VIX trade ideas

I told you so....VIX is the golden goose! All this fake pump in the market was just not sustainable. It is very clear that there are holes and the money printing can't last forever. The S&P fake pumps, and artificial tariffs (which Americans pay 90%) are created out of thin air. The reality is that defaults are very high across the board for most debt classes, VIX is at a YEAR LOW (doesn't happen to often, signaling massive complacency), and now the song will end and all the retailers will be holding the bag! Learn how to trade the VIX! DM me for details.

Always do your own due diligence, but historically this is a good time to get out :) You need to see and take action when you see red flags....

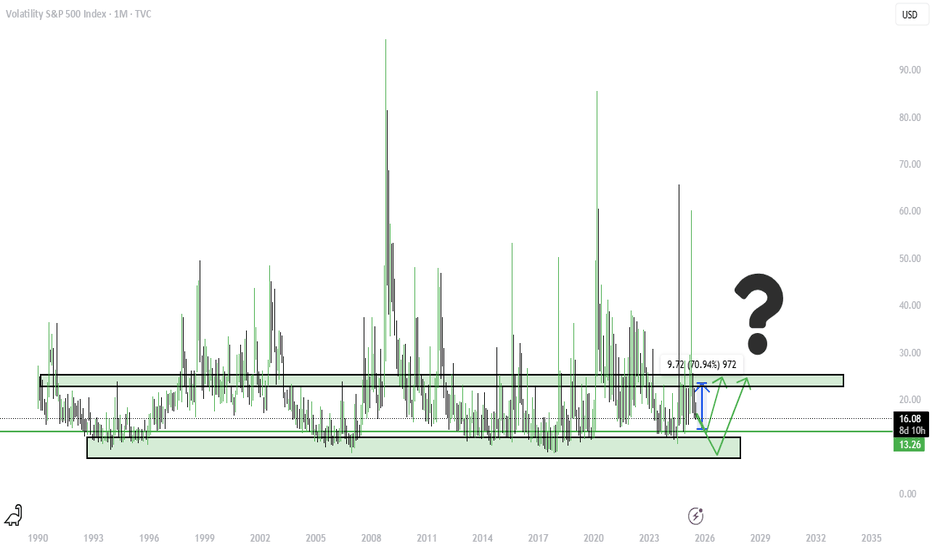

VIX possible long?As equity markets continue to approach all-time highs and expectations of interest rate cuts increase, market sentiment remains highly optimistic. This environment of "good news" characterized by strong performance in equities and the anticipated easing of monetary policy is likely to suppress volatility in the short term, potentially pushing the VIX down into the 12–15 range.

However, this period of euphoria may mask underlying risks. Stock valuations appear stretched, and the crypto market is exhibiting signs of overheating. If corporate earnings begin to miss expectations or if signs of economic slowdown emerge particularly if the economy shows signs of overheating before stabilizing market sentiment could shift rapidly. In such a scenario, volatility may spike again, with the VIX potentially rising back into the 20–25 range as uncertainty returns and risk appetite diminishes.

