PLATINUM trade ideas

Platinum: Protectionism Presents Challenges for a Key MetalBy Ion Jauregui – ActivTrades Analyst

Under a sky of uncertainty and volatility, platinum emerges as a key player in a global economic landscape marked by trade tensions and geopolitical challenges. This precious metal, essential in the automotive, chemical, and jewelry industries, has seen its prices fluctuate dramatically in recent years. The current situation—framed by shifts in international policies and the pressure from previous tariffs—calls for a detailed journalistic analysis that uncovers both the challenges and opportunities for publicly traded companies that depend on this strategic resource.

The Impact of Tariffs and Trade Tensions

During the Trump administration, tariffs and protectionist measures were imposed that, although initially targeted at other sectors, extended their consequences to the platinum market. These measures increased import costs and generated an atmosphere of uncertainty in international trade. The resulting tensions not only affected transactions but also reshaped corporate strategies around the procurement and processing of the metal. The legacy of these policies continues to influence the market, as expectations of new agreements or tariff restrictions keep investors on constant alert.

Publicly Traded Companies and Their Strategies

Mining companies listed on the stock exchange that specialize in platinum extraction have been particularly sensitive to these variations. Giants such as Anglo American Platinum and Impala Platinum (Implats)—whose financial performance is closely tied to the global price of the metal—have been forced to reassess their operational strategies. These market players have faced increased logistical costs and export challenges, factors that erode their margins and limit their ability to expand in such a volatile market. The pursuit of more resilient supply chains and market diversification has become crucial for weathering this environment of uncertainty.

Impacted Sectors and Related Companies

It is not only the mining firms that feel the impact of platinum’s price fluctuations. The automotive industry, which uses the metal in manufacturing catalytic converters to reduce harmful emissions, finds itself in a delicate position. Publicly traded companies like Toyota, Volkswagen, and BMW face the challenge of integrating these increased costs into a final product that is ever more demanding in terms of efficiency and environmental compliance. Meanwhile, the luxury and jewelry sectors are also at stake. Well-known international brands must maintain the quality and exclusivity of their products, all while passing on the additional costs induced by platinum’s volatility to the end consumer. This dynamic can affect both their profit margins and market positioning.

Technical Analysis

Since its peak in May 2024—when platinum reached $1,093.33—the metal exhibited a clear downward trend, settling at $1,052.83 by October of the previous year. Following that, several corrections have taken place, establishing a support zone around $905.34, while the average trading range defined by the point of control (POC) sits at approximately $944.04. Today, platinum trades around $957.50. This recovery reflects a rebound following a sharp move triggered by tariffs imposed during the Trump administration, which saw prices oscillate from $1,008 down to lows of $871.74. After a pause in tariff implementations, the metal’s price bounced back to current levels. The present trend appears to be operating within a long-term range, indicating that further recovery in prices could signal increased activity in key sectors—such as luxury, jewelry, and especially automotive and aerospace. Conversely, should these sectors experience a slowdown, demand for platinum might diminish, pushing the metal back toward its current support zone and testing the year’s recorded lows.

Looking Ahead

Ultimately, platinum stands as a vivid reflection of an economic environment full of challenges and opportunities. The repercussions of the protectionist measures implemented during the Trump administration, compounded by ongoing trade and geopolitical tensions, have set a volatile course for this strategic metal. While recent price recoveries suggest that sectors like automotive, jewelry, and aerospace are showing renewed dynamism, uncertainty remains. As publicly traded companies adjust their strategies to navigate these turbulent waters, the future of platinum will largely depend on the evolving demand in these key industries and the ability of international actors to forge stable agreements that mitigate the impact of trade policies.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Platinum Wave Analysis – 15 April 2025

- Platinum reversed from support level 905.00

- Likely to rise to the resistance level 970.00

Platinum recently reversed up from the strong long-term support level 905.00 (which has been reversing the price since April of 2024), standing near the lower daily Bollinger Band.

The upward reversal from the support level 905.00 created the daily Japanese candlesticks reversal pattern Long-legged Doji which stopped the previous impulse wave i.

