PUMP/USDTCurrent Market Structure

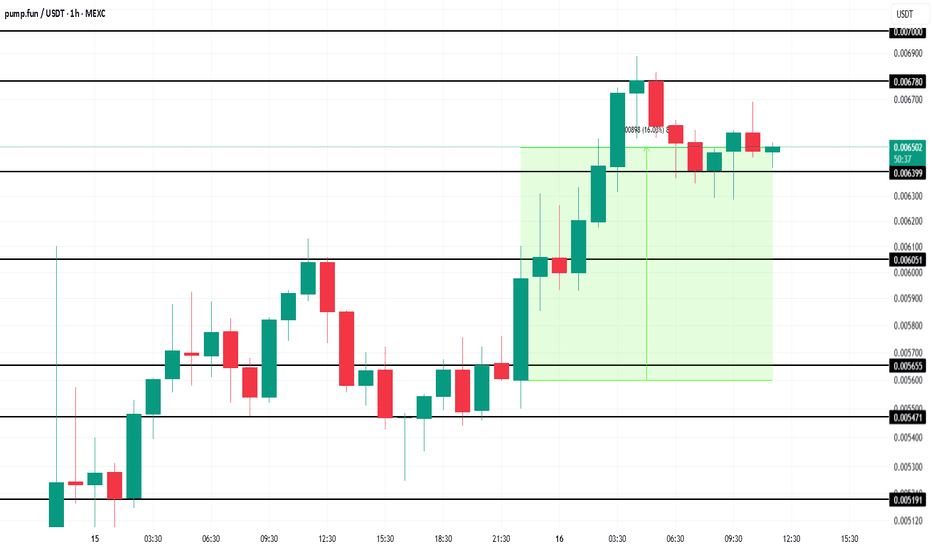

Strong pump occurred around July 13th, peaking above 0.0072.

Price retraced and is now ranging between 0.00580 – 0.00640.

Appears to be forming a consolidation or flag pattern, which can break either way.

Volume is declining, indicating potential for breakout buildup.

Pump.Fun (PUMP) Token Nears Milestone $1 Billion OI In 3 DaysMEXC:PUMPUSDT price stands at $0.0065 after bouncing off the $0.0063 support level. The token has gained 16% in the last 12 hours , showing that the demand for PUMP is strong.

The valuation of Pump.Fun has skyrocketed in just two days, reflecting a surge in demand. In only 48 hours since its laun

#PUMP is trying to break out of the falling channel! #PUMP Our previous trade setup, SL, got hit.

Currently, it is trying to break out of the falling channel on the 1H chart.

If it holds above the breakout zone, it could push toward $0.0082 📈

Entry: 0.0060 – 0.0063

Stop Loss: 0.00578

Targets:

TP1: 0.0068

TP2: 0.0074

TP3: 0.00795

TP4: 0.00823

Class

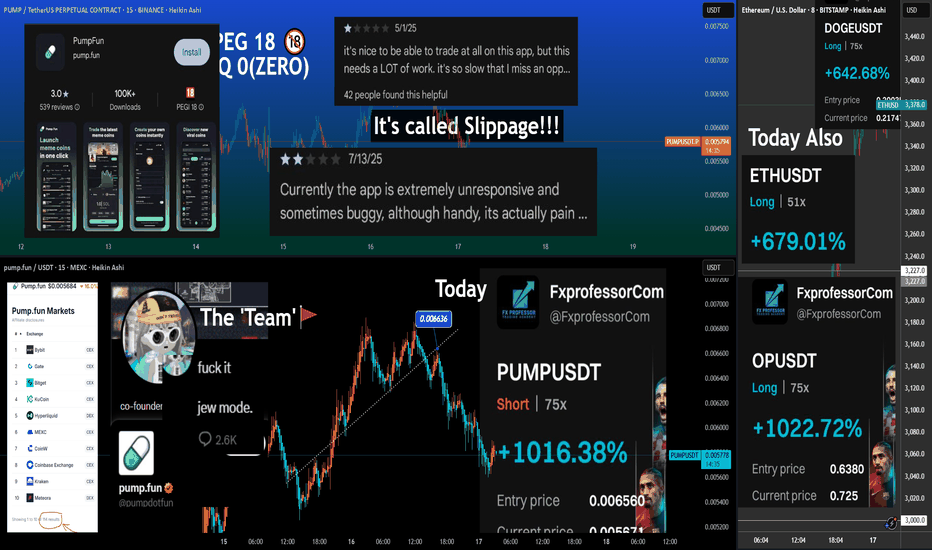

Dirty Little Crypto World: Episode 1 🚩🔍 Dirty Little Crypto World: Episode 1 – Built for Beginners, Designed to Drain 🧠💥

I've called some BIG red-flagged ones before:

FTX: ( i will post proof in the comments)

Luna:

— both collapsed, and I said it before the smoke hit the screen.

But this time, the 'smoke' moved differentl

Where Should We Rebuy The PUMP? (8H)With the large bearish master candle formed at the top, the structure has turned bearish.

The green zone is the best and lowest-risk area for long positions or rebuys.

Reaching this zone may take some time, but you can already add this symbol to your watchlist and wait for it to reach the area befo

$PUMP’s Stochastic at 60 – Room for Growth?Analysis: At $0.167, NYSE:PUMP ’s Stochastic Oscillator is at 60 on the daily chart, suggesting room for upside before overbought levels. Resistance at $0.17 is critical; support at $0.15 holds. Recommendation: Long on a break above $0.17; stop below $0.15.

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.