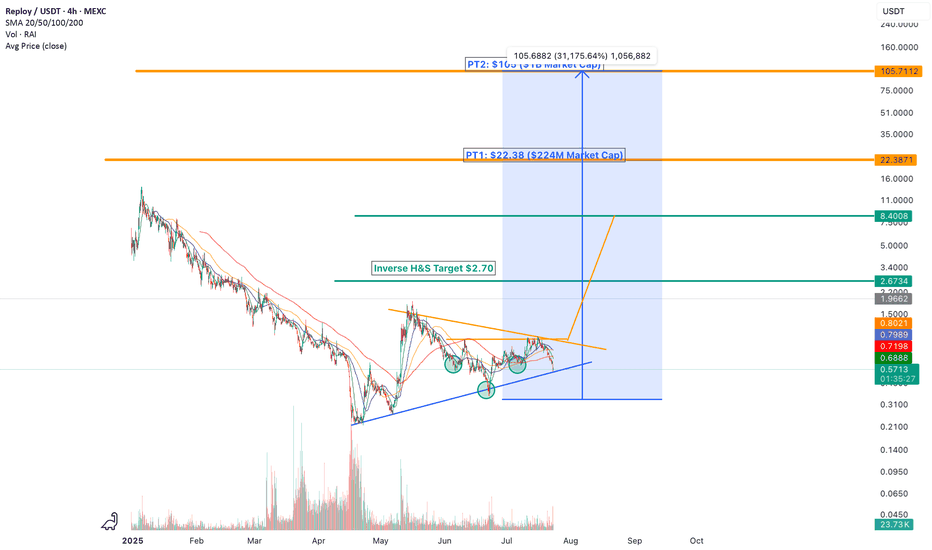

RAI Breakout Imminent: Bullish Wedge + AI Tailwinds = 8x Setup🚨 RAI Breakout Imminent: Bullish Wedge + AI Tailwinds = 8x Setup Into August 🚨

Reploy AI ($RAI) is coiling like a spring inside one of the cleanest bullish wedge formations we’ve seen this cycle — and it’s about to detonate.

📈 Current Price: $0.57

🎯 Short-Term Target: $8.40

💥 Potential Upside: +1,372% (8x)

📅 Timing Window: Early–Mid August 2025

📊 Pattern: Inverse Head & Shoulders + Bullish Wedge Breakout

📦 Catalyst: SaaS product releases this quarter

🧠 Why Reploy AI?

Reploy AI isn’t just another AI hype coin — it’s shipping real products. According to the latest roadmap, multiple SaaS applications are scheduled to go live this quarter, directly tapping into the exploding AI tooling demand. This isn’t speculative fluff — it’s a low float, low cap, high output AI infrastructure play.

🔥 Technical Setup: Textbook Bullish Wedge

The chart shows a tight multi-month wedge with a confirmed inverse head & shoulders pattern underneath. This is classic accumulation before vertical expansion. The breakout projection targets:

✅ $2.70: Initial iH&S target

✅ $8.40: Mid-term breakout target (market structure + fib extension)

After that? It’s clear skies toward $22+ and beyond (as previously mapped to $105 in the parabolic scenario).

🌊 Altcoin Market Context

With ETH dominance pulling back, and altcoins gaining strength as ETH/BTC consolidates, we’re entering a prime altseason rotation window. Low-cap AI tokens like $RAI — especially those with real utility — are set to outperform massively.

Combine that with the bull steepening macro backdrop (liquidity rushing into risk), and this becomes a perfect convex trade: defined downside, exponential upside.

🧠 TL;DR: The Most Asymmetric Trade in AI Right Now

🔒 Tight technical structure, primed to break

🚀 Explosive short-term upside (8x)

🧠 Real-world SaaS utility hitting market soon

📉 Still under $0.60 — before the crowd arrives

📌 Not financial advice — but if you missed Render, if you missed Fetch, if you missed Bittensor — this is your whisper before the roar.

RAI to $8.40 is just the beginning.

RAIUSDT trade ideas

Reploy AI ($RAI) Daily Chart: Inverse H&S PT $2.70Reploy AI ($RAI) Daily Chart: Inverse Head & Shoulders Breakout Signals Bullish Continuation

The daily chart for Reploy AI ($RAI) is flashing a textbook bullish reversal pattern: an Inverse Head & Shoulders, signaling a potential trend reversal after a prolonged downtrend. This formation, identified by three distinct troughs (a lower low flanked by two higher lows), has now completed its right shoulder and is pushing against neckline resistance.

