4.02 PKR

55.91 M PKR

5.78 B PKR

About K.S.B. PUMPS CO LTD

Sector

Industry

CEO

Imran Ghani

Website

Headquarters

Lahore

Founded

1959

ISIN

PK0023501015

FIGI

BBG000BK8WC0

KSB Pumps Co., Ltd. engages in the manufacture and sale of pumps, valves, and related systems. Its products are used for industrial applications, building services, process engineering, energy conversion, water treatment, water transport, solids transport, and other areas of application. The company was founded on July 18, 1959 and is headquartered in Lahore, Pakistan.

Related stocks

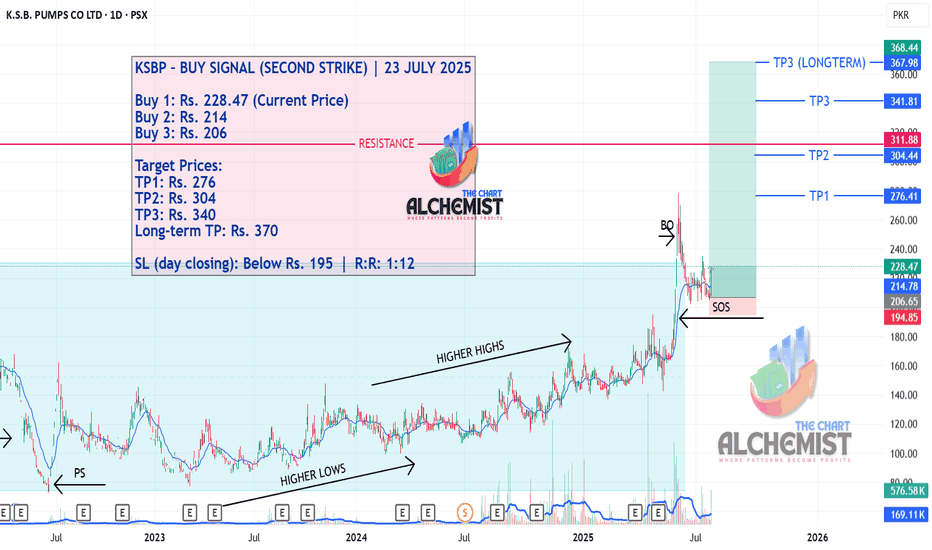

KSBP – BUY SIGNAL (SECOND STRIKE) | 23 JULY 2025 KSBP – BUY SIGNAL (SECOND STRIKE) | 23 JULY 2025

After completing a Wyckoff Re-accumulation Phase marked in a light blue color channel, KSBP stock broke out and achieved a high of Rs. 278 before entering a pullback. The pullback now seems to have ended, and the stock is poised to move higher toward

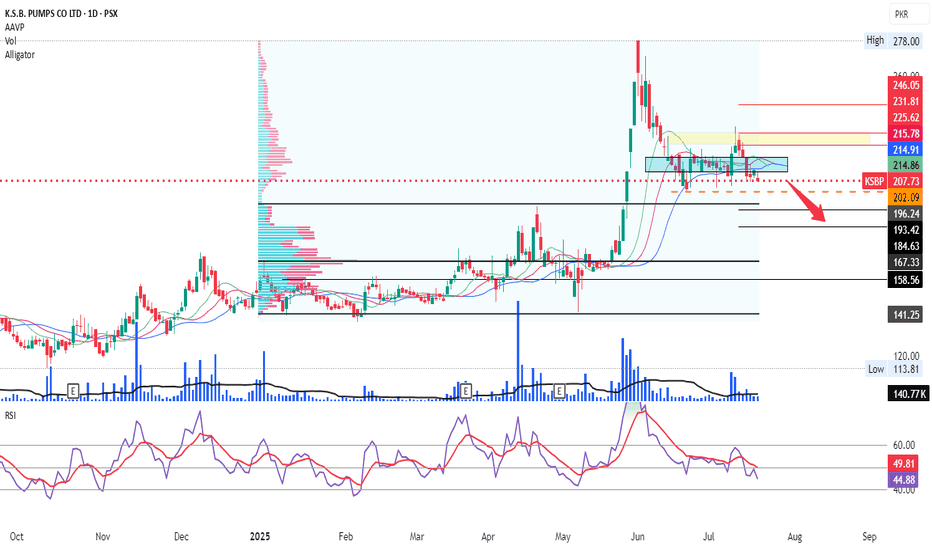

KSBP ON THE DAILY TIME FRAMEIndicators are weak..... needs to sustain the dotted marked line and IF NOT SUSTAINED, then, may eventually end up landing at around the 190-194 and 180-184 price levels and this downward movement, will be quite instant, in my humble opinion.

