HCAR trade ideas

HCAR LONG TRADEHCAR has been in Bearish Channel which actually acts as Bull Flag.

It went below the channel in false breakdown to facilitate Selling Climax which is transfer of possession from Weak Hands ( Individuals ) to Strong Hands ( Institutions ).

This process and its components are actually a fuel for future uptrend.

Low Wave volume during Selling Climax/ Bear Trap are signs of Fake Breakdown to influence weak hands to sell their shares so that institutions have ownership during uptrend

BUY HCAR 290-300

TP1 320

TP2 340

SL BELOW 280

HCAR Stock Buying Strategy HCAR Buying Opportunity:

Key Levels:

1. Current price: 314

2. Buy zone: Below 300

3. Stop loss: 282

4. Targets: 324, 338, and final target 348

Strategy:

1. Buy on weakness: Enter the trade if the price dips below 300.

2. Risk management: Set a stop loss at 282.

3. Profit targets: Aim for 324, 338, and 348.

Considerations:

1. Market conditions: Monitor market trends and news.

2. Risk tolerance: Adjust position size according to risk appetite.

This strategy is based on the provided information. Always conduct your own research and consider consulting a financial advisor before making investment decisions.

Buy HCARHCAR after completing its Elliott Wave cycle in December 2023 has gone into complex correction. First phase of correction completed with type ABC Irregular Failure following all rules both price and time-wise. Now it is forming its second phase of correction with contracting triangle. It has fulfilled its criteria for formation of e-wave. It can start its trending move any time at the levels 289-278. However, there are also chances that e-wave may go further into formation of another small triangle. In that case, this small triangle will be formed without affecting price level to the down-side. It is matter of time only that HCAR may start its upward move towards 417. BUY @ cmp is recommended.

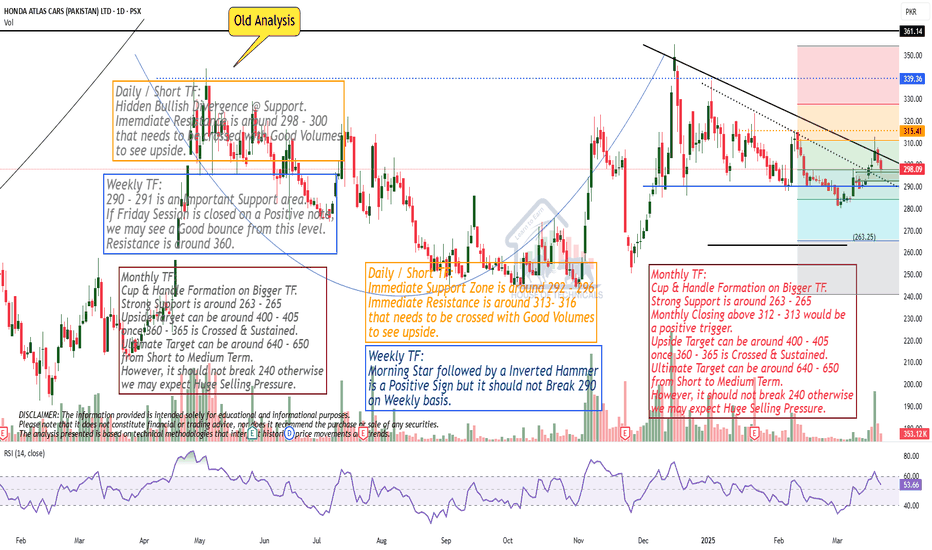

Monthly TF:

Cup & Handle Formation on Bigger TF.

Strong Support is around 263 - 265

Monthly Closing above 312 - 313 would be

a positive trigger.

Upside Target can be around 400 - 405

once 360 - 365 is Crossed & Sustained.

Ultimate Target can be around 640 - 650

from Short to Medium Term.

However, it should not break 240 otherwise

we may expect Huge Selling Pressure.

HCAR - LongThe auto sector as a whole has seen movement, but HCAR has yet to perform, primarily due to the lack of new product launches, making it less competitive against peers. However, sales for the January–March quarter have shown a significant increase , which is expected to reflect positively in profitability.

From a technical perspective, the stock needs to close above 312 with a strong green candle to gain momentum. All target levels are marked on the chart.

Please conduct your own research before making any investment decisions.

HCAR | Expected 100 Rupee Gain!Take a look at what we have here! I believe we can all agree that this chart is quite intriguing.

HCAR is showing bullish momentum after an uptrend making higher highs and higher lows pattern. The price is currently retesting for establishing its low. A possible pullback might be expected in its price action.

We’re likely to see a new bullish wave towards 400 level which is almost 33% gain but I believe there’s potential for significantly more growth in the months ahead.

Thank you so much for your continued support. Let’s ride this bullish wave together!

KSE 100 - HCAR - long or short?HCAR is currently in a strong bullish trend, with no signs of a reversal yet. The price is still showing upward momentum, and the trend remains intact. At the current level, it presents a good buying opportunity.

Entry: Buy at the current price level.

Stop Loss: Set at 263 to manage risk.

Take Profit: Target 398, with potential further movement towards 400, where the AB=CD pattern completes and aligns with a key resistance level.

The AB=CD pattern completion at 400 suggests that this area may act as resistance, so it’s critical to watch price action closely as it approaches this level. However, the overall trend is still bullish, and as long as the price remains above the 263 support level, the upward momentum should continue.

HCAR has a potential to post 160% gain within next 12 monthsCritical point to watch is Rs. 410 which was a monthly LH, Monthly closing above 410 will trigger the journey towards the historical HH of 928, however, as per falling wedge pattern, the projected price would be around 848 which is a 166% gain from these levels. However, Stop loss should be placed at 243