🔹 Inverse Head & Shoulders Target: $2.70

The neckline has been tested multiple times, and volume has steadily increased—both signs of growing bullish conviction. A confirmed breakout above the neckline projects a measured move to $2.70, representing a potential 3x move from current levels (~$0.87). This is the first key target, marking the start of a potentially explosive rally.

🟠 Mid-Term and Cycle Top Targets

Beyond the $2.70 level, the chart maps out several macro targets aligned with previous structural support, Fibonacci extensions, and estimated market cap milestones.

🔸 PT1: $22.38 — ~$224M Market Cap

Why it matters: This level reflects a realistic mid-cycle valuation if Reploy AI continues gaining adoption as a core AI infrastructure asset.

Context: At $22.38, $RAI would still be under a $250M FDV—well below other AI tokens trading at similar narratives.

Technical note: This zone aligns with historical price congestion during the previous distribution top and acts as the next strong resistance.

🔸 PT2: $105 — ~$1.1B Market Cap

Why it matters: This is where the parabola starts steepening. A $1B market cap is the threshold where institutional players and VC funds begin re-rating upside in real terms.

Narrative momentum: By this stage, AI-driven protocol layers could see broad media attention, and $RAI's positioning as a decentralized inference engine may become central to the AI x crypto thesis.

🔸 Bull Market Top: $1,110 — Moonshot Scenario

Why it matters: While speculative, this level would mirror the kind of exponential blow-off top we’ve seen in prior crypto supercycles (think: Chainlink in 2021, or Solana from $1 to $250).

Valuation basis: A fully diluted market cap over $10B could still be justified if $RAI becomes the de facto compute layer for multiple LLM platforms or AI-native protocols.

Psychological: This price reflects peak euphoria and may act as the terminal blow-off before macro reversal.

🔹 Macro Setup

Volume accumulation near lows is reminiscent of early-stage breakouts in past altcoin cycles.

The chart structure is tight, with higher lows forming a clear ascending triangle—fuel for a squeeze.

Momentum indicators (RSI, MACD) are curling upward from oversold regions, supporting a Q3 breakout thesis.

🔮 Final Thoughts

With AI continuing to dominate both traditional and crypto narratives, Reploy AI ($RAI) is well-positioned as a deep-tech infrastructure play. The inverse head and shoulders breakout to $2.70 is just the ignition point. If confirmed, it sets the stage for a stair-step rally into the $20–$100+ range as the 2025 bull cycle matures.

As always, confirm breakouts with volume and protect capital with smart position sizing.

The Yield Curve Just Turned Bullish, So Did $RAI’s Future🚀 The Yield Curve Just Turned Bullish — So Did $RAI’s Future

Why This AI Token Could Be the Biggest Beneficiary of the Bull Steepening Cycle

"When the curve steepens, capital doesn’t trickle — it floods into risk. And $RAI is perfectly positioned."

📈 Macro Setup: Bull Steepening Means Risk-On

The story starts with rates. Here's the shift:

Where we were: Bear steepening — long-end rates spiked on inflation fears while short-end stayed high. Liquidity was scarce. Risk was punished.

Where we are now: Bull steepening — short-end rates are falling faster than long-end rates rise. This signals reflation and the beginning of a capital rotation into growth and risk.

Historically, this phase fuels massive runs in:

Small caps (Russell 2000)

Narrative-driven tech

Crypto

And especially AI-powered, low-float tokens like $RAI

🤖 Why Reploy AI ($RAI)?

$RAI isn’t just an AI meme coin — it’s an infrastructure layer for decentralized AI inference. With only 10M tokens, it’s one of the most scarce, utility-based plays in Web3 AI.

And now, macro tailwinds + chart setup + capital rotation = asymmetric upside.

🎯 Updated Upside Targets

✅ Mini-Top: $10.61 by July 18

This target aligns with:

The top of the current regression band.

Mid-summer capital rotation.

Historical pre-breakout behavior from 2020/2021 AI-coins like NYSE:FET and $OCEAN.

🧮 From today’s ~$0.69: That’s a 15x move in ~3 weeks.

💥 Blow-Off Top: $114 to $1,012 by Dec 21

This is the big one — and your chart now reflects the most important extension:

A 5-week window from Nov 18 to Dec 21, aligning with prior cycle tops.

