RADUSDT CHART ANALYSİS - EDUCATIONAL POSTHow NFT Technology Developed

NFT technology was created in 2017 based on Ethereum smart contracts. Since then, we have witnessed many successful NFT projects and deals. Stories like these perfectly describe the current and future possibilities of the technology.

The development of blockchain technology and the emergence of NFT services coincided with other processes in society and the economy. Many new players appeared in the stock markets, including non-professional traders and amateur investors.

The democratization of financial markets coincided with the pandemic: being in self-isolation, alone with their devices, many people began to pay attention to new financial instruments.

The information that arose around them also played a specific role in the “revival” of NFTs. The big names in the news headlines supporting NFTs couldn’t help but draw attention to them. That is one of the reasons why the success of the technology was inevitable.

RADUSDT trade ideas

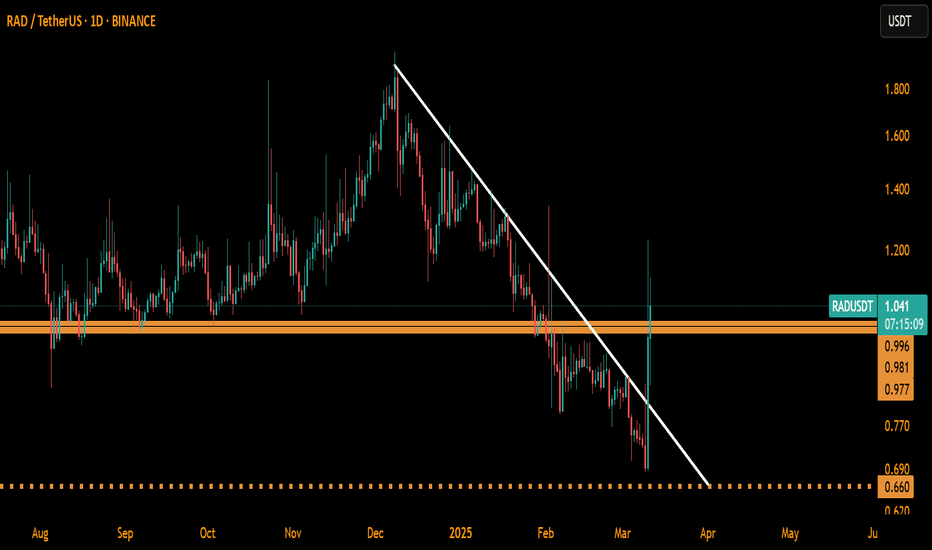

RADUSDT: %220 Daily Volume Spike – The Smartest Entry Revealed!RADUSDT is seeing a massive %220 daily volume spike , signaling an intense surge of activity. For those looking to capitalize on this momentum, the blue box zone represents the most rational and carefully chosen entry point.

Why This Matters:

The Blue Box Advantage: This zone has been meticulously selected using advanced tools like volume footprint, volume profile, cumulative delta volume (CDV), and liquidity heatmaps . It’s designed to pinpoint where buyers are likely to step in.

Confirmation Is Key: I will validate trades in the blue box using CDV, liquidity heatmaps, volume profiles, volume footprints (ensuring buyer presence), and upward market structure breaks in lower time frames .

Risk Management: While the opportunity is huge, the market still demands caution. Always maintain strict risk management rules.

Why Boost and Comment?

Your engagement motivates me to keep sharing such precise and actionable insights. If you find this analysis helpful, please don’t forget to boost and comment ! Let’s win together.

Want to Learn the Process?

I’m happy to teach anyone for free! DM me to learn how I use CDV, liquidity heatmaps, volume profiles, and volume footprints to find these high-probability zones.

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis (the list is long but I think it's kinda good : )

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

RAD Pump to 2.4XX $ is about to happen after break 1.8XX $ Area Radicle (RAD) has recently experienced a significant price surge, but it's important to be cautious about its future direction.

Key Technical Analysis:

* Fakeout: to 2.4XX is more likely to happen

* Potential Correction: A deeper correction towards the $1.6 or $1.5 support levels is possible.

Remember:

* Do Your Own Research: Always conduct thorough research before making any investment decisions.

* Risk Management: Use stop-loss orders to protect your investments from potential losses.

* Diversification: Spread your investments across different assets to reduce risk.

Stay tuned for more updates on Radicle and other cryptocurrencies!

