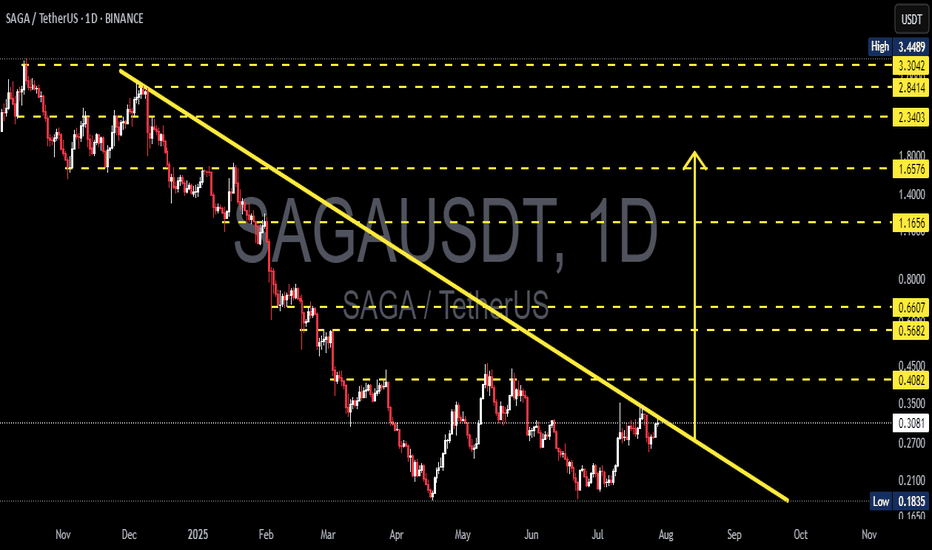

SAGAUSDT – Testing Major Trendline Resistance: Breakout?Chart Description:

SAGAUSDT (SAGA vs USDT) is currently retesting a long-term descending trendline (yellow line) that has acted as strong resistance since November 2024. The price is now approaching a critical zone, with potential for either a breakout or a strong rejection, which could define the next major move.

---

📊 Pattern & Structure Overview:

Downtrend Line (Major Resistance): The diagonal trendline reflects consistent bearish pressure over the past several months.

Current Price: ~0.30 USDT

Key Support Level: 0.1835 USDT (Yearly Low)

Immediate Resistance Zones: 0.3066 – 0.4082 USDT

Horizontal yellow lines indicate potential target levels if the price breaks out and sustains upward momentum.

---

🐂 Bullish Scenario:

A confirmed breakout above the trendline resistance would signal a possible trend reversal or a strong bullish continuation.

Bullish confirmation strengthens if the price breaks and holds above:

0.4082 (structural resistance)

0.5682 and 0.6607 (key mid-range resistance zones)

If momentum continues, extended targets lie around 1.1656 – 1.6576 USDT and beyond.

---

🐻 Bearish Scenario:

Failure to break the trendline or a clear rejection from this level could trigger another downward move.

Potential support zones include:

0.2700

0.2100

0.1835 (key yearly low)

A breakdown below 0.1835 may open the door for deeper bearish continuation.

---

🧠 Conclusion:

SAGAUSDT is at a critical decision point, approaching the descending trendline that has defined its bearish trend. A breakout could initiate a new bullish phase, while rejection could resume the downtrend. Watch for volume and price action over the coming days to confirm the direction.

#SAGAUSDT #CryptoBreakout #TrendlineResistance #AltcoinAnalysis #TechnicalAnalysis #CryptoTrading #BullishSetup #BearishSetup #SAGA #PriceAction

SAGAUSDT trade ideas

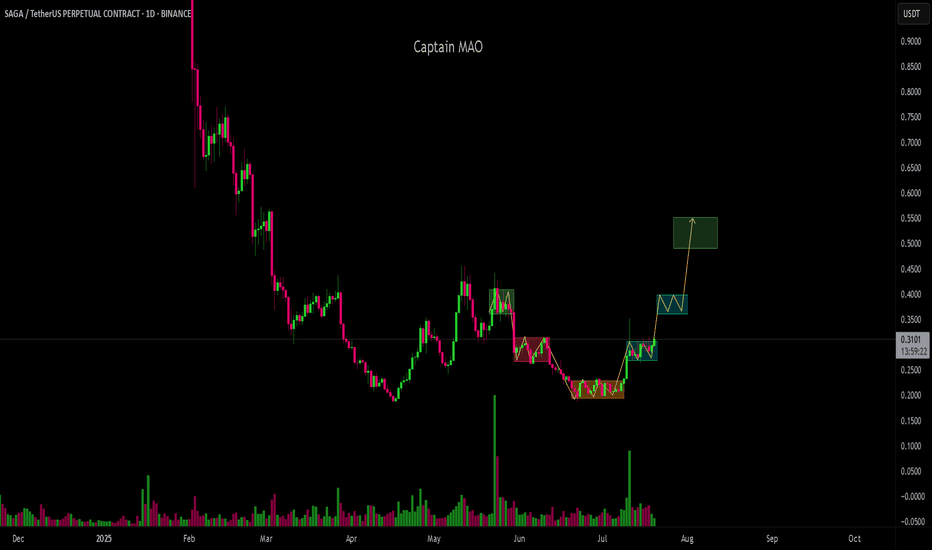

SAGA/USDT - MMM forming a clear (MMM) structure. After completing the accumulation phase, price made a strong move up and is now in the re-accumulation phase, showing signs of strength with higher lows and tightening consolidation.