Price range between $114 and $1,012.

Implies a market cap of $1.14B to $10.12B (fully diluted) — still modest compared to likely peers if AI mania peaks.

Think BIST:LINK in 2021 or CRYPTOCAP:SOL in late 2020. $RAI has the same structure — now layered with macro rocket fuel.

🧠 Why It Matters

In bull steepening cycles, capital chases asymmetry. The whole framework flips:

Safe → Speculative

Yield → Growth

Real → Narrative

AI + Web3 sits at the intersection of the two hottest macro themes. $RAI is the leading microcap expression of both.

If you're looking to allocate based on macro structure + narrative rotation + price action, this chart is screaming.

📣 Summary for Readers:

We're in the early innings of a reflationary, risk-on regime shift. If the blow-off top hits by December as expected, tokens like $RAI could become the top performers of the entire cycle.

With a $0.69 entry price, the risk-to-reward is wildly asymmetric.

📈 Don’t just follow the trend. Front-run it.

💡 $RAI is where narrative, structure, and scarcity converge.

How Many $RAI Tokens Do You Need to Become a Millionaire?How Many Reploy AI ($RAI) Tokens Do You Need to Become a Millionaire?

If you missed buying Bitcoin at $345 or Ethereum at $7, here’s your second chance.

There’s a little-known AI crypto gem called Reploy AI ($RAI) that’s still flying under the radar. It’s trading at just $0.68 right now. And if this microcap rocket hits its projected target, it could turn a modest investment into life-changing wealth.

Let’s break it down.

💸 The Magic Number: 7,000–7,500 RAI

At today’s price of $0.68, buying 7,000 to 7,500 $RAI tokens will cost you about $4,800 to $5,100.

If $RAI hits its target price of $133–$143 this cycle (which would happen if it reaches a $1 billion market cap), that $5,000 becomes $1,000,000.

Yes — one million dollars from a $5K investment.

This isn’t a fantasy. It’s math:

7,500 RAI × $133 = $997,500

7,000 RAI × $143 = $1,001,000

📊 Why $1 Billion Market Cap Is a Realistic Target

In crypto, $1 billion is not some unreachable fantasy — it’s the threshold for serious projects.

Look at what $1B market cap means for other AI and RWA tokens:

Render ( EURONEXT:RNDR ): >$4 billion

Akash ( CSEMA:AKT ): ~$1.5 billion

Ethena ( MIL:ENA ): >$1.3 billion (after just weeks)

Reploy AI’s model — decentralized compute + AI tooling — is at the intersection of two of the most explosive trends in tech. It’s a matter of time before this market catches on.

🧠 Why Buying Early Matters

Here’s the truth: most people will wait until $RAI is already $10, $50, or $100 before they even consider it. But by then? The life-changing gains will already be in the past.

If you’re reading this now, you’re early. And that’s everything.

🔐 Key Takeaways

$RAI Price Today: ~$0.68

Target to Become a Millionaire: 7,000–7,500 tokens

Cost Today: ~$5,000

Potential Return: $1 million if $RAI hits $133–$143

Projected Market Cap Needed: ~$1B (very realistic in this AI cycle)

🚀 Final Word

It only takes one right bet per cycle to change everything.

Reploy AI could be that bet.

You don’t need to go all-in. You don’t need to time it perfectly. You just need to be early, and size your conviction wisely.

The future is AI. The rails will be decentralized. And $RAI might just be the network powering it all.

⏳ Time is ticking. Are you in?

Disclaimer: This is not financial advice. Crypto is volatile. Always do your own research and never invest more than you can afford to lose.

Buying Reploy AI (RAI) Today Is Like Buying Bitcoin at $345Buying Reploy AI (RAI) Today Is Like Buying Bitcoin at $345—Or Even $3.45

Imagine going back in time to 2016 and buying Bitcoin at $345. Most people didn’t believe in it. They thought it was too risky, too early, or just plain irrelevant. Today, Bitcoin is trading in the six figures. The opportunity was historic.

Now, there’s another chance brewing—and it’s quietly sitting in front of us.

That opportunity is Reploy AI ($RAI).

🚀 What is Reploy AI?

