Nasdaq 100 drops to its lowest level since January 2024Nasdaq 100 drops to its lowest level since January 2024

According to the chart of the Nasdaq 100 (US Tech 100 mini on FXOpen), the index opened this week around the 16,500 mark – a price level last seen in early 2024.

This suggests that the sharp sell-off in equities seen last Thursday and Friday may well continue today.

Stock indices respond to Trump’s tariffs

Treasury Secretary Scott Bessent said on NBC News’ Meet the Press that there is “no reason” to expect a recession.

However, equity charts reflect market sentiment described by CNN Business’s Fear & Greed Index as “extreme fear”. This wave of negativity followed President Trump’s announcement on 2 April of harsher-than-expected international trade tariffs. In response, China and other nations announced retaliatory measures.

As a result, the Nasdaq 100 (US Tech 100 mini on FXOpen) now trades roughly 25% below its 2025 peak – officially entering bear market territory.

Technical analysis of the Nasdaq 100 (US Tech 100 mini on FXOpen)

Back on 28 February, we drew an ascending trendline (line A). Bulls attempted a rebound from this support (as shown by the arrow), but their efforts were overwhelmed by the White House’s latest policy decisions.

Given the updated price action, we can now treat line A as the median of an ascending channel. From this perspective, the index is currently near the lower boundary of the channel.

Technically, this could indicate potential support. However, as long as the price remains below the bearish gap – which includes the key psychological level of 17,000 – talk of a meaningful recovery may be premature.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NAS100 trade ideas

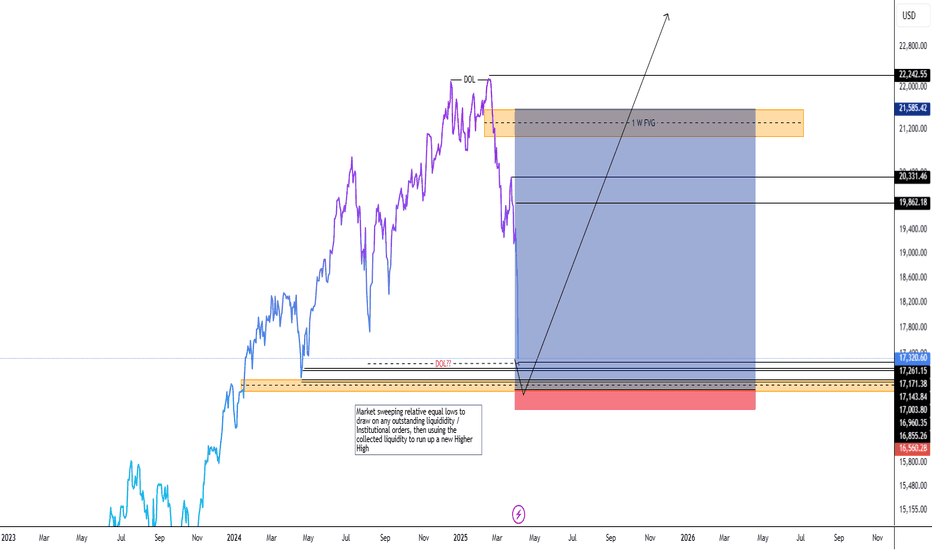

What Happens Elliott Wave Sequence Completes?Just a quick chart on Nasdaq to show what happens when the Elliott Wave count is completed?

Usually you'd see a major correction. The choice of word depends on the chart time frame. On a monthly chart its still a correction, obviously that is not true for a daily chart where it looks like a SPIKE down.

This chart shows, Wave 5 is terminating within Target zone.

