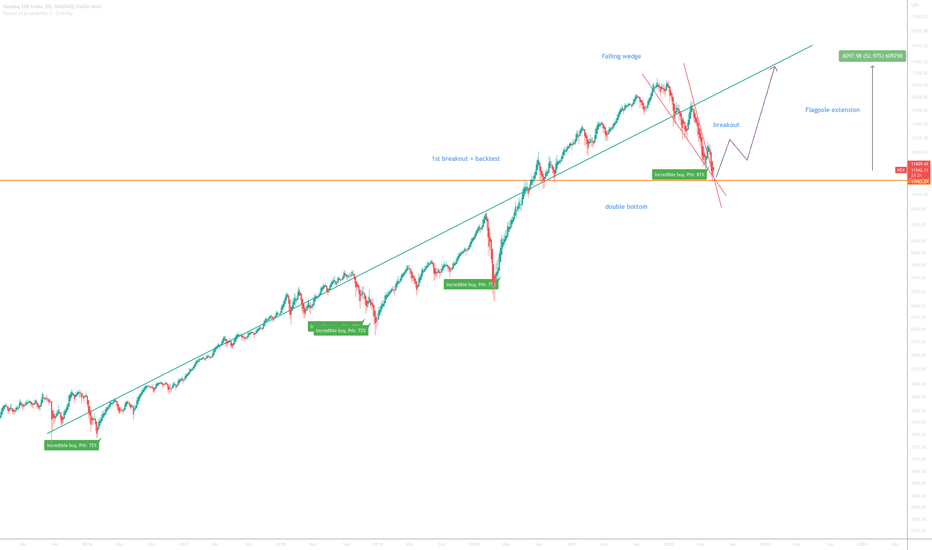

Nasdaq 100 to 17000On the above 3-day chart price action has corrected 33% since late December. A number of reasons now exist to be bullish, including:

1) The ‘incredible buy’ signal has printed. Look left.

2) The buy signal is coming in at 81% probability. The previous were 75%, 72@, & 72% percent, respectively. Look at the strength of if a 75% recovery, what do you think a 81% will be like? This can only be the result of a massive short squeeze, in my opinion.

3) Price action has just printed a ‘double bottom’ (orange line) on past support / resistance - look left!

4) Most recently price action has broken out of a bullish falling wedge formation with back test confirmation, see below.

Is it possible price action falls further? For sure.

Is it probable? No.

Good luck!

Ww

A little closer

NAS100 trade ideas

NASDAQ 100 – Mega Wedge Ending? Black Swans Circling!📉 NASDAQ 100 🦢💥

By: Bullmaster 🐂

This isn’t just a chart – it’s a macro time bomb ticking louder each month.

Zoomed out to the monthly timeframe, the US Tech 100 is sitting at the edge of a massive rising wedge, formed over two decades.

We’ve completed what looks like a classic Elliott Wave 5-structure ✅

Every historic peak is marked:

🧱 Dot Com Bubble Peak

🏦 2008 Peak

🧪 Covid Peak

🏛️ Trump-Era Peak

Now comes the real danger…

🔻 If the wedge breaks down, major levels below are exposed:

• 16,659 – First line of defense

• 10,669 – Covid crash retest

• 4,816 – 2008 crisis level

• 2,239 – Dot Com peak

🦢 Black Swans are stacking up: • 💵 Unsustainable debt levels

• 📉 Artificial liquidity driving irrational prices

• 💼 AI bubble inflating fast

• 🌍 Geopolitical tensions (Taiwan, Middle East, etc.)

• 🏦 Fragile banking systems in the shadows

• 🧨 Overexposure to a handful of megacaps

“Markets rise in euphoria, and fall in terror. Be ready for both.” – Bullmaster

📊 This isn't FUD. It's macro risk preparation.

Stay sharp, manage risk, and remember: crisis = opportunity for those who survive the drop. 💀➡️👑

#NASDAQ #MacroView #CrashComing? #BlackSwanAlert #Bullmaster #ElliottWave #RiskManagement #TechBubble

NAS100 Is Bullish! Buy!

Please, check our technical outlook for NAS100.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 18,440.0.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 21,081.9 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NASDAQ BuyPossible reverse to the upside, markets are very volatile and great opportunities to buy at a discount are there. Given the current political climate we could see unexpected large moves in short spaces of time. please exercise proper risk management and dont overtrade, and stick to your plan.

NQ/US100/NAS100 Short - Day TradesNAS100, US100, NQ, NASDAQ short for day trade, it got bullish pressure but not yet to take rocket flight, came back to pick more orders, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

You may enter only 1 trade

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

Maybe fast we VA V-shaped recovery in stocks refers to a very sharp and rapid decline in the market (or a particular stock or index), followed by an equally fast and strong rebound. If you look at a price chart, the movement resembles the letter “V”.

🔍 Key Characteristics:

📉 Rapid drop: Often caused by panic, crisis, or a major economic shock.

📈 Quick rebound: Recovery begins quickly after the bottom and moves upward with strong momentum.

