USDX trade ideas

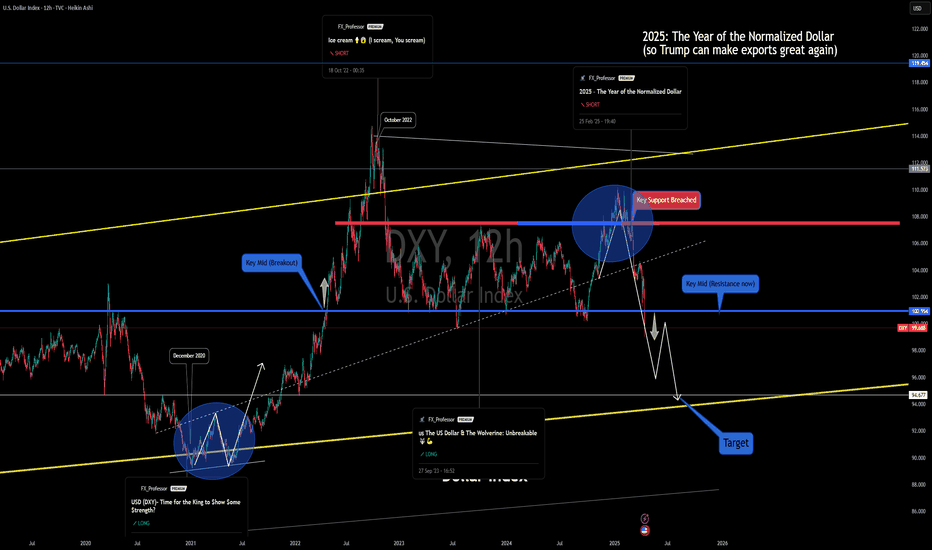

USD Breakdown – Trump, Tariffs, and the End of King Dollar?📉 USD Breakdown – Trump, Tariffs, and the End of King Dollar?

In my February post, I said:

2025 would be the Year of the Normalized Dollar — where political pressure meets policy hesitation.

Now that scenario is unfolding.

The dollar is unwinding. The technicals are confirming it.

And the macro backdrop? Only intensifying the move.

📊 Chart Breakdown

100.95 — the key mid-level — is now broken

That level is resistance

Target remains 94.00 — the zone I first called as a bottom back in 2020

From that zone, I called the bull run.

Now, we’re completing the circle.

The King Dollar move is done.

🌐 Macro Pressure Mounts

CPI cooled to 2.4%

Trump wants a weaker dollar to push exports

Tariffs are back — and escalating

The Fed is paused , but still under fire to cut rates

Meanwhile:

🇨🇳 China is accumulating gold aggressively

🪙 Gold is at all-time highs

🧠 Bitcoin is rising as the U.S.'s digital hard asset hedge

⚔️ This Isn’t Just a Chart — It’s a Shift

What we’re watching is more than a breakdown in DXY.

It’s the realignment of monetary confidence:

→ Gold for protection

→ Bitcoin for evolution

→ Dollar for... survival?

The breakdown in USD may be normalizing on the surface...

But underneath it’s signaling a changing of the guard.

One Love,

The FXPROFESSOR 💙

Dollar I Daily CLS I Weekly CSL Potential plays for next weekHey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS range, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behaviour of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

🛡️ Models 1 and 2:

From my posts, you can learn two core execution models.

They are the backbone of how I trade and how my students are trained.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

📍 Model 2

occurs in the specific market sequence when CLS smart money needs to re-accumulate more positions, and we are looking to find a key level around 61.8 fib retracement and target the opposing side of the range.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

⚔️ Listen Carefully:

Analysis is not trading. Right now, this platform is full of gurus" trying to sell you dreams based on analysis with arrows while they don't even have the skill to trade themselves.

