How to navigate the Amazonian Squeeze. AMZNHello I am the Cafe Trader.

This week has been a deep dive on the MAG 7 and today AMZN is up next.

We are going to look at long term and short term opportunities.

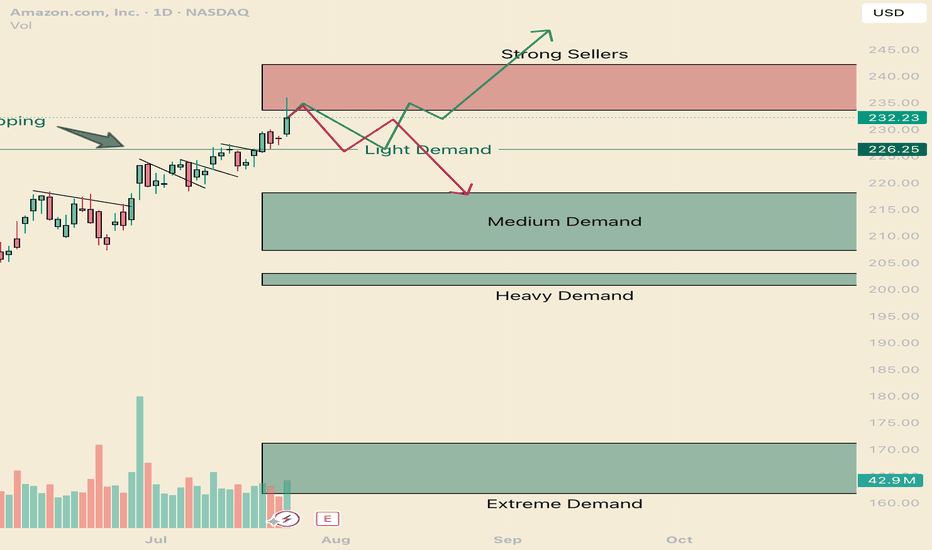

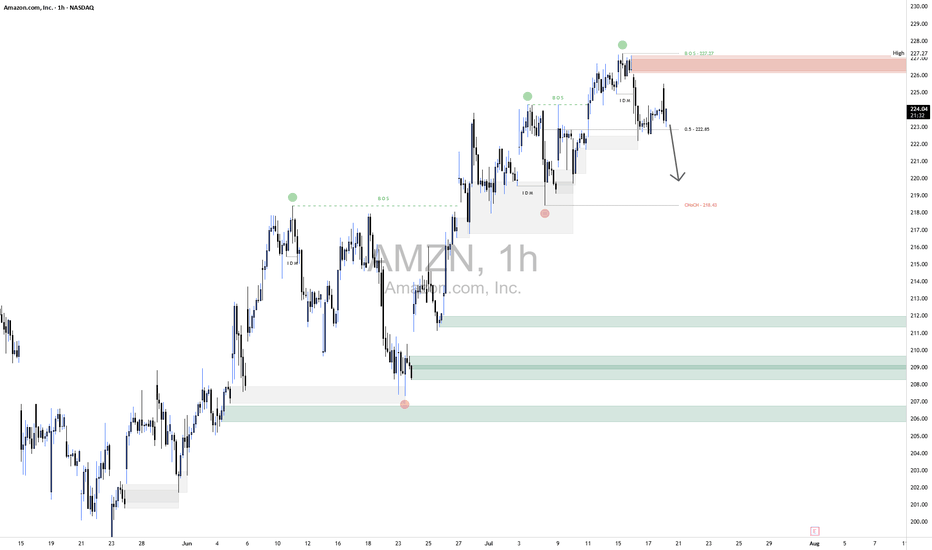

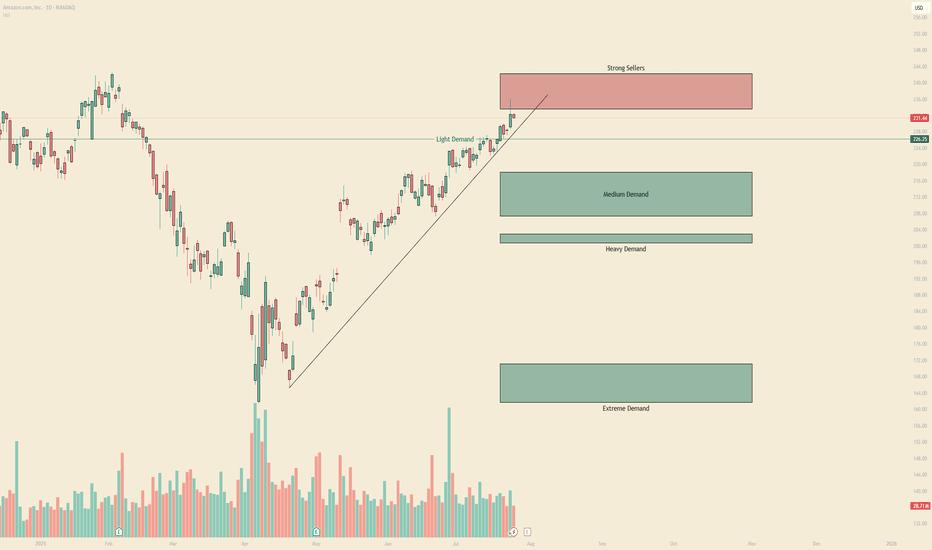

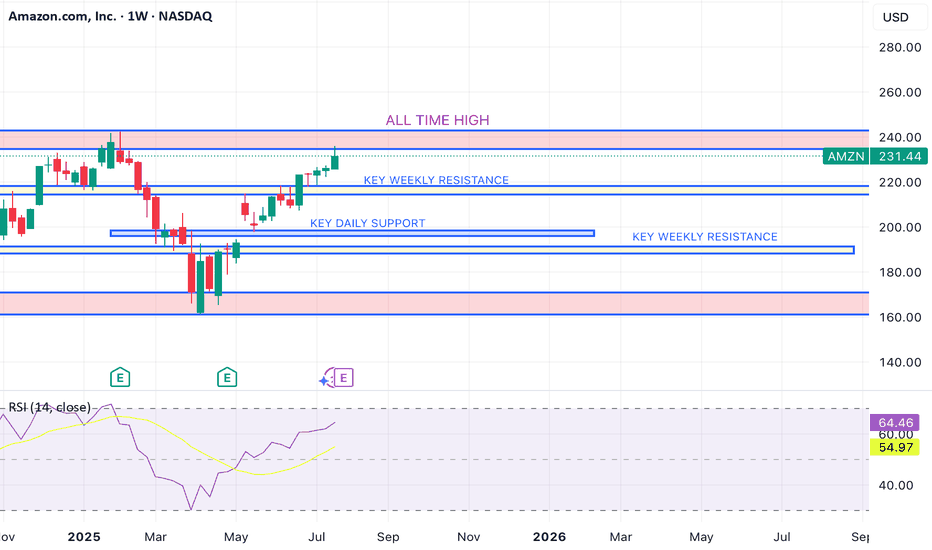

We are near the All Time Highs, with one final Seller to get through before making the break.

Today we tested to see if those sellers are there still (and indeed they are). Today was a key reaction, I'm going to give you the keys to profit.

Long Term

It's important to consider how aggressive you would like to be with pricing. This list of prices should align with your conviction with Amazon.

Aggressive: $226 is where the current aggressive players are sitting. They are going to look to buy again at this level, although they should be the weakest of the buyers.

Fair sentiment: 203-210 is where stronger buyers are sitting. I think this price is still realistic to get to.

Conservative: 161 - 171 Is a great price, buyers have shown to buy this with extreme demand. Amazon at this price is a fantastic purchase, if you are holding from here or lower, congradulations.

Short term

Testing the supply and rejecting tells us that sellers are still really active in this zone. We will see how tomorrow closes, if we do not close in the supply zone, there is a good chance that net week will have some bearish winds and a great chance of testing the light demand at 226. this brings us to the two trading ideas.