⏱️ Short duration: The total period of decline and recovery is relatively brief.

💼 Investor sentiment: Confidence returns quickly, and buying pressure increases.

Im in 17.860 out 18,364 - SL in profit - 18.051

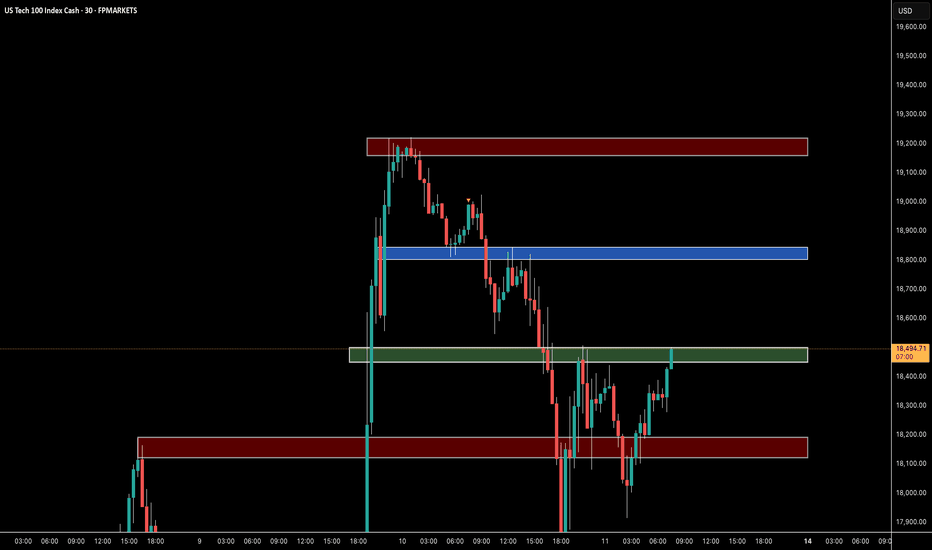

NasDaq100 1 Hr Trade analysis After president trumps tariffs pause announcement on 4/09/2025 Nasdaq rallied saw bullish momentum to $19,200 levels. Price consolidated after around $19,194(resistence) & $18,609 (support) levels. As a break-out trader, we waited for price to break the support level of $18,609. Forming our indication, correction and continuation analysis on the 15min time frame a explained in the video.

Follow on Insta:@phoenixtradingx

Hanzo | Nas100 15 min / Time To Take A Seriouce Short 🆚 Nas100

The Path of Precision – Hanzo’s Market Strike

🔥 Key Levels & Breakout Strategy – 15M TF

🔥 Deep market insight – no random moves, only calculated execution.

☄️ Bearish Reversal – 19100 Zone

Price must break liquidity with high volume to confirm the move.

🩸 15M Time Frame Confluence

————

CHoCH & Liquidity Grab @ 16880

Key Level / Equal lows Formation - 16350

Strong Rejection from 16350 – The Ultimate Pivot

Strong Rejection from 16890 – The Ultimate Pivot

🔥 1H Time Frame Confirmation

Twin Wicks @ 16890 – Liquidity Engineered

Twin Wicks @ 17000 – Liquidity Engineered

☄️ 4H Historical Market Memory

——

💯 18 jan 2024 – Bearish Retest 16900

💯 11 jan 2024 – Bearish Retest 16900

💯 18 jan 2024 – Bullish Run After Break That level

👌 The Market Has Spoken – Are You Ready to Strike?

IS it about Money or The love of itA lot of us get wavered to the side by the pressure of not having any money at our age, whereas on our sides are boys - girls who are killing it. Sometimes though I feel like if we cared less about money itself and were patient about our existence, we would achieve more, not lazy, but patience, in a content manner. The pressure is not from within, the pressure is external and justified by our fear of not being worth any thing. Let is relax, more years of a solid foundation of overnight success.

NQ: ST consolidation is expectedGood day!

After the 90-day pause of the tariffs, NQ should consolidate in the ST (2-3 days) before resuming the fundamental downtrend.

The effect of CPI and PPI will be very limited whatsoever the data. However Consumer data will trigger the downtrend if this data is undershoot. Otherwise, consolidation will prevail.

The blue box should delimitate the consolidation area.

Where is the support level for Nasdaq?! Is the bloodbath over?Bearish fair value gap ranges are taking over this chart and when we rally up into them, they have been sending us down over and over.

This week we have had the advantage of a bearish gap from last week's low. This gave us clear reason to seek longs to fill the gap. Now we have a small cushion of long interest in this range after retesting the 2023 yearly candle's broken high.

As long as we remain above this yearly level--16.960ish (Using last year's low for NQ 17,570ish)-- we will see a neat consolidation and sitting upon these levels before the rally that may lead us out of this range.

That is what I expect, however, if we lose these levels, you already know we are headed to the dungeon of a true recession.

