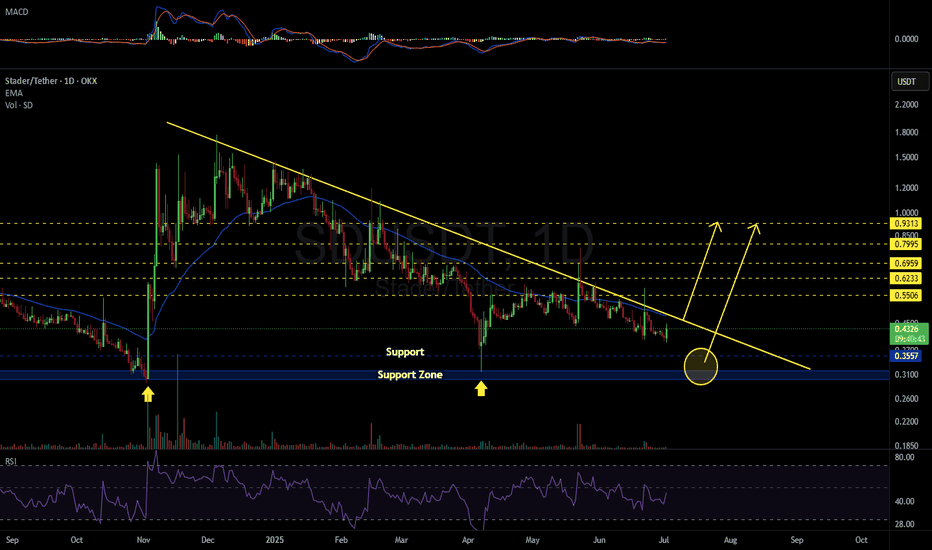

SDUSDT 1DConsider buying some #SD at the current price and near its support levels.

If a breakout occurs above the descending resistance and the daily EMA50, the targets are:

🎯 $0.5506

🎯 $0.6233

🎯 $0.6959

🎯 $0.7995

🎯 $0.9313

Support levels:

🛡 $0.3557

🛡 $0.3189

🛡 $0.2998

⚠️ As always, use a tight stop-loss and apply proper risk management.

SDUSDT trade ideas

SD/Tether USD Cryptocurrency Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# SD / Tether USD Cryptocurrency Quote

- Double Formation

* (Downtrend Argument)) | Completed Survey

* 0.236 & 0 Retracement Area | Subdivision 1

- Triple Formation

* ((Triangle Structure)) | Ranging Set Up | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Regular Settings

- Position On A 1.5RR

* Stop Loss At 1.50 USDT

* Entry At 0.55 USDT

* Take Profit At Out Of Range Area USDT

* (Ranging Argument)) & Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

Potential Bullish Reversal for Stader (SD/USDT)#SD/USDT #Analysis

Description

---------------------------------------------------------------

+ The chart shows a descending channel pattern forming since the peak in end of 2023. The price has respected the upper and lower bounds of this channel multiple times, indicating a strong bearish trend within this range.

+ The price is currently near the lower boundary of the descending channel, around $0.51, which has acted as a significant support level.

+ A breakout above the upper boundary of the channel around $0.93 could signal a potential trend reversal.

+ If the price holds above the $0.50 support level and breaks out of the descending channel, we can expect a potential move towards the $1.15 resistance zone.

+ Further upside could see the price targeting the $2.00 - $2.50 levels

+ The RSI is currently at 40.42, indicating that the asset is nearing the oversold region. A reversal in RSI towards the 50 mark would support a bullish momentum shift.

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: $0.5109

Stop Loss: $0.37

------------------------------

Target 1: 0.8259

Target 2: 1.15

Target 3: 2.0

Target 4: 3.0

Target 5: 5.0

------------------------------

Timeframe: 1W

Capital Risk: 1-2% of trading amount

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights.

Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

SDUSDT-Symmetrical Triangle #SD/USDT

Massive Accumulation inside of Symmetrical Triangle💁♂️

Full Send🚀

FA

1 20% of Total Supply Zone will be burned - 25th June

2 SD Quarterly buybacks - live

3 Reward capping - Today

4 Insurance coverage against Slashing fee - soon

5 RWA , bitcoin staking - incoming

SDStader (SD) token is the native governance and value accrual token for Stader. Stader has established key mechanics that make SD tokens intrinsically tied to the Stader platform.

Value Capture for SD Token:

Stader charges a % of rewards as fees and the fees is the key revenue source for Stader platform. The fees charged will be in the range 3%-10% of the rewards based on type of solution (if elected by governance). A portion of the protocol fees will be paid to SD token stakers.

Token Utility:

SD tokens will have 4 major utilities.

Governance: When users stake SD tokens, they will receive xSD which is an auto-compounding token. xSD will have governance rights.

Preferential Delegations & Slashing Insurance: Validators stake xSD tokens to receive preferential delegations and provide slashing insurance. In v2, any xSD holder can stake to support a validator that he/she prefers by staking on his/her behalf.

Liquidity Pools: Liquidity providers for SD, xSD pairs with stables/native tokens will receive SD token rewards and pool fees.

Stader Infrastructure: Third-party protocols will stake xSD tokens to leverage Stader contracts/infrastructure.