Platinum can be expected to rise to the next resistance level 970.00 (former support from the end of March, the target price for the completion of the active wave ii).

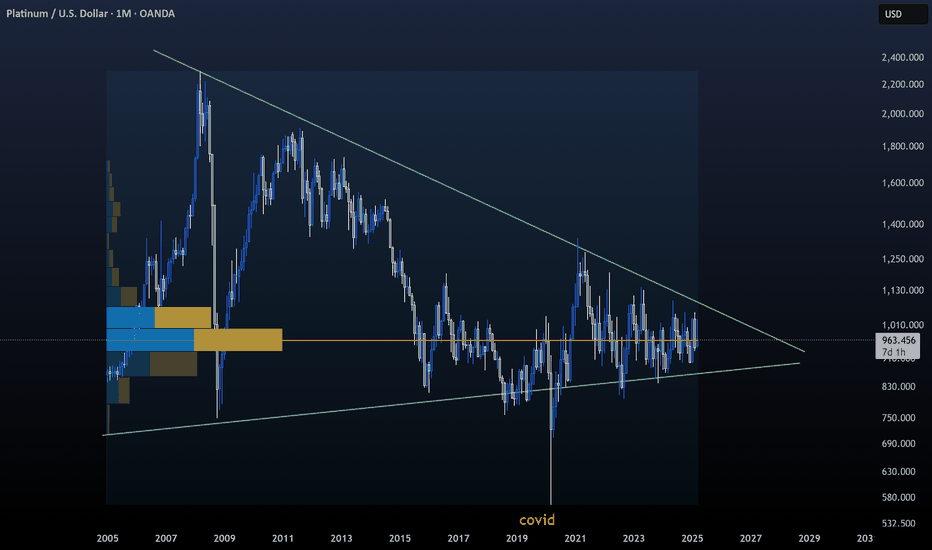

PLATINUM Strong Triangle buy opportunityLast time we looked at Platinum (XPTUSD) was more than 2 months ago (January 30, see chart below) getting our expected rise and hitting the 999.50 Target:

This time the price is at the bottom (Support Zone) of the 11-month Descending Triangle pattern, which is a technical buy opportunity. The last Bullish Leg hit the 0.618 Fibonacci retracement level, while the one before the 0.786.

As a result we have a minimum 985.00 Target on this emerging Bullish Leg.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Platinum: Looking for a LongNot the cleanest setup, to be honest — we've got heavy red candles, elevated volatility, closes near the lows, and overall sentiment is weak. Other commodities aren’t helping either.

Still...

We’ve come down to a solid level where a long looks worth a shot.

The sell-off seems largely driven by Trump’s tariff noise. But the broader play isn't just about raising tariffs — it’s a negotiation tactic. We saw the same with Mexico and Canada. Now other countries are starting to show willingness to talk too.

In my view, most of the downside pressure has likely been priced in — at least for now. I don’t expect another leg down straight away. Even if the market wants lower, it probably needs to base a bit first.

All in, I’m comfortable taking a long here. Let’s see how the open shapes up, but this one’s already in my trade plan.

There's a similar decent setup in palladium, but the stop is way too wide there, so I’m going with platinum.

Platinum Price Analysis: Breakout Strategy and Market OutlookIn this video, we take a look at platinum prices following a request from a reader. Despite a brief breakout, the price hasn't risen as expected and may be morphing into a classic triangle pattern. The best strategy now is probably to wait for a triple top to form before potentially trading a breakout. We also discuss different strategies, including trading within the pattern itself.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

Platinum Portfolios: A Bullish Signal for Future Gains!Yesterday, as markets slept, a shadow flickered across Platinum’s charts. Portfolios materialized like cryptic clues—hours before prices erupted in a 3% vertical rally. But here’s the twist: the official CME report won’t land until tomorrow. By the time most traders react, the first wave will already be history.

The Setup: Why This Move Matters

1️⃣ "The Insiders Always Whisper First"

Last times, a similar pattern in Platinum’s options market foreshadowed a 150$ surge. History doesn’t repeat, but it rhymes.

