PEPEUSDT trade ideas

Crypto Trade: PEPEUSDT Long Swing Trade BINANCE:PEPEUSDT Long Swing Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader.

I manage trade on daily basis.

this is good trade, lets see, don't be greedy, risk what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

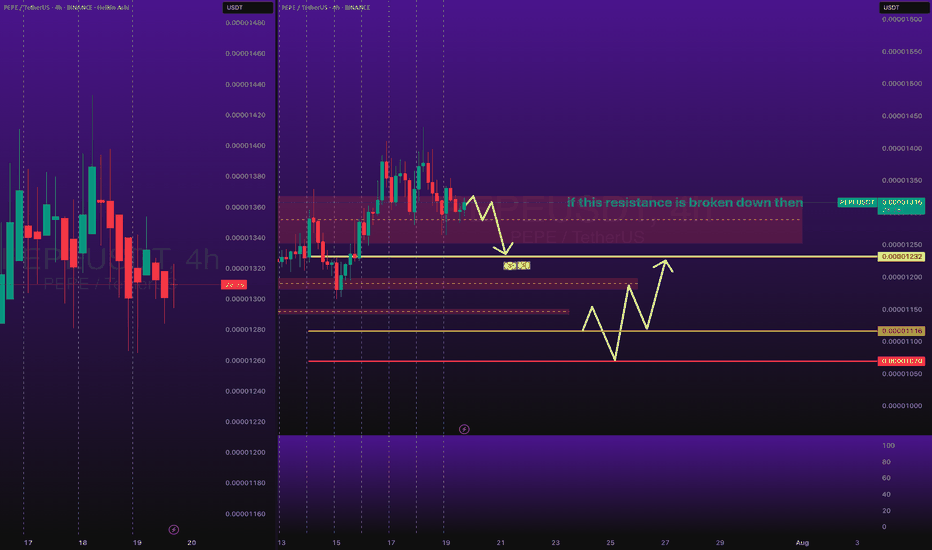

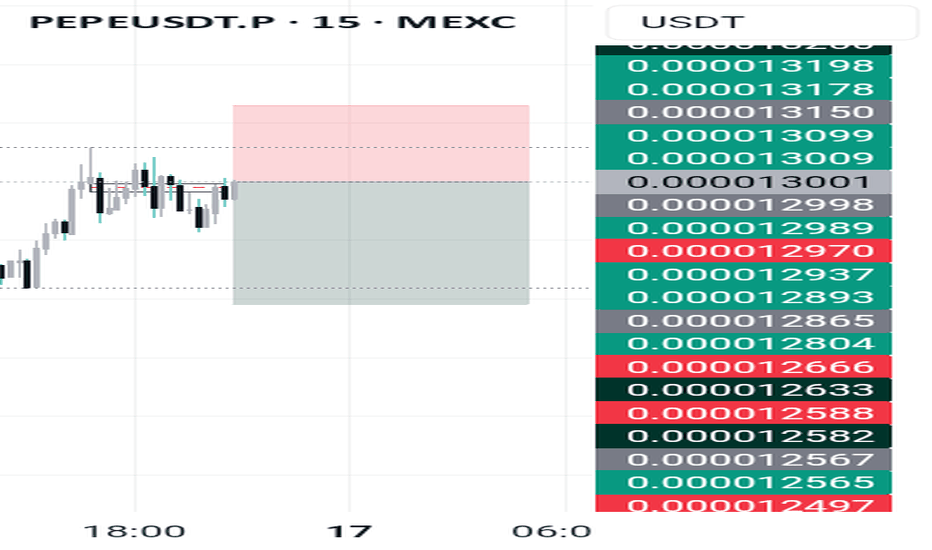

PEPEUSDT Dipping Down for Key Zone 0.00001230 to TouchBINANCE:PEPEUSDT has been quite on bullish trend and last week has been stopped being bullish, and started ranging, now PEPEUSDT will correct itself slightly by dipping down towards 0.00001230 which is very important level.