1 Green line

I think we will test those sellers by next week. and i think its very possible that we break trend and touch the light demand line. If its a slow drag down to the light demand, Shorts will have to cover as soon as any real demand shows up (Light Demand Line).

Entry 226.50

Stop 221.50

Partial TP 233, or you can hold for a test of the highs (242 would suffice)

2 Red Line

If we get a Hot reaction from the supply zone, or if we close below 233.50 tomorrow, Look for a retest and short entry off the supply zone. If the reaction starts to be slow (more than 5 days of red bars) it's likely this will turn into the green scenario.

Entry 233.5

Stop 237

Partial TP 226.5

Full TP 218

That's all for AMZN Follow for more!

Also comment if you would like me to chart a stock you are considering.

@thecafetrader

AMZN01 trade ideas

AmznLooks like 250 is incoming on this stock

V-shape recovery happening in real time

Don't put too much Emphasison this rising wedge in terms of bearishness.. just use it as a range to trade... Will most likely trade inside of it until a catalyst comes to push it to breakout to the upside

Looking for 230 this week

I like any Dips down to 222. Range will be tight so keep that in mind if you are swinging short dated

Amazon Has a Mixed Technical Picture Heading Into EarningsNext week will see four of the "Magnificent Seven" stocks report quarterly earnings -- Apple NASDAQ:AAPL , Amazon NASDAQ:AMZN , Microsoft NASDAQ:MSFT and Meta Platforms NASDAQ:META . Let's check out AMZN ahead of its results.