These portfolios? They’re not random. They’re telegraphs from players who trade with one eye on the horizon.

The Bottom Line

This isn’t just about Platinum. It’s about trade pattern recognition. The market rewards those who connect dots before they’re obvious.

So, ask yourself:

Are you watching the right data?

Will you be ready when the next domino falls?

Stay sharp. Stay curious. And never underestimate the whispers. 🧠💥

Bullish winds are blowing. Will you sail with them? 🌪️🚀

Do your own research or follow along with us! Two minds are preferable to one!

Platinum Breakout Looming: A 6x Risk-Reward Setup in PlayPlatinum is setting up for a breakout above $1,010, with chart patterns pointing to a target near $1,092 and a potential 6x risk-reward ratio. While other metals have already moved, platinum could offer a strong short-term trade if the breakout triggers.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

Platinum- While everyone is chasing Gold’s rally, I’ve got my eyes on Platinum.

- That doesn’t mean Gold is a bad investment, it just means it’s already had its moment.

- Platinum feels “delayed,” but its time is coming.

- Observe closely, this simple graph reveals a tightening triangle.

Remember my first rule: Buy the blood, not the moon.

Stay sharp. Diversify. Never go all in.

Happy Tr4Ding

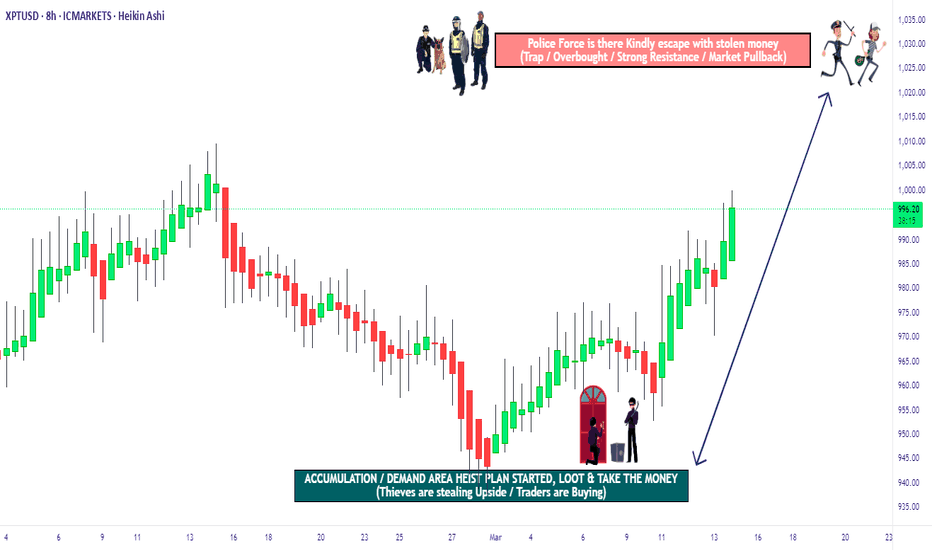

XPT/USD "The Platinum" Metals Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "The Platinum" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (970.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1025.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XPT/USD "The Platinum" Metals Market is currently experiencing a bullish trend,., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

PLATINUM IS COMPLETELY UNDERVALUED, BUY NOW!TVC:PLATINUM CAPITALCOM:PLATINUM

Platinum is absolutely undervalued and is currently trading at only $975 USD.

The Gold to Platinum Ratio just hit a new all time high with the Current Ratio being 3,09 even though Platinum has traded since the 1970s till 2016 at a consistent average of 1:1. Gold's all time low against Platinum was at 0,42 in June 2008; AKA the 'Great Financial Crisis'.

Every single indicator shows that right now is the perfect time to buy Platinum especially because the 'Gold rush' is in its absolute final stages.

Keep in mind that Platinum is around 15 times rarer than Gold on Planet Earth.

