Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.03 PKR

13.09 B PKR

369.24 B PKR

1.39 B

About BANK OF PUNJAB

Sector

Industry

CEO

Zafar Masud

Website

Headquarters

Lahore

Founded

1989

ISIN

PK0045001010

FIGI

BBG000GMP9G9

The Bank of Punjab is a holding company, which engages in the provision of banking and financial services. It operates through the following business segments: Corporate and Investment Banking, Cards and Public Sector Deposits, Consumer Banking Group, Treasury, Islamic, and Others. The Corporate and Investment Banking segment includes loans, project finance, real estate finance, export finance, trade finance, commercial, and investment banking. The Cards and Public Sector Deposits segment relates to public sector deposits and related banking services. The Consumer Banking Group segment focuses on private sector deposits and loans under retail finance, agriculture customers, small, and medium enterprises. The Treasury segment refers to the fixed income, equity, foreign exchanges, commodities, credit, funding, and own position securities. The Islamic segment is involved in the full scale of Islamic banking operations. The Others segment relates to the head office related activities. The company was founded in 1989 and is headquartered in Lahore, Pakistan.

Related stocks

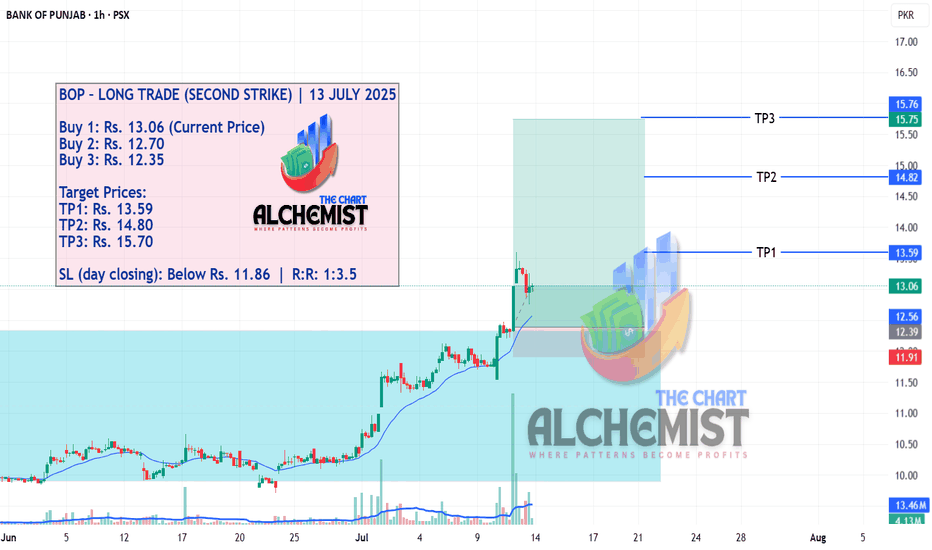

BOP Trade SetupThe stock has recently corrected towards its 200-day EMA, currently positioned at PKR 8.99, and has shown signs of stabilizing near this key long-term support level. Historically, the 200 EMA often acts as a strong bounce zone, especially in stocks that have previously demonstrated bullish momentum.

Understanding BOP’s Bullish Trendstock’s strong uptrend, trading within an ascending channel, and currently consolidating within a resistance zone.

The price is currently consolidating within a red resistance box, indicating that it is facing some selling pressure.A breakout above this zone could trigger another bullish rally

Imme

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BOP is 13.49 PKR — it has increased by 0.37% in the past 24 hours. Watch BANK OF PUNJAB stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on PSX exchange BANK OF PUNJAB stocks are traded under the ticker BOP.

BOP stock has risen by 3.82% compared to the previous week, the month change is a 32.17% rise, over the last year BANK OF PUNJAB has showed a 160.42% increase.

BOP stock is 2.60% volatile and has beta coefficient of 1.37. Track BANK OF PUNJAB stock price on the chart and check out the list of the most volatile stocks — is BANK OF PUNJAB there?

Today BANK OF PUNJAB has the market capitalization of 44.49 B, it has decreased by −0.15% over the last week.

Yes, you can track BANK OF PUNJAB financials in yearly and quarterly reports right on TradingView.

BANK OF PUNJAB is going to release the next earnings report on Sep 3, 2025. Keep track of upcoming events with our Earnings Calendar.

BOP net income for the last quarter is 1.73 B PKR, while the quarter before that showed 5.33 B PKR of net income which accounts for −67.55% change. Track more BANK OF PUNJAB financial stats to get the full picture.

Yes, BOP dividends are paid annually. The last dividend per share was 1.80 PKR. As of today, Dividend Yield (TTM)% is 13.24%. Tracking BANK OF PUNJAB dividends might help you take more informed decisions.

BANK OF PUNJAB dividend yield was 16.65% in 2024, and payout ratio reached 44.99%. The year before the numbers were 15.43% and 29.52% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 28, 2025, the company has 14.66 K employees. See our rating of the largest employees — is BANK OF PUNJAB on this list?

Like other stocks, BOP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BANK OF PUNJAB stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BANK OF PUNJAB technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BANK OF PUNJAB stock shows the strong buy signal. See more of BANK OF PUNJAB technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.