Reploy AI is a micro-cap artificial intelligence (AI) project focused on decentralizing the compute layer that powers AI training and inference. It’s building a distributed AI network that connects GPU resources with developers and businesses in need of scalable AI infrastructure. Think of it as the decentralized AWS + OpenAI — built from the ground up for speed, accessibility, and equity.

It’s early. But the fundamentals, vision, and market positioning are explosive.

💰 Let’s Talk Numbers: The Bitcoin Comparison

Right now, Reploy AI ($RAI) trades at a tiny market cap—roughly $3 million at the time of writing.

If $RAI hits a $1 billion market cap, that’s a 31,000% return.

Yes, 31,000% — not a typo. That’s a 310x gain.

That would be like buying Bitcoin at $345, before it ran to over $100,000.

If $RAI grows into a $10 billion AI ecosystem, it would be like snagging Bitcoin at just $3.45.

Let that sink in.

🌐 Why This Could Actually Happen

AI Is the Next Internet

The world is undergoing an AI revolution. But centralized giants (like OpenAI and Google) dominate access. Reploy offers a decentralized, censorship-resistant alternative — and the market desperately needs it.

Micro Cap = Maximum Asymmetry

Unlike hyped-up billion-dollar AI tokens, Reploy is still undiscovered. Small caps like this can explode with just one partnership, listing, or viral catalyst.

Strong Tokenomics & Ecosystem Design

RAI has a deflationary supply structure, utility-driven demand, and real infrastructure use cases tied to decentralized compute, developer tooling, and enterprise deployment.

It’s Not Just Hype. It’s Being Built.

Reploy isn’t vaporware. The team is shipping code. The platform is live. And the network of compute contributors is growing.

⚠️ Of Course, This Is Risky

Yes, it’s still early. Yes, micro-cap tokens carry real risk. But so did Bitcoin when it was $345. So did Ethereum when it was $7.

The difference is this: most people only see opportunity when it’s already gone.

This isn’t financial advice. But if you’ve ever wished for a second shot at catching a generational trend early—this might be it.

🧠 Final Thought

In crypto, the biggest returns come from spotting the future before it’s obvious.

Buying $RAI at today’s price could be your version of buying CRYPTOCAP:BTC at $345—or even $3.45. The only question is: will you see it in time?

📈 DYOR. Stay sharp. Think long-term. And don’t miss what might be the next breakout in AI + crypto.

RAI Golden Cross 50 crosses 100 day SMARAI Just Flashed a Golden Cross: Why This Microcap AI Token Could Be Poised for a Massive Breakout

If you’ve been sleeping on Reploy AI ($RAI), now might be your last chance before it enters price discovery.

This week, RAI printed a textbook golden cross, with the 50-day simple moving average (SMA) crossing above the 100-day SMA—a classic technical signal that often precedes explosive upward momentum.

🔍 What’s a Golden Cross?

For the uninitiated, a golden cross is a highly bullish chart pattern that occurs when a shorter-term moving average crosses above a longer-term moving average. In this case, the 50-day SMA just overtook the 100-day SMA, confirming a shift in long-term trend direction from bearish to bullish.

Historically, golden crosses on small-cap tokens like RAI have preceded major rallies—often signaling a new uptrend backed by growing investor confidence and increasing volume.

📈 RAI’s Technical Setup Screams Asymmetry

Golden Cross confirmed: 50-day SMA has crossed above the 100-day SMA

Higher lows + RSI strengthening: Hidden bullish divergence was already flashing on the daily

Breakout zone overhead: A move above recent resistance could trigger a parabolic move

Microcap advantage: With a current market cap still under $4 million, the upside is enormous

🧠 Why RAI Is More Than Just a Chart Play

RAI isn’t just another low-float pump. It’s a real AI infrastructure play, powering next-gen language models and tooling in the decentralized stack.

In a world where AI and blockchain are converging, Reploy AI is building the pipes, and early adopters know the next OpenAI won’t be centralized.

DePIN (Decentralized Physical Infrastructure) meets AI execution layer

RAI is creator-owned, open, and permissionless

Momentum is growing in both community and dev activity

🎯 Price Targets Based on Prior Golden Crosses

If history is any guide, golden crosses on microcap AI tokens often lead to 5–10x returns in the following months. For RAI, that means:

Base Case: $0.21–0.40 ($20M–$40M market cap)

Upside Case: $0.65+ ($60M+ market cap, still microcap territory)

With the AI narrative heating up again and microcaps starting to rotate, RAI could be next in line to explode.

