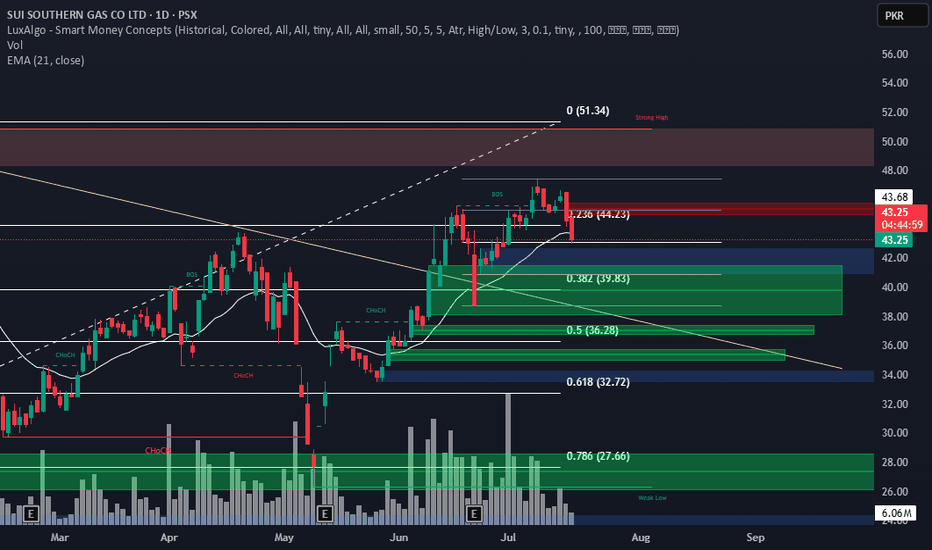

SSGC – BUY SIGNAL | 01 AUGUST 2025SSGC – BUY SIGNAL | 01 AUGUST 2025

The stock recently broke out of a bearish channel (marked light pink) and made a high of Rs. 47.41. Since the breakout, it has been undergoing a lateral pullback, which now appears to be complete based on the volumetric profile and recent price action. With momentum shifting back in favor of buyers, SSGC is poised for the next leg upward.

SSGC trade ideas

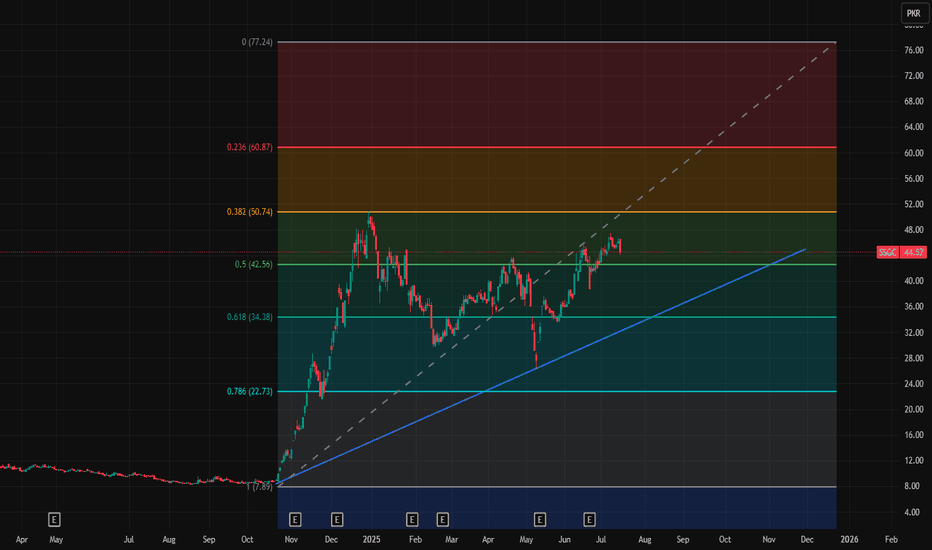

Bullish on All Time Frames.SSGC Closed at 44.24 (18-06-2025)

Bullish on All Time Frames.

Important Resistance Zone : 50 - 57

Important Support Zone : 35 - 41

Very Strong Bullish Patterns appearing

on Bigger Time frames.

Crossing 56 - 57 with Huge Volumes, may

result in further upside move of price

towards 80+

However, this time it should not break 24.

Hidden Bullish Divergence will play?as mentioned during market

timings, 36.50 was important to

sustain. It could not and hit the

Lower Lock at 36.03

Next Support is around 34.50 - 34.62

Now it is Important to Sustain 36.50 - 36.70

on Weekly basis.

Monthly Support is around 35.

One +ve sign: Hidden bullish divergence has

also appeared.

SSGC | Downward-Sloping ChannelThe stock in a downward-sloping channel after a strong rally that peaked near PKR 50.87. Currently trading at PKR 39, the price is above the 200 EMA level (28.70 PKR), suggesting longer-term bullish strength despite short-term weakness. Recent price action faced resistance near the upper trendline, and today's bearish candle indicates selling pressure. Key support lies around 37.00–35.00 PKR, while a breakout above 41.00–43.00 PKR could signal a resumption of the uptrend if backed by strong volume.

SUI SOUTHERN GAS CO LTD SSGS has good potential to grow more because of current government in Pakistan try their best resolve the issue of circular debt SSGS is the one of beneficiary of circular debt.

1) Currently SSGS share price following Dow theory of uptrend.

2) Volume on daily time frame showing strong sentiment for future grow.

3) Completed 50% retracement of fib`s , Show strong reverse from golden number of fib.

4) Following AB:CD pattern on daily, weekly and monthly time frame, while completed (C) leg of AB:CD pattern and started to follow ( D) leg.

5) Also seen cup & handle pattern of daily, weekly time frame, currently following to complete handle of cup and handle pattern.

6) According to Elliot impulse theory completed 2nd leg and started 3rd leg which can expect more higher than past one.

Trade Plane

AB:CD Pattern Targets

Target (1) : 50.54

Target (2) : 72.00

Stop loss : 29.80

Cup & Handle Targets

Target: 89.45

SSGC PSX Stock SummarySSGC (Sui Southern Gas Company) on the Pakistan Stock Exchange (PSX) is showing positive momentum, with a near-term target of PKR 43.90. The recommended entry is at the current market price, with a stop loss set at PKR 40.00 to manage downside risk. The stock appears poised for an upward move based on recent trading activity and technical indicators.

Disclaimer: This summary is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Please conduct your own research or consult with a licensed financial advisor before making investment decisions. Trading in stocks involves risk, including the potential loss of capital.

SSGCA rising wedge or ascending channel is forming.

A descending channel target is marked at 25.80 PKR in case of a breakdown.

Key Price Levels & Trade Strategy:

Safe Buying Zone: Above 39 PKR if sustained.

Take Profit (TP) Levels:

First TP: 44.40 PKR

Second TP: 48.25 PKR

Long-term TP: 50 PKR (if a bullish divergence forms and price breaks upward).

Relative Strength Index (RSI): Displayed below the price chart.

RSI appears to be declining after a peak, which could indicate a potential pullback or consolidation.

Interpretation:

Bullish Scenario: If the stock sustains above 39 PKR, it could rally toward 44.40 PKR and 48.25

Bearish Scenario: If it fails to sustain and breaks below support, it could drop towards 25.80