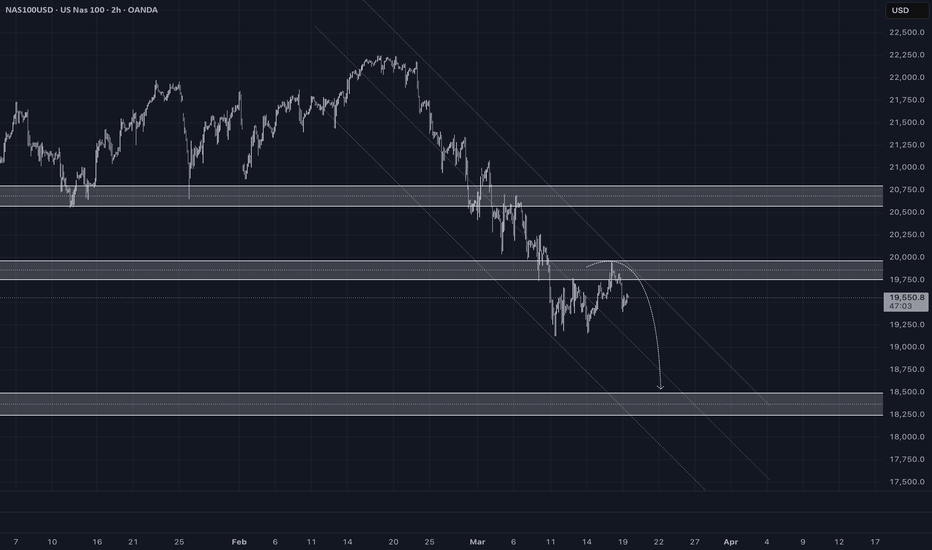

Nas100 - Huge bear trap or further downside?The Nasdaq 100 has recently broken a critical rising trendline that has supported its bullish trajectory for an extended period. This break signifies a potential shift in market sentiment, suggesting that the prior uptrend may be losing steam. When an established trendline is breached, it often signals a change in the market's direction, indicating that buyers are losing control and sellers are starting to assert dominance.

In addition to the trendline break, the Nasdaq 100 has now fallen below all of its key moving averages—namely, the 50-day, 100-day, and 200-day moving averages. These moving averages are widely followed indicators of trend strength, and their loss is typically a bearish sign. When prices drop below these averages, it signals weakening momentum, and it becomes harder for the index to regain upward traction without strong buying pressure.

The weekly timeframe shows a beautiful support level if the bulls fail to reclaim all the key moving averages.

Together, the break of the rising trendline and the loss of key moving averages suggest that the Nasdaq 100 could be entering a phase of increased volatility and downward pressure. Traders should closely monitor the index for potential further declines or a failure to reclaim these key technical levels, as they could signal deeper market corrections.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

$SPX $NAS100 FILL THE GAP = "LEARNED BEHAVIOR" IN PLAY🏒🏒🏒🏒🏒FILL THE GAP! FILL THE GAP! FILL THE GAP!

Hopefully, institutions want to reach 7,000 from here, as the majority of them wrote in public New Year resolutions.

A great example of learned behavior.

Let’s watch.

FILL THE GAP! FILL THE GAP! FILL THE GAP!🏒🏒🏒🏒🏒

Market Review: Full Higher Time Frame Review of NASDAQ bear runI hope this get's featured 🎯

The simplest macroeconomic review of NASDAQ you may see this year.

It's all a fib retracement. That's all I have to say for now 🔪 Share this with someone looking for a good review 💰

**Video was cut short by a minute or two but the general idea was complete

NASDAQ New Week Gap will tell you everything you need to knowIf you watched my idea update from Friday, I was saying that the sellside monthly lows as well as the 2023 yearly high are being targeted.

Low and behold, we hit all targets on the weekly gap drop. Let's see how price approaches the new week opening gap mid level (dashed white). It will definitely hit that level before the end of the week.

If it does not, that means we have super easy sellside targets to hit after a clear rejection back below tested highs as always.

Share this with someone needing easy targets 🎯

NAS100 Weekly Gap: Prime Short Setup or a Trap in Disguise?The weekly gap on NAS100 is lining up as a textbook short target—but will it hold or get steamrolled? While stops beyond the gap offer safer trade placement, downside momentum suggests any pullback may be short-lived. With 16,000 in sight as the next major low, bears have a reason to stay aggressive. Just don’t get caught on the wrong side of a gap fill gone rogue.

NAS100The NAS100, also known as the Nasdaq 100, is a stock market index that includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market. It primarily represents technology and innovation-driven companies, such as those in sectors like technology, healthcare, consumer services, and industrials. The index is often used to gauge the performance of the tech-heavy part of the stock market. It reflects how well these companies are performing overall, but unlike other indexes, it excludes financial companies like banks and insurance firms. Investors and analysts often look at the NAS100 to track trends in the tech sector and its influence on the broader economy.

NQ: Upcoming Weekly Analysis!FA Analysis:

ST/MT/LT Outlook: Sell

1- Tariffs came into effect on April 2nd and market reacted badly to it. This was completely expected.

2- NFP data came green but market ignored it and continued the sell-off. This tells you the fundamental change in market expectations vis-a-vis US market! So bad data will be bad for equities and good data will be also bad.

3- This week, we've CPI, PPI and Consumer sentiment as major key data. They'll be fuel to the current fire.

4- The FED was tacit and still data related. The FED is running a risk of a late intervention!

5- Additional retaliations from the rest of the world are also expected. USA is isolating itself from the world economy; the damage is here to stay even if Trump cancel those tariffs or deregulate or cut taxes.

TA Analysis:

Weekly TF:

We got a strong bearish weekly close. A gap down should be added to the weekly candle.

A continuation down is expected.

Daily TF:

NQ provided one of the largest daily candle. Market was down until the last minute Friday! There is no interest to buy the dip at all!

A gap down is expected.

In the case of a gap, price might close the gap and continue down.

Hope we get some retrace to join the sell side during NY session.

Happy week with a lot of green pips!

