RENDER Spot Re-add PlanAlready holding Render as my biggest spot bag. Just setting clean limit orders to compound on weakness.

📍 Limit Orders (laddered):

• 3.45 → Daily FVG top (40%)

• 2.95 → Weekly VAL zone (40%)

• 2.55 → Deep HTF discount (20%)

Long term hold. Pure add-on entries.

DISCLAIMER:

I am not providing financial advice or investment signals. This post reflects my personal accumulation strategy and is shared solely for documentation purposes. I'm adding to an existing long-term position based on my own analysis and conviction. Sharing this openly helps me stay accountable and focused on my goals. If you choose to act on any of this, it's entirely at your own risk. Always do your own research and make informed decisions based on your situation.

RENDERUSDT trade ideas

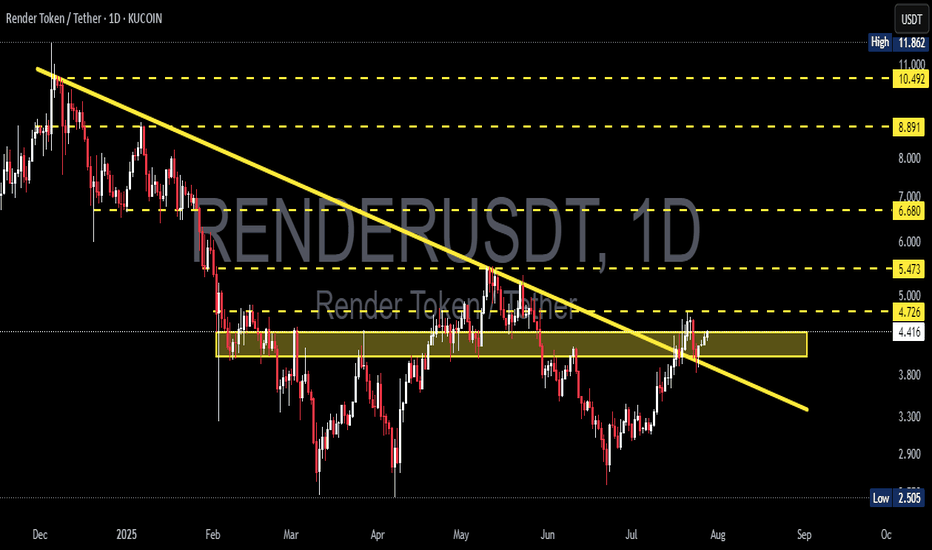

RENDERUSDT Breaks Major Downtrend – Will Bulls Sustain!🧠 Market Context & Structure:

RENDERUSDT is currently presenting one of the most technically compelling setups in recent months. After enduring a prolonged downtrend since late 2024, price action has finally broken above the major descending trendline that has acted as dynamic resistance for over 7 months.

This breakout signals a potential shift in market control from sellers to buyers, marking a critical phase transition from bearish pressure to a possible bullish reversal.

---

📊 Key Technical Levels:

Descending Trendline (Breakout Confirmed): Clean breakout with bullish momentum—first signal of a structural shift.

Major Consolidation Zone (Supply Zone): $4.41 – $4.72

↪ Previously acted as strong resistance; now being tested as potential support reclaim.

Critical Support (Retest Area): $3.80 – $4.00

↪ If the breakout fails, this zone will be the next major defense for the bulls.

Upside Resistance Targets:

⚡ $5.47 – Minor horizontal resistance

🚀 $6.68 – Key resistance from prior swing highs

🧨 $8.89 and $10.49 – Mid-term bullish targets if trend continuation holds

---

🔍 Pattern Analysis:

Descending Trendline Breakout

A textbook reversal pattern, where a successful breakout above the long-term trendline signals a shift in momentum.

Supply Zone Reclaim

Price is now attempting to reclaim a previously rejected supply zone. If successful, it may indicate the beginning of a Wyckoff-style markup phase.

---

🟢 Bullish Scenario (Optimistic Outlook):

Price holds above $4.72, validating the breakout with strength and possibly retesting the area as new support.

