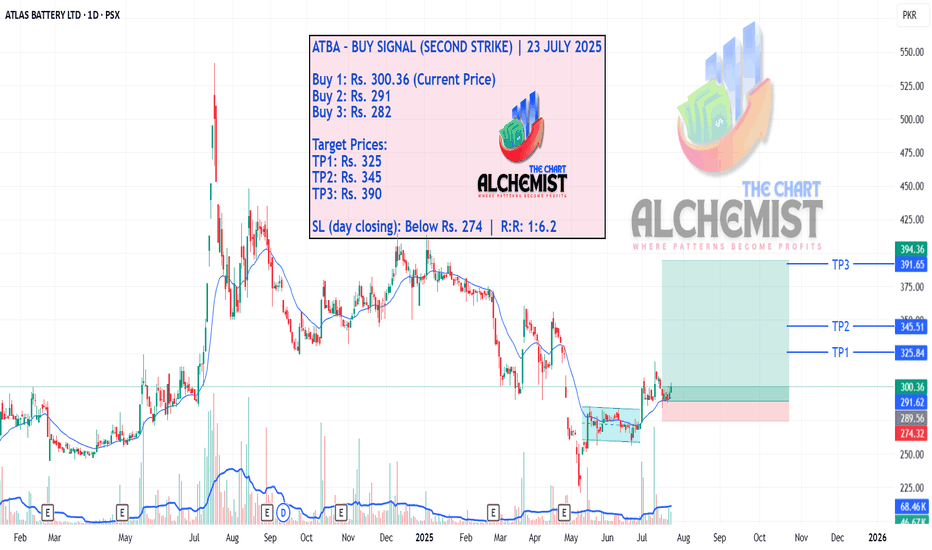

ATBA – BUY SIGNAL (SECOND STRIKE) | 23 JULY 2025 ATBA – BUY SIGNAL (SECOND STRIKE) | 23 JULY 2025

We previously gave a buy call for ATBA stock, which remains valid. However, the current price action has developed a new bullish structure, offering another high-probability opportunity for a second strike. This setup provides favorable entry levels aligned with strong quantified targets.

ATBA trade ideas

ATBA LongATBA is making inverse head and shoulders pattern.

After the war fiasco, it broke the orange trendline and is currently struggling to close above it on monthly chart. A monthly closing above 270 would be a very good sign.

Once it closes above it, next resistances will be 283, 333 and 383 before eventually moving towards its all time high (500-530)

ATBA Hourly AnalysisScrip has taken a good correction of more than 50.00% and penetrated the Golden Zone. Formation of a Green Candle hopefully signals a move towards the upside and relevant Price levels / zones marked.

But as markets aren't predictable 100% and can move in any directions, therefore we should also be prepared for the unforeseen movement and define levels towards the downside as well. Approximate Levels have also been marked towards the downside; in case the scrip move down.

ATBA plunge & possible downside TargetsIf Scrip continues its downward movement, then it may come down to fill in the GAP highlighted in GREEN as it has already filled in the first GAP also nullified / also mitigated the first FVG as well.

Its next GAP filling is due at the level 425-412 approx. and Next CAP price Level is calculated @ 410.22, both are more or less at the same price levels.

If it still goes down then before confronting the next GAP filling it has to cross the Equilibrium zone (which is halfway between the Premium & Discount zones or 0.500 Fib level), which stand about at 400-389 Price level. After that GAP filling area is 389-376 approx.

The second unmitigated FVG on Daily TF is between 389-350 approx., and the above-mentioned GAP is part of this second FVG, and this can be another price zone that can be mitigated towards the downside.

Worthwhile to mention here is the fact that the Scrip may bounce to the upside depending on the Market Demand & Supply forces BUT the most probable area of reversal can be the FVG i.e. 389-350 price level.

IF THIS SOUNDS A BIT CONFUSING THEN GO THROUGH THE BELOW APPROXIMATE PRICE LEVELS AS PER SMC IN CASE SCRIP MOVES TOWARDS THE DOWNSIDE: -

▶ 425-412 Gap Filling zone

▶ 400-386 Equilibrium zone

▶ 389-376 Gap Filling zone

▶ 389-350 i.e. complete FVG price level zone / area - Gap Filling zone = 389-376