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

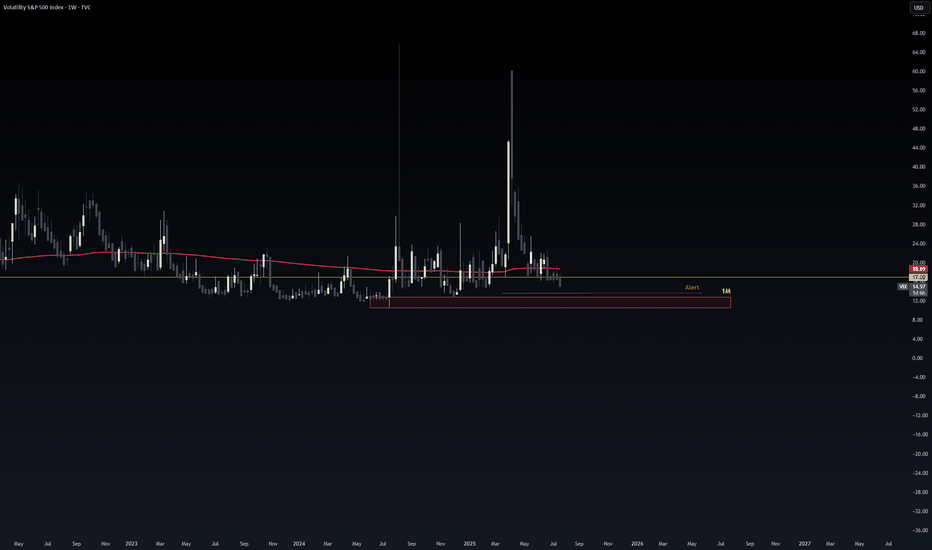

Unprecedented VOL suppression will lead to VIX October explosionAccording to my discussions with ChatGPT and analyzing various metrics we are currently in one of the longest periods, if not *the longest* period, of Vol suppression in the entire history of volatility.

Zooming out and looking at the current chart pattern VIX is very clearly in a falling wedge, which means its falling days are numbered.

Once you see a daily close breach of the upper boundary of the upper wedge channel, I would consider buying some VIX 30 calls for Oct 22 expiration.

Once VIX pierces 25, take profit and close the option.

Good luck and happy trading!

VIX: From “Calm Tension” to a ReboundWhy does a small uptick matter today… if we’ve already seen 60+ readings four times in the past 17 years?

The first week of August 2025 brought back a familiar market force: volatility.

The VIX, which tracks expected fluctuations in the S&P 500, jumped 21% in just a few days, rising from 17.4 to 20.37, with an intraday high of 21.9 on August 1.

At first glance, the move may seem minor. But it broke through key long-term moving averages (SMA 50 and 200) and exited its recent comfort zone (14–19 pts). That alone is enough to make portfolio managers and traders pay attention again.

🔙 Historical context: when the VIX truly spiked

📅 Date 🔺 VIX intraday 🧨 Trigger

Oct 1, 2008 96.40 Subprime mortgage crisis, Lehman collapse, AIG bailout

Mar 2, 2020 85.47 COVID-19 global spread, border shutdowns

Aug 5, 2024 65.73 Surprise Fed rate hike + overheated jobs data

Apr 7, 2025 60.13 Panic over new U.S. tariffs on global partners

Compared to those moments, today's VIX levels look “mild.” But the technical and macroeconomic signals suggest that volatility may be establishing a new baseline.

1. 📊 Breakdown: First week of August 2025

Weekly increase: from 17.4 → 20.37 (+21%).

Technical breakout: monthly close above both the 50-day and 200-day simple moving averages (SMA 19.25 and 19.45).

MACD on the monthly chart has flipped positive for the first time since March 2023.

Key drivers:

🏛️ The Fed left interest rates unchanged on July 30, but two dissenting votes favored a rate cut.

👷♂️ Softening jobs data: July NFP came in at only +73,000 jobs (vs. +110,000 expected).

🧾 New U.S. tariffs, announced on August 1, reignited inflation concerns.

2. ⚖️ Comparing August 2025 to the August 2024 storm

Factor August 2024 August 2025 (Week 1)

🔺 VIX peak 65.73 21.9

🏛️ Fed stance Surprise 25 bp rate hike Rates unchanged, internal division

👷 Labor market Hot, wage pressures Cooling down

📉 S&P 500 reaction −12% in 3 weeks Approx. −3% decline underway

💧 Market liquidity Very low (pre-market) Normal

Conclusion:

2024 was a systemic shock.

2025 is more of a volatility warning sign—but one that matters for risk management.

3. 📍 Technical signals to monitor

The monthly MACD just turned positive, which historically precedes sustained volatility spikes.

Key short-term range: 18–22 pts. A sustained close above 22 could trigger heavy selling in high-beta stocks.

Options expiration (OPEX, Aug 16) may amplify moves via gamma flows.

4. 🔮 What could move the VIX next?

