LKOH trade ideas

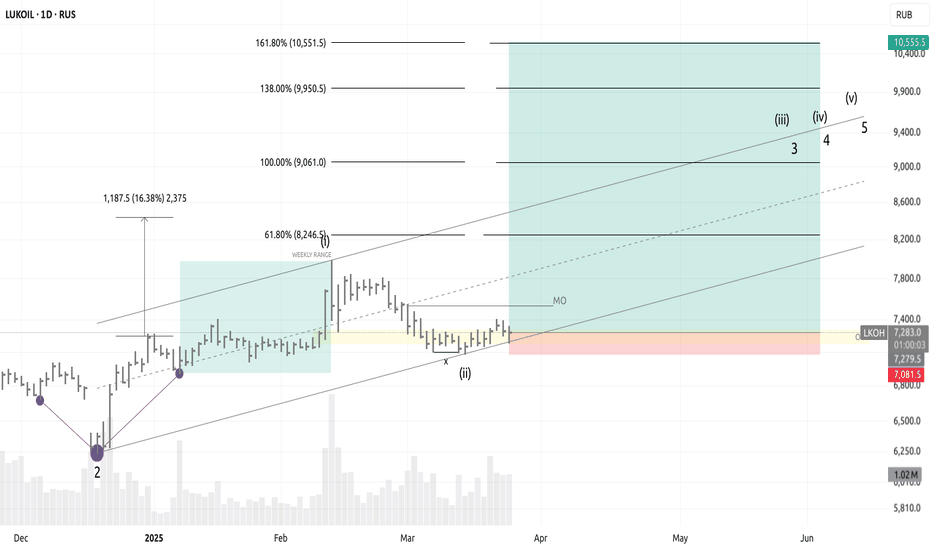

LKOH / LONG / 25.03.25⬆️ BUY LKOH 25.03.25

💰 Entry: 7279.5

🎯 Goal: 10555.5

⛔️ Stop: 7081.5

Entry reasons:

1) OSOK:

— Month minimum was set at the 2nd weekly

2) Eliott waves:

— 1D: 2th wave is formed, 3th is forming

3) Larry Williams:

— Long term point is formed

4) Range:

— Weekly bullish range, correction into OTE

5) Additional arguments:

— Divergence delta cluster

— Divergence delta oscillator

— Weekly liquidity is captured

Strategy: #osok #wave #larry #cluster

LUKOY if i had to pick one russian stockIf i had to pick one russian stock after this huge sell-off, that would be LUKOIL (LUKOY).

PJSC LUKOIL engages in exploration, production, refining, marketing, and distribution of oil and gas.

Last year they had earnings of $773Bil and paid a dividend of $7.35, which is now higher than the price of one share.

It will be adjusted for sure.

The Market Cap is also low, $31.608Bil.

Looking forward to read your opinion about it.

Continuation "Lukoil"PJSC "LUKOIL»

Disclaimer/

On average, 90% of all stocks move down with the market, and 75% move up.

The wave principle applies to some extent to individual stocks, but counting the waves for them is often confusing and does not have much practical significance. But since the company has a large capitalization, we assume that the state of the shares depends on the psychology of the masses./

LUKOIL is one of the largest oil and gas companies in the world, accounting for about 2% of global oil production and about 1% of proven hydrocarbon reserves.

Aviabunkerovka-achieved a 30% market share of the Russian Federation.

Ship bunkering-Achieved 30% market share in the Russian Federation.

>30 countries.

▪ 16 billion boe of proven reserves.

▪ 2.2 million boe/day of production.

▪ 1.4 million boe / day of oil refining.

▪ 39 billion boe of reserves and resources.

Traditional|LKOH|Long and shortLong and short LKOH

Activation of the transaction only when the blue zone is fixed/broken.

The author recommends the use of anchoring fixed the blue zone, this variation is less risky.

If there is increased volatility in the market and the price is held for more than 2-3 minutes behind the activation zone after the breakdown, then the activation of the idea occurs at the prices behind the activation zone.

Working out the support and resistance levels of the consolidation zone.

* Possible closing of a trade before reaching the take/stop zone. The author can close the deal for subjective reasons, this does not completely cancel the idea and is not a call to the same action, you can continue working out the idea according to your data, but without the support of the author.

+ ! - zone highlighted by the ellipse is a zone of increased resistance, in this area there is a possible reversal for a correction, please take this factor into account in this transaction.

The "forecast" tool is used for more noticeable display of % (for the place of the usual % scale) of the price change, I do not put the date and time of the transaction, only %.

The breakdown of the upper blue zone - long.

Breakdown of the lower blue zone - short.

Working out the stop when the price returns to the level after activation + fixing in the red zone.

Blue zones - activation zones.

Green zone - take zone.

Red zone - stop zone.

Orange arrows indicate the direction of the take.

Red arrows indicate the direction of the stop.

Priority - The value of the priority parameter implies the author's subjective opinion about the more likely activation zone on this idea, this does not mean that this idea will be 80% activated by this parameter, the purpose of the parameter is to provide for the risk of the inverse of the zone parameter.

Example: "Priority Long: So the author inclines more in the direction of the activation zone open long trades, in this case, when reaching the activation zone in short you should be very careful, because this area may be highly likely to be punched about the breakdown/do not get to take/activate transaction from go to stop."

Please consider this parameter if you use my ideas.

