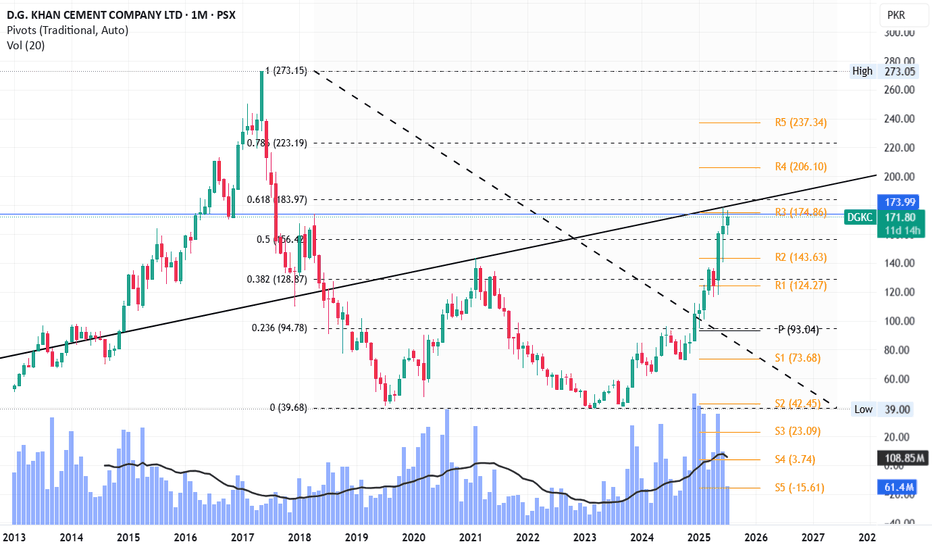

DGKC LongCurrently the trendline and previous resistance level (173 - 179) are stopping it from going upward.

Fib 0.618 level is also near (184) which will be again a major hurdle before it goes further up towards 223 and 273.

However, RSI, MACD and Stoch are fine that suggest no extreme pressure for the price to go downwards yet.

DGKC trade ideas

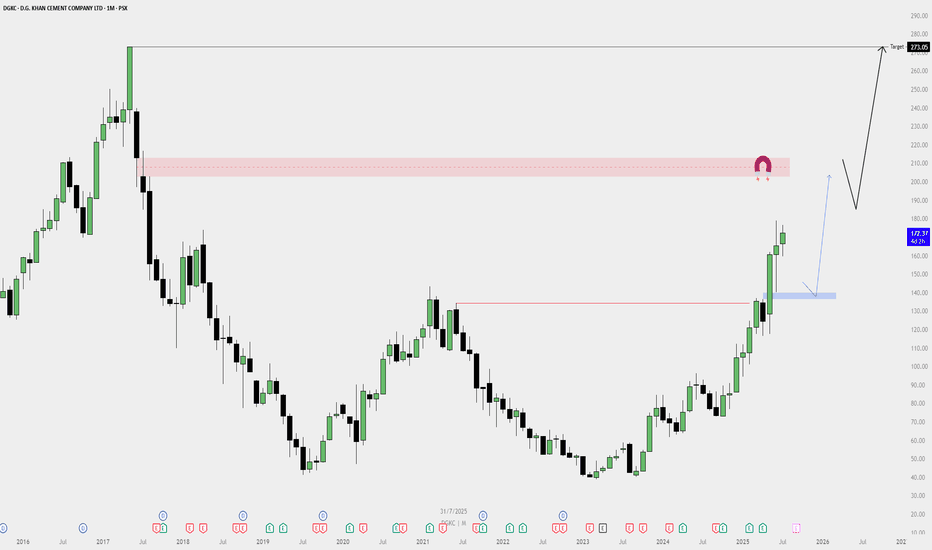

DGKC Monthly Buy Plan — Bullish Outlook📈 DGKC Monthly Buy Plan — Bullish Outlook

✅ Bias: Strongly Bullish

Price has broken major resistance levels with high momentum, forming a big bull trend on the monthly timeframe.

🔍 Key Observations:

Break of Structure:

Price broke past a major resistance zone (previous high).

Strong monthly green candles show institutional interest.

Demand Zone (Blue Box):

A fresh demand zone is formed — a possible area for pullback re-entry.

If price retests this zone, it may offer a high-probability long setup.

Liquidity Magnet Zone (Red Box):

A clear monthly imbalance / supply zone around the 210–220 range.

Could act as a temporary resistance before continuation.

Final Target:

Monthly inefficiency / liquidity target at 273.05, likely the final destination of the move.

Market structure suggests this level can be reached before any major reversal.

🔄 Plan Execution:

🔵 Scenario 1 (Pullback Entry):

Wait for a pullback to the blue demand zone.

Look for lower timeframe confirmation to enter long.

🔵 Scenario 2 (Momentum Continuation):

If price continues without deep pullback, consider smaller timeframes for continuation setups.