Nasdaq drawing back for for a mini 'bull run' I'm no professional trader, so please don't quote me on this. But I've been doing this for 5 years now, and one thing that i notice time and time again is how just before a big push up there's always a low created first. Almost like the draw of a bow and arrow. So with that theory as well as my strategy applied, this is what i think Nasdaq is preparing to do.

US100 (NASDAQ) Trade Idea 📊 US100 (NASDAQ) Trade Idea: Critical Support Test & Potential Reversal Setup

🔍 Key Levels & Context:

The US100 is currently testing a significant support zone between 16,000–17,000, which has historically acted as a springboard for rallies (see 2023 bounce). A breakdown below 16,000 would suggest a deeper correction toward 15,242 (next support) or even 14,000, while holding above 17,000 could keep the bullish structure intact.

🎯 Profit Targets (If Bullish Reversal Confirmed):

Initial Target: 19,000 (Previous resistance → now potential support-turned-resistance)

Secondary Target: 20,000–21,000 (Psychological level & measured move from consolidation)

Stretch Target: 23,000–24,000 (All-time high retest, Fibonacci extension confluence)

📉 Bearish Scenario (If Support Fails):

A close under 16,000 opens the door to 15,242 (2023 swing low)

Short-term rallies into 17,500–18,000 could then become sell opportunities.

So I think the US100 pursues the following projection, and I'd be happy if you share your thoughts 🫡

#Trading #NASDAQ #US100

Nasdaq what to expect next?The Nasdaq has declined approximately 23% from its all-time high, positioning us near a notable discount on a global timeframe. In my professional assessment, this presents a compelling opportunity to begin constructing a diversified portfolio. However, I anticipate further downward movement in the near term, so I recommend a measured approach—allocate capital gradually rather than deploying all available cash at once. Consider initiating positions through Contracts for Difference (CFDs) or Exchange-Traded Funds (ETFs), focusing on high-quality, blue-chip equities such as Microsoft (MSFT), Apple (AAPL), NVIDIA (NVDA), Nike (NIKE), and Walmart (WMT), among others.

That said, I advise against overcommitting capital at this juncture. The potential for an economic recession remains, and the market could trade sideways for an extended period—potentially one to two years. Prudence is warranted.

Additionally, the Fear and Greed Index for U.S. stocks currently stands at 6, a level strikingly close to the 5 recorded during the COVID-19 market crash. Those familiar with market history will recall the significant rebound that followed. This historical parallel suggests a potential inflection point.

Personally, I am actively participating in this market, incrementally rebuilding long-term positions within my investment account. Opportunities of this magnitude are infrequent, occurring perhaps once every few years. However, this does not preclude further declines—markets can always test lower levels. From a statistical perspective, though, the current environment supports initiating long-term investment positions with a disciplined strategy.

Let me know if you’d like a deeper analysis of specific assets or portfolio allocation tactics!

NOT FA!

NASDAQ: Wave Analysis & Forecast for April-MayHello, traders! Let’s analyze the current wave structure of the NASDAQ index.

At the moment, there is a high probability that the index is forming wave C of a correction. Most likely, this is a horizontal expanded correction.

✅ Sub-wave 1 of wave C has already formed.

✅ Sub-wave 2 is also likely completed.

On Friday, the index showed a strong decline and closed at the day’s lows, indicating a high probability of further downside movement next week.

What’s next?

We expect the formation of the third sub-wave within wave C. Most likely:

🔻 The index will continue to decline toward 17,700, where the 38% Fibonacci level is located.

🔻 The key support zone is 17,300.

🔻 After a short correction, the decline may extend to 16,300.

🔻 In a deeper scenario – down to 15,700-15,000.

Technical factors

⚡ The price failed to break above the 200-day moving average, bounced off it, and started declining.

⚡ The next major support is the 200-week moving average, around 16,200.

⚡ Throughout April – May, the market is likely to remain in a correction phase.

Once key levels are reached, we expect a potential reversal and new highs in the second half of 2025.

Stay tuned and share your thoughts in the comments!

US100 Downtrend Analysis & Key LevelsAfter analysing the US100 chart, the index has been trading within a downtrend channel since Friday, February 21, 2025. After dropping to 19,131, it attempted a recovery but faced strong resistance at 19,957, leading to a decline. As the saying goes, “ Follow the trend—the trend is your friend. ” Given the ongoing downtrend, US100 may continue to decline toward the next strong support level at 18,489.

Ensure you adhere to proper risk management for long-term success.

Happy Trading

Potential Bearish SetupThe chart indicates that the US100 index has broken below a strong ascending trendline, signaling a possible shift from bullish to bearish momentum.

📊 Trade Idea:

Entry: On a pullback to the 18,300–18,350 zone (look for bearish confirmation like a reversal candlestick).

Target: 15,500–16,000 area

Stop-loss: Above 18,350 (above the resistance/pullback zone)

Risk/Reward: Favorable setup if confirmed

This setup is based on classic price action: trendline break + pullback + continuation.