After 0.00001230 then next key level is 0.00001117 but we need to see if it really need to go down there or will bounce back up from 0.00001230.

0.00001327 is the Key Resistance Level, if its respected well then our target is very obvious to hit.

Use proper risk management

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

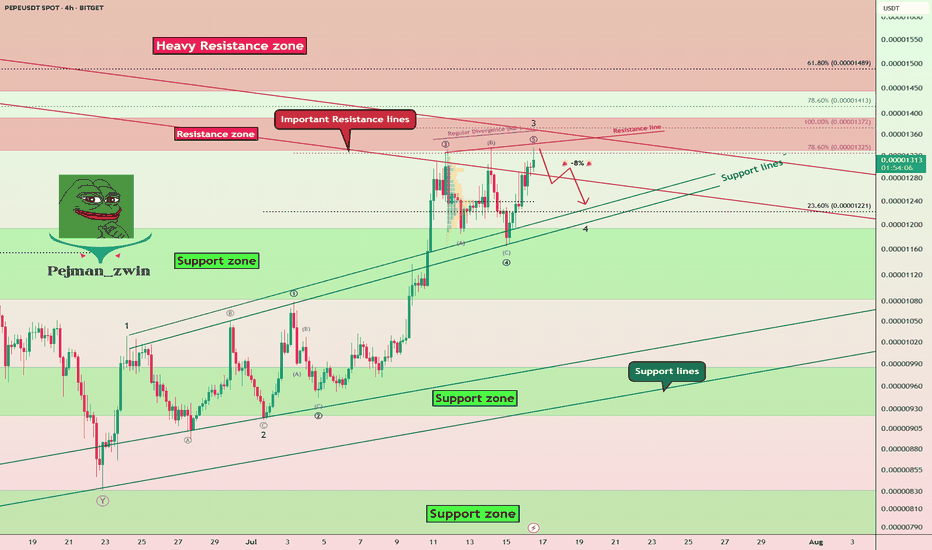

PEPE Faces Key Resistances – Is a -8% Pullback Coming?The PEPE memecoin ( BINANCE:PEPEUSDT ) is currently near the Resistance zone($0.00001392-$0.00001330) and Important Resistance lines . This is the third time that PEPE has attacked the Important Resistance lines .

In terms of Elliott wave theory , it seems that PEPE is completing the microwave 5 of the main wave 3 , so that the main wave 3 is of the extended type .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect a -8% drop for PEPE in the coming hours.

First Target: $0.00001251

Second Target: $0.00001212

Note: Stop Loss(SL)= $0.00001400

Please respect each other's ideas and express them politely if you agree or disagree.

PEPE Analyze (PEPEUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

PEPEUSDT broken trendline and bullish market aheadAs we can see on the major resistances which was red trendline broke and price now after more range here or without it can see more gain at least to the targets like 0.000017$.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