If you’re ever thinking about buying a Trading Course or Signals from anyone. Always demand a verified track record. It takes less than five minutes to connect 3rd third-party verification tool and link to the widget to his signature.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

The Dollar's Gone Crab-Walking!!The U.S. Dollar Index (DXY) has recently breached the 100 level, marking the first instance of such a decline since July 2023.

This development signifies a potential shift in the dollar's strength against a basket of major currencies.

Market observers are now closely monitoring the index, particularly around the 99.3 mark, as some anticipate a possible rebound and upward trajectory from this level.

The near-term performance of the DXY will likely be influenced by a variety of factors, including evolving macroeconomic data, shifts in monetary policy.

SEYED.

DXY Breakdown: Bearish Momentum Builds Amid Weak U.S. DataThe U.S. Dollar Index (DXY) is maintaining a clear bearish trajectory, with price action on the H4 chart showing a consistent pattern of lower highs and lower lows inside a descending channel. The technical structure points to continued selling pressure, and recent fundamental developments only reinforce this view.

📰 Key drivers behind the decline:

The latest U.S. CPI data came in weaker than expected, signaling easing inflationary pressure and fueling expectations that the Federal Reserve may cut interest rates sooner than anticipated.

A slight uptick in jobless claims has raised concerns that the U.S. labor market may be losing momentum.

Simultaneously, global players like China and Japan are shifting toward more stable monetary policy, prompting capital flows away from the dollar.

📉 From a technical perspective, DXY has broken below the key 100.817 support zone and is now trading around 99.7. Each attempt at a bullish pullback has been short-lived, with sellers regaining control quickly. The green arrows on the chart indicate potential reaction zones, but the descending channel structure remains firmly intact.

Outlook: If the index fails to reclaim the 100.8 – 101.3 resistance area, there’s a high probability of further downside toward the 98.5 – 98.0 support region.

In short, DXY is under pressure both technically and fundamentally, which explains the current bullish momentum in EUR/USD, GBP/USD, and especially gold (XAU/USD).

Dollar Index Tests Key Demand Zone: What's Next?The Dollar Index is currently testing a major demand zone between 99.50 and 101. This area has marked the end of downward moves and the beginning of dollar rallies five times since early 2023.

The recent downward pressure is largely driven by rising expectations of an economic slowdown and a strengthening euro.

At this point, several possible scenarios could unfold, depending on how the market reacts to this key support zone:

Repeat of the Past: Just like the previous five instances, the Dollar Index rebounds sharply from the zone and starts a strong upward move.

Trendline Test: The Dollar Index breaks below this zone and moves toward testing the long-term uptrend line that originated in 2011.

Fakeouts and Reversal: The Dollar Index briefly falls below the demand zone, approaches the long-term trendline, and then stages a false recovery above the zone. After trapping both bulls and bears and creating a fake breakout signal, it dips below the trendline before reversing and beginning a new medium-term uptrend that ultimately aligns above the long-term trend.

Given the high level of global economic uncertainty and recent sharp reversals in financial markets, the third scenario may carry slightly higher probability. A similar pattern played out in 2017, when both the 200-week moving average and the demand zone were broken. The key difference this time is that TVC:DXY is much closer to the long-term trendline.

DeGRAM | DXY broke the triangle downwardDXY is in a descending channel under a triangle.

The price is moving from the upper boundary of the channel, resistance level and upper trendline, which previously acted as a pullback point.

The chart failed to form an ascending structure, but it formed a harmonic pattern and broke down the mirror support level, which now acts as resistance.

On the main timeframes, the relative strength index is below 50 points.

