PEPEUSDT.P trade ideas

Strategy - Pepe Descending Triangle - Training ExamplesExample on example: One to keep an eye on is that 1st one on the left - Ascending.

Why at the moment it's not a threat? Because the asset has put in a higher high. (What I think).

The current trend is, higher high, higher low higher high, higher low. Seems that's being protected.

So, interesting! I think if we loose this market structure, well at least I will look back at that ascending triangle low as a range low.

At the moment, theres no reason to think that. Just keep that in mind.

Follow up to:

Pepe - History being made Good luck seeing this level again :)

This is my kiss you goodbye level. I've had this level drawn for some time now and it's been so well respected!

This contradicts my Eliot Wave theory being the 4th wave but this level is awesome!

Maybe emotional but, this level is key!

Lose it then yes probably more downside. As long as were above, were kicking ass! To the upside!

Pepe - Elliot Wave UpdateTrying to keep this clean and not had much time to study the theory exactly!

What's drawing me to this pattern the most is the trend lines (brown/orange)

IF, 1,2,3,4,5 (Blue)and we've hit wave 5 already. We're very much in the corrective phase (Green).

B to C I've drawn the fib highest high to the lowest low (This is trading logic, not sure this is how waves are measured for correctve waves).

Just to provide an idea given so much uncertainty in the market. :) Need more time to check the technicals, for me this is a good start.

If I had to commit, and I will. Nothing to me at the moment looks bearish! That's my point of view. Just not spot on yet!

Road to riches - paved with good intentions Order block 1 day timer has yet to fall to the previous buy zone

Order block 1 hour timer just hit the bottom of a buy zone and may reverse to 800 zone.

The 4 hour order block is half way thru a plunge of 3 buy zones

Once 1 hour recovers and higher ones do too.

But how much further will we drop?

Right now we entering a high order block buy zone that can drop to 400 or 500 zone.

Be careful trading lower time frames - we are still seeing turbulence.

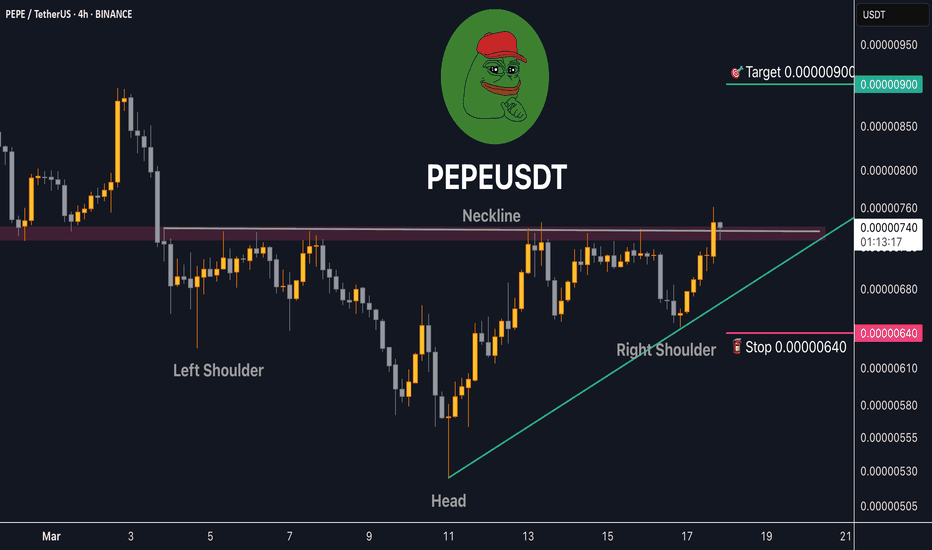

Let's Look at PEPE's Potential Moving ForwardLet's Look at PEPE's Potential Moving Forward

Based on the 4-hour PEPE/USDT chart, we can see an interesting pattern forming. Here are the key observations:

Downtrend Breakout

PEPE had been in a prolonged downtrend channel (marked by the two green lines).

Recently, it broke out of this descending structure, indicating a potential reversal.

Inverse Head and Shoulders Pattern

A possible inverse head and shoulders pattern is forming, which is a bullish reversal signal.

The price is currently testing the neckline resistance.