Amazon's Fundamental Analysis

FactSet recently reported analysts' consensus view calls for S&P 500 companies to see 9.3% earnings growth for 2025 as a whole, of 9.3%, up from 9% in 2024.

But very interestingly, FactSet also said that earnings growth across the "Magnificent Seven" is projected at 14.1% year over year for just Q2 alone.

By contrast, analysts project just 3.4% y/y earnings gains for the S&P 500's other "Less Than Magnificent 493." That illustrates the Mag-7's impact on the broader market.

As for Amazon, analysts estimate that the e-commerce giant will see $1.32 in Q2 GAAP earnings per share on roughly $162 billion of revenue.

This would represent 4.8% y/y growth from Q2 2024's $1.26 in GAAP EPS, as well as a 9.5% y/y gain from the approximately $148 billion in revenues that AMZN saw in the same period last year.

This has become the norm for Amazon, as revenue growth has landed between 9% and 11% for each of the past four quarters (and is projected to print within that range for the next four quarters as well).

But significantly, of the 34 sell-side analysts that I can find that track AMZN, 27 have reduced their Q2 earnings estimates for the firm since the current quarter began. (The other seven swam upstream and actually boosted their forecasts.)

Amazon's Technical Analysis

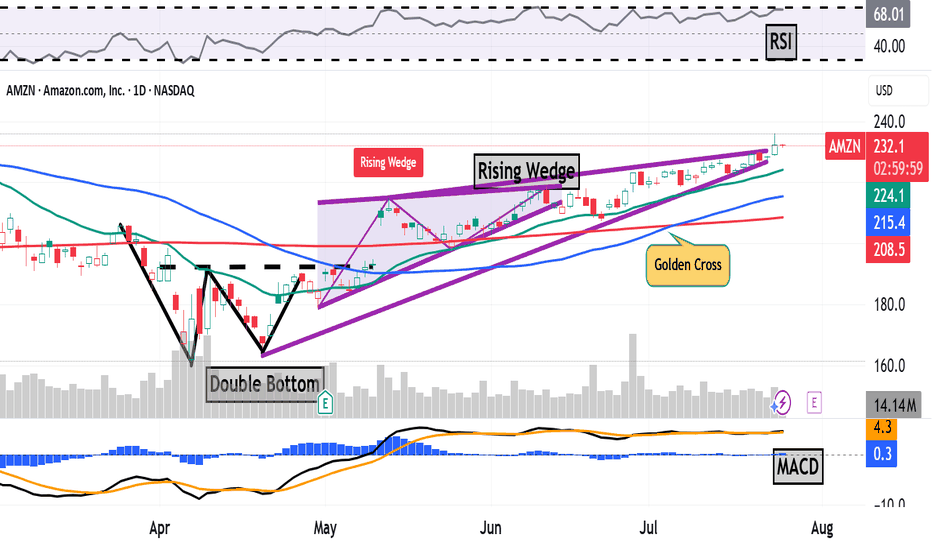

Next, let's look at AMZN's chart going back some six months and running through Tuesday afternoon:

This is an interesting chart, with both positive and negative technical signals.

On the positive side, the stock saw a "double-bottom" pattern of bullish reversal that spanned the month of April, with a $193 pivot (marked "Double Bottom" at the above chart's left).

That produced an upside breakout that appeared to accelerate, with a "golden cross" occurring on July 7 (marked at the chart's right).

A golden cross is generally seen as a bullish technical pattern that occurs when a stock's 50-day Simple Moving Average (or "SMA," denoted with a blue line in the chart) crosses above a rising 200-day SMA (the red line).

There's a catch, though.

While breaking out higher in the chart above, AMZN appeared to develop a "rising-wedge" pattern of bearish reversal, marked with purple diagonal lines in the chart above.

Readers will note that this pattern actually began at the nadir of the double bottom's second bottom in late April. The rising wedge's upper trendline then kicked in on May 13, but the pattern's two lines appear to be closing.

When a wedge closes after two to three touches on each trendline (which we have here), the resultant move can be explosive.

However, it's not necessarily clear which way a stock will move from there -- up or down. A true closing pennant can explode violently in either direction, but as noted above, what we're seeing with Amazon is a pattern of bearish reversal.

This does give me pause about AMZN and makes me more cautious than I might otherwise be about getting involved with the stock ahead of earnings. (I don't currently own any AMZN shares.)

