ALRS 1D Long Investment Aggressive CounterTrend TradeAggressive CounterTrend Trade

- short impulse

+ volumed T1

+ support level

+ biggest volume Sp

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

Take profit

1/3 - 1 to 2 R/R

1/3 - 1D T2 / 1M T2

1/3 - 1/2 of 1Y

Calculated affordable stop limit

Take profit

1/3 - 1 to 2 R/R

1/3 - 1D T2 / 1M T2

1/3 - 1/2 of 1Y

Monthly CounterTrend

"- short impulse

+ volumed TE / T1

+ support level

+ volumed Sp

+ test"

Yearly Trend

"+ long impulse

+ 1/2 correction

+ T2 level

+ support level

+ manipulation"

ALRS trade ideas

ALROSA PJSC $ALRS: CAN IT WEATHER THE STORM?💎 ALROSA PJSC (ALRS.ME): CAN IT WEATHER THE STORM?

Russia’s diamond giant, Alrosa, is under pressure from global sanctions and weak demand. Can this dominant player maintain its shine ✨ or will it get buried under geopolitical and market risks? Let's dig in! 👇

1/ Revenue Hits:

Alrosa's diamond sales halted in Sept-Oct 2024, reflecting a tough market.

This move was part of a strategic response to sluggish demand 📉 and efforts to stabilize earnings.

The diamond industry isn't sparkling like it used to. 💎

2/ Market Stabilization Efforts: 🛑

No recent earnings reports were mentioned, but the sales halt highlights how volatile the market has become.

Alrosa is bracing for financial pressure while keeping reserves intact for better conditions.

Is this a smart move, or just delaying the pain? 🤔

3/ Major Threat: G7 Sanctions ⚠️

The G7 plans to ban Russian diamond imports, a major blow to Alrosa's access to key markets.

Sanctions could severely disrupt revenue and global sales channels. 🌍

This geopolitical chess match might redefine the company's future moves. ♟️

4/ How's Alrosa Valued? 💲

The last known analysis suggested a 25% undervaluation (based on a DCF model in 2019).

However, without updated data, it's unclear if this still holds true under current conditions.

Alrosa's financial outlook hinges on lifting or navigating around sanctions.

5/ Comparing Alrosa to Peers:

Alrosa’s dominance in diamonds is clear, but sector-wide data remains limited.

Compared to precious metals miners, Alrosa’s reliance on one commodity increases its risk exposure.

Diversifying might be crucial for long-term resilience. 🏗️

6/ Key Risks to Watch: 🚨

Geopolitical Tensions:

Sanctions are the biggest risk threatening Alrosa's market access.

Market Demand Slump:

Global demand for natural diamonds is weakening as lab-grown diamonds gain popularity. 🧪

Regulatory Risks:

Changes to mining laws in Russia could further complicate operations.

Currency Volatility:

The ruble's instability 💱 may distort reported earnings and profitability.

7/ SWOT Analysis: 🔍

Strengths:

✅ Global leader with significant diamond reserves

✅ State-backed, offering some political protection

Weaknesses:

⚠️ Heavy reliance on a struggling market

⚠️ Susceptible to international sanctions

8/ SWOT Continued:

Opportunities:

🚀 Recovery potential in the diamond market post-sanctions

🚀 Diversification into other minerals or industries

Threats:

🌍 Sanction risks from Western nations

🌍 Rising competition from lab-grown diamonds

Alrosa will need bold strategies to capitalize on any opportunities ahead.

9/ Investment Thesis: 💡

Alrosa’s future remains uncertain due to sanctions and weak market conditions. However, significant reserves and state support could provide resilience if market demand recovers. Investors must weigh the high geopolitical risk against potential recovery gains.

10/ What do YOU think? 💬

📈 Bullish: Alrosa can weather this storm.

🔄 Hold: Let’s see how sanctions evolve.

🚫 Bearish: Too risky, no recovery in sight.