Disclaimer: This is not financial advice. Please do your own research before making any investment decisions.

TRY TO HAVE AN ADVENTAGE FROM FAKEOUT PUMPS AND TRADE THE RANGE UNTIL IT BREAKS

#RAD #Next 7X Gem on Spot! 06/12/2024💎 Next 7X Gem on Spot! 💎

Get ready, traders! We have multiple confirmations for a breakout alert based on the 4D Chart! 🚀

🔥 Key Indicators:

- Falling Wedge Breakout

- Three-Ball Bottom

- Very close to breaking the triangle and rectangle patterns!

⏰ Current Price: $1.72

🎯 Targets: $2.70 | $4.50 | $6.63 | $8.20 | $9.70 | $11.00 | $12.50

❌ Invalidation Level: If the 4D candle closes below $1.09

Stay alert and happy trading! 💰✨

#Trading #Crypto #Breakout #Investing #SRFXGlobal

RADICLE - Getting Ready Now (+Targets)Hello ! We can see other coins running nicely like AMPera Token.

AMP also had a similar signal on this time frame. Even thought i did not review it ...

However.. there is a whole list of coins giving signals these days.

TARGET 2.52

Trade Safely !🍀🍀🍀

If you need targets with your coins

just leave a comment bellow

RAD to FLIP 1.3 to Support Will open Doors to 1.8Radicle (RAD) has recently experienced a significant price surge, but it's important to be cautious about its future direction.

Key Technical Analysis:

* Fakeout: The recent pump above the $1.53 level could be considered a fakeout, as the price has since retraced to the $1.3 support level.

* Potential Correction: A deeper correction towards the $1.20 or $1.00 support levels is possible.

Remember:

* Do Your Own Research: Always conduct thorough research before making any investment decisions.

* Risk Management: Use stop-loss orders to protect your investments from potential losses.

* Diversification: Spread your investments across different assets to reduce risk.

Stay tuned for more updates on Radicle and other cryptocurrencies!

Disclaimer: This is not financial advice. Please do your own research before making any investment decisions.

TRY TO HAVE AN ADVENTAGE FROM FAKEOUT PUMPS AND TRADE THE RANGE UNTIL IT BREAKS

RAD/USDT: Eyeing a Potential Breakout Above Trendline Resistance RAD/USDT: Eyeing a Potential Breakout Above Trendline Resistance

RAD/USDT is showing strong potential for a breakout 🚀 as it approaches a key trendline resistance on the chart 📉➡️📈. The price action is consolidating within a narrowing range, hinting at a potential explosive move 💥. If a breakout occurs, it could trigger a solid bullish run 📊. Traders should watch closely 👀 for confirmation signals before making any decisions.

Key observations:

1. Trendline resistance: RAD/USDT is testing a well-defined downward trendline. Multiple rejections at this level make it a critical zone to monitor.

2. Volume dynamics: A spike in trading volume during a breakout would confirm strong buyer interest 📈.

3. Bullish momentum: Indicators such as RSI and MACD are currently signaling improving momentum ⚡, which aligns with the potential breakout narrative.

Tips for confirming a breakout:

- Candle close above resistance: Wait for a 4H or daily candle to close convincingly above the trendline resistance 🔑.

- Increased volume: A significant rise in volume during the breakout indicates strong participation by buyers 📊.

- Retest of broken resistance: A retest of the trendline as support post-breakout strengthens the validity of the move 🔄.

- Avoid false breakouts: Monitor for wicks or quick reversals above the resistance, which may indicate a trap ⚠️.

Potential targets (if breakout is successful):

- Immediate resistance:

- Next resistance:

Risk management:

- Always use stop-loss orders to protect your capital 🛡️.

- Position sizing should align with your risk tolerance 🎯.

This analysis is for informational purposes only. It is not financial advice. Always do your own research (DYOR) 🔍 before making any investment decisions.

#RAD (SPOT) entry range ( 1.000- 1.110)T.(2.470) SL(0.990)BINANCE:RADUSDT

entry range ( 1.000- 1.110)

Target (2.470)

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (0.990)

Golden Advices.

**********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

**********************

My total posts

( www.tradingview.com )

1Million Journey

( www.tradingview.com )

( www.tradingview.com )

********************************************************************************************************************** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH # AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT # IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER .

