DOLLAR INDEX (DXY): Long-Awaited Recover

It looks like Dollar Index is going to pullback

after a test of a significant support cluster on a daily.

A strong bullish imbalance candle that was formed on an hourly

time frame shows a strong buying interest from that zone.

I expect a bullish movement at least to 102.35

❤️Please, support my work with like, thank you!❤️

USDX trade ideas

Dollar Index at Risk: Key Support Holds the Fate of the TrendThe U.S. Dollar Index (DXY) has broken down from a Head & Shoulders pattern, confirming a bearish reversal after a successful retest of the neckline. The price is currently near a key support area, and if it fails to hold, a drop toward the lower strong support zone is likely.

Additionally, RSI is showing bearish divergence and is below the neutral 50 level, indicating weakening momentum.

DYOR, NFA

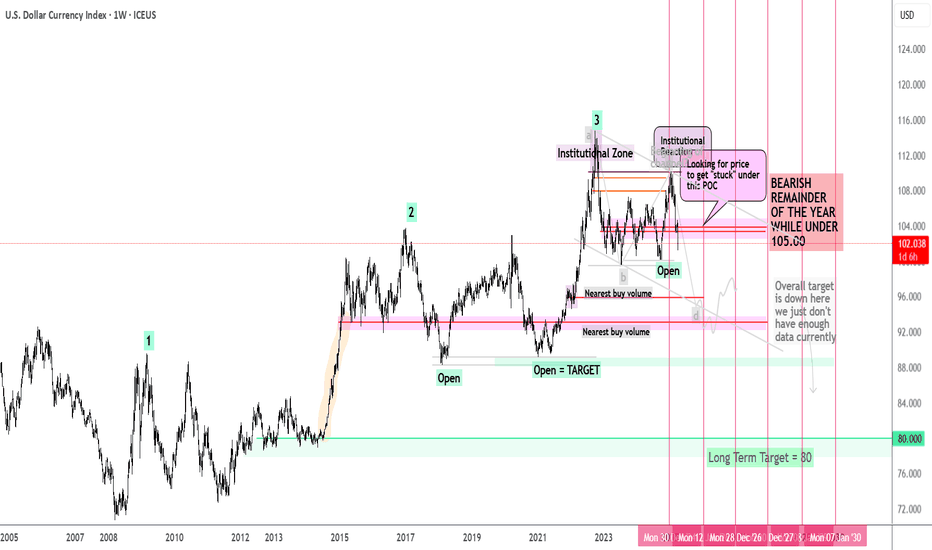

DXY to 80? ...Tariffs the First Domino in a Multi-Year Collapse?This is a pure technical walkthrough of the U.S. Dollar Index—no fluff, no indicators, no fundamentals. Just market structure, smart money, and liquidity concepts.

Back on January 14th , I posted about a potential 20%+ drop in the DXY — you can view it here . This video builds on that thesis and walks you through the full technical story from 1986 to today , including accumulation cycles, yearly trap zones, and my long-term target of 80. Am I crazy? Maybe. Let's see if I can convince you to be crazy too 😜

There is a video breakdown above, and a written breakdown below.

Here are timestamps if you want to jump around the video:

00:00 – The Case for $80: Not as Crazy as It Sounds

02:30 – The 0.786 Curse: Why the Dollar Keeps Faking Out

06:15 – How Smart Money Really Moves: The 4-Phase Playbook

12:30 – The Trap Is Set: Yearly Highs as Liquidity Bait

20:00 – Inside the Mind of the Market: 2010–2025 Unpacked

25:00 – The Bear Channel No One’s Talking About

36:00 – The First Domino: Is the Dollar’s Slide Just Beginning?

👇 If you're a visual learner, scroll down—each chart tells part of the story.

Chart: Monthly View – Three Highs, .786 Retraces, and Trendline Breaks

History doesn’t repeat, but it sure rhymes.

Each major DXY rally has formed a sequence of three swing highs right after a break of trendline structure. In both instances, price retraced to the .786 level on the yearly closes—an often overlooked fib level that institutional players respect.

We’re now sitting at a high again. You’ll notice price has already reversed from that zone. That doesn’t guarantee a collapse, but when we line it up with other confluences (next charts), the probability of a deeper markdown becomes hard to ignore.

I'd also like to note that all of the highlighted moves, are 2-3 year trend runs. Which means if we are bearish, this could be the exact start of a 2-3 bear market.