📅 Date 📌 Event ⚠️ Volatility Risk

Aug 14 Core CPI (July) Reading above 0.3% m/m could reignite hawkish Fed bets

Aug 22–23 Jackson Hole Symposium Powell’s speech could reset the policy outlook

End of Aug Q2 GDP revision Confirm whether slowdown = soft landing or stagflation

📌 Note: The VIX cannot be traded directly. Exposure is typically obtained through futures, options, or ETNs—each with specific risks like contango, low liquidity, and roll decay.

📌 Final thoughts

The VIX doesn’t need to hit 60 to send a message.

The fact that it’s breaking above long-term averages, reacting sharply to macro data, and threatening key levels is enough to suggest that the era of ultra-low volatility may be ending.

History shows us that major VIX spikes come fast and unannounced.

If you remember 2008, 2020, or even April 2025—you know that preparation beats prediction.

Weekly Volatility ReadGood Evening --🌗 🌕🌓

I hope everyone is having a relaxing weekend with friends and family alike because soon we will be in the thick of the price action again -- and it may get spicy! Let't us dive in as we review what happened last week and we look towards the next to trade range or observe.

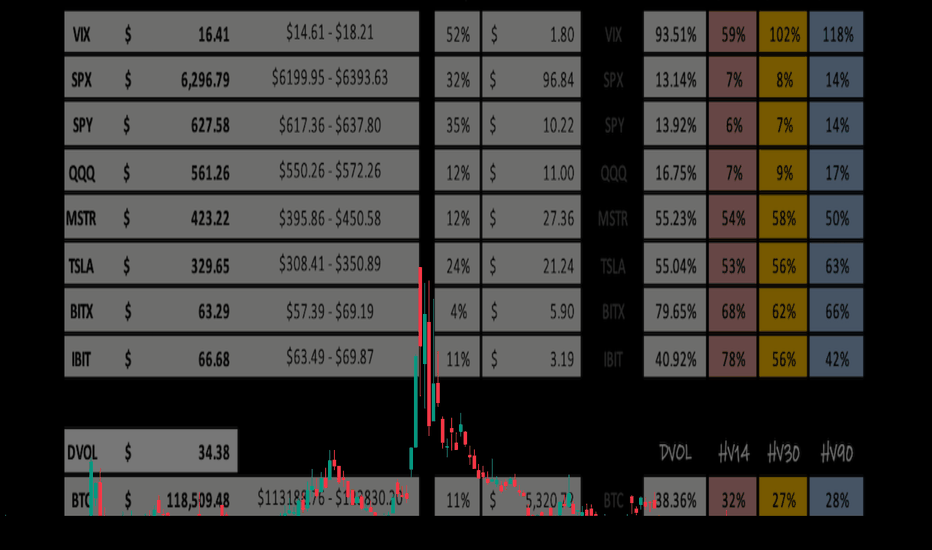

The CBOE:SPX opened the week fairly slow at $6,193.18 and increased throughout the week wicking up to a new ATH of $6,315.61 only to close the week off at $6,267.28 -- This leaves the IM on the week +$83.10. This closest respects the quarterly implied range that was a 'strength of IV' of 129.30%.

Now looking towards this next week we have extremely low HV across the board in the broader markets. CBOE:SPX IV (13.14%) is trending 32% IV percentile on the year -- premium is seemingly cheap. HV10 (6.97%) is coiled within 97.67% of it's sliding yearly lows, showing a need for short-term volatility to consolidate. HV21 (7.78%) is even more coiled to it's yearly low at 98.76% respectively. Both are roughly mid 50% 'strength to IV' as IV predicts twice the potential move next week.

Lastly, HV63 our quarterly trending values is showing a 'strength of IV' at only 108% but, could be supporting the thesis IV is projecting, as we do need a TVC:VIX pop OR time-wise consolidation. 📈📉

I hope everyone has a great week trading ranges and I will see you next weekend!