Meanwhile, Amazon's Relative Strength Index (the gray line at the chart's top) looks strong, but nowhere near being technically overbought.

That said, the stock's daily Moving Average Convergence Divergence indicator (or "MACD," marked with black and gold lines and blue bars at the chart's bottom) isn't telling us much at all.

The histogram of Amazon's 9-day Exponential Moving Average (or "EMA," marked with blue bars) is flat-lining right around the zero bound, while the 12-day EMA (black line) is running in line with the 26-day EMA (gold line).

While both lines are running above zero, it matters greatly which one ends up on top. For the short to medium term, the bulls will be rooting for the black line, while the bears will be hoping that the gold line can wind up on top.

(Moomoo Technologies Inc. Markets Commentator Stephen “Sarge” Guilfoyle had no position in AMZN at the time of writing this column.)

This article discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve. Specific security charts used are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. Moomoo and its affiliates make no representation or warranty as to the article's adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

TradingView is an independent third party not affiliated with Moomoo Financial Inc., Moomoo Technologies Inc., or its affiliates. Moomoo Financial Inc. and its affiliates do not endorse, represent or warrant the completeness and accuracy of the data and information available on the TradingView platform and are not responsible for any services provided by the third-party platform.

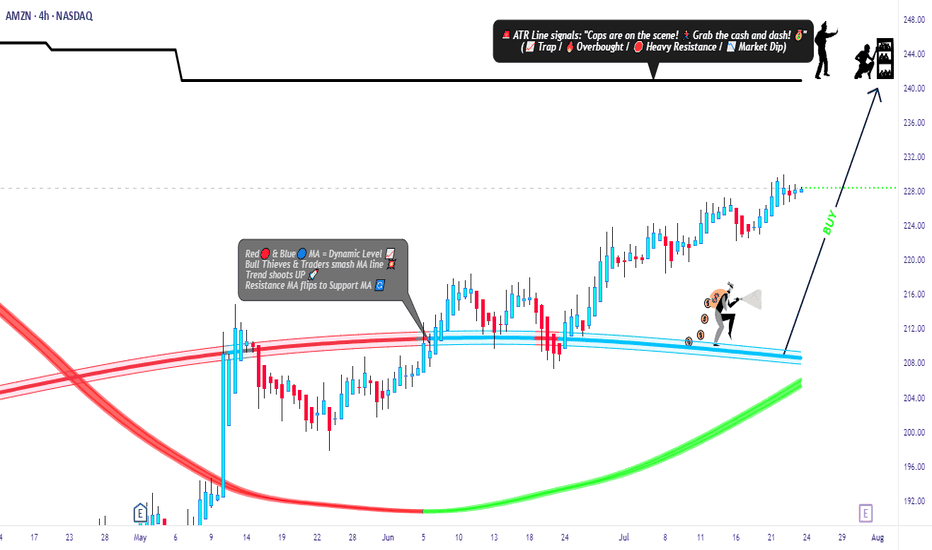

Amazon Market Robbery Blueprint – Swing/Scalp Long Setup🟨💣 “AMZN Market Heist Blueprint – Bullish Robbery in Progress 🚨💼💸” 💣🟨

By Thief Trader – Rob the Market with Precision

🌍 Hello World! Hi, Hola, Ola, Bonjour, Hallo, Marhaba!

🤑💰 Calling all Money Makers & Market Robbers – get ready to execute the next bullish heist on AMAZON.COM, INC (NASDAQ: AMZN), powered by our signature Thief Trading Style™ – where technical precision meets psychological warfare.

🔥 Plan Summary:

Based on our fundamental & technical intel, we’re eyeing a long entry into AMZN. The target? 💥The High-Risk ATR Police Barricade Zone – a zone flooded with liquidity, overbought conditions, fakeouts, and bear traps. It's where most traders get caught – but we walk in with a blueprint.

🟩 Entry Zone – “The Vault Is Wide Open!” 💼📈

🕰 Entry timeframe: 15min / 30min (preferably after confirmation or rejection wick)

💵 Buy Limit Orders: Place multiple layered entries (DCA-style) near recent swing lows/highs. Wait for breakout confirmation; no blind orders before breakout!

Thief Note: This isn’t spray-and-pray – this is sniper-mode. Scope, place, execute.🎯

🛑 Stop Loss – “SL is the Escape Route!”

📍 SL below recent 4H candle wick swing low (around 219.00 – adjust based on your risk/margin size).

Important: Only place SL after breakout; not before. Risk per order must match your lot strategy.

🎯 Target – “Grab the Bag or Escape Before the Alarms!”

