NQ: Uncertainty after the bloodbath!Good day!

Yesterday close was irrelevant: Uncertainty, indecision and inside the previous huge candle. Until clear direction, we've today Trump's ultimatum to China with additional 50% tariffs if China does not step back with its retaliation of 34%. China has additional tools: sell US Treasuries which trigger a crise worldwide and particularly in USA.

Along this, we've some cracks within Trump billionaires, including E. Musk, who start showing frustration with tariffs.

NAS100 trade ideas

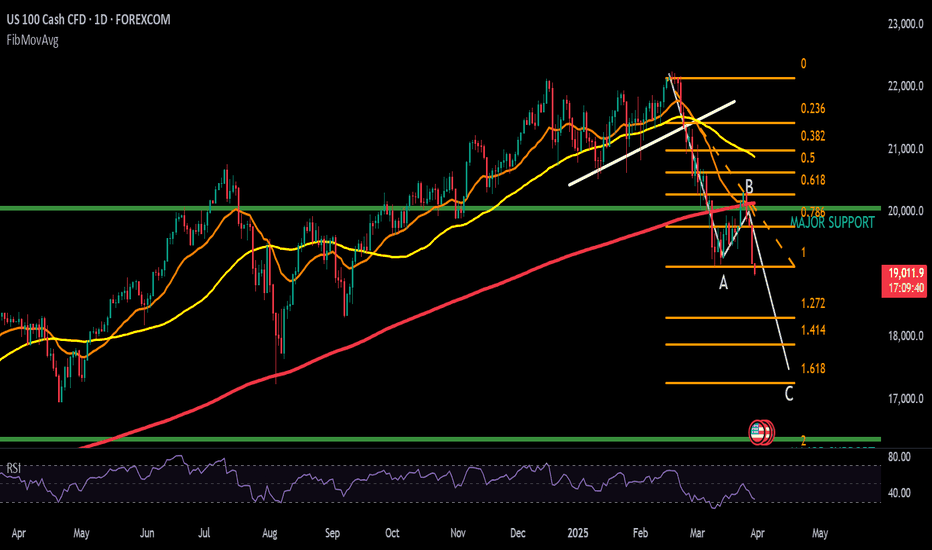

Nasdaq 1 day - Imbalance 📝 Chart Structure Overview

The chart previously formed a rising wedge — a classic bearish reversal pattern — which broke down aggressively.

The breakdown has now led to a steep decline, bringing price back to the major support zone between 17,000 – 17,700, which held strong multiple times in the past (highlighted in purple).

📉 Current Price Action

Current price: 17,618.3

Price is hovering just above a key demand zone from 2023, with a small bounce visible today.

The large red candle breaking through multiple support levels suggests strong bearish momentum, but this area could act as temporary support or a bounce zone.

💹 Volume Analysis

There’s a visible spike in volume, indicating capitulation or panic selling — this can often lead to short-term relief rallies or bounces as buyers step in at support.

📊 RSI (Relative Strength Index)

RSI is 34.76, approaching oversold territory (<30), signaling potential exhaustion of the sellers.

Momentum is still bearish but could be ripe for a short-term bounce or consolidation phase.

⚠️ Key Levels

Support Zone (Demand): 17,000 – 17,700

Resistance Levels:

19,921 (previous support, now resistance)

20,532 (supply zone)

Breakdown Level: ~20,000 (former wedge support)

✅ Potential Trading Setups

1. Reversal/Bounce Play (Short-Term Bullish Idea):

Entry: Around 17,600–17,700 if price stabilizes

Target 1: 18,400

Target 2: 19,200–19,500

Stop Loss: Below 17,000

2. Bearish Continuation (If support fails):

Entry: On break below 17,000 with high volume

Target: 16,000 (next major support)

Stop Loss: Above 17,700

ABC Correction on nas100!Trading plan

SL:20,448.6

TP:17,000 / floating

Trading set up

(ABC) correction

A-Wave: Initial sharp decline with increasing volume, breaking short-term support.

B-Wave: Temporary recovery (typically 50-61.8% retracement) with lower volume.

C-Wave: Final decline, typically final capitulation, targeting major support and weekly moving averages or 1,618 fib level around 17,000 level as target price for correction

reasoning:

Trade war, trump tariff ,geopolitical issue and stocks has been overpriced for the last couple of months.

Nasdaq-100 H1 | Potential bullish bounceNasdaq-100 (NAS100) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 17,407.64 which is a swing-low support that aligns close to the 50.0% Fibonacci retracement.

Stop loss is at 17,000.00 which is a level that lies underneath an overlap support and the 61.8% Fibonacci retracement.