Cheers! 🍻🍻🍻

Go Long on VIX: Predictions for Increased VolatilityCurrent Price: $16.41

Direction: LONG

Targets:

- T1 = $17.50

- T2 = $18.25

Stop Levels:

- S1 = $15.90

- S2 = $15.65

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in VIX.

**Key Insights:**

The VIX, commonly referred to as the "Fear Index," is currently hovering at historically low levels of 16.41, well below the psychologically significant threshold of 20. This indicates a relatively calm equity market, but traders know all too well that complacency often precedes sharp volatility spikes. Key breakout levels range between 18 and 19, with the potential to test mid-20 range if significant macroeconomic or geopolitical events materialize. Traders are advised to consider hedging strategies while monitoring these thresholds closely.

The current low-volatility environment reflects broad market optimism, but it also suggests the possibility of a quick reversal. Historically, prolonged periods of suppressed VIX readings can lead to sharper corrections when fear abruptly rises. For this reason, traders should stay vigilant, particularly with major economic events on the horizon.

**Recent Performance:**

Over the past few weeks, the VIX has steadily declined, breaking below 17 and reaching the current zone of 16.41. This downward momentum aligns with bullish equity markets, where major indices like the S&P 500 continue to hover near all-time highs. This subdued state demonstrates investor confidence but warns of potential complacency risks.

**Expert Analysis:**

Market analysts emphasize the importance of the 18-19 zone, which serves as a critical resistance range. A sustained breakout above these levels could lead to a move into the 20-25 range, driven by renewed market uncertainty. Technically, the VIX remains oversold, implying the probability of an upward momentum shift soon. Experts point to factors such as Federal Reserve policy statements, inflation data, and geopolitical surprises as potential catalysts. Overall, professional sentiment skews towards a medium-term bullish stance on VIX.

**News Impact:**

Recent market headlines indicate hedging activities through August and September VIX futures, preparing for a potential volatility spike tied to macroeconomic concerns or policy announcements. Additionally, the simultaneous drop in the MOVE index—a measure of bond market volatility—further signals market complacency, raising questions about whether markets are adequately pricing in risks. These factors, combined with historically low VIX levels, suggest that a volatility breakout is on the table in the coming weeks.

**Trading Recommendation:**

With the VIX at suppressed levels, traders have an opportunity to position themselves for a potential upside. Going long on VIX with an initial target of $17.50 and a secondary target of $18.25 provides a favorable risk-to-reward setup. Stop-losses at $15.90 and $15.65 help manage downside risks effectively. This strategy aligns with historical patterns where low VIX levels are followed by periods of heightened volatility, especially during critical market junctures.

VIX will save you! Learn how to trade itHave been trading the VIX for years and it is absolutely gorgeous how well it performs when everything else tanks! Check out monthly spikes, it's trend, and cycles going back over 30 years. For details DM on the ABCs of using leverage without taking on any directly yourself and trading entry / exits with backtesting algorithmic support!

Soon we will get to the 20s and then it's when the fun begins....30s and 40s is very much a real scenario and the economy is doing far worse than people think. Most stocks are trailing below SMA 200 and only a dozen companies are holding the ship afloat. This is not sustainable!

The S&P is highly correlated, most in 5 years, which means that diversification has less impact. VIX has a beta of 0.1! Let that sink in, use it to your advantage before the massive correction happens. Not financial advise, always do your own due diligence, but have beaten the market multiple times over :)

What will go down VIX or SPX?When SPX pushes fresh highs while the VIX floor makes higher lows, fragility rises.

This post is for informational/educational purposes only and is not investment advice or a solicitation to buy/sell any security. Past performance is not indicative of future results. I may hold positions related to the instruments mentioned.

Weekly Volatility Snapshot Good Evening --

I hope everyone is having a restful weekend and enjoying your time away from markets. Always appreciate it while you can, and spend that precious time with loved ones. Now, let us review the price action last week as we look towards our expectations for the coming trading sessions.