A clear continuation may drive the price toward $5.47 and $6.68 in the short to medium term.

Rising volume and strong bullish candlesticks (e.g., marubozu or bullish engulfing) will further confirm momentum.

---

🔴 Bearish Scenario (Caution Required):

If price fails to hold above $4.41 – $4.72 and closes back below the breakout zone:

This would suggest a false breakout (bull trap).

Potential downside toward $4.00 or even $3.50.

Selling pressure could re-emerge, especially if broader market sentiment turns negative.

---

🧠 Market Psychology:

Traders are watching closely to see if this breakout is real or a trap.

This is a decision zone, where early profit-taking clashes with new momentum entries.

A strong close above $4.72 with increasing volume may invite more participation and confirmation of a trend reversal.

---

🧭 Conclusion:

RENDERUSDT is at a critical technical crossroads. The breakout from the long-standing descending trendline is a major bullish signal—but the real test lies in whether bulls can hold and flip resistance into support.

If successful, we could witness the early stages of a mid-term bullish trend, with potential targets reaching up to $10.49 in the coming weeks. However, caution is advised in case of a breakdown back below the key zone.

#RENDERUSDT #RenderToken #CryptoBreakout #TrendReversal #TechnicalAnalysis #BullishBreakout #DescendingTrendline #SupportResistance #CryptoCharts #WyckoffMethod #Altcoins

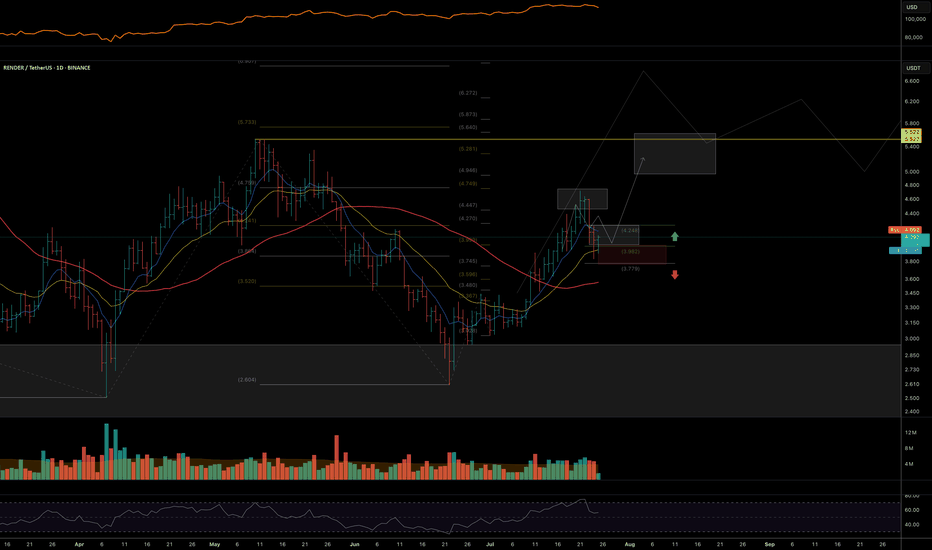

RNDR/USDT at a Critical Turning Point: Golden Pocket as the Key?✨ Overview:

Render Token (RNDR) is currently testing a crucial support zone — the Golden Pocket Fibonacci Retracement between 0.5 (3.616) and 0.618 (3.385). This zone not only represents a significant retracement level but has historically acted as a strong demand area, often serving as a springboard for major price reversals.

---

🧠 Detailed Technical Analysis:

🔸 Support Zone & Golden Pocket

Price has retraced back to the 0.5 – 0.618 Fibonacci zone, a high-probability reversal area.

This zone has acted as a demand base multiple times since February 2025.

How the price reacts here will likely define the next major trend direction.

🔸 Market Structure

The overall structure shows a mid-term downtrend, marked by lower highs and lower lows.

However, the current price action shows slowing bearish momentum, indicating potential hidden accumulation.

A potential double bottom pattern could be forming, hinting at a bullish reversal if confirmed.