Currently it’s on the verge of breaking out from re-accumulation, supported by growing volume and bullish momentum. If the breakout is confirmed, we anticipate the next leg targeting the $0.50 – $0.55 zone, aligning with previous liquidity zones and imbalance fills.

SAGAUSDTNow is the time to buy and hold with low risk.

Target: 0.70

Stop-loss: Weekly candle close below 0.17

I'm just sharing my personal opinion to help us all better understand the market’s potential.

Always do your own research before investing — don’t rely solely on my view as a beginner, or anyone else's, even top analysts.

No one can predict the future with certainty.

Wishing peace and clarity to everyone.

SAGAUSDT Forming Falling WedgeSAGAUSDT is showing promising signs of a trend reversal as it completes a falling wedge pattern, which is a widely respected bullish continuation signal in crypto trading. This chart structure suggests that the recent downtrend could be coming to an end, with the price poised for a strong upward breakout. The current market volume looks healthy, adding weight to the possibility of this setup playing out successfully. With an expected gain of 90% to 100%+, this pair could attract significant attention from swing traders and position traders looking to capitalize on the next big move.

This crypto pair has been drawing increasing interest from investors due to the innovative vision behind the Saga ecosystem and its growing presence in the decentralized applications space. Community sentiment has turned optimistic as fresh liquidity appears to be entering the market, a critical factor for sustainable bullish momentum. As more buyers step in to accumulate around the wedge support, the likelihood of a confirmed breakout strengthens.

Traders should keep a close watch on key breakout levels and look for strong bullish candles closing above the wedge resistance line. An ideal scenario would include a volume spike accompanying the breakout, as this often validates the breakout strength and confirms that new buyers are stepping in aggressively. Proper risk management remains crucial—placing stop-losses below recent swing lows can protect capital while riding this high-probability setup.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

SAGAUSDT Breaks Free After Long Consolidation.Big Moves Ahead?SAGAUSDT Breaks Free After Long Consolidation.Big Moves Ahead?

BINANCE:SAGAUSDT was consolidating within a tight range for quite some time, forming a classic accumulation box. Today, it finally broke out of that zone with strong momentum, signaling the potential start of a bullish move. This breakout could be the beginning of a bigger trend, and we’re eyeing further upside in the coming sessions.

As always, risk management is key, make sure to place your stop loss wisely and protect your capital.

#SAGAUSDT Currently trading at 0.245

Buy level : Above $0.235

Stop loss : Below $0.21

Target : $0.4

Max leverage 5x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

SAGA (can pump like ALT did?)SAGA and similar cycle-growth coins (not necessarily same sector or area)

More from a perspective from a similar chart pattern and also similar listing date/period

For more details please give a comment

we have many bullish indicators as well > KDJ

Also look at

AEVO XAI and so on. DYM MANTA ACE AI CYBER OMNI and so on

SAGA | Inverse Head & ShoulderOn the daily timeframe, SAGA/USDT is presenting a bullish reversal pattern in the form of an Inverse Head and Shoulders, further validating the its high green volumes. This is a classic technical signal that often precedes a significant trend reversal, especially after a prolonged downtrend like the one SAGA has experienced.

What makes this setup compelling is that the neckline—around the $0.43–$0.45 region—is being tested. A successful breakout above this resistance would confirm the pattern and potentially trigger a strong bullish move. The height of the pattern projects a measured move toward the $0.80–$0.83 range.

SAGA SHORT RESULT SAGA price rejected from minor Support level due to Pump in BTC and Altcoins Generally.

Took a little hit on this one, wasn't paying attention to it actually, would've closed at the break out of the first resistance Trendline.

But it's part of trading. Better Setup and profits coming soon.

_THE_KLASSIC_TRADER_.

SAGA RoadMap (1D)From the point where we placed the red arrow on the chart, it appears that SAGA's correction has begun.

This correction seems to be either a diametric or a symmetrical pattern. Now, considering the extended duration of wave C, its relative comparison with the other waves, the heavy drop, and the formation of a demand zone at the bottom, wave C seems to have ended.

A rebuy can be considered on the pullback to the green zone.

The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

SAGA Rebuy Setup (8H)A strong move has formed, and we have a bullish CH (Change of Character) on the chart.

We can look for buy/long positions around key zones, as buyers are present in these areas.

We are focusing on buy/long positions at the entry points.

Targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

SAGAUSDTmy entry on this trade idea is taken from a point of interest above an inducement (X).. I extended my stoploss area to cover for the whole swing as price can target the liquidity there before going as I anticipate.. just a trade idea, not financial advise

Entry; $0.2819

Take Profit; $0.2612

Stop Loss; $0.2949

SAGA buy/long setup (4H)The SAGA symbol has made significant breakouts and formed a support zone. Additionally, there is a bullish iCH on the chart.

We can look for buy/long opportunities on this symbol.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

SAGAUSDTmy entry on this trade idea is taken from a point of interest below an inducement (X).. I extended my stoploss area to cover for the whole swing as price can target the liquidity there before going as I anticipate.. just a trade idea, not financial advise

Entry; $1.0158

Take Profit; $1.1015

Stop Loss; $0.9886

SAGA Long OpportunityThis is the type of trade which I take without thinking twice.

Bottom with bullish RSI divergence

Higher high without divergence

Impulsive pattern to the upside, corrective pattern to the downside

Low risk, high reward

You can enter half or 1/3 position here and wait and see, if the SL is hit, makes little impact.