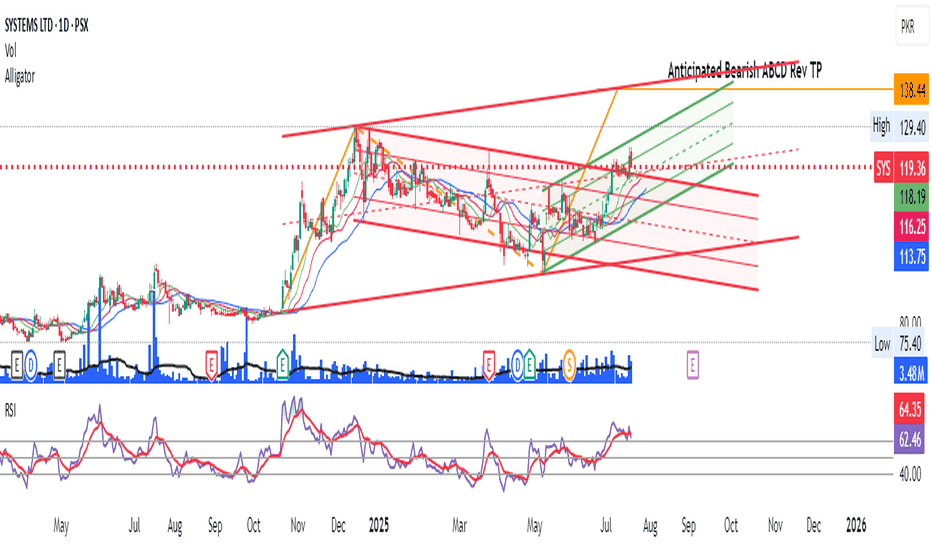

SYS trade ideas

PSX: Systems Limited IdeaTrade Plan for Systems Ltd (SYS) — Monthly Chart

✅ Trade Type: Swing Trade (Position trade with multiple months’ holding horizon)

⚙️ Technical Setup Summary:

Price is in a bullish breakout structure after testing key Fibonacci levels.

Break above 0.618 Fibonacci retracement (128.55 PKR) confirms bullish momentum.

Price currently retesting the 0.786 Fib level (138.34 PKR).

Clear trendline support.

Bullish price action and increasing volume confirm accumulation.

🔸 Entry Plan

Entry Zone: Between 128.50 – 133.50 PKR

Ideal scenario: Entry on a bullish reversal from the purple support box (~128.50 area), near the 0.618 Fib level.

Alternatively: Add partially now, and scale into position if the price dips toward support.

🛑 Stop Loss (SL)

SL Level: 121.60 PKR

Below the recent support structure and 0.5 Fib retracement level.

Protects against trend reversal and false breakout.

Tight but logical based on structure.

🎯 Take Profit (TP) Targets

TP1: 150.80 PKR (1.0 Fibonacci Extension)

TP2: 170.00 PKR (1.414 - 1.618 Fib Extension Zone)

⚖️ Risk-to-Reward Ratio (RRR)

RR: ~1:3

SL = ~12 PKR

TP1 = ~17 PKR gain

TP2 = ~37 PKR gain

🔍 Trade Justification

Price action broke key resistance near 128.50 with volume.

Monthly candle structure shows strength; previous resistance now acting as support.

Long-term trendline intact.

Fibonacci cluster and historical price action align for confluence.

Positive momentum with potential continuation toward TP2.

🧠 Trade Management

Partial Profit: Take 50% at TP1, trail SL to break-even.

Trail Remainder: Use monthly candle lows or 20 EMA as dynamic trailing stop.

Re-evaluation: If price consolidates between 138–145 for several weeks, reassess risk and possible breakout re-entry.

🗓️ Time Horizon

Expected Holding Period: 2 to 6 months

Review price action on weekly closes for confirmation or exit signs.

SYS – LONG TRADE (SECOND STRIKE) | 12 JULY 2025SYS – LONG TRADE (SECOND STRIKE) | 12JULY 2025

The stock previously trended downward in a pink channel but consolidated and formed a springboard (light blue channel). After achieving TP1 in our previous call, the stock has created a bullish structure, making this location a good spot for a second entry.

100 is a Very Important Support level.SYS Closed at 104.21 (05-06-2025)

100 is a Very Important Support level

that should be sustained on Monthly basis.

Immediate Resistance is around 114 & then

128 - 129. Crossing this level will make it

more Bullish with targets around 150+

But if it breaks 92, there would be more

selling pressure & next Support would be

around 82 - 83 then.

Weekly Closing just at Resistance!Weekly Closing just around Resistance

level (580), so a slight pressure may be seen, unless it

Sustains 580. If this be the case, 545 - 565 can be witnessed.

Bullish on Weekly TF & a perfect

Morning Star Formation on Weekly Tf.

Also, it has retested the previous breakout level

around 520.

Now it should Cross & Sustain 605-606 to continue

its Bullish Momentum & immediate targets can be around

650 - 655.

On the safe side, 596 - 621 Zone is a Resistance zone.

Re-Testing of Breakout Level around 520.Re-Testing of Breakout Level around 520.

If Weekly Candle Closes above 520 - 521, we may

expect an Upside towards 550.

Also there is Bullish Divergence so we may

expect that it will play this time & push the price upside.

On the flip side, 500 - 504 is the Channel Bottom.

and Remember, Once 650 is Crossed with Good Volumes,

it may expose New Highs targeting around 700.

SYS - PSX - Technical AnalysisOn daily time frame, price after defining a Higher Low of bull cycle is going up. A hidden bullish divergence has also played indicting that trend will continue. KVO also suggest that bull run is still on. TPs have been set using Fib.

Trade Value:

Buy CMP: 599.78

TP1: 679

TP2: 716

SL: 520

Very bullish Pak IT stock I'm very bullish on this Pakistani IT stock - the growth potential is immense for 5-20 years for long term holding

See sales growth & Profit margin and earning ratios - dps.psx.com.pk

Sales are to mostly foreign clients , therefore local currency and economic risk is manageable