Market Phases Since 1986

This chart illustrates how DXY has moved through repeating cycles of:

🟡 Accumulation: Smart money building positions quietly.

🔵 Markup: Price accelerates with buy orders + media hype.

🟣 Distribution: Smart money sells to latecomers.

🔴 Markdown: Public panic → smart money reloads.

If we are indeed entering another markdown phase, this would align perfectly with the pattern seen over the past 40 years.

You’ll also notice the "Point of Control" (POC) zones—volume-based magnets that price often returns to. These spots often act as the origin of the move, and as such, they make for strong targets and areas of interest.

Liquidity Zones and Stop Loss Traps

This is where it gets juicy.

The majority of breakout traders placed long entries at the blue lines—above swing highs, thinking resistance was broken. But what’s under those highs? Stop loss clusters.

Institutions use these areas as liquidity harvests.

Several key levels are marked as “OPEN” in this chart, meaning price has yet to return to sweep those orders. That’s why I’m expecting price to begin seeking out that liquidity over the coming months.

There's also an imbalance gap (thin price action) around the 85–86 zone. If price falls into that trap door, there’s nothing to stop it until the 80s.

The 2025 Outlook

Here’s how I’m approaching this year:

✅ Bearish bias under 105

🎯 Targets at 100, 95, and 90

🚪 Trap door under 86 if volume is thin

Price is currently stuck under the recent point of control and showing signs of distribution. If that level continues to hold as resistance, we could see a multi-leg push downward, with the 100 and 95 zones acting as check-in points.

If we break under the 90s and enter the imbalance zone, 80 becomes more than just possible—it becomes probable.

🗣️ Let’s Sharpen Together

Do you see this unfolding the same way?

Do you disagree with the 80 target?

Drop a comment with your view or share your own markup—this is why we trade!

Stay safe,

⚠️ Risk Disclaimer

This post is for educational purposes only and reflects my personal analysis and opinions. It is not financial advice. Trading involves significant risk and may not be suitable for all investors. Always do your own research, manage your risk appropriately, and never trade money you can’t afford to lose.

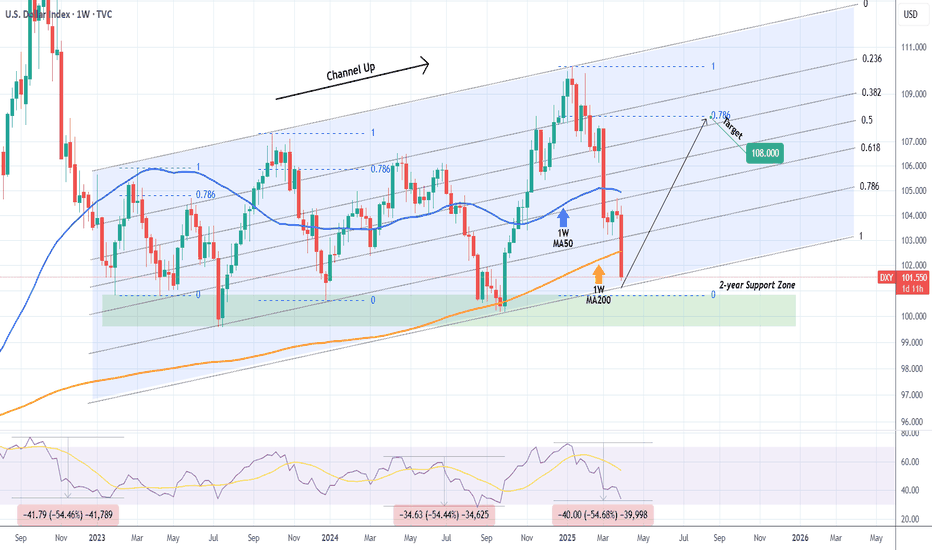

My Analysis of the DXY ChartLooking at this chart, the DXY is moving within an ascending channel defined by the two white trendlines. Based on my analysis, there are a few key levels to watch, especially the Fibonacci retracement levels.

First, if the price starts to drop from the upper boundary of the channel, it is likely to retrace down to the 0.61 Fibonacci level. This is an important support zone, and the price might bounce back up from here.

However, if the 0.61 Fibonacci level doesn’t hold, the price could continue falling towards the 0.78 retracement level. This level is a much stronger support and could trigger a significant reversal if the price reaches it.