---

📈 Bullish Scenario:

1. Strong Rebound from the Golden Pocket

Watch for bullish candlestick patterns (e.g., pin bar, bullish engulfing) near $3.38–$3.61.

Initial resistance levels: $4.16 – $4.72

If broken, mid-term targets could extend to $5.47 – $6.68

2. Double Bottom Confirmation

A confirmed double bottom with a neckline breakout around $4.16 would greatly strengthen bullish momentum.

3. Increased Buying Volume

A spike in volume during the rebound would validate bullish sentiment and potential trend reversal.

---

📉 Bearish Scenario:

1. Breakdown Below the Golden Pocket

If the price breaks below $3.385 with strong volume, we could see a move down toward $2.77, the next significant support.

2. Weak Bounce / Lower High

A failed breakout above $4.16 may indicate a bearish continuation after a temporary relief rally.

---

📌 Summary:

RNDR is currently at a technically sensitive zone. The Golden Pocket between $3.38 and $3.61 is the key area to watch. A strong bullish reaction could signal the start of a trend reversal, while a breakdown could trigger further downside continuation. Traders are advised to wait for clear confirmation via price action before committing to any strong positions.

---

🔖 Key Levels to Watch:

Level Description

3.38 – 3.61 Golden Pocket (Potential Buy Zone)

4.16 Minor Resistance

4.72 Bullish Breakout Trigger

5.47 – 6.68 Mid-Term Reversal Targets

2.77 Strong Support if Breakdown Occurs

---

🧩 Chart Patterns Observed:

Potential Double Bottom – early bullish reversal signal.

Golden Pocket Reaction Setup

Descending Structure – still intact but weakening.

---

🔍 Trade Ideas:

🔄 Wait-and-see approach: Wait for clear bullish confirmation on daily candles.

🎯 Aggressive Long Entry: Around 3.40–3.60 with a tight stop-loss.

⚠️ Short Opportunity: If a strong breakdown below 3.38 occurs with volume confirmation.

#RNDR #RenderToken #RNDRUSDT #CryptoAnalysis #GoldenPocket #FibonacciRetracement #DoubleBottom #PriceAction #SupportResistance #AltcoinSetup #CryptoSignals #TechnicalAnalysis

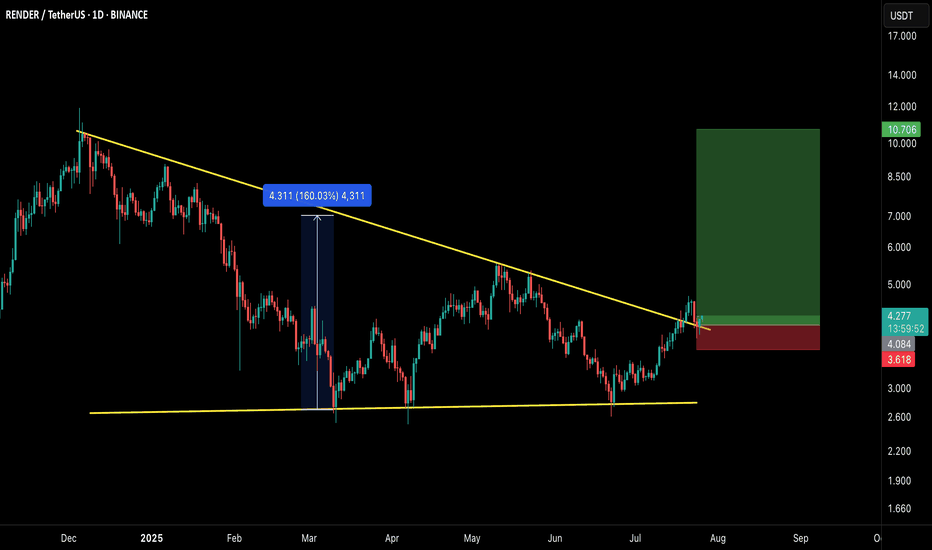

$RNDR/USDT – Breakout Setup Alert!RNDR has officially broken out of the long-standing descending trendline, confirming a bullish reversal structure. This breakout comes after a sustained consolidation phase and successful retest, indicating strength in buyer momentum.