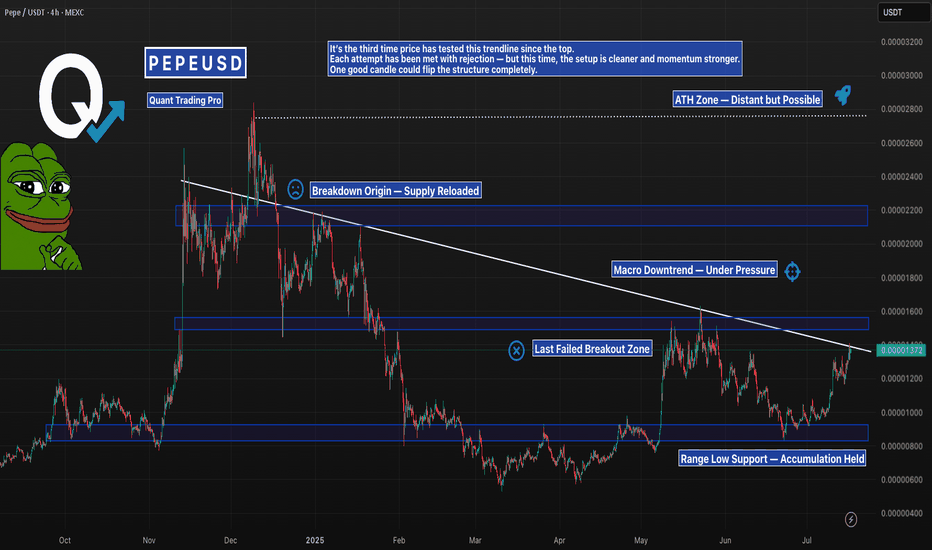

PEPE Pressing Into Its Macro Downtrend — AgainPEPE is back at the same trendline that’s slapped it down twice before — but this third attempt comes with strength.

We’ve got higher lows, reclaimed support, and a solid grind into resistance.

Still, a macro downtrend is a macro downtrend… until it breaks.

This next move will decide if this is the real deal or just another fakeout.

#PEPE #PEPEUSDT #MemeCoinCharts #CryptoAnalysis #TrendlineTest #BacktestEverything #TradingView #QuantTradingPro #CryptoBreakout

