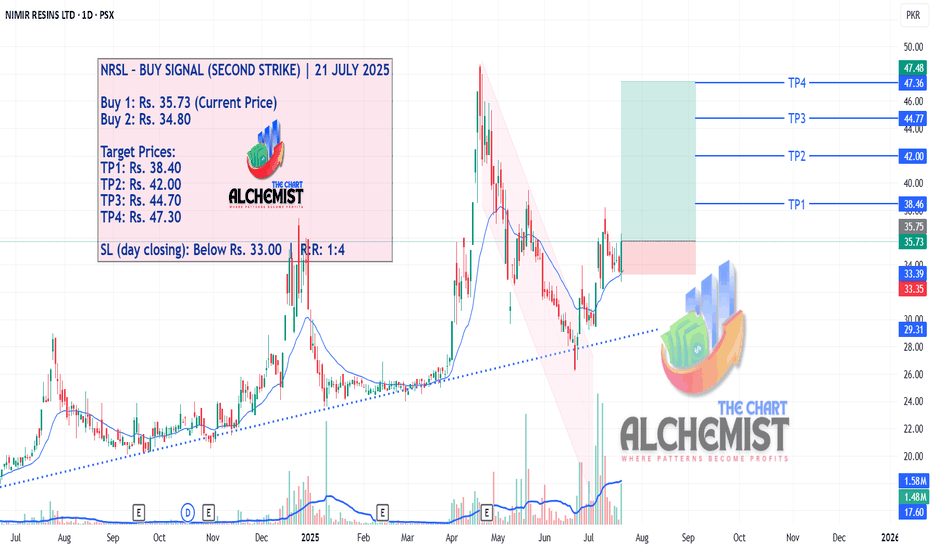

NRSL – BUY SIGNAL (SECOND STRIKE) | 21 JULY 2025 NRSL – BUY SIGNAL (SECOND STRIKE) | 21 JULY 2025

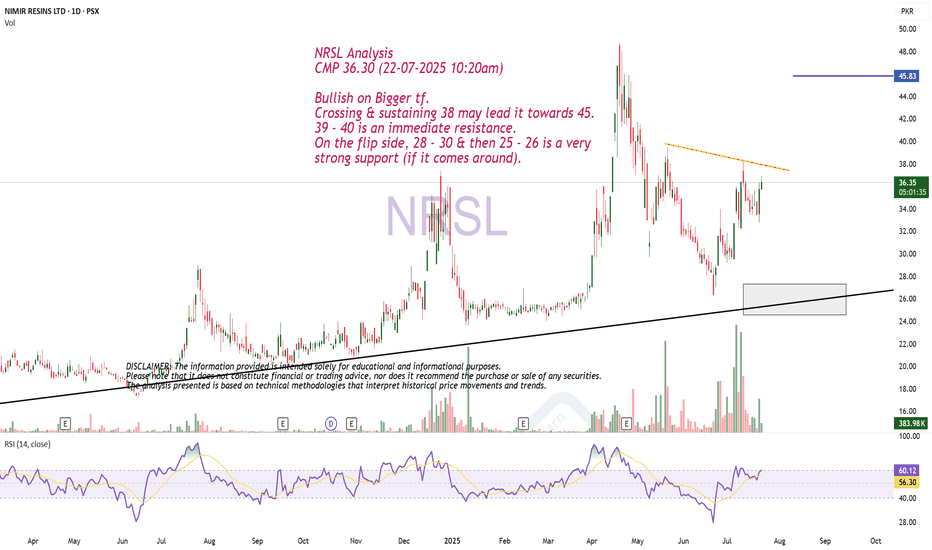

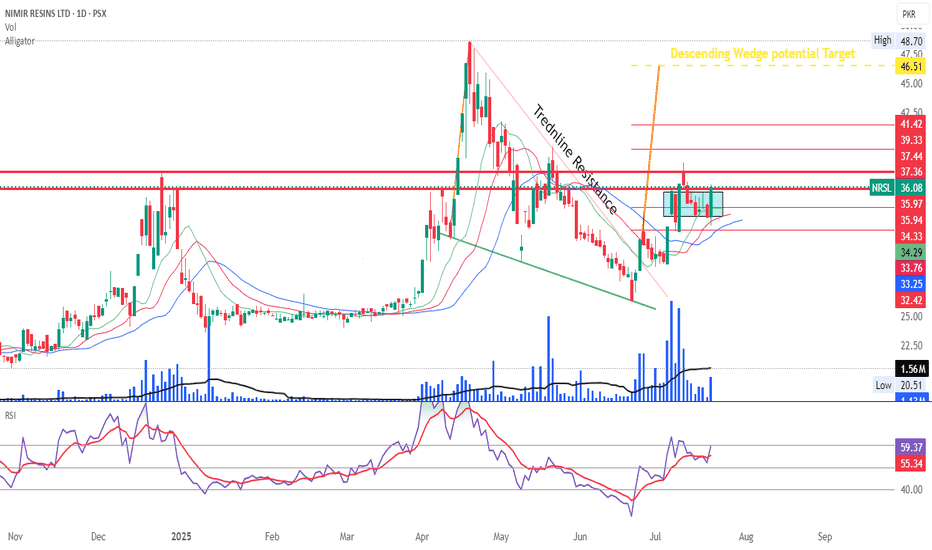

We previously issued a buy call for NRSL, which remains valid. The stock recently marked a high of Rs. 38.10 before entering a pullback. That pullback now appears complete, and the stock is showing signs of resuming its upward move toward fresh displacement targets.