May fortune favor the bold, and as always - DYOR NFA ! ;)

CYANE

Platinum at Trendline Support – Will the Rally Continue?Platinum is holding strong at the lower trendline of a bullish parallel channel, keeping the uptrend alive. This key support level has previously fueled upward moves, and traders are now watching to see if the rally will continue. Adding to the bullish case, a bullish divergence has formed on the 15-minute timeframe, signaling weakening downward momentum and acting as a strong confluence for a potential bounce.

Further supporting the bullish outlook, sentiment data from MyFxBook shows an overwhelming bias: 91% of traders are long, while only 9% are short. This extreme sentiment, combined with the technical setup, suggests strong buying interest in Platinum.

A bounce off the trendline, supported by the bullish divergence and sentiment data, could reignite upward momentum, pushing Platinum toward the upper channel resistance. However, a break below the trendline might signal a potential reversal.

Platinum at Key Support Zone – Will Buyers Step In?OANDA:XPTUSD is approaching a significant support zone, marked by prior price reactions and strong buying interest. This area has previously acted as a key demand zone, increasing the likelihood of a bullish bounce if buyers step in.

If the price confirms support within this zone through bullish price action—such as long lower wicks or bullish engulfing candles—we could see a reversal toward 978.700, a logical target based on previous market structure and price behavior.

However, if the price breaks below this support zone and sustains, the bullish outlook would be invalidated, potentially leading to further downside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

Platinum Prices Poised for Decline as Seasonality & Supply ZonePlatinum prices are currently approaching a key Supply zone as the Futures contract PL1! retraces following an initial bearish impulse. This price action suggests that the market may be poised for further downside movement.

Analyzing seasonal trends reveals a potential for bearish behavior, consistent with patterns observed over the past decade. Historically, this time of year has often been associated with a decline in platinum prices, making the current setup particularly noteworthy.

With these indicators in mind, we are actively monitoring the market for short setups. The convergence of the price approaching the Supply zone and historical seasonality trends reinforces the possibility of a downward move in platinum. As the market unfolds, we aim to position ourselves accordingly to take advantage of any shorting opportunities.

✅ Please share your thoughts about Platinum in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

XPT/USD "Platinum vs US Dollar" Metals Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XPT/USD "Platinum vs US Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most re cent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at the recent / nearest low level Using the 4H timeframe,

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1070.000 (or) Escape Before the Target

🔵Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XPT/USD "Platinum vs US Dollar" Metals Market is currently experiencing a Bullish trend., driven by several key factors.

🟢Fundamental Analysis

Demand and Supply

- Demand for Platinum is increasing due to its use in catalytic converters and investment appeal.

- Supply disruptions in South Africa, a major Platinum producer, may impact global supply.

Market News

- Platinum prices rose 1.5% yesterday due to increased demand and supply concerns.

- The US dollar index is down 0.2% today, supporting precious metal prices.

⚪Macro Economics

- Global Economic Outlook

The global economy is expected to grow at a slower pace in 2025, with a forecast of 3.0% global GDP growth rate.

- Interest Rates

The US Federal Reserve is expected to keep interest rates on hold in the near term, while the European Central Bank is expected to maintain its accommodative monetary policy stance.

- Inflation

Inflation expectations are muted, with the US Consumer Price Index (CPI) expected to rise by 2.0% in 2025.

- Geopolitics

Geopolitical tensions between the US and China remain a concern, with the potential to impact global trade and economic growth.

🔴Trader Positioning

Institutional Traders

52% short, 48% long

Retail Traders

55% long, 45% short

Hedge Funds

50% short, 50% long

COT Report

Non-Commercials (Speculators)

net long 5,500 contracts

Commercials (Hedgers)

net short 3,500 contracts

🟠Market Sentiment

Retail Sentiment

Bullish (55% of retail traders are long)

Institutional Sentiment

Bearish (52% of institutional traders are short)

Hedge Fund Sentiment

Neutral (50% of hedge funds are short, 50% are long)

🟡Overall Outlook

Based on the analysis, the overall outlook for XPT/USD is bullish in the short term, driven by increasing demand, supply concerns, and a bullish market sentiment. However, the pair may experience a short-term correction due to the bearish sentiment among institutional traders.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