$RAD will fly - Breakout & RetestBroke out of the wedge and retested on the daily.

Same pattern can be seen in other altcoins as well.

Market is bullish, CRYPTOCAP:BTC going to 78K and alts following with strong pump.

After new ATH i expect for CRYPTOCAP:BTC.D to calm down and fall below 60% , at this point with bitcoin approaching and breaking ATH we want a strong dominance.

US elections pump is here and either you're locked or missed it .

Radworks Perfect Chart Setup For Sudden/Fast GrowthThis is it. If you are looking for a pair/chart that is about to produce a strong jump, suddenly, this is it.

The rounded bottom already proved twice to be a strong reversal signal on this pair. In this instance, we are looking at the third one in a row. It is the lowest one and the biggest one... We are looking at Radworks (RADUSDT).

There was a major low in November 2022. Another one in October 2023. RADUSDT moved below these levels and is now trading back above them. This trading above is ultra-bullish and opens the doors for a massive bullish wave.

We are talking about a short-term bullish breakout, fast, but the overall growth can happen long-term. The bottom will be something of the past. So it can move fast at first and then continue growing long-term based on an uptrend. This is what the chart is currently saying.

Looks good. We will now let the market take care of the rest.

Thank you for reading.

Namaste.

RADUSDT - UniverseMetta - Analysis#RADUSDT - UniverseMetta - Analysis

Update of the previous forecast..

On D1, the price consolidated above the upper border of the narrowing channel, which may be a signal for long-term purchases, with targets for updating 3.58. It is clear that the price tried to return to the channel, but found support there at 0.97. Further, consolidation is visible at these values and the formation of a triangular formation with a breakout of the trend line. Now a potential retest of this level may be realized, which may lead to a continued increase in volumes for purchase.

Target: 1.34 - 3.58

Rad / Usdt BINANCE:RADUSDT

### Current Price and Support Level

- **Current Price: $1.015**

- You’re noting that the price of Rad is currently $1.015.

- In technical analysis, a "support level" is a price point where an asset tends to stop falling and may even bounce back up. It’s considered a level where buying interest is strong enough to overcome selling pressure.

- **Support Area**

- The term "support area" suggests that $1.015 is a price level where buyers have historically been active enough to prevent the price from dropping further. If the price holds at or above this level, it might indicate that the support is strong.

### Potential for Price Movement

- **If the Price Holds at Support:**

- If the price of Rad can stay at or above the $1.015 support level, it might indicate that this support is holding strong. In this scenario, traders often look to identify the next levels where the price might face resistance as it moves upwards.

### Resistance Zones

- **Next Resistance Zones: $1.164 and $1.345**

- Resistance levels are price points where selling interest tends to increase, potentially preventing the price from rising further. These are levels where the price has previously struggled to move beyond or where selling pressure has historically increased.

- You’re predicting that if Rad holds the $1.015 support, it could next face resistance at $1.164 and possibly at $1.345. These are the price levels where the price might experience difficulty moving higher and might encounter selling pressure.

### Summary

- **Support Level**: $1.015 is seen as a crucial level where the price might stop falling and potentially start rising.

- **Resistance Zones**: If the price maintains above the support level, the next significant resistance levels you’re watching are $1.164 and $1.345. These are potential points where the price might struggle to advance further.

### Important Notes

- **Not Financial Advice**: It’s important to remember that this is a general analysis and not financial advice. Many factors can influence price movements, including market sentiment, news, and broader economic conditions.

- **Do Your Own Research**: Always do your own research and consider consulting with financial professionals before making any trading or investment decisions.

RADUSDT - UniverseMetta - Analysis#RADUSDT - UniverseMetta - Analysis

On D1, the price consolidated above the upper border of the narrowing channel, which may be a signal for long-term purchases, with targets for updating 3.58. It is worth being careful if an ABC or 3-wave structure is formed in the opposite direction, the price may make a false breakout and once again update the minimum or return to the channel and continue to decline.

Target: 1.45 - 3.58

#RAD/USDT#RAD

The price is moving in a descending channel on the 12-hour frame and is sticking to it very well and is expected to break it upwards

We have a bounce from a major support area in green at .9400

We have an uptrend on the RSI indicator that was broken upwards which supports the rise

We have a trend to stabilize above the 100 moving average which supports the rise

Entry price 1.18

First target 1.40

Second target 1.70

Third target 1.95