If maintained / sustained, then upside levels marke

Trade Setup with Multi-Stage Target LevelsThe stock experienced a sharp upward movement, breaking out from a long consolidation phase and reaching a high near PKR 278. Currently, it has pulled back to PKR 235. The chart outlines a trading plan with multiple levels: the first entry point around PKR 226, and a second entry around PKR 210, ind

KSBP LONG TRADE (SECOND STRIKE)KSBP LONG TRADE (SECOND STRIKE)

Those who missed, KSBP is offering another ride. It has potential to attain targets beyond current price.

It is in Spike Phase and it created several Inefficiency Zones and Defensive POI. Not to forget the Marubozu candles in the past week demonstrating strength of t

Hidden Bullish Divergence appeared.Hidden Bullish Divergence appeared.

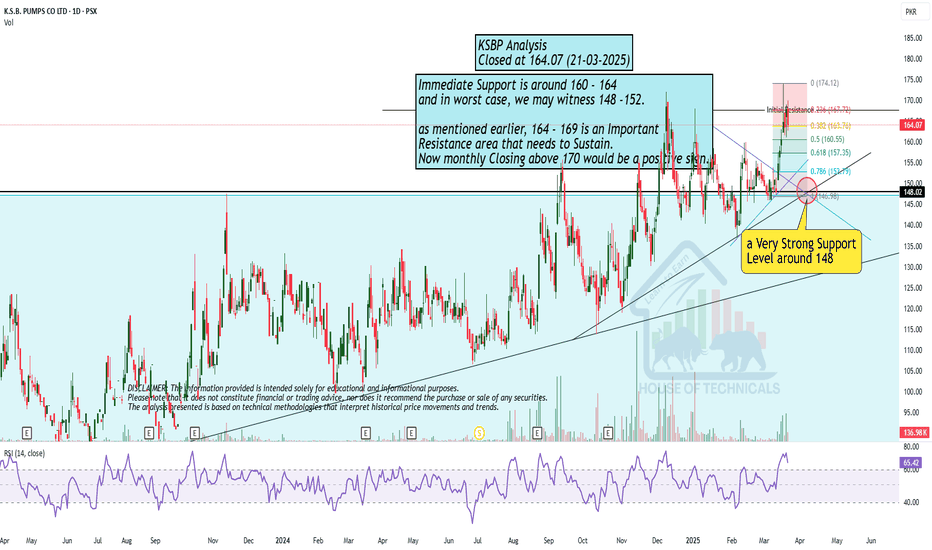

Breaking Out a long Consolidation Box around

145 - 149.

164 - 169 is a Strong Resistance zone.

If this Level is Sustained, we may witness

200+

However, if 135 - 136 is broken, more Selling

Pressure will be witness & it may drag the price

towards 113 - 115.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of KSBP is 224.46 PKR — it has decreased by −0.66% in the past 24 hours. Watch K.S.B. PUMPS CO LTD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on PSX exchange K.S.B. PUMPS CO LTD stocks are traded under the ticker KSBP.

KSBP stock has fallen by −4.07% compared to the previous week, the month change is a 4.20% rise, over the last year K.S.B. PUMPS CO LTD has showed a 75.37% increase.

KSBP reached its all-time high on Jan 25, 2017 with the price of 470.79 PKR, and its all-time low was 56.77 PKR and was reached on Mar 20, 2013. View more price dynamics on KSBP chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

KSBP stock is 4.04% volatile and has beta coefficient of 0.45. Track K.S.B. PUMPS CO LTD stock price on the chart and check out the list of the most volatile stocks — is K.S.B. PUMPS CO LTD there?

Today K.S.B. PUMPS CO LTD has the market capitalization of 6.94 B, it has decreased by −6.82% over the last week.

Yes, you can track K.S.B. PUMPS CO LTD financials in yearly and quarterly reports right on TradingView.

KSBP net income for the last quarter is 60.15 M PKR, while the quarter before that showed 195.76 M PKR of net income which accounts for −69.27% change. Track more K.S.B. PUMPS CO LTD financial stats to get the full picture.

K.S.B. PUMPS CO LTD dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 286 employees. See our rating of the largest employees — is K.S.B. PUMPS CO LTD on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. K.S.B. PUMPS CO LTD EBITDA is 550.79 M PKR, and current EBITDA margin is 8.32%. See more stats in K.S.B. PUMPS CO LTD financial statements.

Like other stocks, KSBP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade K.S.B. PUMPS CO LTD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So K.S.B. PUMPS CO LTD technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating K.S.B. PUMPS CO LTD stock shows the buy signal. See more of K.S.B. PUMPS CO LTD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.