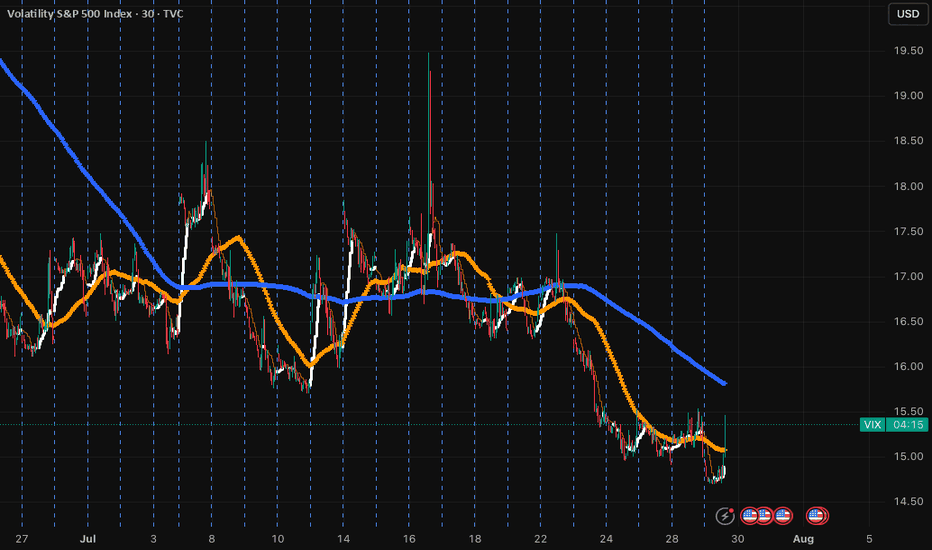

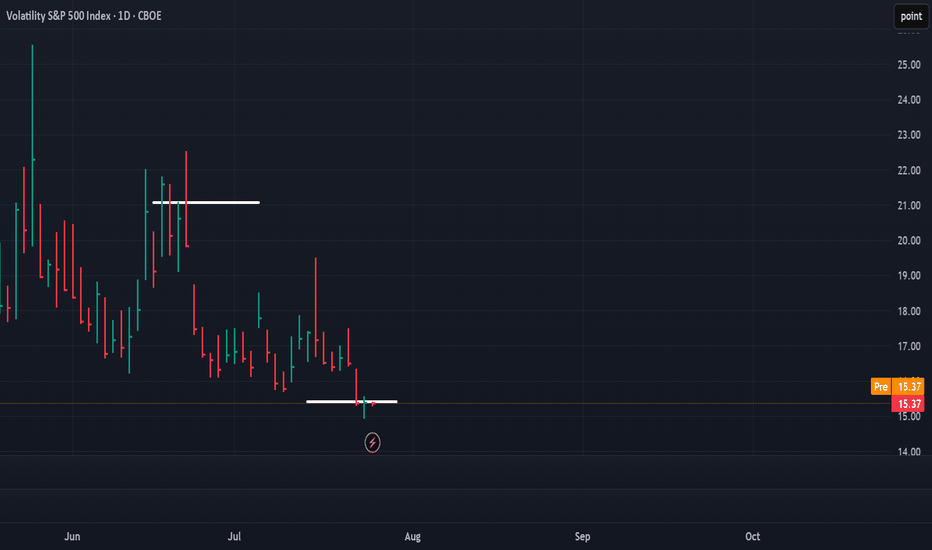

The CBOE:SPX opened the weekly candle at $6,126.15 and closed $6,252.50 -- this respectively puts the weekly move at +$126.35. This is slightly above what IV was stating entering the week. We are starting to see seasonality set in as the markets top and look for consolidation. The TVC:VIX dropped throughout the week putting a bottom in at $15.70 which shows volatility creeping to it's lowest point year-to-date.

We should all expect a volatility bounce in the near future as the run the broader markets have made out of the steep correction needs to cool off before moving forward. Below is my volatility read for the S&P 500. You will see that HV10 (7.94%) is coiled within 3.30% of its sliding yearly lows. This tells me between the low sentiment in fear and the low volatility in short-term trends, we need to cool off a little.

