attention. Don't sleep on this one.

Best of luck!

Cheers,

Ivan Labrie.