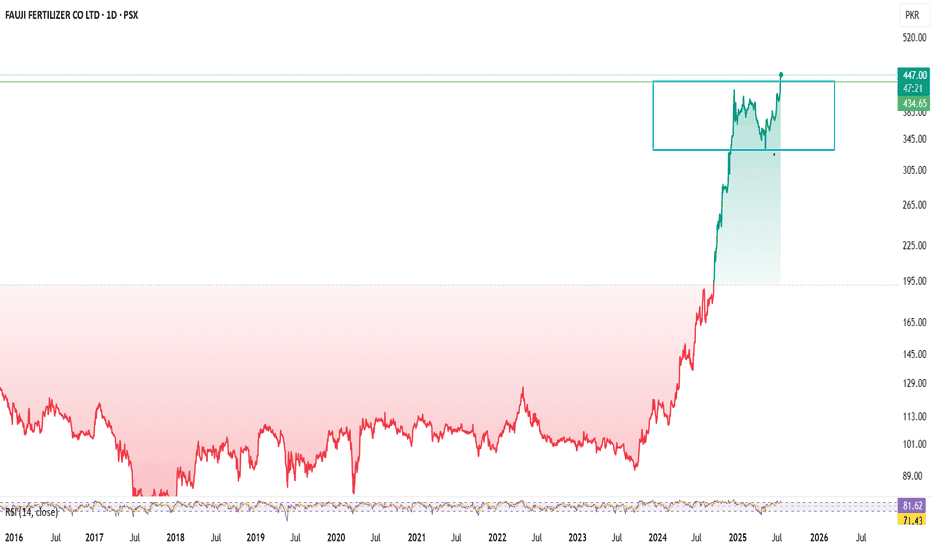

FFCFFC PSX STOCKs breakout Day Level Buy Call

Fundamental Strengths

Robust earnings growth:

FY 2024 net profit ~PKR 64.7 B vs ~PKR 29.7 B (2023) – EPS nearly doubled to PKR 45.49

Pakistan Stock Exchange

+15

StockAnalysis

+15

.

Q1 2025 EPS ~PKR 9.33 (Sep‑Nov on TTM ~PKR 66.6)

Pakistan Stock Exchange

.

Attractive valuation:

TTM P/E ~9.6× (TradingView shows ~6.6×—likely consolidated vs standalone) .

High dividend yield:

~8.7–9.9% yield in 2024, with a ~60% payout ratio

TradingView

.

Diversified portfolio:

Operations across fertiliser, power, food, banking (via Askari Bank), wind generation, phosphate JV – mitigating sector risk

TradingView

+1

+1

Strong ownership:

Backed by Fauji Foundation (~43% owner) – adds stability and governance credibility

FFC trade ideas

FFC Share Buying StrategyFFC Share Buying Strategy

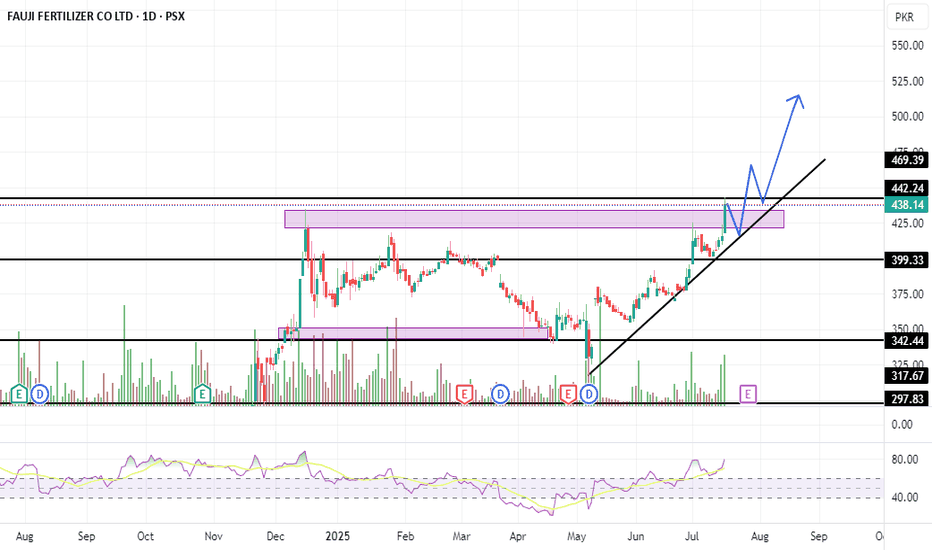

Key Buying Zone:

📍 Buy between PKR 438 – 416

Note: if tomorrow open above 442 then buy don't wait for dip

Stop Loss:

🚫 Place stop loss at PKR 399

Targets:

🎯 Target 1: PKR 464

🎯 Target 2: PKR 500

Extended Strategy:

🔒 If price sustains above PKR 500, hold the position and apply a trailing stop loss to protect profits.