⚠️ Final Thoughts: Get In Before the Herd

Golden crosses don’t flash often, and when they do—especially on fundamentally promising microcaps like RAI—they can be once-in-a-cycle signals. The technicals have aligned, and the fundamentals are quietly gaining momentum.

This is your warning shot. RAI is golden-crossing into a new era.

Not financial advice. Do your own research. But if you're reading this, you're early.

🟡🚀

Reploy AI ($RAI): The Microcap AI Gem with 310x PotentialWhile the market chases overbought giants like Nvidia and high-FDV AI tokens, Reploy AI ($RAI) is quietly building what could become one of the most asymmetric trades of the entire cycle. With a current price near $0.65 and a projected upside to $105 (a conservative $1B market cap), we’re looking at a potential 310x+ return from today’s levels.

Yes, 310x. And here’s why that’s not just hopium — but based on real narrative fit, technical structure, and market cap mechanics.

🧠 What is Reploy AI?

Reploy is building the connective tissue for decentralized AI services — think:

Agent-driven infrastructure

AI-as-a-Service marketplaces

Tools for developers to launch, train, and monetize AI models across Web3 rails

Whereas most “AI coins” just slap on buzzwords, Reploy is going after the actual AI developer stack — composable tools that plug into real-world workflows, just like what OpenAI, Langchain, and Hugging Face are doing — but decentralized and token-incentivized.

📉 The Chart: Silent Accumulation Ending Soon?

Let’s break it down:

Current price: $0.648

PT1: $22.38 → 758% gain (~8.6x)

PT2: $105.68 → +31,175% (~310x)

RSI hovering near neutral (44–49) — signaling a coiled spring

Price compressed near lows after the launch hype — potential for massive reaccumulation breakout

This isn’t just a moonshot — it’s a setup eerily similar to early moves from TAO, RNDR, or even MATIC in 2020.

📊 Market Cap Math That Makes This Work

At $0.65, RAI is trading at a tiny microcap valuation — sub-$5M fully diluted (depending on supply disclosures). That means:

$50M = 10x

$100M = 20x

$1B = 200–310x, depending on circulating supply

With AI narratives dominating VC, crypto, and big tech headlines — a true AI infrastructure token with composable tools could easily hit a $500M–$1B cap if properly positioned.

And remember: most AI infra companies in TradFi have valuations north of $2B without a token model or flywheel.

🔥 Why This Isn’t Just a Narrative Pump

This is why $RAI isn’t just “another AI token”:

✅ 1. Low float, clean chart

It’s not overbought like TAO or RNDR. The consolidation range is primed for breakout if volume returns.

✅ 2. Actual product direction

Reploy is shipping dev-first tools — not just speculation, but infrastructure (think LangChain meets Web3).

✅ 3. Narrative megastack

AI 🧠

Agent economies 🤖

Decentralized infra ⚙️

Microcap parabolic setups 🚀

🏁 Final Word

We’re entering a phase where AI and crypto are finally converging with purpose — and while everyone’s watching TAO near a $3B cap, Reploy AI sits quietly under $5M, waiting for the spark.

If you’re looking for hyper-convex exposure to the AI + Web3 thesis, Reploy AI ($RAI) offers one of the cleanest, most asymmetric entries in the entire market right now.

The best trades are obvious in hindsight. This one’s obvious right now — if you’re paying attention.

Disclosure: Not financial advice. Do your own due diligence. But in terms of pure upside potential with real product direction? $RAI might just be the next TAO — at 1/600th the price.

RAI - Hidden Bullish Divergence - 8.5x Short-Term TargetRAI, the native token powering Reploy AI’s decentralized inference network, is quietly setting up for what could be one of the strongest short-term moves in the altcoin space. A hidden bullish divergence is flashing on the daily chart, signaling that smart money may already be positioning for a breakout — with technicals and fundamentals aligning for a potential 8.5x upside.

🔍 Technical Setup: Hidden Bullish Divergence in Play

A hidden bullish divergence occurs when price prints a higher low, while the RSI (Relative Strength Index) makes a lower low — a subtle but powerful signal that an existing uptrend is preparing to resume with force.

That’s exactly what’s happening on RAI’s daily chart:

Price Action: RAI has printed a higher low vs. prior corrections, maintaining its bullish structure and showing resilience even in a choppy market.