🔍 Technical Breakdown:

Descending triangle breakout confirmed

Previous breakout from similar structure yielded a massive 160% rally

Currently retesting the breakout zone, providing a high R:R long entry opportunity

Clear invalidation point below the recent local support

🟢 LONG Setup:

Entry Zone: $4.00–$4.30

Stop Loss: $3.60 (below breakout retest & structure)

Targets:

TP1: $6.00

TP2: $8.00

TP3: $10.70+ (full breakout projection zone)

🧠 Strategy Insight:

This setup aligns with a broader bullish market structure across multiple altcoins. If momentum continues, this could mirror the prior explosive leg. Always manage risk accordingly.

⚠️ This is not financial advice. DYOR and use proper risk management.

💬 Let me know your thoughts or if you’re riding this wave!

Crypto market review [UPD]: set-ups in BTC and alt-coinsMade a quick video going over some of the setups I see developing in Bitcoin and a few altcoins I personally track and trade.

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re following — feel free to ask in the comments (just don’t forget to boost the idea first 😉).

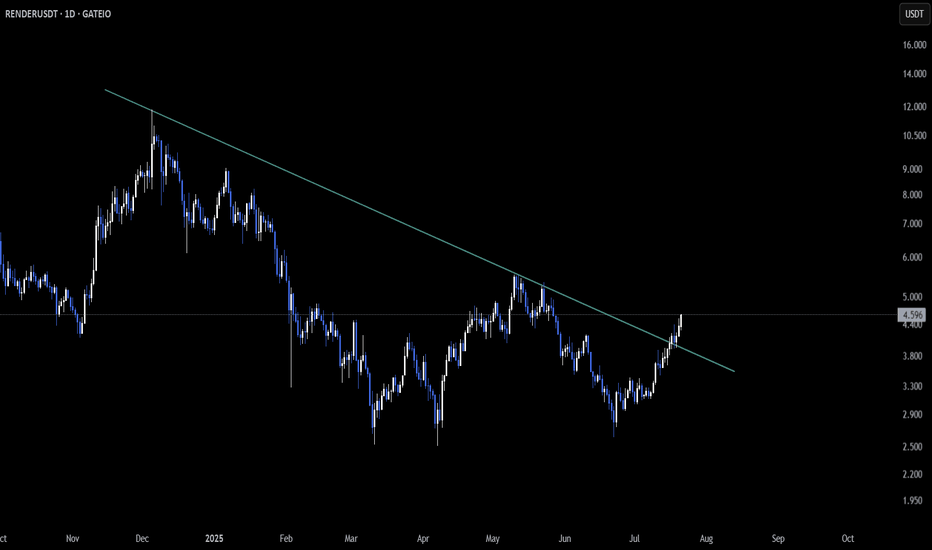

RENDER – Clean Breakout Sets the Stage for Next MoveCRYPTOCAP:RENDER is showing a smooth and confident breakout from the descending trendline on the daily chart 📈. After testing the resistance zone, price is now holding above it—signaling control by the bulls 🟢.

What stands out is the calm, steady pace of this move—no sudden spikes, just consistent momentum building under the surface.

If this rhythm continues, traders might witness a stronger leg upward without the typical volatility whipsaws 🚀.