Resistance Levels to Watch

$0.00000760 – Immediate resistance level.

$0.00001694 - $0.00001900 – The next target zone if the breakout sustains.

RSI Indicator

The RSI is currently around 43.80, meaning it is neither overbought nor oversold.

If buying pressure increases, there is room for further upside.

Potential Scenario

If PEPE manages to break and hold above $0.00000760, it could trigger a rally toward $0.00001694 - $0.00001900 as the next key resistance area. However, if rejection occurs at the neckline, we might see a retest of lower support levels.

Overall, this setup suggests a potential bullish momentum shift, but confirmation is needed with increased volume and a successful breakout. 🚀

Breaking: $PEPE Coin Dipped 10% Today- Is the Frog Meta Dead?Pepe the Frog ( CRYPTOCAP:PEPE ) memecoin saw its token price plummet by 10% today albeit the general crypto landscape experienced a deja vu as The US Personal Consumption Expenditures (PCE) inflation numbers for February have been released, showing a steady trend in headline inflation but a slight uptick in core inflation.

Bitcoin and altcoins have extended losses further from earlier today as BTC slips under $85,000, while Ethereum (ETH) tanks 7% slipping under $1,900. Current trend shows that investors could expect strong volatility over the weekend.

US PCE Data Shows Inflation Remains Sticky

As per the Bureau of Economic Analysis, the US PCE inflation data remained unchanged at 2.5% for the month of February, aligning with the market expectations and the previous month’s reading. However, the year-over-year core inflation came hotter-than-expected at 2.8%, higher than both the previous reading of 2.6% and the expected 2.7%.

Technical Outlook of PEPE

As of the time of writing, CRYPTOCAP:PEPE is down 8% trading within a bearish trend pattern. the asset is approaching the 65% Fibonacci retracement point is serving as support point should selling pressure submerged. Furthermore, with the RSI at 45, there might be further consolidatory move by CRYPTOCAP:PEPE to cement a perfect liquidity pick region to increase the demand for $PEPE.

Pepe Price Live Data

The live Pepe price today is $0.000008 USD with a 24-hour trading volume of $519,642,130 USD. Pepe is down 8.84% in the last 24 hours. The current CoinMarketCap ranking is #31, with a live market cap of $3,265,213,245 USD. It has a circulating supply of 420,689,899,653,544 PEPE coins and a max. supply of 420,690,000,000,000 PEPE coins.

PEPE Looks to Repeat the Upward Consolidation it had Before PumpPEPE, a meme-based cryptocurrency, has gained significant traction in the crypto space due to its strong community-driven approach. With around 800K followers on X (formerly Twitter), the coin has maintained a loyal user base, which has played a crucial role in its price action. Over the past few weeks, PEPE has demonstrated signs of a bullish reversal, bouncing off key support levels and showing an increase in futures open interest.

PEPE’s recent price action saw it rise to $0.000008960, marking a 73% increase from its lowest point this year. This resurgence in price coincides with a broader recovery in the crypto market and growing investor interest.

Key Technical Indicators and Price Movement

One of the major technical patterns observed in PEPE’s price chart is the rejection of the $0.0000054 support level. This level has historically served as a strong demand zone, preventing further declines. PEPE’s rebound aligns with past price cycles, where it consolidated before making a substantial upward move, similar to what was observed in November 2024’s weekly candle.

Another bullish signal for PEPE is the falling wedge breakout pattern that formed recently. This pattern typically suggests a reversal in bearish momentum, leading to potential upside movement. Additionally, the Relative Strength Index (RSI) has climbed to 60, indicating growing bullish momentum, while the MACD lines are nearing the zero line, further reinforcing the positive sentiment.

The 50-day Exponential Moving Average (EMA) has also been breached, signaling a short-term trend reversal. If the price continues to hold above this level, it could confirm a sustained upward movement toward the next key resistance at $0.00001700 in the next 25 weeks.

Futures Open Interest and Investor Sentiment

A critical factor supporting PEPE’s rally is the surge in futures open interest, which has risen to $324 million from $166 million earlier this month. This 95% increase suggests that more traders are entering the market with leveraged positions, often considered a strong indicator of growing bullish sentiment.