20 min breakdown:

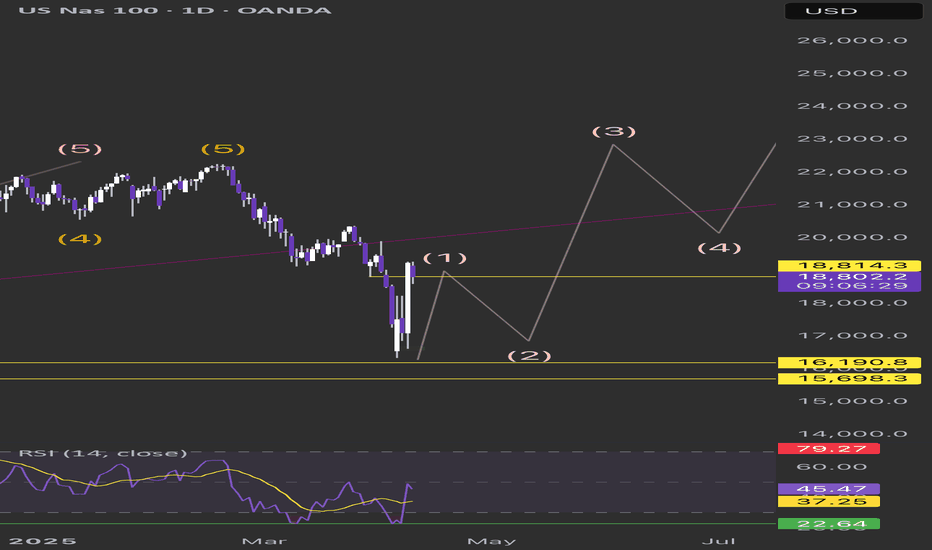

NASDAQ Long Wave 5 Targeting Supply Zone, Then Looking to ShortI’m currently holding long positions from the end of Wave 2 (entry around 16,849). I took partial profits after Wave 3 (around 19,000–19,200) and now waiting for 4H TF Wave 4 to pull back and give a re-entry.

Once Wave 4H TF Wave 4 completes, I plan to scale back in and target the 19,500–19,900 zone.

If price reaches that zone and shows rejection, I’ll look to switch bias and short as I believe that will begin a daily Wave 2 correction to the downside.

Key levels I’m watching:

• Wave 2 support: 16,849

• Wave 3 resistance zone / TP1: 19,000 area

• Wave 5 supply zone / Final TP: 19,500–19,900

• Sell zone if confirmed reversal: 19,500–20,000

• Next short target (after confirmation): TBD once Wave 5 completes

Will update this idea as Wave 4 forms and price action confirms the next leg.

NASDAQ 100 outlook and the 90-day tariff pauseThe US has paused the highest tariffs for 90 days, but markets remain under pressure from global trade tensions, and the Nasdaq 100 remains bearish. So what are the levels we need to watch next?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

12 Tips Every New Forex Trader Should Know!New to Forex? These 12 tips will save you months of frustration.

Forex trading can be overwhelming in the beginning, but it doesn’t have to be. Whether you're just starting out or still finding your feet, these tips are designed to help you avoid common mistakes and fast-track your learning curve.

✅ Save this post

✅ Follow for more Forex insights

✅ Drop a comment with your biggest struggle as a beginner, I might turn it into the next tip!

Let’s grow together. 📈💪

NASDAQ100 - Trade Idea 10 April 2025📌 Key Points on the Chart:

Bullish Engulfing Daily (Orange Circle)

This is a candlestick pattern that suggests a possible trend reversal from downtrend to uptrend.

A big green candle fully engulfs the previous red candle → a strong sign that buyers are taking control.

Strong Low & Swing Low (Lowest Points)

These areas are considered strong support zones.

Price previously dropped to this level and quickly bounced back up → seen as a “cheap” price by Smart Money.

High Volume Spike

Notice the high volume bar when the bullish candle formed – this shows strong buying interest.

Likely that big players (institutions) are stepping in to buy.

Projected Price Movement (White Zigzag Path)

The chart suggests price may continue to rise (possibly toward the 20,000+ zone).

But first, there may be a slight pullback (cooling off) before continuing upward.

FVG (Fair Value Gap)

This is a price gap that hasn't been filled yet – price often returns to fill these gaps.

In ICT, FVG is treated as a discount or premium zone for potential entries.

50% Level (Fibonacci Retracement)

This line shows the midpoint between a previous swing high and swing low.

It often acts as a reaction zone for price – either support or resistance.

🔍 Simple Summary:

The chart is showing a potential bullish reversal.

A bullish engulfing pattern + high volume = signs of institutional buying.

Expectation: price may pull back slightly, then continue rising.

Strategy: traders might wait for a pullback into the FVG or 50% zone to look for buy entry opportunities.

Long NQ FuturesLooking for a 50% retracement back to roughly the 19300 level. Will likely be a bumpy ride up, with the first test of resistance at 18300 (minor wave A), back down to the bottom of the gap at 16900 (minor wave B), and then back up to 19300 (minor wave C).

Expecting to reverse short once 19300 is reached, but will evaluate further if and when target is reached.