ALRS 5M Conservative CounterTrend DayTradeConservative CounterTrend Trade

- long impulse

+ 1/2 correction

- SOS level

+ support level

+ volumed 2Sp+

Calculated affordable stop limit

1 to 2 R/R take profit slightly above 1 H range

Transferrable to Swing after closes test and resumes buying on 1H

Transferrable to Investment trade after ends test and resumes buying on 1D

1H CounterTrend

"- short impulse

+ 1/2 correction

- unvolumed T1

+ support level

- volumed 2Sp-

+ test"

Daily CounterTrend

"- short impulse

+ volumed T1

+ support level

+ biggest volume Sp

+ weak test"

Monthly CounterTrend

"- short impulse

+ volumed TE / T1

+ support level

+ volumed Sp

+ test"

Yearly trend

"+ long impulse

+ 1/2 correction

+ T2 level

+ support level

+ manipulation"

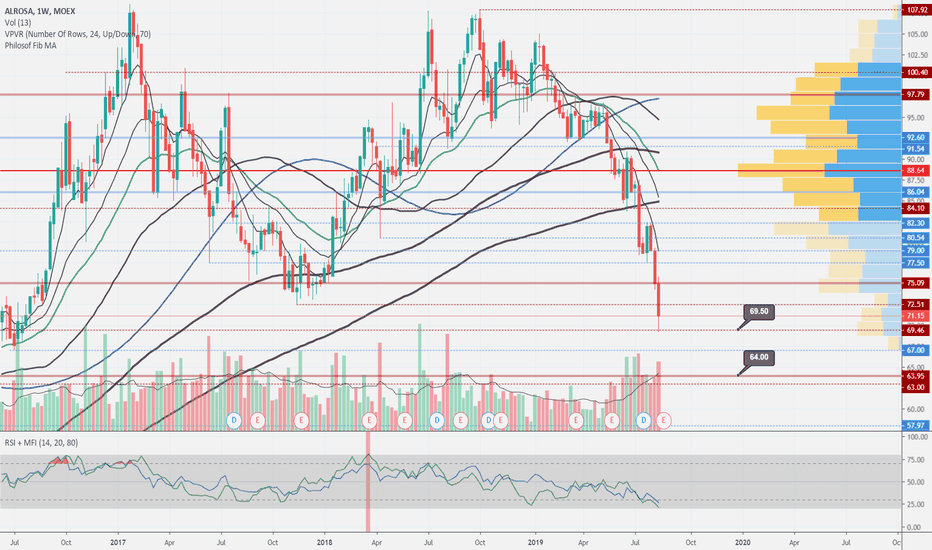

$ALRS is a well-growing company. Idea is here.MOEX:ALRS reached a high of the building. But this is just an intermediate step to jump to the building much higher. To proceed with this plan, it will loose a part of capitalization for a while. Till 75 to prepare an opportunity for getting better impulse to the level of 107.

Buy - 80-75

Sell - 100-110

Does not constitute a recommendation.

#furoreggs #investing #stocks #shares #idea #forecast #trading #analysis

If you want to discuss, please subscribe and challenge this point of view )

Traditional|ALRS|Long and shortLong and short ALRS

Activation of the transaction only when the blue zone is fixed/broken.

The author recommends the use of anchoring fixed the blue zone, this variation is less risky.

If there is increased volatility in the market and the price is held for more than 2-3 minutes behind the activation zone after the breakdown, then the activation of the idea occurs at the prices behind the activation zone.

Working out the support and resistance levels of the consolidation zone.

* Possible closing of a trade before reaching the take/stop zone. The author can close the deal for subjective reasons, this does not completely cancel the idea and is not a call to the same action, you can continue working out the idea according to your data, but without the support of the author.

+ ! - zone highlighted by the ellipse is a zone of increased resistance, in this area there is a possible reversal for a correction, please take this factor into account in this transaction.

The "forecast" tool is used for more noticeable display of % (for the place of the usual % scale) of the price change, I do not put the date and time of the transaction, only %.

The breakdown of the upper blue zone - long.

Breakdown of the lower blue zone - short.

Working out the stop when the price returns to the level after activation + fixing in the red zone.

Blue zones - activation zones.

Green zone - take zone.

Red zone - stop zone.

Orange arrows indicate the direction of the take.

Red arrows indicate the direction of the stop.

Priority - The value of the priority parameter implies the author's subjective opinion about the more likely activation zone on this idea, this does not mean that this idea will be 80% activated by this parameter, the purpose of the parameter is to provide for the risk of the inverse of the zone parameter.