Take profit is at 18,238.84 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Possible move for nasdaqI had to redraw my channels from my last view. Sometimes we really have to zoom out to get the bigger picture.....I believe we may have entered a bear phase for the market. I have noted the important levels on the chart. I have outlined the possible path the market might take...There are plenty of untested levels below where massive buy orders are sitting. Of course it will not get there in a day or 2. But it is very clear where bears are sitting. Bear market bull rallies are also quite strong and might give an impression that we will go to ATH. But there is a reason why channels work most of the time at least from a long term perspective. This is merely a conjecture, but if you view the larger time frame as a 5 min chart, you know what moves might take place. I'm not advocating a full blown market crash, but we might get to see lower highs and lower lows over the next few months.....I could be completely wrong on this....For investors these are the best levels to enter big, for day traders...well...vix is still elevated and we trade the day whether it is bullish or bearish...So keep your position size smaller than usual as you will need a wider SL. Trade small, trade safe....Investors can start accumulating good stocks bit by bit and average out with every 10-15% dip, of course in smaller amounts....As we don't know when a bottom will happen...

NAS100 - Monthly Demand Zone Rejection | Massive Bullish PotentThe NAS100 has pulled back significantly from its all-time highs, retracing into a major monthly demand zone aligned with the 50% Fibonacci retracement level (16,344.76).

🔍 Key Technical Highlights:

Demand Zone: Price has tapped into a historically strong demand block between 14,955 – 16,344 (gray box), which previously acted as a launchpad for the last rally.

Fibonacci Levels: Price bounced right off the 50% Fib level, showing early signs of bullish interest. Below lies the 61.8% and deeper retracement levels at 14,955 and 13,872 respectively—strong areas to watch if price dips further.

Bullish Reversal Candlestick: Current monthly candle showing potential reversal with high buying pressure.

RSI: The RSI is rebounding from near the 40 level, historically acting as support during major bull runs.

🎯 Trade Idea:

Entry: Near current levels or on a retest of 16,344

Target: 25,410 (Previous ATH and Fibonacci extension zone, +27%)

Stop Loss: Below 14,000 support, giving room for volatility

🧠 RSTRADING View:

We’re anticipating a long-term bullish reversal as the market finds footing at a key institutional zone. With macroeconomic optimism returning and tech stocks regaining momentum, NAS100 could be setting up for a new leg higher.

NAS100 Rebounds Sharply from Demand Zone – More Upside Ahead?The NASDAQ 100 (NAS100) just delivered a textbook bounce from the key demand zone between 16,800 and 16,900, showing signs of a strong bullish reaction after a sharp drop.

This reaction may be the start of a potential bullish reversal, especially with upcoming US news that could add fuel to the move.

Key Levels:

Demand Zone (Support): 16,800 - 16,900

This zone has held firm and triggered a rapid bullish engulfing move – clear buyer interest!

Next Resistance Levels:

18,437 (Mid-range target – strong historical resistance)

19,852 (Supply zone – high confluence area with potential to reject price)

Bullish Bias Reasoning:

Strong bullish momentum post-dip

Buyers defended key structure near 16,826

Clean structure for risk-reward trades

Possible double bottom forming on lower timeframes

Possible Trade Setup (Not Financial Advice):

Entry: 17,000 – 17,100

SL: Below 16,750

TP1: 18,437

TP2: 19,850

Watchlist Alert:

US economic data incoming – high-impact news could create volatility and push NAS100 into breakout territory.

---

Are you buying the NASDAQ dip or waiting for confirmation? Comment your outlook below!

The Nasdaq 100 nears a big breaking pointThe Nasdaq 100 has continued declining, attempting to find some support after breaking below the August 2024 lows on 4 April. The next obvious support levels lie around the late 2021 and 2022 highs, which, for now at least, are offering some stability. It would not be surprising to see the index test that region during the trading session.

However, a break below support at 16,700 could be a negative signal for the Nasdaq, suggesting the index may head even lower. The next level of technical support would not appear until the July 2023 highs at 15,750. If that level breaks, the next area of support lies at the October 2023 low of 14,100, effectively erasing all gains made over the past 18 months.

The problem for the Nasdaq is that several areas on the chart will likely offer little to no support should it break under its 2021 highs, with numerous lower gaps remaining unfilled. This suggests the potential for further declines, which could extend to the 1.618% level around 14,510, especially as we’ve only seen a full extension of the initial bear flag so far.

If the Nasdaq can find support at the November 2021 highs, there is room for a rally back to 17,265, which marks the August lows, and potentially further to 18,360. However, a complete reversal back to the previous highs seems highly unlikely, given that the market may now reprice risk and reassess how much it is willing to pay for it.

