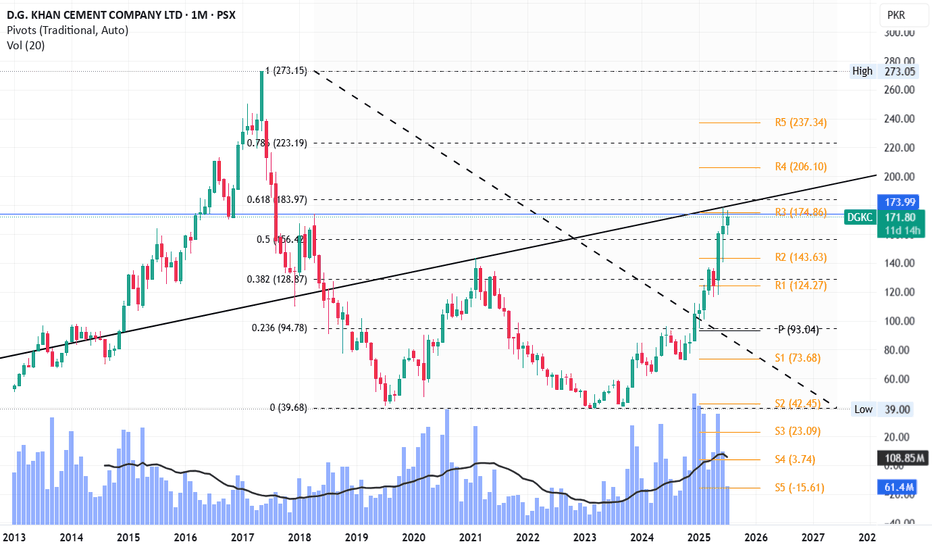

DGKC LongCurrently the trendline and previous resistance level (173 - 179) are stopping it from going upward.

Fib 0.618 level is also near (184) which will be again a major hurdle before it goes further up towards 223 and 273.

However, RSI, MACD and Stoch are fine that suggest no extreme pressure for the pri

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.26 PKR

620.90 M PKR

71.89 B PKR

225.76 M

About D.G. KHAN CEMENT COMPANY LTD

Sector

Industry

CEO

Raza Mansha

Website

Headquarters

Lahore

Founded

1978

ISIN

PK0052401012

FIGI

BBG000GMV1S6

D.G. Khan Cement Co. Ltd. is a holding company, which engages in the manufacture and distribution of cement. It operates through the following segments: Cement, Paper, and Dairy. The Cement segment produces and sells clinker, ordinary portland, and sulphate resistant cements. The Paper segment manufactures and supplies paper products and packing materials. The Dairy segment refers to the production and sale of raw milk. The company was founded on September 27, 1978 and is headquartered in Lahore, Pakistan.

Related stocks

DGKC | Is This Cup & Handle Pattern?Here we have a classic pattern and price dynamics. A major high leads to a low and then a recovery wave. The recovery wave peaks before reaching the previous high and this reveals that a new drop is approaching.

Trading volume is low on the current rise and the latter part of it goes into a parabol

Play on Levels

Weekly closing above 125 is a positive sign.

No bearish divergence yet.

However, 137 - 138 is an Important Resistance

zone.

If the trendline support is broken (127),

the blue highlighted area may act as Immediate

support zone (112 -114)

Upside targets can be around 150 - 160 if

137 - 138 is crossed

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of DGKC is 172.37 PKR — it has increased by 0.71% in the past 24 hours. Watch D.G. KHAN CEMENT COMPANY LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on PSX exchange D.G. KHAN CEMENT COMPANY LTD stocks are traded under the ticker DGKC.

DGKC stock has fallen by −0.56% compared to the previous week, the month change is a 7.70% rise, over the last year D.G. KHAN CEMENT COMPANY LTD has showed a 93.13% increase.

We've gathered analysts' opinions on D.G. KHAN CEMENT COMPANY LTD future price: according to them, DGKC price has a max estimate of 240.00 PKR and a min estimate of 118.00 PKR. Watch DGKC chart and read a more detailed D.G. KHAN CEMENT COMPANY LTD stock forecast: see what analysts think of D.G. KHAN CEMENT COMPANY LTD and suggest that you do with its stocks.

DGKC reached its all-time high on May 31, 2017 with the price of 273.05 PKR, and its all-time low was 39.00 PKR and was reached on Mar 3, 2023. View more price dynamics on DGKC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

DGKC stock is 1.67% volatile and has beta coefficient of 1.05. Track D.G. KHAN CEMENT COMPANY LTD stock price on the chart and check out the list of the most volatile stocks — is D.G. KHAN CEMENT COMPANY LTD there?

Today D.G. KHAN CEMENT COMPANY LTD has the market capitalization of 75.52 B, it has increased by 1.85% over the last week.

Yes, you can track D.G. KHAN CEMENT COMPANY LTD financials in yearly and quarterly reports right on TradingView.

D.G. KHAN CEMENT COMPANY LTD is going to release the next earnings report on Sep 23, 2025. Keep track of upcoming events with our Earnings Calendar.

DGKC earnings for the last quarter are 4.58 PKR per share, whereas the estimation was 3.75 PKR resulting in a 22.13% surprise. The estimated earnings for the next quarter are 5.01 PKR per share. See more details about D.G. KHAN CEMENT COMPANY LTD earnings.

D.G. KHAN CEMENT COMPANY LTD revenue for the last quarter amounts to 18.11 B PKR, despite the estimated figure of 17.85 B PKR. In the next quarter, revenue is expected to reach 17.71 B PKR.

DGKC net income for the last quarter is 2.10 B PKR, while the quarter before that showed 2.87 B PKR of net income which accounts for −26.97% change. Track more D.G. KHAN CEMENT COMPANY LTD financial stats to get the full picture.

As of Jul 26, 2025, the company has 2.3 K employees. See our rating of the largest employees — is D.G. KHAN CEMENT COMPANY LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. D.G. KHAN CEMENT COMPANY LTD EBITDA is 13.21 B PKR, and current EBITDA margin is 15.41%. See more stats in D.G. KHAN CEMENT COMPANY LTD financial statements.

Like other stocks, DGKC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade D.G. KHAN CEMENT COMPANY LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So D.G. KHAN CEMENT COMPANY LTD technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating D.G. KHAN CEMENT COMPANY LTD stock shows the strong buy signal. See more of D.G. KHAN CEMENT COMPANY LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.