Do not chase price; wait for valid structure.

DGKC | Is This Cup & Handle Pattern?Here we have a classic pattern and price dynamics. A major high leads to a low and then a recovery wave. The recovery wave peaks before reaching the previous high and this reveals that a new drop is approaching.

Trading volume is low on the current rise and the latter part of it goes into a parabola. A parabola can only end in a retrace.

DGKC is now set to produce a correction, this correction is set to develop in the short- to mid-term.

RSI indicator if at over bought level while MACD is line is above the signal line, and can show a cross over which establish some negative stance on the price.

Fibonacci levels for the support are PkR123 (0.382 level) and PkR119 (0.5 level) from where a pull back can be expected

On the flip side, if the price gives a break out and closed above PkR137 level then only new bullish wave is expected.

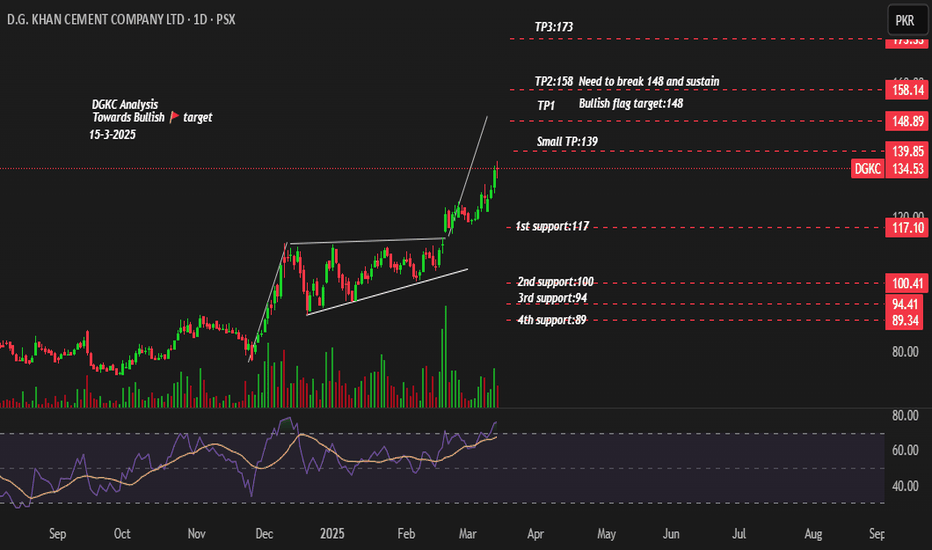

Play on Levels

Weekly closing above 125 is a positive sign.

No bearish divergence yet.

However, 137 - 138 is an Important Resistance

zone.

If the trendline support is broken (127),

the blue highlighted area may act as Immediate

support zone (112 -114)

Upside targets can be around 150 - 160 if

137 - 138 is crossed with Good Volumes.

DGKC Trading Analysis:DGKC broke down after consolidating between 32-36 and is now trading at 124. The strategy is to exit if the price shows weakness when it revisits the 30-level mark.

Downside Targets:

1. *First target*: 110

2. *Second target*: 102

This analysis suggests a cautious approach, with a focus on managing risk and potential downside targets.

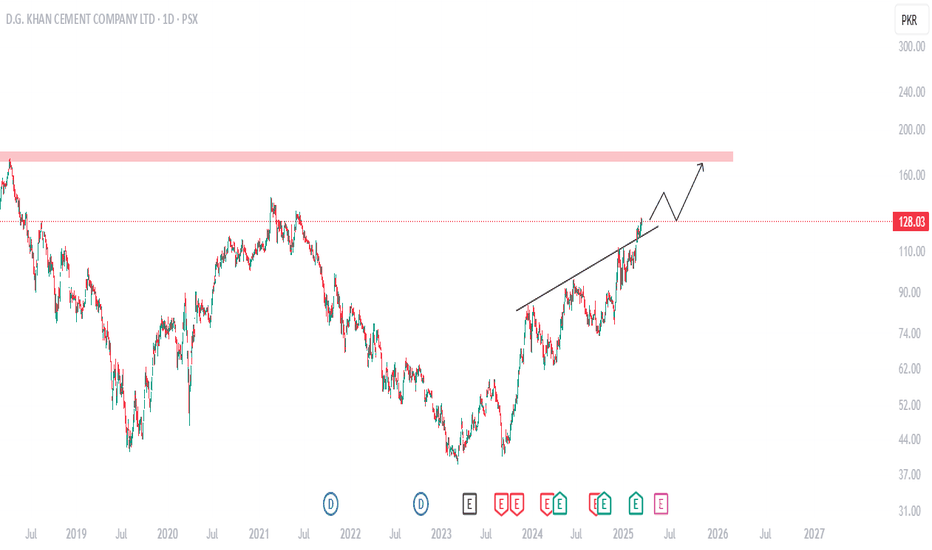

135 - 145 Important Resistance ZoneImmediate Important Support lies around 125 - 128.