Finally, the lower boundary of the channel, marked by the white trendline, serves as the ultimate area of support. If the price falls this far, there’s a strong chance it will bounce back upward within the channel.

This analysis highlights the key zones where the price is likely to react and helps identify the next potential moves for the DXY

DXY Chart SummaryEh bro, this chart showing two roads for Dollar Index lah.

If price can break above that 100 level ah, then maybe will fly up to 92-94 area (last resistance zone).

But if kena reject at 100, then jialat, price can drop back down to 110 area again.

So now hor, this green box is the decision point — break or reject.

Wait for clear move first, don’t simply jump in."

DXY just broke below the 1W MA200 after 6 months!The U.S. Dollar index (DXY) broke today below its 1W MA200 (orange trend-line) for the first time in 6 months (since the week of September 30 2024). By doing so, it has almost hit the bottom (Higher Lows trend-line) of the long-term Channel Up.

The last contact with the 1W MA200 initiated a massive Bullish Leg two weeks after, so it would be an encouraging development if the candle holds here or better yet even close above the 1W MA200.

If it does, we expect a new strong Bullish Leg to start, targeting initially at least the 0.786 horizontal (blue) Fibonacci level at 108.000.

If not, the 2-year Support Zone is the last defense, with 99.600 as its lowest level (the July 10 2023 Low). Below that, a multi-year downtrend for DXY awaits.

Notice however, the incredible 1W RSI symmetry between selling sequences. Since January 2023, we've had two -54.50% declines. Right now, the current decline since January 2025 is exactly at -54.50%. If DXY rebounds here, it will confirm this amazing symmetry.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

"DXY/Dollar Index" Bull Money Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "DXY/Dollar Index" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (104.100) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (103.500) Scalping/Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 105.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"DXY/Dollar Index" Indices Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DXY Will Go Lower From Resistance! Sell!

Take a look at our analysis for DXY.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 104.207.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 102.727 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

DXY | Major Cycle Peak – Is the Dollar Losing Its Grip?The U.S. Dollar Index (DXY) appears to be following a well-defined historical cycle, marking major peaks approximately every 15–20 years. If history repeats, the 2022 peak near 114 could signal the beginning of a multi-year dollar decline, impacting global markets, commodities, and currency pairs like EUR/USD.

Historical Peaks & Reversals

Examining past DXY cycles, we see:

969 Peak (~120): Followed by a prolonged decline into the 1970s.

1985 Peak (~165): Marked by the Plaza Accord, triggering a sharp dollar downtrend.

2001 Peak (~120): Led to a multi-year decline as the Fed shifted policies.

2022 Peak (~114): The most recent high—could it mark the next major reversal?

Each peak historically aligns with aggressive Fed tightening cycles, followed by a shift towards easing policies, leading to a weaker dollar. With U.S. interest rates expected to plateau or decline, this pattern suggests a potential long-term bearish trend for the dollar.

Implications of a Weaker Dollar

Bullish for EUR/USD – A declining DXY typically strengthens the euro.

Boost for Commodities – Gold, oil, and other dollar-denominated assets could rally.

Stronger Emerging Markets – A softer dollar eases financial conditions globally.

With DXY showing signs of a historical cycle peak, investors and traders should watch for confirmation of a multi-year downtrend, potentially reshaping global markets.

Dollar I Monday CLS, KL - Order Block, Model 1Hey Traders!!

Feel free to share your thoughts, charts, and questions in the comments below—I'm about fostering constructive, positive discussions!

🧩 What is CLS?

CLS represents the "smart money" across all markets. It brings together the capital from the largest investment and central banks, boasting a daily volume of over 6.5 trillion.

✅By understanding how CLS operates—its specific modes and timings—you gain a powerful edge with more precise entries and well-defined targets.

🛡️Follow me and take a closer look at Models 1 and 2.

These models are key to unlocking the market's potential and can guide you toward smarter trading decisions.

📍Remember, no strategy offers a 100%-win rate—trading is a journey of constant learning and improvement. While our approaches often yield strong profits, occasional setbacks are part of the process. Embrace every experience as an opportunity to refine your skills and grow.

Wishing you continued success on your trading journey. May this educational post inspire you to become an even better trader!

“Adapt what is useful, reject what is useless, and add what is specifically your own.”

David Perk ⚔