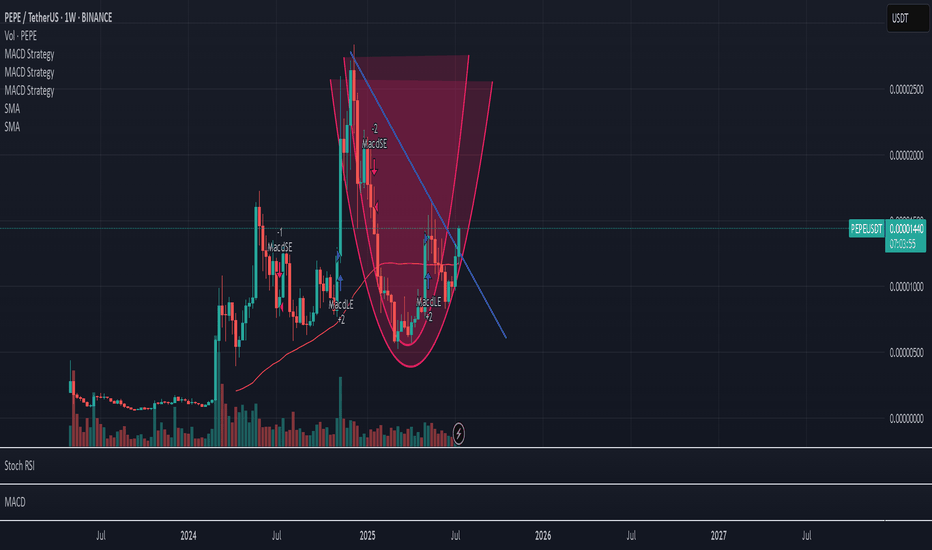

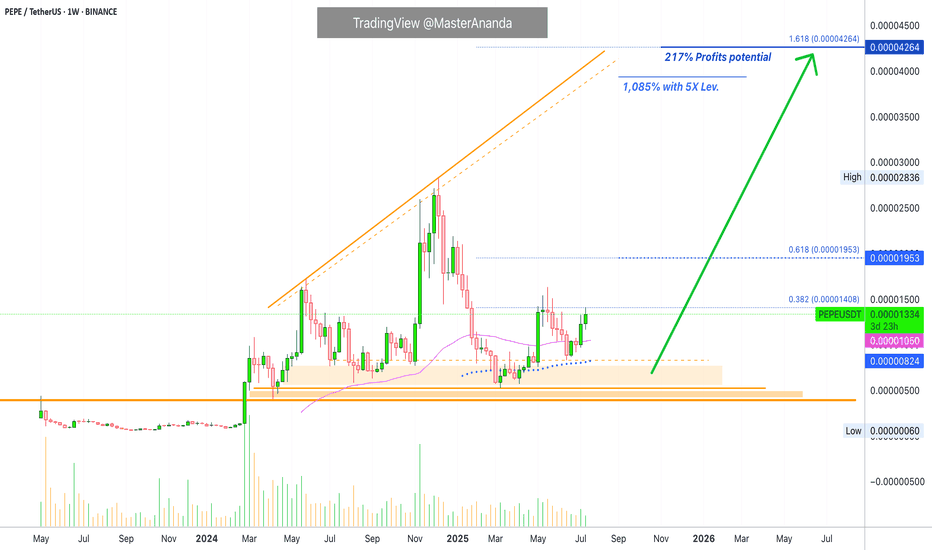

Pepe's Bullish Bias Intensifies · 217% PP = 1085% 5X Lev.The bullish bias for PEPEUSDT is starting to intensify, still early of course. It is still early on this one because the action is still lower than the 19-May high. There are many projects that are already trading above their last high. So it is good news to find a pair that is moving below because we know that soon it will be moving above. In the coming days.

While the 19-May wick high reached 0.00001632, the weekly close happened at 0.00001361. As you can see from the chart, the current price is already higher than the highest weekly close and this gives us a strong bullish signal.

Notice again how the action moved above EMA89 back in mid-April. When the retrace happened, May-June, the recovery happened above this level. A signal of strength.

PEPEUSDT moved briefly below EMA55 only two recover and this is the second week above this level. Trading weekly above EMA55 & EMA89 means that the bullish bias is fully confirmed. A fully confirmed bullish bias means we are set to witness a higher high, and a higher high means prices moving above 0.00001953, short-term. In a matter of days.

The main target for this move is 0.00004264 giving us a nice 217%. With 5X leverage, relatively low risk, that would be beyond 11X (1,085%).

In a matter of days, the entire altcoins market will be bullish and moving higher. Make sure you are fully invested by the time everybody is rushing to buy. That is, you should be all-in now. It is not too late.

Thank you for reading and for your continued support, it is truly appreciated.

Namaste.

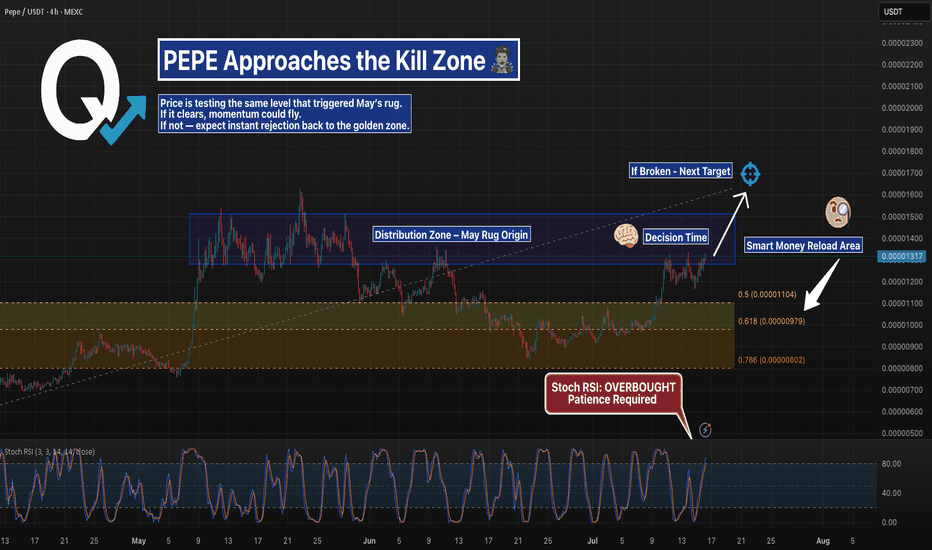

PEPEUSDT – Back Into the Trap Box | Fib Support BelowPEPE is retesting the same high-volume resistance that sparked a selloff in May.

With price pressing into the top box again, this becomes a key decision point.

A breakout sends us higher — but rejection could send price back toward the golden pocket between 0.00001104 and 0.00000979.

Watch the reaction closely.

This is where the next major move begins.