SUM PNL: This parameter displays the total % of all closed ideas of the "new" format (according to the author) for this sector at the time of publication of the idea. The calculation is very "clumsy" just the sum of the profits of all the ideas, based on this indicator, you can more accurately assess the risks when working with my ideas of this sector. I present you the construction of the idea, you can use it yourself as you like based on your subjective view and risks, the calculation of the PNL indicator is carried out only on transactions that the author closed on TV in manual mode or by take.

P.S Please use RM (risk management) and MM (money management) if you decide to use my ideas, there will always be unprofitable ideas, this will definitely happen, the goal of the system is that there will be more profitable ideas at a distance.

Traditional|LKOH|Long and shortLong and short LKOH

Activation of the transaction only when the blue zone is fixed/broken.

The author recommends the use of anchoring fixed the blue zone, this variation is less risky.

If there is increased volatility in the market and the price is held for more than 2-3 minutes behind the activation zone after the breakdown, then the activation of the idea occurs at the prices behind the activation zone.

Working out the support and resistance levels of the consolidation zone.

* Possible closing of a trade before reaching the take/stop zone. The author can close the deal for subjective reasons, this does not completely cancel the idea and is not a call to the same action, you can continue working out the idea according to your data, but without the support of the author.

+ ! - zone highlighted by the ellipse is a zone of increased resistance, in this area there is a possible reversal for a correction, please take this factor into account in this transaction.

The "forecast" tool is used for more noticeable display of % (for the place of the usual % scale) of the price change, I do not put the date and time of the transaction, only %.

The breakdown of the upper blue zone - long.

Breakdown of the lower blue zone - short.

Working out the stop when the price returns to the level after activation + fixing in the red zone.

Blue zones - activation zones.

Green zone - take zone.

Red zone - stop zone.

Orange arrows indicate the direction of the take.

Red arrows indicate the direction of the stop.

Priority - The value of the priority parameter implies the author's subjective opinion about the more likely activation zone on this idea, this does not mean that this idea will be 80% activated by this parameter, the purpose of the parameter is to provide for the risk of the inverse of the zone parameter.

Example: "Priority Long: So the author inclines more in the direction of the activation zone open long trades, in this case, when reaching the activation zone in short you should be very careful, because this area may be highly likely to be punched about the breakdown/do not get to take/activate transaction from go to stop."

Please consider this parameter if you use my ideas.

SUM PNL: This parameter displays the total % of all closed ideas of the "new" format (according to the author) for this sector at the time of publication of the idea. The calculation is very "clumsy" just the sum of the profits of all the ideas, based on this indicator, you can more accurately assess the risks when working with my ideas of this sector. I present you the construction of the idea, you can use it yourself as you like based on your subjective view and risks, the calculation of the PNL indicator is carried out only on transactions that the author closed on TV in manual mode or by take.

P.S Please use RM (risk management) and MM (money management) if you decide to use my ideas, there will always be unprofitable ideas, this will definitely happen, the goal of the system is that there will be more profitable ideas at a distance.

🛢Investments in the Russian oil sector...●● Mine scenario

🕐 1W

MOEX:LKOH

«Pic.1»

We successfully predicted the growth of the fifth wave after the triangle ((iv)) and the subsequent decline within the wave 4 , which, based on the norm of alternation, is still expected in the form of a triangle.

🕐 1D

MOEX:LKOH

«Pic.2»

Combination "Double Three" SZ-X-CT

🕐 1D

MOEX:LKOH

«Pic.3»

The main purchases are planned under the condition of a fully completed triangle, at the end of the final wave ((e)) in its structure.

🕐 2h

MOEX:LKOH

«Pic.5»

This count has a number of disadvantages. They are: two sideways corrections in waves ii-iv , and a truncation within the assumed diagonal v . In connection with the above, I recommend any speculation in the short only after the breakout of the top iv , the level marked as «confirm.lvl» .

🕐 2h

MOEX:LKOH

«Pic.6»

Along the way, I am considering a variant count with a triangle in (b) of ((b)) , which suggests continued growth within wave (c) . Waiting for the implementation of my count for continued growth, I hold the buy position.

●● Alternative scenario

🕐 1W

MOEX:LKOH

«Pic.8»

As for the alternative count shown in "Pic. 8" , taking into account the probability of its implementation, I do not increase the volume of a long-term long position until we form a triangle as it is schematically depicted in "Pic. 1".

The wave marking in the double circle parenthesis corresponds to the green marking in the circle on the chart.

LKOH (MOEX) - Already break, continue BullishHumbled, we would like to thanks for your support who has already liked, commented and followed us. Your support, strengthens us, to help in analyzing the market.

If you have any questions, do not be hesitant to send us message (inbox). Again, We have also provide signal recommendation with detail instruction & also training for technical.

LKOH (MOEX) - Already break, continue Bullish

LUKOILLUKOIL is one of the largest oil and gas companies in the world, accounting for about 2% of global oil production and about 1% of proven hydrocarbon reserves.

Aviabunkerovka-reached 30% market share of the Russian Federation.

Ship bunkering-Reached 30% market share of the Russian Federation.

>30 countries.

▪ 16 billion boe of proven reserves.

▪ 2.2 million boe/day of production.

▪ 1.4 million boe / day of oil refining.

▪ 39 billion boe of reserves and resources.