Example: "Priority Long: So the author inclines more in the direction of the activation zone open long trades, in this case, when reaching the activation zone in short you should be very careful, because this area may be highly likely to be punched about the breakdown/do not get to take/activate transaction from go to stop."

Please consider this parameter if you use my ideas.

SUM PNL: This parameter displays the total % of all closed ideas of the "new" format (according to the author) for this sector at the time of publication of the idea. The calculation is very "clumsy" just the sum of the profits of all the ideas, based on this indicator, you can more accurately assess the risks when working with my ideas of this sector. I present you the construction of the idea, you can use it yourself as you like based on your subjective view and risks, the calculation of the PNL indicator is carried out only on transactions that the author closed on TV in manual mode or by take.

P.S Please use RM (risk management) and MM (money management) if you decide to use my ideas, there will always be unprofitable ideas, this will definitely happen, the goal of the system is that there will be more profitable ideas at a distance.

Traditional|ALRS|LongLong ALRS

Activation of the transaction only when the blue zone is fixed/broken.

The author recommends the use of anchoring fixed the blue zone, this variation is less risky.

If there is increased volatility in the market and the price is held for more than 2-3 minutes behind the activation zone after the breakdown, then the activation of the idea occurs at the prices behind the activation zone.

The idea is to work out the resistance level .

* Possible closing of a trade before reaching the take/stop zone. The author can close the deal for subjective reasons, this does not completely cancel the idea and is not a call to the same action, you can continue working out the idea according to your data, but without the support of the author.

+ Maybe right now we will go even lower, then it's okay, the idea is not activated and simply canceled.

The "forecast" tool is used for more noticeable display of % (for the place of the usual % scale) of the price change, I do not put the date and time of the transaction, only %.

Blue zones - activation zones.

Green zones - take zones.

The red zone - stop zone.

Working out the stop when the price returns to the level after activation + fixing in the red zone.

Orange arrow - the direction of take.

Black arrow - neutral scenario without activating the trade.

The red arrow - the direction of the stop.

SUM PNL: This parameter displays the total % of all closed ideas of the "new" format (according to the author) for this sector at the time of publication of the idea. The calculation is very "clumsy" just the sum of the profits of all the ideas, based on this indicator, you can more accurately assess the risks when working with my ideas of this sector. I present you the construction of the idea, you can use it yourself as you like based on your subjective view and risks, the calculation of the PNL indicator is carried out only on transactions that the author closed on TV in manual mode or by take.

P.S Please use RM (risk management) and MM (money management) if you decide to use my ideas, there will always be unprofitable ideas, this will definitely happen, the goal of the system is that there will be more profitable ideas at a distance.

Diamonds-Alrosa 1)Leader in diamond production

27% market share in global diamond mining

2)Shareholder Structure

33%-Republic of Yakutia

34%-Free float

33%-Russian Federation

On average, 90% of all stocks move down with the market, and 75% move up.

The wave principle applies to some extent to individual stocks, but counting waves for them is often confusing and does not have much practical significance. But since 33(66)% of the shares are owned by the state and the company has large capitalization, we assume that the state of Alrosa shares depends on mass psychology(Also ALRS - 1,90% of RTSI).

Alrosa near the bounceAlrosa been showing bad results for the whole 2019 year. Went below previous lows and now going deeper. Support at 69.5 bounced the price, and at day timeframe it looks nicely oversold and ready to bounce. But at week timeframe the situation is still dramatic. If current 70 SR won't stop the price, next support that has potential to stop the fall is at 64. In any case these stocks will have to recover for some time, before any kind of uptrend may appear.

Buying dip in Alrosa #2020/7The week is far from being over and it is the middle of the month. So basing my trade on W and M charts are a bit premature. However, broad bullish sentiment that moved OANDA:SPX500USD , TVC:USOIL , OANDA:XCUUSD , OANDA:XAUUSD etc. make me conclude that MOEX:ALRS being a mining company is also moving to new highs or forming a bullish pennant.

Risk - 0,24% of my capital

TIme horizon: approx 6 months

Exit strategy: close 50% of the position at 107.6, move SL to 0 loss and wait for the pennant to confirm before adding

I will consider adding midway if there is welcoming price action.