RSI Signal: Meanwhile, the daily RSI has dropped lower than its previous trough, suggesting temporary momentum weakness that isn’t confirmed by price itself.

Implication: This divergence often signals bullish continuation and typically resolves with a sharp move upward, catching lagging traders off guard.

📈 Why 8.5x? The Technical Case

RAI’s consolidation has formed a large base, and hidden bullish divergence often marks the final fakeout before explosive expansion. If the price reclaims key horizontal resistance levels with volume, a measured move projection from the current range puts the target in the 8.5x zone from current levels.

Key confluences:

Major resistance above has thin liquidity, meaning breakouts can be fast.

RSI reset allows for a full expansion cycle without being overbought.

Past altcoin breakout patterns in similar setups (especially low float, AI-adjacent tokens) have delivered 5–10x moves once structure resolves bullishly.

🧠 Fundamentals Still Underpriced

RAI isn’t just a technical play — it’s backed by one of the few projects building decentralized inference infrastructure, positioning it at the intersection of AI x Crypto, arguably the two most explosive megatrends of this decade.

AI infrastructure tailwind: As demand for decentralized GPU compute rises, RAI’s role as a native coordination token becomes more mission-critical.

Undervalued vs. peers: RAI’s market cap still lags similar tokens by 5–20x — making the 8.5x target not only plausible, but arguably conservative if the project continues hitting milestones.

🧠 Bottom Line: Hidden Strength Before Open Momentum

The market often gives quiet signals before loud moves — and the hidden bullish divergence on RAI may be that signal. With a clean technical setup, explosive narrative tailwinds, and breakout potential that could shift sentiment fast, RAI may be entering its pre-expansion phase.

Smart money watches divergence. Retail chases candles. Which side are you on?

🧭 Target: 8.5x

📆 Timeframe: Short-term (4–8 weeks)

📊 Setup: Daily hidden bullish divergence + structural higher low

🔓 Unlock zone: Reclaim of next resistance on volume confirms breakout

RAI next PT $2.83 1.618 FibAfter the recent war in Israel/Iran and the new truce agreement, the bottom is in. Alt-season is beginning.

Expect RAI to be one of the leaders in the AI / Web3 Space.

Bitcoin historically has a flat or slightly negative June on average the past 12 years.

July however has had strong gains 8 out of the last 12 years. Expect this July to continue past trends and to be even stronger given this is a post-halving July.

Reploy AI 2025 Bull Run ATH $115 or 115xReploy AI: The $115 Dark Horse of the 2025 Bull Run

In a market where every protocol is screaming “AI” to catch a pump, Reploy AI is quietly building — and that’s exactly why it might become the most explosive play of the 2025 cycle.

Trading at just $1.00 today, Reploy doesn’t have the hype machine of a Bittensor or the brand name of a SingularityNET. But under the surface, it’s packing the kind of real utility, protocol design, and asymmetric upside that could catapult it 115x to $115 per token by the time this bull run hits its euphoric blow-off top.

Here’s why Reploy might just be the most undervalued LLM infrastructure layer in crypto today.

Built in America And That Matters Now

Unlike many crypto projects hiding behind offshore foundations, Reploy AI is a U.S.-registered LLC based in Florida and that positioning could soon matter a lot.

With President Trump making it clear that he plans to reward U.S.-based tech and AI firms, Reploy stands to benefit from potential tax incentives, domestic investment subsidies, and clearer regulatory treatment. In a world where location suddenly matters again, Reploy’s domestic foundation could act as both de-risking and upside leverage.

This isn't just optics, it’s strategic positioning.

The Real AI Stack, Not Just a Buzzword

Most "AI tokens" are glorified UI wrappers for ChatGPT or vague ideas hunting a pump. Reploy is different.

Reploy is building decentralized, containerized compute infrastructure for AI, enabling LLM inference, training, and deployment across GPU node operators. Think permissionless SageMaker, but with crypto incentives and open access baked in.

Devs can launch models via CLI in seconds, deploy inference endpoints, manage GPU billing, and soon verify results onchain with zero-knowledge proofs of compute.

That’s not hype. That’s protocol-level innovation.

Tokenomics Set for a Squeeze

The RAI token underpins usage payments, node incentives, and governance. With a tiny circulating supply, usage-based demand, and future staking/burn mechanics, the token’s fundamentals are gearing up for a massive supply shock, just as the AI narrative reaches escape velocity.