Another important metric is exchange reserves, which have declined by 0.73% in the past week to 240.7 trillion tokens, indicating that investors are moving their holdings off exchanges. This behavior suggests that investors are holding for the long term rather than selling, which reduces selling pressure and supports price appreciation.

Additionally, top PEPE holders remain confident in their positions, with the most profitable trader still holding 91% of their tokens and the next three leading traders maintaining nearly 100% of their holdings. This high conviction among large investors further reinforces a strong bullish outlook.

Broader Market Trends and Future Price Targets

PEPE’s recent price action aligns with the overall improvement in the crypto market sentiment. The Crypto Fear & Greed Index has climbed from 18 to 34, moving out of the extreme fear zone and reflecting a shift toward optimism.

The next major target for PEPE is $0.00001717, which coincides with the 50% Fibonacci retracement level. If the price successfully breaks this resistance, it could pave the way for a potential move toward its previous all-time high. Given the strong community support, increasing investor accumulation, and bullish technical indicators, PEPE appears poised for a strong performance in the coming months.

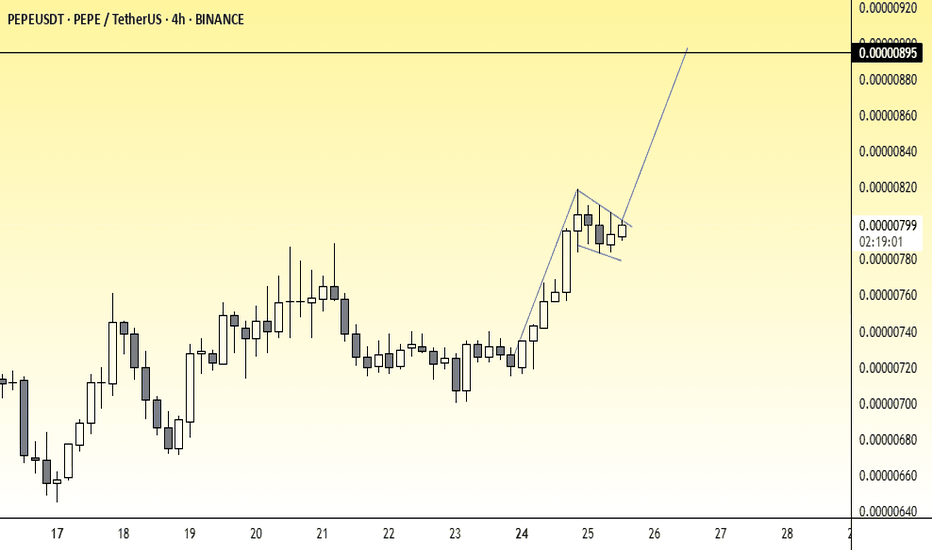

PEPE/USDT (4H Chart)Market Structure & Pattern

The chart shows a strong uptrend, followed by a bullish flag pattern, which is a continuation pattern.

The price is consolidating in a tight range, preparing for a breakout.

Buy Entry & Confirmation

Entry: A confirmed breakout above 0.00000800 with strong volume.

Confirmation: A 4H candle closing above this level signals a buy opportunity.

Target Levels

First Target (TP1): 0.00000880

Second Target (TP2): 0.00000895 (Major Resistance)

Stop Loss (SL)

Stop Loss: Below 0.00000780 (to minimize risk in case of rejection).

Risk-to-Reward Ratio (RRR)

A favorable risk-to-reward ratio (around 3:1), making this a high-probability trade.

PEPE/USDT:BUY LIMITHi friends

You can see that after the price fell in the specified support area, buyers came in and supported the price and created higher ceilings and floors.

Now we can buy at the specified levels with capital and risk management and move with it to the specified targets.

*Trade safely with us*

Pepe Bullish Gartley HarmonicI'll probably get told of for a lack of detail here. But this my friends, is a deadly bullish combo. Already bounced of 0.618, and coming back for the 0.618 on a POC for confluence.

I'm not guaranteeing this is bullish, BUT watch for the reaction of the 0.618 again! If we get a good reaction. Super bullish to cover my previous chart resistance levels.