#PEPEUSDT #MemeCoin #SupportResistance #FibRetracement #QuantTradingPro #TradingView

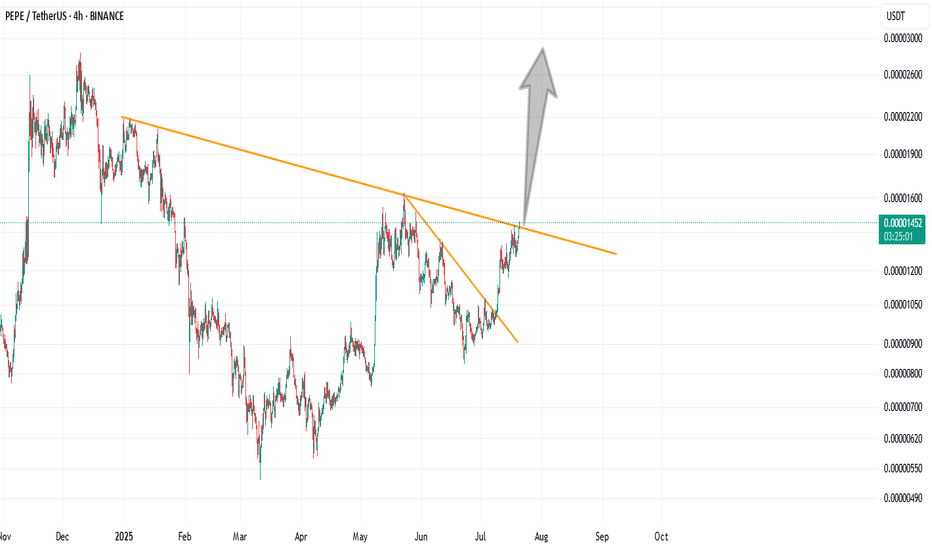

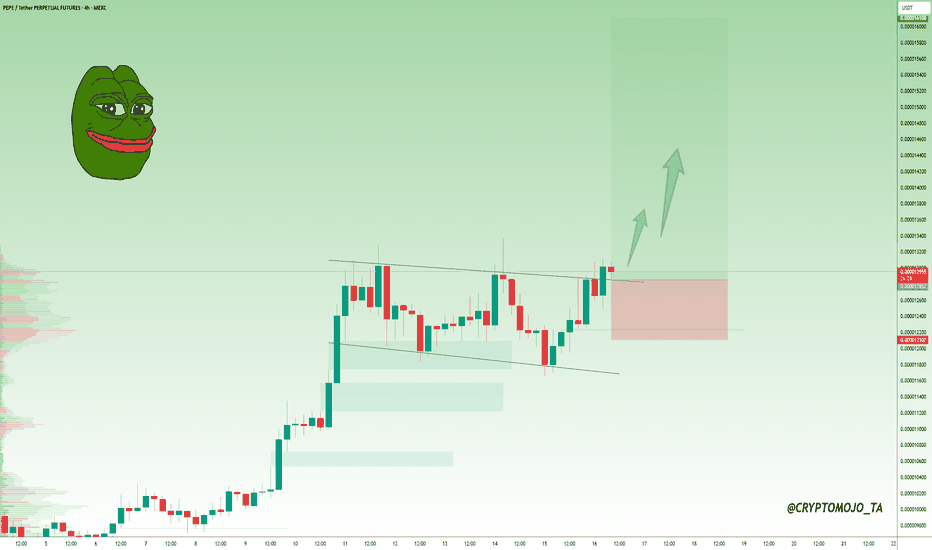

#PEPE:Breakout In Action!#PEPE Breakout In Action 🚀

CRYPTOCAP:PEPE has broken out of the falling wedge on the 4H chart and closed above the trendline.

Price is now retesting the breakout zone, a strong bounce here could push it toward the $0.000016 level (+25%).

