QNTUSD trade ideas

QNT FOR THE WIN!Looking at QNT if youve been following me on another platform under the same name. Youll see we have timed these perfectly. we entered QNT at around $75 sold at $123 the flase breakout/ war and had the rejection right back down to the .618 fib retracement. Once we held beautiful support at the downward trendline, around $90 we had an immediete push up. We wait to see what bitcoin does. If it consolidates or pushed upward we could see QNT push back up to $123 and beyond (currently at the .618 fib retracement).

If bitcoin gets rejected, we may see a small pullback but i cant imagine back down past $90 again. NOT FINANCIAL ADVICE.

Goodluck and have fun with it.

QNT is breaking out of the descending wedge upper trend line.QNT is now starting to trade outside the upper trendline of the descending wedge and is likely to make an attempt to move toward the equilibrium zone—or close to it.

This will be interesting to watch.

Good luck, and always use a stop-loss!

QNT could double in price quicker than you think!The QNT charts are looking incredible right now, and all ISO 20022 tokens are now exhibiting the same, or very similar, internal five-wave patterns that I believe are about to move up to the next level.

Although I don't own any QNT and have no plans to, many of my followers do. Either way, the charts are starting to look like a nice slice of cherry pie.

Good luck, and always use a stop loss!

SWEEEEP!They need your money to send it don't let it be your liquidity. When you see set ups like this is when you should sit on your hands, control your emotions, or just use proper risk management if you just cant help yourself from trading the range, but that's just what we se here. Liquidity needs to be swept and cleared from the lows if we are to go higher here from this level of $105. If GETTEX:QNT 's price action could give us a solid dip (signature pattern with a candle close and rejection) with some sort of reaction that will provide support at key psychological Fibonacci level should provide evidence that we could send higher.

USE PROPER RISK MANAGEMENT

[QNT] QUANT could make a move for (+110%) to (+167%)QNT is showing good strength to continue climbing up, the momentum is shifting to bullish in the monthly timeframe with moneyflow increasing, if it closes a weekly candle above $152 will signaling a reach for higher prices. The target is situated between point of control and value area high from last bull run with fibonacci retracement levels from the top and a weekly level.

TARGET: $280 to $354 up to (+167%)

Qnt forming right shoulder on invh&s while retsting channel ttl I’m hoping the right shoulder quant is now forming here by retracing after reaching that top purple horizontal line, will be a very short shoulder with help from it’s recent golden cross and hopefully the support from the top trendline of the yellow channel that quant just recently broke above. Usually a right shoulder would last for a much longer period of time than I have drawn this one to last in order to be ore proportional with the left shoulder(not shown here), however loopring and a few other charts recently have had very small asymmetric right shoulders on the inverse head and shoulders patterns that their price broke upward from so that may also be the case for quant’s right shoulder as well. We will see soon enough, if Quant is to follow suit with the rest of the altcoin market it’s recent golden cross should give it the bullish momentum it needs to complete this right shoulder as a very small shoulder indeed.

Quant on the rise after goldencross helps confirm triangle breakQuant essentially confirmed its breakout upward from the symmetrical white triangle around the exact same time it had its goldencross. You can also see a light yellow channel it has also broken up from, upon reaching the target of the white symmetrical triangle breakout, Quant should then be able to break upward from the blue channel as well which has a breakout target that can send Quant back to retesting it’s previous all time high. *not financial advice*

Quant’s big green candle today coincides w/ its goldencrossJust like so may other alt coins around the market, Quant exploded upward on the day of its golden cross as well. There’s a slight chance t could pull back from here in which cae then it could possibly form a right shoulder of a potential inverse head and shoulders and give people a chance to enter in lower before the next leg up, or it could just keep pumping right through this current tan colored resistance line and continue up to the purple neckline of it’s massive double bottom pattern. Ether way whenever it flips that purple line to solidified support,the breakout target can send Quant all the way back up to its old all time high, likely making a new all time high in the process. Looking forward to seeing where this one goes. *not financial advice*

Quant finally waking up and joining the rest of the alt pumpLooks like Quant has broken above an inverse head & shoulders pattern with two valid necklines. The higher longer one having a higher breakout target of course. Based on the pattern unfolding on total2 chart right now as well as it’s impending golden cross, I’d say QUant reaching both inverse head & shoulders targets is highly probable *not financial advice*

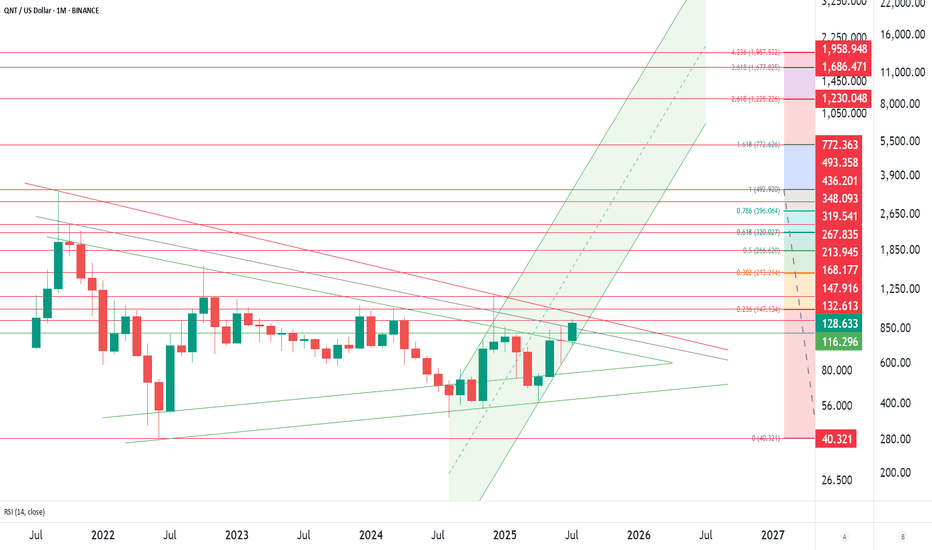

QNTUSDHere is your QNT breakdown:

as you can see all support and resistance levels with take profits

I do not see QNT getting as much volume as it did back when it first came out.

ISO tokens need to be adopted and 2024 isn't the time yet -

2026 2027 something like that but what do I know....

So if all hype and stuff works out the first TP would be 227

anything above this in this bull run would be amazing a solid $300 is great and overall if it goes back to ATH then yeah that would be the signal to sell

Quant price action currently above inverse h&s necklinePrice action is currently above the inverse head and shoulder neckline and has closed a couple candles above it on the daily timeframe. Often times price action will dip back below the neckline after this initial break above it so that is certainly possible here, however if it does validate the breakout without first dipping back below the neckline again here, I have placed the emasured move target price at the top of this dotted pink line. *not financial advice*