Have to say, Chart Champions - Daniel. Not sponsored and genuine awesome traders. Love them! Check them out. I'm an absolute novice. Still and always will be learning. But Chart Champions are AWESOME! I LOVE THEM!

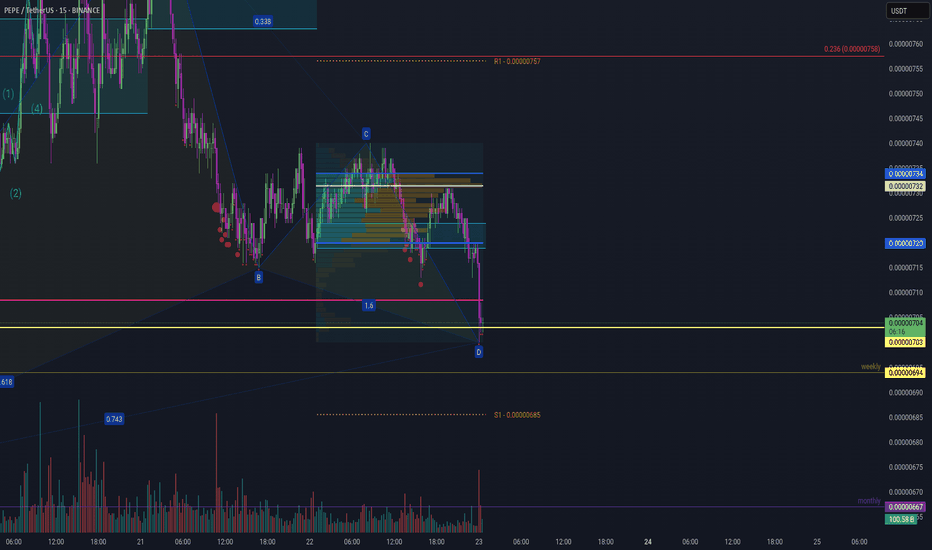

Strategy - Pepe Descending Triangle - TrainingUsing indicator - Market Order Bubbles by Laviathan

Firstly awesome indicator!

Love it for guaging high volume buying and selling (used for panic selling or panic buying).

The higher the volume the selling the bigger the red bubbles. Inversely, greedy buying, bigger green bubbles.

Sometimes, the bubbles are genuine, as literally big sell offs or strong buys.

So, a little strategy, using these bubbles with the trading 101's is very helpful.

Here a decending triangle on a 5 minute. Mental sell off's. Trading the decending triangle using the seel offs as a guide to add confluence to the decending triangle.

Just an example.

Still a great guide to trading 101s. :) www.ig.com

Couldnt publish on 5 minute. Put on a 5 minute time frame with Market Order Bubbles by Laviathan and you will see what I mean.

Happy trading :)

Pepe - Elliott Wave Local and Long Term Idea 22 Mar 2025Eliiot Wave Update

Firstly, I'm bias that I believe were in Wave 4.

Depicted wave count 1 2 3 4 5 in orange may very well be as it is, in that the last low is 5. My bias comes in because from what I've read, 5th wave usually 1.27 fib extension drawn from 1 to 1 to 2. As can be seen, 1.272 is at 0.0000336.

The green paralellel channel from the high to the next higher high. As can be seen with circle support, we found a good reaction to the upside.

Short/medium term looking at the Anchored VWAP (White) and channel top as resistance.

Currently 1.0 a strong support as well as resistance.

My biase based wave theory means that were currently in the 4th wave to the upside, so looking at resitance EXACTLY at the anchored VWAP (white), breaking that to the upside targets of the short fibs drawn to the right that arent extended all the way to the right. Meaning, resistance being,0.382, 0.5, and 0.618.

If that is the end of Wave 4. The price would then see a retracemment to Wave 5, to 1.272.

Non bias view where Wave 5 has been hit already.

Were in a corrective ABC pattern. (This is the part I'm not so sure about).

Then Were in A(1) here no one knows how deep that is but it's good that were going up because A = up B = down and C = up (c or 3 being the longest waves.

If were in the corrective phase, currently were in Wave A (1).

Technically nothing changes. I think. Wait to see how It plays out.

Overall, currently I would NOT be bearish, looking at the next resistance first!Which is (either Wave 4 or correction) 0.236 price 0.000095