Stay focused— CRYPTOCAP:RENDER could quietly lead the next breakout wave. 👀

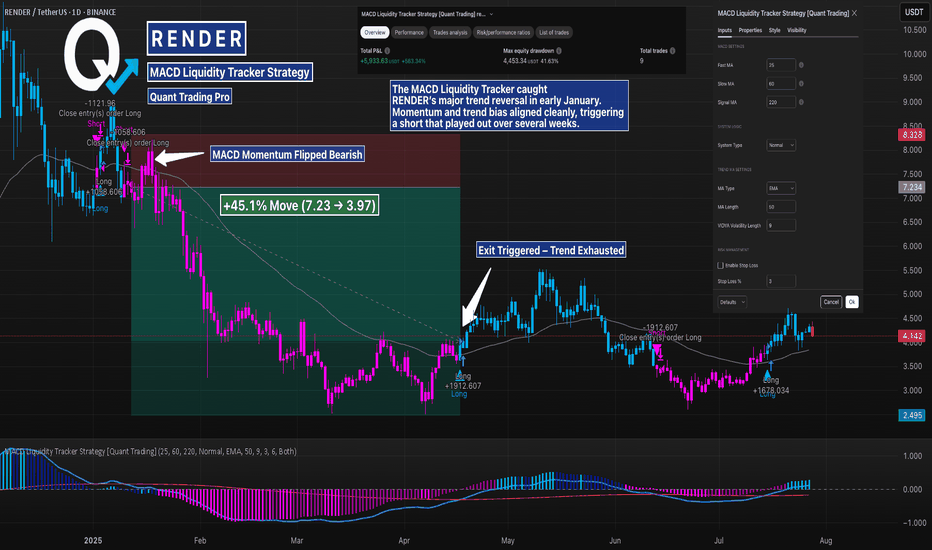

RENDER MACD Liquidity Tracker Strategy – Trend Reversal Catch 1DThis RENDER 1D chart highlights how the MACD Liquidity Tracker Strategy detected a major trend reversal in early 2025. A short was triggered around $7.23, right as MACD momentum flipped bearish and the 60/220 EMAs confirmed downside bias. The position was held until structure and momentum flattened near $3.97, closing out the trade as the downtrend began to exhaust.

What made this setup work:

Bearish MACD confirmation before the breakdown

EMA alignment to confirm trend direction

Strategy stayed with the move through an extended decline

Visual clarity from the pink/blue trend bias kept decision-making simple

This chart is part of our ongoing visual series exploring how momentum + trend filters work across different market conditions. Whether it’s continuation or reversal, structure and signal timing matter.

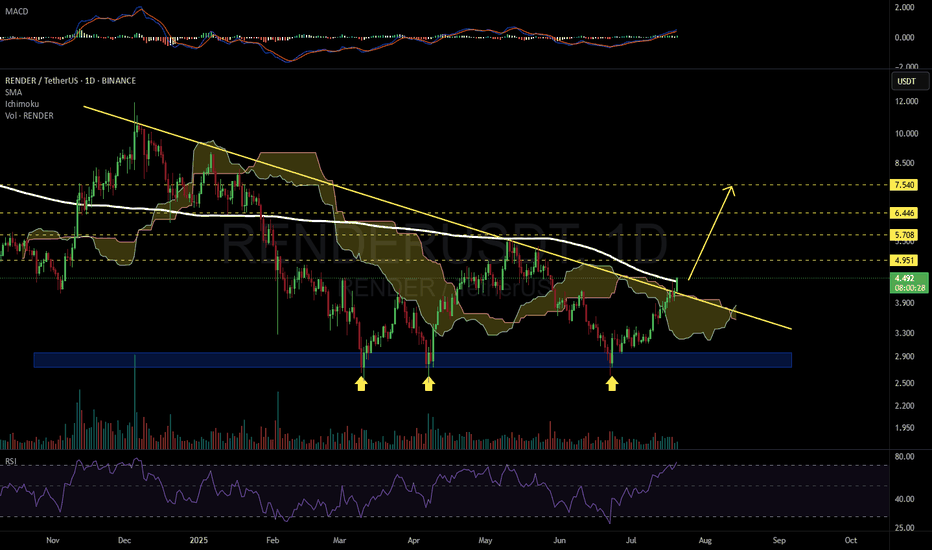

RENDERUSDT 1D#RENDER has broken above the descending trendline and the Ichimoku Cloud on the daily chart. It has also broken above the daily SMA200, though the daily candle has not yet closed. In case of a successful retest of the trendline and confirmation of the breakout above the SMA200, the targets are:

🎯 $4.951

🎯 $5.708

🎯 $6.446

🎯 $7.540

⚠️ Always use a tight stop-loss and practice proper risk management.