Now looking towards this week, I see the broader markets consolidating and even selling off in order to reset the overbought 'lagging' indicators and pop the VIX up a little bit. The administration has pushed the trade deal deadline off till AUG 1st providing some relief to the markets but, has also created more uncertainties with tariff letters that went out Friday.

Look for a negative news cycle sparking up Sunday night into Monday, potentially creating momentum downwards. However, I believe we stay in range of what HV10 weighted to IV implies -- $6,207.72 - $6,311.78. This range holds a divergence from IV of 5.29% and and price gap difference of -$17.32. To me, this says that what is short-term trending is 'contractive' to what IV states.

That's all for this week. Stay hedged against your bias always and remember to practice your ABCs -- If you like what you are reading and love volatility range analysis as much as i do -- feel free to drop me a comment and ill get back to you! Till next time, Cheers!

Weekly Volatility SnapshotGood Evening -- Happy July 4th to everyone

Let us review last week as we look towards the next in anticipation of the trade deal deadline that looms. I had a target on the SP:SPX of $6,253.59 and the weekly high was $6,284.65. The candle on the short week opened at its low of $6,019.21 and closed $6,233.08 making the weekly range +$213.87. This represents closest to HV63 over IV which stated +/-$253.26 and a 'strength of IV' that was 295% . Again the weekly high is above our range target, but my volatility will always be measured close-to-close.

Now as we look towards this week --

IV (13.85%) has shifted upwards slightly with HV10 (7.36%) hinged down and still lowering. In fact, I have bi-weekly volatility as 97.28% 'coiled' to it's sliding yearly low of 4.64% -- HV21 (9.92%) is closer to what IV states with it being 'coiled' 96.61% to it's respective sliding yearly lows.

In my opinion, volatility still has room to consolidate slightly as markets rotate higher. I think we can see upwards $6,327.73, but slowly over the course of the week with the last tariff uncertainty getting out of the way. From there, going into mid July we may need to see a volatility spike. The HV10 range I am watching holds a 'strength of IV' entering this week of only 53% -- this shows the price per move is expensive by almost twice as much.

Till next time, know your ABCs, have a great long weekend, and stay hedge!

CHEERS

How I Manage Risk (When Buying Options) If you’ve read my previous post — “How Much Risk Are You Really Taking?” — you already know my view on risk:

Treat every trade like watching your cash burn in front of you.

Ask yourself:

💭 “Would I be OK watching this much money disappear right now?”

If your answer is yes, take the trade and move on.

If it’s no, don’t do it — resize it.

🚫 What Not to Do:

Many traders fall into the trap of:

“I’ll think about it later”

“I’ll set a mental stop and cut if it hits my level…”

That approach has two fatal flaws:

#### ❗ 1. Execution failure

You might not react fast enough when the market hits your level — or worse, you’ll forget to act at all.

#### ❗ 2. Emotional resistance

Even if your stop level is hit, will you actually cut?

Probably not.

Human nature avoids pain and chases pleasure.

Cutting a loss — even a planned one — is painful. That’s why mental stops often fail.

Mental stops:

Add more burden to monitor

Add more emotion to your decision-making

That’s why I keep it simple.

---

✅ My Risk Rule for Buying Options:

Every dollar of premium I spend is 100% acceptable to lose.

This way:

I don’t need a mental stop.

I don’t need to watch it every second.

I sleep well, regardless of outcome.

---

📊 How Much Do I Risk?

It depends on account size and account type:

#### 📌 Main Account:

Risk 1–2% per trade

Never more than 5% on a single trade

Rarely hold more than 3 trades at once

Targeting 6–10% total exposure, only if trades are uncorrelated

⚠️ SPY & QQQ are NOT uncorrelated — don’t fool yourself.

#### 📌 Small Account:

Can risk 5–10% per trade, but only on A+ setups(See: “What’s Your Catalyst?” for what qualifies as A+ in my book)

The goal of a small account is different: it’s about growth — but still must be strategic.

---

💰 “But How Can I Make Big Money Risking So Little?”