Written by Michael J Kramer, founder of Mott Capital Management

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

NQ sell explaining Hi traders

as u see in the chart we have to LQ one higher and one lower .

- The higher one should be internal LQ that were gonna target it after we took the lower

- The lower is to close and we should focus to take it first

1-1 We observe on the last week huge fall on market and trump decision who affect on the market to move down down

1-2 I'm not sure but 100% the market well open on Gap and if that true we should be patience not take any trade until we got confirmation remember being patience

1-3 the analysis will be 100% if the market not open on huge gap we must wait London session probably were gonna see a Juda swing on London or new York session to move down and took the LQ

this trade for short term not for long term to hold

Good luck any question i would like to answer

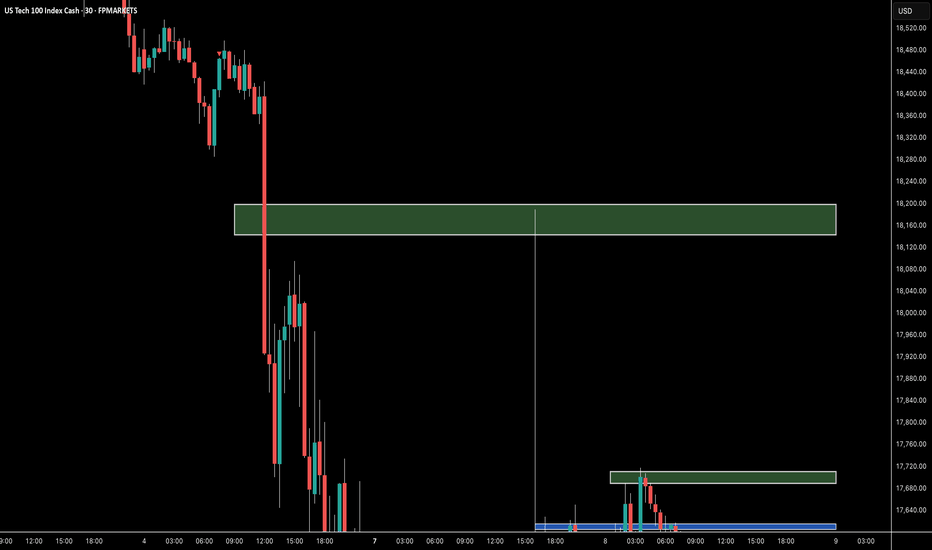

NASDAQ Might Recover From Massive LossesWohooo... These days are wild!

Now let's take a look at how the day can develop, because... the market, at least the NASDAQ, doesn't look that bad anymore.

We are seeing the first signs of a bottom. However, it can be assumed that the market will dip again at the opening.

There is a bullish order block in the area shown, which coincides pretty much exactly with the POC of the last recovery attempt.

An excellent RRR for long trades could be taken here.

NASDAQ - Bounce here could mean strength.The chart is self - explanatory as always.

Nasdaq is sitting at a critical zone — the previous all-time high area — with the 200-week EMA just below.

📊 From a technical standpoint, a bounce here would signal potential strength.

⚠️ But when panic sets in, technicals can take a back seat.

Stay sharp. Manage risk.

Disclaimer: This analysis is purely for educational purposes and does not constitute trading advice. I am not a SEBI-registered advisor, and trading involves significant risk. Please consult with a financial advisor before making any investment decisions.

Understand Trump tariff war, Assess if market rebound is likelyIf you want to better understand Trump’s strategy for the tariff war and the underlying intentions—especially to assess whether a rapid market rebound is likely—you may refer to a paper by Trump’s economic advisor Stephen Miran, titled “A User’s Guide to Restructuring the Global Trading System.”

Here’s a brief summary of the key points from the paper regarding the trade war:

1. Market Volatility Is Anticipated

The paper acknowledges that sharply raising tariffs may trigger financial market turbulence, increase uncertainty, lead to rising inflation, potential interest rate hikes, and a stronger U.S. dollar—all of which could cause broader ripple effects. (In other words, the Trump administration is aware that such moves will shake the markets.)

2. Second Term: Focus Shifts to Legacy

While Trump and his team prioritized stock market performance during the first term, in a second term—when re-election is no longer a concern—he may focus more on leaving a political legacy. This includes reshoring manufacturing, tax reform, reducing national debt, and shrinking the trade deficit.

3. Tariffs as a Strategic and Fiscal Tool

This new round of tariffs serves not only as a pressure tactic , but also as a potential revenue source to fund Trump’s desired tax cuts. As such, the Trump administration may not rush to finalize new trade deals. Instead, tariff reductions would likely occur gradually, and only after securing substantial economic benefits.

