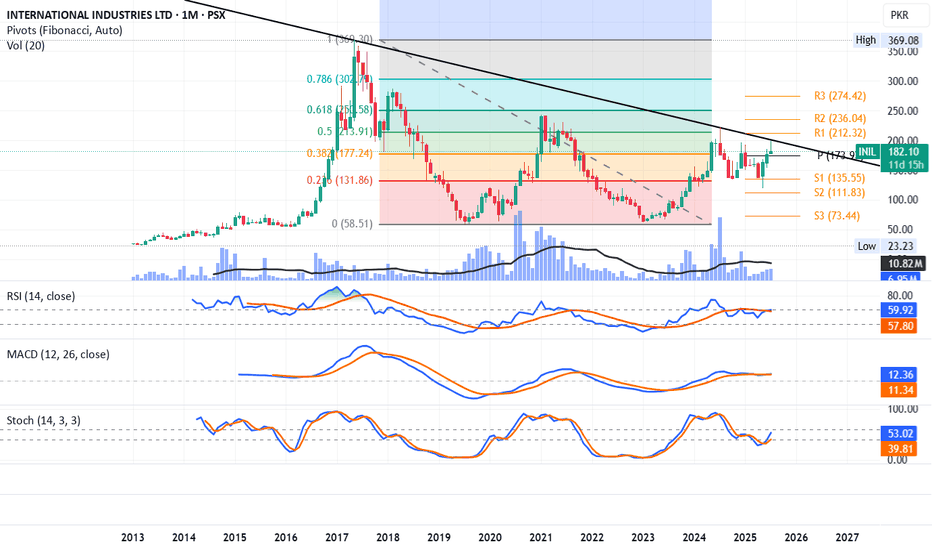

INIL LongRSI, MACD and Stoch, all are giving buy signal.

INIL has tested its monthly support 1 twice, forming a small W which is a bullish pattern.

It is trending above its monthly pivot (174).

Currently, the trendline is stopping it and breaking it will not only make it retest its R1 (212) but also 250 (R2) soon.

Volumes are not supporting though but once it breaks the trendline, we may witness volumes as well.

Its my personal opinion, not a buy / sell call.

INIL trade ideas

Wait for a Good Support LevelIt beautifully completed ABCD pattern around

219 - 220 and then reversed.

Now the immediate Support seems to be around

122 - 123; from where it may start making the

Right Shoulder (may be up to 160 - 170) of H&S pattern.

However, next important Support is around 95 - 100.

INILAre you ready to seize a promising trading opportunity? INIL pulled back from 100-day EMA, this level is 50% Fib retracement also. Possible pull back from this level can be anticipated. As the pattern unfolds, the first resistance level to watch is around 183.61, with a potential surge targeting 203 and then 222. To manage risk, set your stop loss at 165. This well-defined setup offers a structured approach to capitalize on NIL's potential upside while protecting your investment.

Key Points:

Entry Point: Around 180.50-181.

Resistance Levels:

Initial resistance around 183.61.

First target after the breakout at 203.

Ultimate target at 222.

Stop Loss: Set at 165 to manage risk.

PSX KSE 100 INTERNATIONAL INDISTRIES INIL1- Breakup of weekly Trend

2- Volume Increasing day by day

3- Fibonacci retracement also done

4- Hopefully it will get Target

5- Facing resistance at 143.28 and completing Support at 0.382 at 141.05 is again moving up

6- trend is UP

7- Stosch RSI indicator is also generated a buy signal.