The structure rewards real protocol use, not speculation. And that’s how long-term upside is built.

Market Positioning: TAO’s Smarter Cousin?

If Bittensor (TAO) is building the “Neural Internet,” then Reploy is its grounded, containerized cousin, less idealism, more compute. While TAO runs at $6B+ fully diluted, Reploy is sub-$10M FDV, a textbook asymmetry play for crypto-native AI infra exposure.

The 115x Case And Then Some

Let’s break it down:

Current Price: $1.00

Target Price (Blow-Off Top): $115

Return: 115x

Market Cap at $115: ~$1 billion

That’s still modest in today’s market.

Now let’s take it further:

If Reploy captures even a sliver of the decentralized AI compute market and reaches a $5–10 billion valuation, the token price would range from $500 to $1,000. That’s not hopium, it’s math. And in a cycle where meme coins with no utility are pushing $10B+ FDVs, Reploy has a real claim to that throne.

Bittensor, Meet Your Competition

If Bittensor (TAO) is building a neural mesh, Reploy is laying the infrastructure rails for developers. TAO may have the lead in community buzz, but Reploy has the edge in developer accessibility, transparent governance, and domestic regulatory clarity.

At sub-$10M FDV today, Reploy is what TAO was 18 months ago and it’s arguably better positioned.

Final Thoughts

Every bull market has its stealth parabolas, the coins no one was watching at $1, but everyone’s talking about at $100. Reploy AI has the ingredients to be one of them: real devs, real infrastructure, token utility, and a niche that’s screaming to be filled.

If you're looking for AI infra with teeth, this may be your best asymmetric bet of 2025.

Reploy (RAI) – Web3 x AI Revenue-Earning Project with 61x UpsideReploy (RAI) is a rapidly emerging project at the intersection of Web3 and artificial intelligence, designed to streamline how developers build, deploy, and monetize AI agents across blockchains. Unlike many speculative tokens, Reploy stands out for one critical reason: it already earns real revenue.

According to Reploy.ai, the platform offers a no-code/low-code experience that allows anyone to launch custom AI agents and integrate them into DeFi protocols, gaming environments, and decentralized applications. Their architecture combines an on-chain identity layer with decentralized agent hosting, positioning RAI as core infrastructure for the next evolution of intelligent Web3 tools.

The project is still under the radar, trading well below $2, but the fundamentals support a much larger valuation. My 12–18 month price target is $105, which represents a 61x increase from today’s levels. This forecast is based on:

Early revenue traction from agent deployment and API integrations

Strong market tailwinds for decentralized AI applications

Platform stickiness due to unique agent monetization tools and developer incentives

Token utility driving recurring demand (staking, gas, and access control)

RAI isn’t just another AI narrative coin, it's building real infrastructure, already being used, and gaining traction. As adoption grows and more AI agents are hosted through the protocol, the value capture for RAI token holders could be exponential.

Price Target: $105

Current Price: ~$1.72 (as of May 2025)

Upside Potential: +6,000%

RAI/USDT Market UpdateWelcome to today's analysis! Let’s break down the current price action on LSE:RAI and potential trade setups.

🌐 Overview: LSE:RAI Testing Key Resistance

📈 LSE:RAI is currently testing the red resistance zone. If a breakout occurs, the first target is the green line level.

🔄 Current Scenario:

LSE:RAI is at a key resistance level where price action will decide the next move.

If the price reaches the blue zone and breaks out, the bearish structure of lower highs (LH) and lower lows (LL) could be invalidated.

🔑 Key Levels to Watch

🔴 Resistance Zone: Red Zone (Needs breakout for continuation)

🟢 First Target: Green Line (If breakout succeeds)

🔵 Breakout Above Blue Zone: Could confirm the end of the bearish structure (LH and LL)

🛠️ Trade Scenarios

📌 Bullish Scenario (Breakout Above Resistance)

If LSE:RAI breaks and holds above the red resistance zone, it could move toward the green line target.

A further move into the blue zone and a breakout would suggest the bearish structure is broken, confirming a potential shift in trend.

📌 Bearish Scenario (Rejection at Resistance)

If LSE:RAI fails to break out, we could see a pullback or consolidation before another attempt.

📌 Conclusion

LSE:RAI is at a critical resistance zone—a breakout could push the price toward the green target, while a move into the blue zone and breakout could confirm the end of the bearish structure. If the price fails to break out, another retest may be needed.