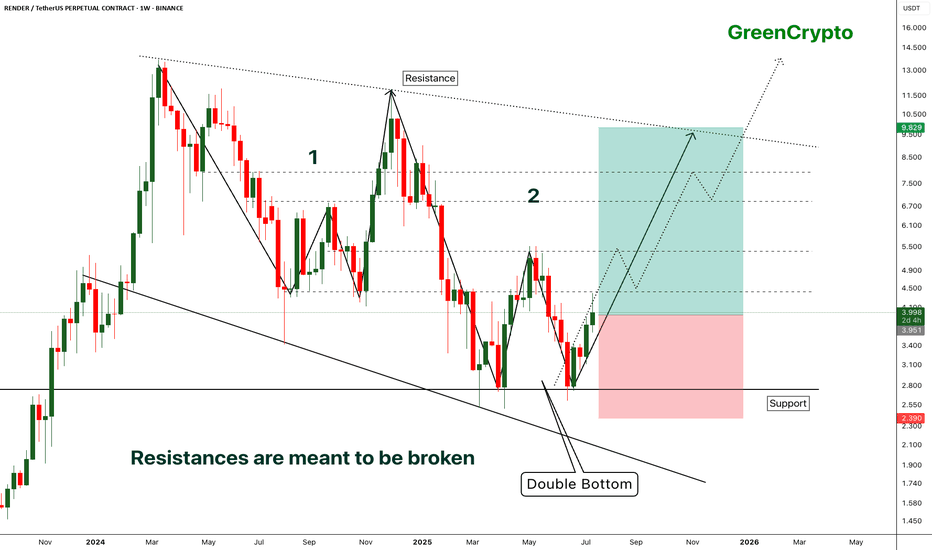

RENDER - [Double bottom] - Resistances are meant to be broken- RENDER has successfully bounced back from the support by forming the double bottom pattern.

- Double bottom pattern is bullish pattern, when it forms at the strong support it becomes extremely bullish. this is one of such scenario.

- Im expecting some minor resistance at the local resistance around 4.3

- A successfull breakout this local resistance will push the price further high.

Entry Price: 3.941

Stop Loss: 2.378

TP1: 4.413

TP2: 5.350

TP3: 6.887

TP4: 8.092

TP5: 9.810

Max Leverage 5x.

Don't forget to keep stoploss.

Support us by Liking and following.

Thanks and Cheers!

GreenCrypto

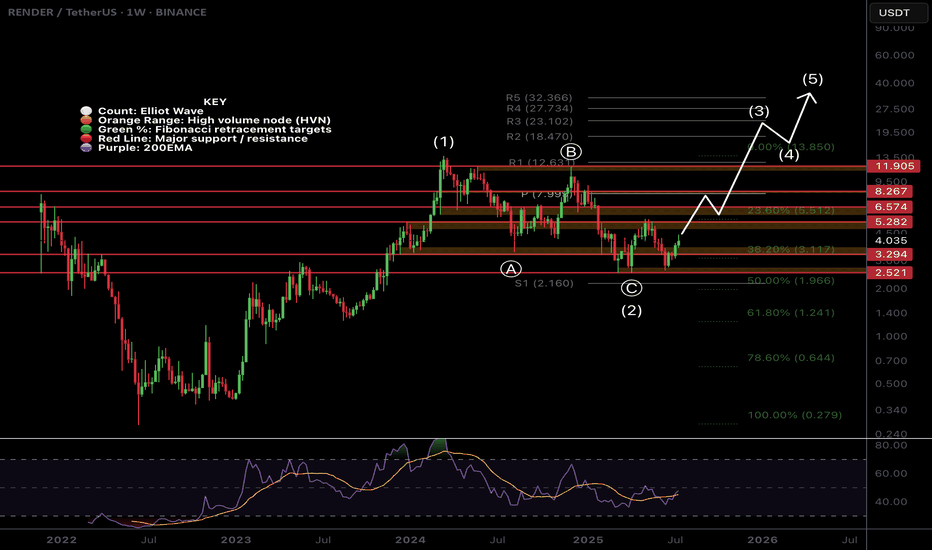

$RENDER Weekly Brings Clarity!CRYPTOCAP:RENDER weekly chart shows long term strength through the depth of the Fibonacci retracement not even reaching 0.5.