This is the common pushback I get:

“Shouldn’t we take big risks to get big rewards?”

Sure — high risk = high reward.

But high risk also = high chance of blowing up.

Even if you hit a few big winners, you’ve compromised your long-term survival.

That’s not trading. That’s gambling.

---

🧠 What I Actually Look For:

Low Risk / High Reward.

Yes, they’re rare.

Yes, they’re like lotto tickets.

But you don’t need to win often if you only risk a little and win big when it counts.

What’s not rare is:

Traders risking big on uncertain setups

Going all in on gut feelings

Wiping out in one or two bad trades

That’s not strategy — that’s self-destruction.

---

🧾 The 2 Core Rules of Risk:

Protect capital at all costs

Only take trades where potential reward outsizes the risk

Don’t flip the logic.

Too many traders hear “high risk = high reward” and assume high risk is required.

It’s not.

That mindset is built for Vegas, not for Wall Street.

---

🧠 If You Want to Be a Trader — Not a Gambler:

You must believe in:

Small risk, big reward

Patience

Discipline

Letting time and luck compound your edge

No other way.

🎯 If you truly get this… congrats.

You’ve crossed the line from gambling to trading.

$VIX Volatility Extremes, Narratives, Booms & Busts!TVC:VIX volatility index extremes have always been an important factor when assessing the cyclical nature of financial markets.

I demonstrate in this chart what values and narratives to look out for at these extremes. This can help ignore the noise when buying during low social mood / fearful events when everyone else is panic selling, and, selling during exuberance and booms when everyone else is FOMO buying.

This is the cyclical nature and intertwined relationship between media, events and financial markets that traders and Investors want to take advantage of.

Good times create positive social mood, exasperating over leveraging and booms with extreme positive news / silly price targets 'New Golden Age / Paradigm shift' style reporting.

This unwinds aggressively creating negative social mood which the media exasperate with 'fear and doom' reporting.

VIX is a useful tool to hedge against market uncertainty.

Safe trading

VIX Breakout: Forex Traders, Buckle Up for Volatility!🚨 VIX Surge: What Currency Traders Need to Know Right Now 🌪️💱

📊 Chart Context & Technicals:

The recent breakout in the VIX signals a major shift in global risk sentiment! 📈 The index has leapt off its base, showing markets are bracing for uncertainty. For forex traders, this is a flashing signal: volatility in equities often spills over into FX, amplifying moves in major pairs and risk-sensitive crosses. ⚡️

🌍 Geopolitical & Macro Backdrop:

This VIX spike is fueled by President Trump’s aggressive new tariffs on BRICS-aligned nations. 🏛️🔥 These moves have reignited global trade war fears, rattled equity markets, and triggered a broad risk-off wave. Historically, VIX surges = sharp swings in USD, JPY, CHF, and commodity-linked currencies. The USD, usually a safe haven, is now under pressure from both trade uncertainty and looming Fed rate cuts as the U.S. economy slows. 🏦📉

💱 FX Market Implications:

USD: The dollar is caught between safe-haven demand and worries over U.S. growth and deficits. Initial VIX spikes can boost USD, but ongoing trade tensions and dovish Fed signals are weighing it down. 💵⚖️

JPY & CHF: Classic safe-haven currencies! As VIX rises, expect flows into JPY and CHF, especially against high-beta currencies like AUD, NZD, and EM FX. 🗾🇨🇭

EUR, GBP, AUD, CAD: European currencies are outperforming in 2025, thanks to fiscal stimulus and capital inflows. Commodity currencies remain volatile, tracking risk appetite and global growth swings. 💶💷🇦🇺🇨🇦

🛠️ Trading & Strategy Takeaways:

Volatility = Opportunity: Elevated VIX means wider ranges and more frequent breakouts in FX. Prime time for breakout and momentum strategies, but demands tighter risk controls and dynamic position sizing! 🚦