Buy Idea: FAUJI FERTILIZER CO LTD (PSX)🔷 Buy Idea: FAUJI FERTILIZER CO LTD (PSX)

Context:

Price tapped into a discount zone, swept liquidity below the recent lows, and formed a strong bullish engulfing candle. The setup aligns with a low resistance liquidity run toward the higher timeframe distribution zone.

✅ Entry Criteria:

Entry: Above the bullish candle close at ~366

Stop Loss: Below the recent swing low at ~323

Target: Monthly resistance / low resistance area at ~435

RR Ratio: ~1:2.5+

📊 Justification:

Liquidity Sweep: Price swept the previous low (creating inducement)

FVG Reaction: Immediate bullish reaction from the demand/FVG zone

Distribution Zone Targeted: Market is likely to grab liquidity from unfilled sell orders in the upper zone

No major resistance till 435 (clean traffic)

⚠️ Risk Notes:

Confirm daily candle closes above 366 before entry

Monitor any reaction at ~390-400 distribution zone

FFC | Ready for More Upside Before Another Fall?By analyzing the FFC chart on the 4-hour timeframe, we can see that price initially followed our bullish scenario, climbing 23 rupees up to 393. However, after hitting that level, price reversed and currently trading around 389 and eventually finding support around 376.

This area acted as a strong demand zone. Currently, FFC is trading around 389, and as long as price holds above the marked demand zone, we may expect another bullish move towards 390 and 400.

FFC : Bullish Divergence Trading Setup (Hourly Time Frame)A Bullish Divergence has been identified between Price and Momentum indicators on the Hourly chart, signaling a potential Bullish Reversal. This divergence suggests weakening downside momentum and increasing probability of an upward move.

Entry levels and Target Prices (TPs) are clearly marked on the chart.

Traders are advised to consider the Stop Loss (SL) at the level indicated on the chart to manage risk effectively.

This setup favors bullish positioning with calculated risk-reward parameters. Monitor price action around the entry zone for confirmation before execution.

FFC- Deeper Retracement is Expected !Reasons for Deeper Retracements are :

1. 20, 50 & 200 SMAs are converging.

2. RSI on daily TF is below 30 which signifies Bearish Trend

3. Weaker Price Action at Recent Swing High is signalling Profit Taking activity is taking place.

Way Forward:

1. Observe Price Action once price tests 200 SMA and 78.6%% Fib. Level.

2.If a Bullish signal (Engulfing, Pin-Bar with surge in Volume) is observed, a good probability trade is on the cards.

Technical Analysis of Fauji Fertilizer Company Ltd (FFC), PSX

Technical Analysis of Fauji Fertilizer Company Ltd (FFC), PSX

Bullish Pennant , Pattern , CMP : 392.81

Date: 11-03-2025

Analysis By : Ali Safwan

Pattern Formation: Bullish Pennant

Potential Targets (TP Levels)

TP-1: Around 450 PKR

TP-2: Near 475 PKR

TP-3: Extended target around 500-525 PKR

Bullish Case:

If the price breaks above 400 PKR with strong volume, it could confirm a bullish breakout, targeting 450-500 PKR.

Bearish Case: If the price fails to break out, it may retest lower support levels at 350 PKR (SMC Discount Zone) or even 310-275 PKR.

Ideal Entry: A breakout above 400 PKR or a dip buy near 350 PKR support.

Stop Loss: Below 350 PKR to manage downside risk.

Disclaimer:

This analysis is for educational and informational purposes only. It represents my personal views based on technical analysis and should not be considered as financial advice or a buy/sell recommendation. Trading and investing involve risk, and past performance does not guarantee future results. Always conduct your own research and consult with a qualified financial advisor before making any trading decisions. You are solely responsible for your own investment choices.

FFC (analysis). Long.

Technical Analysis: FFC (Ticker: FFC)

Pattern Analysis: FFC is forming a bullish flag pattern, signaling a potential continuation of the uptrend.

RSI Analysis: Although a bearish divergence is observed on the RSI, the trend is not yet complete, suggesting a possible upward movement.

ADX and DI+ Analysis: ADX and DI+ indicators are bullish, further supporting a potential price increase.

Trade Recommendation: Consider buying FFC at 147 with a stop-loss below 137 to manage risk.

Resistance Levels: Resistance levels are marked, with targets set at 158 and 179.

Summary: Bullish flag pattern with bullish ADX and DI+ signals. Entry at 147, targets at 158 and 179. 📈✨

Disclaimer: This analysis is for educational purposes only and not financial advice. Perform your own analysis before investing.