The depth of the recent swing low been so close wave (C) does concern me that the larger correction is not yet over and maybe price does want to visit the 'alt-coin' golden pocket of the 0.618-0.768 Fib retracement Where the would be a High Volume Node (not drawn).

For now the upside target is the weekly pivot but the local chart has a lot of work to do first with daily 200EMA!

Safe trading

$RENDER At Major Resistance!CRYPTOCAP:RENDER has been relatively weak. Looking at the local chart it appears we have finished a wave (3) at the daily 200EMA and descending resistance.

Price has overcome the High Volume Node (HVN) support flipped resistance but a strong at coin pull could see fresh lows for Render.

There is also daily bearish divergence on the RSI.

The Elliot Wave count could also be an ABC corrective wave up which has now terminated.

If its a new motif wave and a major bottom has formed , wave 2 should find support at the HVN, daily pivot and 'alt-coin' golden pocket between 0.168 and 0.782 Fibonacci retracement

Safe trading

Is #RENDER Ready for a Reversal or Will it Continue to Fall?Yello, Paradisers! Is this just another range before a full reversal or a sneaky trap waiting to punish early buyers of #RENDER? Let's see the latest analysis of #RENDERUSDT:

💎After several weeks of slowly bleeding within a clean descending channel, #RENDERUSDT is now attempting a breakout from that structure. While the move isn’t confirmed just yet, this is the first real signal that sellers are losing momentum, and a shift could be on the table. Price is currently hovering just above the $3.15–$3.20 zone, and the next few candles will be key.

💎If buyers step up and push #RENDER through this upper trendline with strength, we have a clear runway toward the moderate resistance at $4.20. And if that gets taken out, the next strong resistance area comes in at $5.35, where we expect heavy distribution. But for now, it’s all about reclaiming and holding above this descending structure.

💎So what gives this setup real potential? The demand zone at $2.97 held like a fortress. If it fails, the next line of defense is a strong demand zone at $2.50. Buyers defended it multiple times and sparked a mini-reversal off the bottom of the channel. This demand zone is our launchpad, and as long as the price stays above it, bulls are still in control.

💎But make no mistake: if price loses $2.97, the bullish setup is invalidated. That would open up a deeper drop back toward $2.50 or lower, and we’ll step aside to wait for a better entry again.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

Triangle Breakout Ahead for $RENDERCRYPTOCAP:RENDER is getting ready to break out 🚀

Price has been moving in a tight triangle and is now near the breakout point. It’s holding higher lows and facing key resistance around $3.30.

If #render breaks above this zone, we could see a quick move up.

Entry: $3.22–$3.30

Stop-loss: Below $2.99

Targets: $3.80 and $4.43

The setup looks strong, watch for a clean breakout.

DYOR. NFA

Render (RENDER): Looking For Further Bullish MovementRender coin is still trading in bullish trend where we are aiming to see the price reach as high as $7.00

Despite current weakness in markets, we are still in a bullish channel and as long as we are in it, we are going to look for a bullish move here.

Swallow Academy

Render Token Buy Zone: New ATH $17.7, $27 & $46, 2025-26Render Token (RENDERUSDT) is moving within a strong buy zone. Any price below the 5-August 2024 low is a great entry when you aim for the 2025/26 bull market wave. That is, any entry below $3.41 is a very strong, low risk and high potential for reward buy. This is a solid pair.

Remember in 2024 when I told you it was going down, down, down, down? It has been going down for more than a year and three months. There is good news though, Render Token will go down no more.

The chart shows lower highs and lower lows. The last four months have the same base, no new lows. The lows in late 2024 are also not that far away.

Late 2025 & early 2026 targets (New all-time high)

The lower highs are part of a classic correction pattern, with the current chart structure opening up an easy 160% target. This is very easy.

The main target can reach $17.7 (PP: 453%) with higher prices being almost certain. The last target can be around $27 or $46, for these, we will have to wait and see.