However, 135 - 145 is a Very Strong Resistance.

So Fresh Position is recommended either once

this level is crossed or at a Proper Support around 123-128

& then around 112 - 115

If it breaks 118, we may see more Selling pressure.

Market Trends Favor DGKC: A 40% Gain in Sight?it is up against a multi-week resistance line once again, Several industry peers have already surged past key levels and Some of the producers already broke out and DGKC eventually shall follow suit. I personally expect DGKC to quadruple without much effort upon breakout to gain 40%.

DGKC [ DG Khan Cement] Chart Technical Analysis, PSX DGKC Stock Analysis

CMP : 125.88 , 10-03-2025

The price is currently moving within an ascending channel, indicating a bullish trend.

A breakout above the upper boundary could lead to further upward momentum.

Premium Resistance Zone (130.00 - 135.00):

This is a critical resistance area where the stock may face selling pressure.

A breakout above this zone with strong volume could signal further upside potential.

Daily Fibonacci Levels:

The price is currently trading near the 23.6% Fibonacci retracement (117.49), suggesting strong support.

The next support levels are 109.75 (38.2%), 103.50 (50%), and 97.24 (61.8%).

Support Zones:

There are two key support levels around 110 and 100, which coincide with Fibonacci retracement zones.

If the price corrects, these areas could provide buying opportunities.

Potential Price Movement (Dashed Projection):

The dotted lines suggest a possible retest of the resistance zone (130-135) before a correction or continuation.

If rejected from resistance, the stock may pull back to the lower trendline before resuming its uptrend.

200-Day Moving Average:

The red line (200-day MA) is trending upwards, indicating long-term bullish sentiment.

Conclusion & Trading Plan:

Bullish Scenario: A breakout above 130 could lead to 135-140 levels.

Bearish Scenario: A rejection from resistance may cause a pullback to 110-115.

Support Levels to Watch: 110, 100

Resistance Levels to Watch: 130, 135

Disclaimer:

This analysis is for educational and informational purposes only. It represents my personal views based on technical analysis and should not be considered as financial advice or a buy/sell recommendation. Trading and investing involve risk, and past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making any trading decisions. You are solely responsible for your own investment choices.

DGKC Hits New Highs! Breakout or Reversal Ahead?D.G. Khan Cement (DGKC) is showing strong bullish momentum, breaking past key resistance levels. Currently trading around 126.68 PKR, the stock is hovering near a crucial breakout zone at 127 PKR. If it sustains above this level with volume, we could see further upside. However, a failure to hold could lead to a pullback towards key Fibonacci retracement levels.

The Golden Ratio (0.618 level at 113.46 PKR) is a significant support zone, often considered an ideal level for potential reversals. Other support levels include 121-118 PKR (0.236 and 0.382 Fibonacci levels), which could act as strong demand zones if a correction occurs.

Meanwhile, the Relative Strength Index (RSI) is near overbought territory, indicating strong buying pressure but also a potential risk of short-term exhaustion. If bulls maintain control and push beyond 127 PKR, DGKC could enter a new rally phase. However, if the price faces resistance, we might see a healthy retracement before another move higher.

With the stock at a decisive point, traders must watch whether this breakout sustains or turns into a false signal. Will DGKC continue its bullish trend, or is a correction on the horizon? Let me know your thoughts below!

DGKC ACCUMULATION BOX TRADE IDEADGKC IS TRADING IN A ACCUMULATION BOX. HALF YR RESULT WILL BE ANNOUNCED TODAY. EXPECTING GOOD RESULTS WHICH WILL BREAK THE ACCUMULATION BOX.

THE REAL REISTANCE IS AT 108.20 WHICH IS THE WEEKLY PREVIOUS HIGHER LOW AFTER WHICH THE STOCK WENT DOWN to all time low.

HOWEVER THERE IS A DEVIATION FROM 109 TO 112.

AT THE BREAKOUT AT 112 WITH LARGE VOLUMES will start the uptrend

A retest might be possible at the top of accumualation box at 112. Watch on 5m and 15m The EMA 21 is currently acting as a support.

the next quick target will be 116 . If the stock gives a strong breakout above 116 then 122 looks like the next target.

DGKC ID Chart PSX - Ascending Triangle Buy StrategyDGKC ID Chart - Ascending Triangle Buy Strategy:

- Buy at Current Price: Enter the trade at the current market price.

- Stop Loss: Set a stop loss at 101 to minimize potential losses.

- Take Profit 1 (TP1): Target a first take profit at 132.

- Take Profit 2 (TP2): Set a second take profit at 153 for additional gains.

- "DGKC has delivered impressive results, showcasing strong financial performance and growth."

- "The company's strategic initiatives have paid off, resulting in robust earnings and market confidence."

- "DGKC continues to exceed expectations, reinforcing its position as a leader in the cement industry."

Happy Trading.