Entry: 0.00001285 – 0.00001300

Stop Loss: 0.00001210

Targets:

TP1: 0.00001400

TP2: 0.00001520

TP3: 0.00001580

TP4: 0.00001640

Structure is bullish, watch for continuation after retest📈

DYOR, NFA

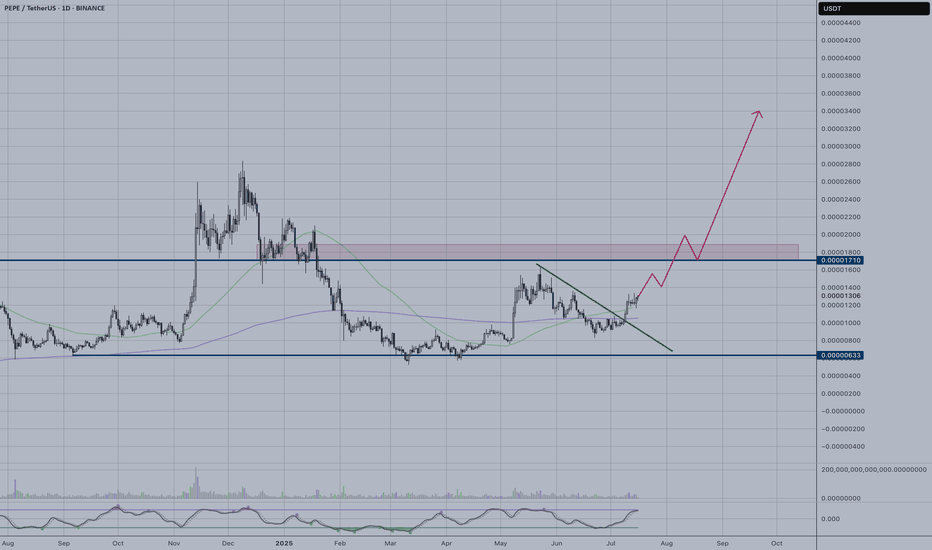

PEPE | On the Way to New HighsPEPE shows a compelling bullish setup following a successful breakout from a descending wedge pattern. The price has broken out and is now positioned for a potential rally toward new highs, as indicated by the upward trajectory arrow.

Key Technical Signals:

- Clean breakout from descending wedge formation

- Strong momentum building after extended consolidation period

- Volume supporting the breakout move

Price Targets:

- First resistance: 0.00001800 (pink resistance zone)

- Extended target: 0.00003500+ (following the projected path)

Risk Considerations:

- Meme coin volatility requires careful position sizing

The technical setup suggests PEPE is well-positioned for a significant upward move, with the breakout confirming renewed buying interest after months of consolidation.

Is Pepe growing? Read the caption, it's important.Hello friends🙌

✔Some factors caused the price to fall, but in a support area that we have drawn for you with several Fibonacci waves, you can see that a classic double bottom pattern has been formed and buyers have entered.

🔊Now there is no more news of a fall and buyers have raised the price to the point where it has created a higher ceiling and floor, and this is very important and signals a change in trend.

📈Now that the price has broken the specified resistance line and is well supported by the specified support line, we can expect the price to move to the specified areas, but do not forget that the most important thing to observe in trading is capital management⚠

🔥Follow us for more signals🔥

*Trade safely with us*

PEPE Update on current situationI'll elaborate on updates but I wanted to share a short info about BINANCE:PEPEUSDT and how I see it.

Pepe is currently slightly bellow of the VAH of the range. it fell, again , into the downward channel and goes again (as of now) bellow the VAH. BUT on the left side u can see the high of may/june which functions as a support zone (dotted line) - it already bounced off of it once during december (disregarding the wick deeply into it but that was a flash crash) and hols it so far.

if BTC doesn't f*ck up completely, then PEPE could bounce from that and push towards the POC at 2100 and the VAH at 2500 again. Once a new HH (higher high) from the past lower high is established, it should invalidate the downtrend and find new , stronger support around the POC area and push higher from there.

it all depends on BTC and the market sentiment regarding Trump, Fed, recession etc. but the moment PEPE breaks above again, and I'm certain it will, it'll go for 3000 and up. nobody knows how high it'll still go in this run but I bet it at least will touch 4000 in the next months.