When to sell

If the initial move has much force, buyers support and bullish momentum, we can aim for the higher targets. If the initial action is weak and there isn't enough market-buyers support, then we aim lower; it all depends on how the bull market develops but overall the potential is very strong. For Render, for Bitcoin and the rest of the altcoins.

Thanks for the support.

Namaste.

RENDER more downside to come?In this chart I present you RENDER.

1 Week timeframe. I expect that price will go lower, in the 0.29$ area by September (impossible to do timing in the market, but I try to give a month though). After that, we should have the spices for another alt run. In my opinion this will apply for many alts. I don't active trade Render now (dont have a short position), but I am prepared with $ to cash in an oppotunity.

Many of you will tell me that I am delusional, but guess that time will tell.

RENDER: Swing Spot Long 16/06/25Trade Direction:

RENDER Swing Spot Long

Risk Management:

- Total risk on spot account approx 0.5%

- Stop loss below most recent swing point will not executed unless daily close below.

Reason for Entry:

- Confirmed daily bullish divergence

- Higher time frame drawn liquidity swept and tapped

- Daily hammer candle

- Daily 0.718 retracement off leg

- Positioned in strong weekly and monthly demand zones

Additional Notes:

- Clean chart, gives me upside for a potential bottom formation here

- Not aiming for a huge swing upside just next DOL

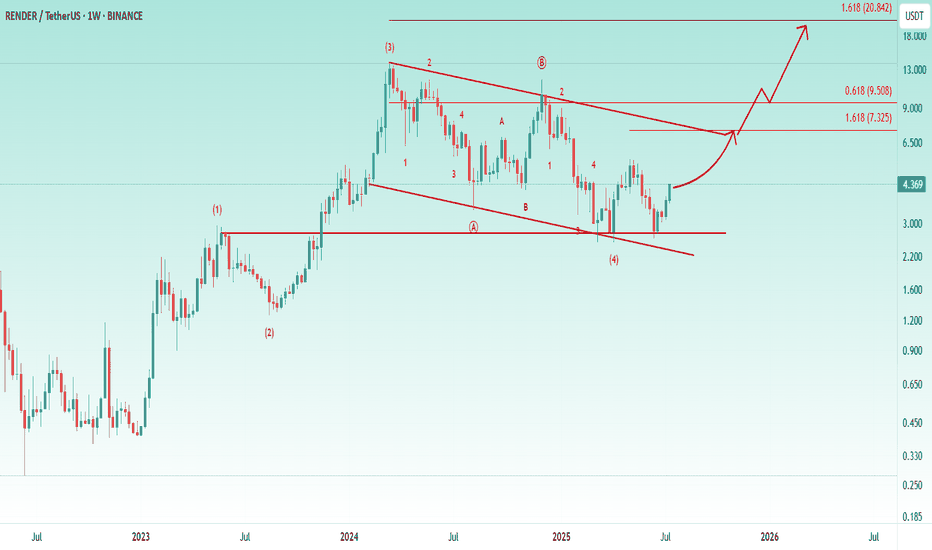

Render Trade plan RNDR/USDT – Wave 3 Setup in Progress 🚀

This is an Elliott Wave-based setup on the 1D chart for RENDER. Wave 1 and Wave 2 appear to be completed, with Wave 3 yet to unfold. Price is currently sitting near the 50%–61.8% Fibonacci retracement zone ($3.98–$3.63), which is a typical launchpad area for a strong impulsive Wave 3 move.

📉 Wave Structure:

✅ Wave 1: Complete

✅ Wave 2: Retested key Fib zone

🔜 Wave 3: Expected to extend towards the 1.618 Fib extension at $12.37

🎯 Entry Zone: $3.98–$4.00

🛑 Invalidation: Below $3.13 (78.6% retracement)

🚀 Wave 3 Target: ~$12+

This setup offers a favorable risk-to-reward ratio with clear invalidation. Watching closely for bullish confirmation.

#RNDR #ElliottWave #CryptoAnalysis #RenderToken #AltcoinSeason