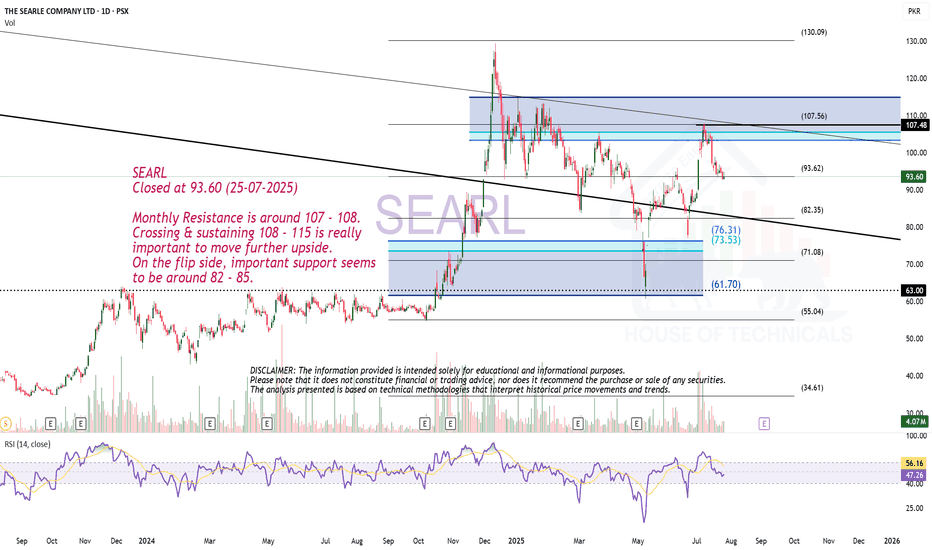

SEARL trade ideas

SEARLE LONG TRADESEARLE has been in downtrend since Dec 25, it has recently take support from a strong Breaker Block and also crossed over a bearish Breaker Block which is a sign of strength.

The downward Bear Channel is actually a Bull Flag as per Price Action Principles of Al Brooks the Father of Price Action.

Price went below this channel in shape of Selling Climax to dry out all Supply at those lower levels, this process has shifted the possession of Searle from Weak Hands to Strong Hands (Big Institutions). thus creating a Supply Vacuum.

Price has only logical direction to go and that's upwards.

BUY SEARLE 78-84

TP1 95

TP2 105

TP3 120

SL 70

SEARL LOOKS BEARISH LONGTERMSEARL LOOKS BEARISH LONGTERM (5-10 years from now)

SEARL has a very long leg from start to the top of 300 value. This long leg makes it vulnerable in current scenario for long term upward progress. After top it has been on decline reaching to ~35.

However the bounce back does not look impulsive instead it has corrective nature.

In my analytical view I can not rule out a impulsive downward movement until and unless crosses above 750.

Currently, it must cross and sustain above 180 to show some indication of long-term upward progress.

Nearest levels of upward rejection can occur at 100 (did not happen), 130 (happened) and lastly 180.

130 rejection can be considered as upward rejection if it moves down below 75. Otherwise it can test 180 value.

If it sustains above 180 then the rejection values are 300, 550 and 740.

Any sustained upward move above 750 will confirm the long-term targets of 1900, 6000, 11000 and 22650.

The impact of rejection from upside is displayed by arrows showing two scenarios of rejection to downside and their possible targets.

GOOD LUCK

DISCLAIMER:

The information provided doesn't guarantee results. 𝙏𝙧𝙖𝙙𝙞𝙣𝙜 𝙞𝙣 𝙛𝙞𝙣𝙖𝙣𝙘𝙞𝙖𝙡 𝙢𝙖𝙧𝙠𝙚𝙩𝙨 𝙘𝙖𝙧𝙧𝙞𝙚𝙨 𝙧𝙞𝙨𝙠𝙨. Individuals should perform a thorough analysis and consider their risk tolerance before making investment decisions. 𝙄 𝙖𝙢 𝙣𝙤𝙩 𝙧𝙚𝙨𝙥𝙤𝙣𝙨𝙞𝙗𝙡𝙚 𝙛𝙤𝙧 𝙛𝙞𝙣𝙖𝙣𝙘𝙞𝙖𝙡 𝙡𝙤𝙨𝙨𝙚𝙨 𝙧𝙚𝙨𝙪𝙡𝙩𝙞𝙣𝙜 𝙛𝙧𝙤𝙢 𝙖𝙘𝙩𝙞𝙤𝙣𝙨 𝙗𝙖𝙨𝙚𝙙 𝙤𝙣 𝙩𝙝𝙞𝙨 𝙥𝙤𝙨𝙩. Consult with a qualified financial advisor before entering to trade in stocks.