4. Trade and Security Will Be Linked

Future trade negotiations will likely tie economic cooperation to national security. The U.S. could use a dual standard—“tariffs + security”—to compel other nations to follow U.S.-defined trade and geopolitical rules.

For example: Countries might be forced to join a tariff alliance against China. In exchange for market access, they would either have to tax Chinese goods or accept high U.S. tariffs and reduced security cooperation. For the EU, if it does not meet U.S. demands, tariffs would become a key revenue stream for the U.S., while freeing up American resources to focus on China’s rise rather than spending time and money on European security.

5. Big Picture Strategy: Build a Global “Tariff Wall”

This paper lays out a grand strategy to use tariff warfare to pressure countries into forming a global “tariff wall” encircling China, aimed at constraining China’s economic influence.

Strategic Implications

Based on this approach, the U.S. goal in trade negotiations is not merely tariff reductions or market access, but achieving:

1. Market access for U.S. goods via lowered barriers abroad.

2. Adoption of U.S.-led trade and geopolitical rules, including encircling China and sidelining nations like Iran and Russia.

3. Increased U.S. government revenue— meaning tariffs might persist throughout Trump’s term and not be eliminated outright!

Market Outlook

If the U.S. follows this roadmap, it’s unlikely that a consensus with China or other China-dependent economies (like the EU) will be reached quickly. This suggests that market volatility could persist for some time if these strategies are enacted.

Given the current asset declines showing signs of a liquidity crunch, without a clear positive catalyst (e.g., successful trade deals, tax cuts, or rate cuts), it may be difficult for equities, crypto, or even gold to see a meaningful rebound in the short term.

As markets remain highly sensitive to news, it’s crucial to focus on risk control in trading and consider reducing position sizes when needed.

Let’s keep the discussion going—what do you think about the future direction of U.S. trade policy under Trump?

Hanzo | Nas100 15 min Breaks – Will Confirm the Next Move🆚 Nas100

The Path of Precision – Hanzo’s Market Strike

🔥 Key Levels & Breakout Strategy – 15M TF

🔥 Deep market insight – no random moves, only calculated execution.

☄️ Bullish Setup After Break Out – 17000 Zone

Price must break liquidity with high volume to confirm the move.

🩸 15M Time Frame Confluence

————

CHoCH & Liquidity Grab @ 16880

Key Level / Equal lows Formation - 16350

Strong Rejection from 16350 – The Ultimate Pivot

Strong Rejection from 16890 – The Ultimate Pivot

🔥 1H Time Frame Confirmation

Twin Wicks @ 16890 – Liquidity Engineered

Twin Wicks @ 17000 – Liquidity Engineered

☄️ 4H Historical Market Memory

——

💯 18 jan 2024 – Bearish Retest 16900

💯 11 jan 2024 – Bearish Retest 16900

💯 18 jan 2024 – Bullish Run After Break That level

👌 The Market Has Spoken – Are You Ready to Strike?

NASDAQ Black Monday or a Massive Rally??Nasdaq (NDX) opened on early Monday futures trade below both its August 05 2024 and April 19 2024 Lows. All technical Supports have been broken and the market made new 12-month Lows. The market sentiment is extremely bearish, technically oversold, even the 1W RSI is below the 30.00 oversold barrier and the prevailing fundamentals regarding the back-and-forth Tariffs between nations don't leave much room for encouragement.

The index is more than -25% off the February 17 2025 All Time High (ATH), technically Bear Market territory, and the last time it dropped more this fast is during the lockdowns of the COVID crash (February 20 - March 23 2020). The market dropped by -32%, below also all known technical Supports (including its August low) before finding support and forming a bottom just above the 1W MA200 (red trend-line).

The two time events are virtually identical with the only notable difference is that Nasdaq is about to form the 1D Death Cross now while in 2020 it did about 1 month after the low.

The only technical development that leaves room for encouragement is that the 1W RSI during COVID got oversold just a day before the eventual market bottom.

Does today's 1W RSI drop into oversold territory mean that we are about to form a bottom? Unknown. But what we do know is that on March 03 and 16 2020 on two urgent, out-of-schedule meetings, the Fed stepped in to save the market from the free-fall (and save they did) by cutting the Interest Rates to near zero (first to 1.25% and then to 0.25% subsequently from 1.75% previously).

Perhaps that is the only thing that can restore investor confidence (certainly the only action that the Fed can do) and avoid a Black Monday below the 1W MA200, which would be catastrophic. On the other hand, if the U.S. government reach indeed trade deals with the rest of nations and the Fed do what they can from their end, we may even hit new ATH by August!

So what do you think it's going to be? Black Monday or Massive Rally?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