Lingrid | PEPEUSDT Corrective Channel BreakoutThe price perfectly fulfilled my previous idea . BINANCE:PEPEUSDT rebounded powerfully from the 0.00000843 support and broke out of the long-standing downward channel, marking the start of a bullish impulse leg. Price is now holding above the breakout point and consolidating above the 0.00001159 structure, setting the stage for continuation. As long as buyers defend this reclaimed level, price could attempt another leg toward the upper resistance zone at 0.00001500. Structure and volume suggest that accumulation is complete and bulls are in control.

📉 Key Levels

Buy trigger: sustained support above 0.00001159 and breakout follow-through

Buy zone: 0.00001100–0.00001159 (former resistance turned support)

Target: 0.00001500

Invalidation: breakdown below 0.00001100 risks trapping longs

💡 Risks

Volatility around breakout retests may shake weak hands

Failure to reclaim momentum at 0.00001250 could stall the push

Re-entry into the old consolidation range may delay upside momentum

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

PEPE – Strongest Setup Among Top Meme Coins

Out of the higher-cap meme coins, I’m leaning more toward $PEPEUSDT.

From a price action perspective, it’s showing more strength than CRYPTOCAP:DOGE , CRYPTOCAP:SHIB , and $WIF. That’s not to say the others won’t pump—but personally, CRYPTOCAP:PEPE looks the most appealing here.

The green box is a solid area to build a position. It’s held the trimester lows well and continues to test them while responding bullishly.

Let’s see how it plays out over the next two months—but I like the odds of upside from here.

PEPEUSDT high potential pump is cooking As we can see price is near major resistance of 0.000013$ and any breakout here to the upside is going to pump price hard to the targets like 0.000040$.

Two major resistance here is now same which are 0.000013$ which is weekly resistance zone + red trendline resistance also now is here so after breaking this resistance pump is expected and i am looking for heavy pump and even new ATH here.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

PEPE Trendline Retest – Reclaim Incoming or Final Rejection?PEPE is testing a major descending trendline that has capped price action since early April. After a strong breakout push, price is now consolidating directly under this resistance — inside a tight decision zone.

We’re watching for one of two outcomes:

A reclaim of the trendline + confirmation = potential continuation toward 0.00001350+

A rejection from this level could signal another leg down, continuing the macro bearish trend

🧠 Note: Stoch RSI is reset, hinting that bulls could make another attempt.

📍 Key Levels:

🔼 Reclaim above 0.00001317 = bullish breakout

🔽 Breakdown below 0.00001200 = rejection confirmed

This level will define the next major move.

#PEPE #PEPEUSDT #TrendlineTest #CryptoBreakout #ReclaimSetup #AltcoinWatch #QuantTradingPro #TradingView

PEPEUSDT Forming Falling ChannelPEPEUSDT is showing promising signs of a potential breakout, supported by a clear price structure that resembles a falling channel pattern. This technical setup is widely known among traders for indicating a possible trend reversal when the price successfully breaches the channel’s upper resistance line. Coupled with good trading volume, the current market sentiment around PEPE is generating optimism for a potential 60% to 70% gain as buyers step in at these attractive levels.

This crypto pair has caught the attention of both retail and institutional investors due to the growing hype and community-driven momentum behind the PEPE token. Despite its meme origins, PEPE has demonstrated significant staying power in the market, with steady liquidity and regular price swings that attract short-term and swing traders alike. As new investors continue to accumulate positions, the probability of a breakout move increases, reinforcing the bullish outlook.

Technically, the price action indicates that PEPEUSDT may be forming a solid base for an upward surge. The falling channel pattern, if validated with a confirmed breakout and retest, could set the stage for a strong push towards higher levels, aligning perfectly with the projected upside potential. Traders should keep a close eye on the breakout level and volume spikes, as these will serve as key confirmation signals for the next move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!