Watch Correlations: Rising VIX typically strengthens JPY and CHF, while risk currencies (AUD, NZD, EM FX) weaken. USD direction is more nuanced—initially bid, but vulnerable to U.S. policy missteps and data misses. 🔄

Event Risk: With Trump’s tariff policy in flux and central banks diverging, expect FX volatility to stay high. Stay nimble around news releases and be ready for headline-driven whipsaws! 📰⚡️

🎯 Pro Takeaway:

The VIX is flashing a clear warning for currency traders: risk sentiment is deteriorating, and volatility is back in force. This environment rewards disciplined, adaptive trading—favoring safe-haven currencies, tactical hedges, and a readiness to pivot as policy headlines evolve. For those trading USD/JPY, EUR/USD, and cross-rates, expect bigger intraday swings and more false breakouts. Use the VIX as your real-time risk barometer and adjust your strategies accordingly! 🧭

VIX Hits Key Level as S&P 500 Breaks Out – What’s Next?I keep a close eye on VIX levels that consistently matter — and one of those was just tagged:

📍 VIX levels I watch:

11.00 | 14.35 | 18.16 | 20.58 | 37.22

Today, we spiked up to 18.16 and stalled. This is my "in-between" level — not major, but notable — and we’re already seeing volatility slow right at that point.

Meanwhile, the S&P 500 ( SP:SPX ) has broken out to fresh all-time highs.

What I’m watching now:

➜ Will VIX stay below 20.58 and compress further?

➜ Does SPX hold the breakout into early July?

➜Could this set the tone for a melt-up summer?

July’s first half is historically up and a mixed bag in the back half, but the price action and volatility narrative could give us the edge. July is the best month of Q3 traditionally (institutions). Stay focused on the close and the VIX response.

#VIX #SP500 #SPX #volatility #macro #tradingview #DisciplineTrading

Weekly Volatility SnapshotGood Morning -- ☀️☀️☀️

What an amazing last full week of June that was as we pulled out of corrective territory and onto new ATHs with the SP:SPX body of its weekly candle moving +3.41% -- bottom to top. The weekly move open-to-close was +$98.40 as that is how I gauge my volatility metrics. This in comparison is closest in value to IV entering the week as it was stating an implied move of +/-$102.08, which was a volatility read of 16.34% -- As you see in reflection of the weekly chart below and within daily candle structure, price action moved upwards all week surpassing quarterly marks. This in turn is raising short-term volatility and lowering monthly averages as we rotate higher.

Here is the weekly price action of the TVC:VIX from a 5m perspective. This is showing the EOW trend break upwards drilling the indices back down -- A healthy pullback after being seemingly over-extended. This happened during the news cycle release of the U.S. and Canada reciprocal tariff disagreement. Hopefully this settles over the weekend and we rotate higher into the 4th of July week.

Now looking towards this holiday week -- We have the SP:SPX IV (13.29%) after melting during the ATHs move previously -3.09% -- This places IV on the sliding yearly spectrum at the 39% down range showing increasing discount in yearly value. Remember, If you form option positions IV affects VEGA 1% at a time and the algos bid down IV in contracting markets as they rotate higher. HV10 (12.46%) has hinged down and still is contractive per IV prediction but, increasing in comparison with a ' strength of IV ' now showing 94% entering this week.

As the TVC:VIX has closed at $16.32 -- I believe that there is still a little room to extend potentially upwards to the HV10 weekly range of $6253.59. Currently, the SP:SPX YTD return is +4.96% with weekly momentum pointing up and room for volatility to still decrease. If this mark is reached it would put the YTD return at +6.52%. Very feasible and realistic being halfway through the year and going into the 4th of July 🇺🇸🇺🇸🇺🇸🇺🇸 Watch as we climb the wall of worries around us. This would in turn decrease short-term volatility more maybe even to a bottoming point and IV would melt during the rotation upwards with the VIX slowly grinding down.

Come back next week as we review what happened within the implied ranges posted and overlook the volatility potentially bottoming and looking towards a VIX spike in the near future.

Remember to know your ABCs and stay hedged against your bias! CHEERS!