We expect the decline to continue.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DXY – Bullish BAT Harmonic Pattern Formed

✅ Overview:

Pattern Identified: Bullish BAT

Current Trend: Bearish

Reversal Zone: Near 0.886 Fibonacci level (Potential PRZ – Potential Reversal Zone)

Bias: Short-term bearish ➝ Medium-term bullish

🧩 Pattern Structure:

X to A: Initial bullish leg

A to B: Retracement ~38.2%–50%

B to C: Extension to ~88.6%

C to D: Final bearish leg completing near 0.886 of XA

→ D point is the potential long entry zone

📈 Trade Plan – LONG Setup (Once PRZ is Hit)

Entry:

Buy near the 0.886 level of XA leg (watch for reversal candles or structure break)

Wait for confirmation on lower timeframes (1H or 4H)

Stop Loss:

Below the X-point or slightly below 0.886 zone

Targets:

TP1: 0.382 retracement of AD

TP2: 0.618 retracement of AD

TP3 (Optional): Break and retest of structure above B point

R:R Goal: At least 1:2

⚠️ Key Considerations:

Short-term DXY is still bearish; wait for reaction at PRZ

Ideal to pair with bullish divergence or support zone confluence

Watch for fundamental catalysts (CPI, NFP, Fed speakers) impacting USD strength

Dollar Index Testing Support - Possible TankI finally noticed today (haven't been doing my research) that the dollar has been dropping since January.

Bond yields rising at the same time as the market dropping and the currency dropping can only mean that the Euros are dumping ALL American assets. Trump has basically ruined confidence in the dollar, there was a 2% drop today. I only noticed because gold popped up 2%, because I'm looking at gold futures in dollars.

If the dollar breaks support, I'm buying gold (will post chart). Other alternatives are long on UDN, short on UUP, Euros, Yen or Swiss franc. You could even leverage with options if you want to make extra money.

DXY SUPPORT AHEAD|LONG|

✅DXY is approaching a demand level of 100.138

So according to our strategy

We will be looking for the signs of the reversal in the trend

To jump onto the bullish bandwagon just on time to get the best

Risk reward ratio for us

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DXY Support Ahead! Buy!

Hello,Traders!

DXY keeps falling down

In a downtrend but the

Index will soon hit a

Horizontal support

Of 100.200 and after

The retest a bullish rebound

Is to be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US DOLLAR at Key Support: Will Price Rebound to 103.000TVC:DXY is currently approaching an important support zone, an area where the price has previously shown bullish reactions. This level aligns closely with the psychological $100 , which tends to have strong market attention.

The recent momentum suggests that buyers could step in and drive the price higher. A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would increase the probability of a bounce from this level. If I'm right and buyers regain control, the price could move toward the 103.00 level.

However, a breakout below this support would invalidate the bullish outlook, potentially leading to more even more downside.

This is not financial advice!

DXYDXY(DOLLAR) is overall bullish we are currently sitting on a demand zone once that level holds scale down to the daily timeframe for execution but once the first demand zone get invalidated we wait for the next demand zone to look for another bullish movement back into supply levels REMEMBER: TREND IS KING

Dollar Daily CLS I Key Level - FVG I Model 1 it goes bellow 100.Hey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS range, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behaviour of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

🛡️ Models 1 and 2:

From my posts, you can learn two core execution models.

They are the backbone of how I trade and how my students are trained.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

📍 Model 2

occurs in the specific market sequence when CLS smart money needs to re-accumulate more positions, and we are looking to find a key level around 61.8 fib retracement and target the opposing side of the range.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

⚔️ Listen Carefully:

Analysis is not trading. Right now, this platform is full of gurus" trying to sell you dreams based on analysis with arrows while they don't even have the skill to trade themselves.

If you’re ever thinking about buying a Trading Course or Signals from anyone. Always demand a verified track record. It takes less than five minutes to connect 3rd third-party verification tool and link to the widget to his signature.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

DeGRAM | DXY seeks to close the gapDXY is in a descending channel between trend lines.

The price is moving from the support level, which has already acted as a reversal point twice.

During the decline, the chart formed a gap and afterwards formed an inverted hammer and a harmonic pattern.

On the 1H Timeframe, the Relative Strength Index is in the oversold zone and indicates bullish convergence.

We expect the index to head towards the gap after breaking the 38.2% retracement level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!