BIFO trade ideas

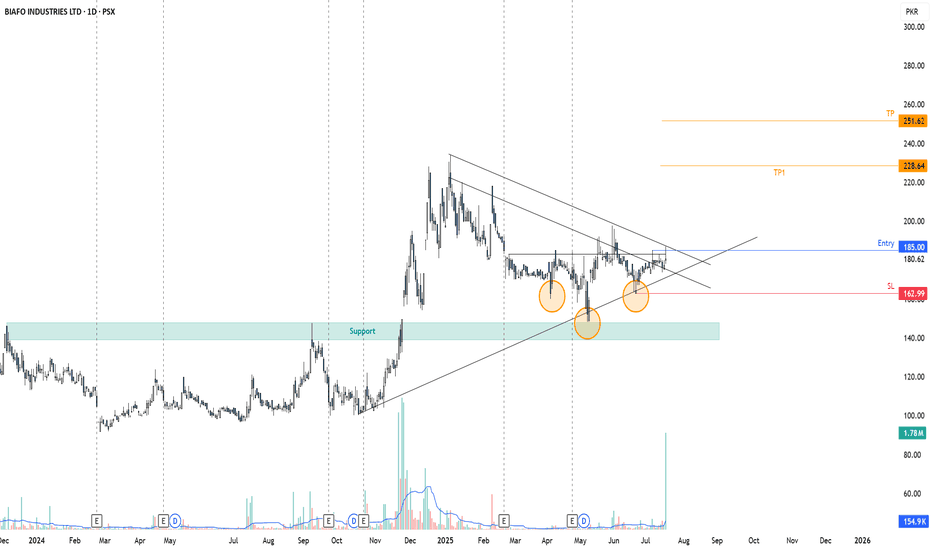

BIFO having over 50% gain potentialThe stock can be accumulated at these levels with SL around 120. Its is being retraced and likely to test its Bullish pennant breakout level of 146.08 which will be over 50% retracement against the recent High, if retraced till 62%, the downside could be Rs. 138. So it should be accumulated between these levels.

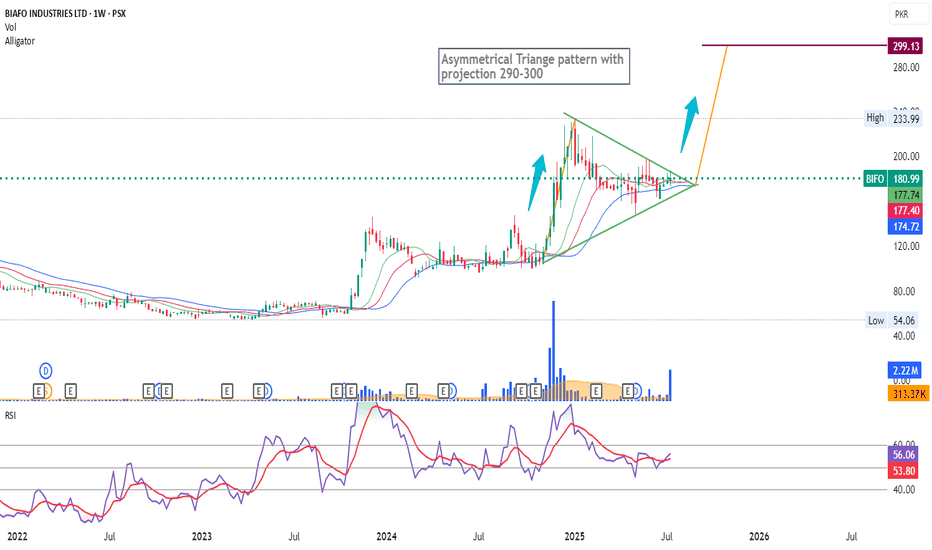

Safe side traders should enter the trade at its previous HH of 195 for the next expected level of 240+

Entry at these level with SL of 120 will make first TP of 200 with RR of 1:1 and for 1:2 TP2 would be around 240