💸 Target Zone: 240.00

🧠 Smart robbers know when to bail early – use a trailing SL to lock gains. Exit before reversal or heavy volume shift.

👀 Scalper Alert – “Only One Way – LONG!”

If you’re a quick thief with a fat bag, hit-and-run with a Long scalp. If you’re running lean, swing with the crew. Watch the PA and news timing. Trailing SL = insurance policy.

📊 Why Bullish? Here’s the Background:

🔍 Macro Drivers

💼 COT Report

🌍 Geo-political Influences

🧠 Sentiment Score

📈 Index Correlation

🔮 Intermarket Signals

💹 Institutional Positioning

All lights flashing green for short-to-midterm bullishness, but keep checking real-time updates.

⚠️ Risk Alert – News Triggers Can Blow Your Cover 🚨

🗞 Avoid trading near major news releases – they cause volatility spikes.

🧲 Always protect gains with trailing stops and don’t over-leverage your ammo.

💖 Support the Robbery – Hit BOOST 🔥

Smash that 💥BOOST💥 button if you ride with the Thief Trading Crew!

Let’s build this into the #1 robbery squad on TradingView.

Make money. Protect profits. Trade like a bandit – with a plan. 💼📈🏆

🔔 Stay Tuned for the Next Robbery Mission 🔔

Another heist plan dropping soon. Until then, rob smart, rob safe, and rob rich.

– Thief Trader™ | Rob The Market. Not Your Wallet.

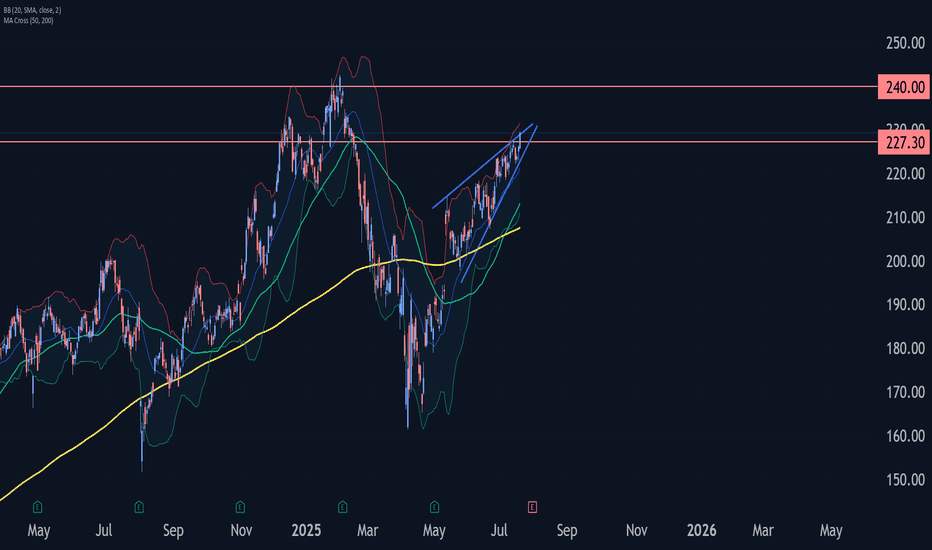

Amazon Wave Analysis – 21 July 2025

- Amazon broke resistance zone

- Likely to rise to resistance 240.00

Amazon recently broke the resistance zone between the resistance level 227.30 (top of the previous impulse wave i) and the resistance trendline of the daily Rising Wedge from May.

The breakout of this resistance zone accelerated the active impulse wave 5 of the intermediate impulse sequence (C) from April.

Given the strength of the active impulse wave 5, Amazon can be expected to rise further to the next resistance level 240.00 (former multi-month high from February and the target price for the completion of the active impulse wave iii).

AMZN Short1.Liquidity Landscape

Buy-Side Liquidity Cleared:

Liquidity above the recent swing high was taken — likely triggering breakout traders and stop orders from earlier shorts.

This move appears to be a classic liquidity raid before a reversal.

Sell-Side Liquidity in Focus:

Price is now targeting sell-side liquidity resting below recent higher lows (e.g., below ~222 and especially near 218.50).

This aligns with the direction of your arrow, suggesting price may hunt liquidity pools beneath internal lows.

2. Confirmation via Reaction

The strong rejection from that supply zone confirms no intent to hold price above 227, meaning that was likely a liquidity raid, not a genuine breakout.

Price has already broken below the midpoint (0.5 level at 222.85), adding confidence to the short bias.

3. Liquidity Targets Below

The next likely targets are sell-side liquidity pools resting below:

Around 218.50 (marked zone)

Deeper lows near 211–212, and potentially 208–209, where untouched demand and previous stop clusters lie.

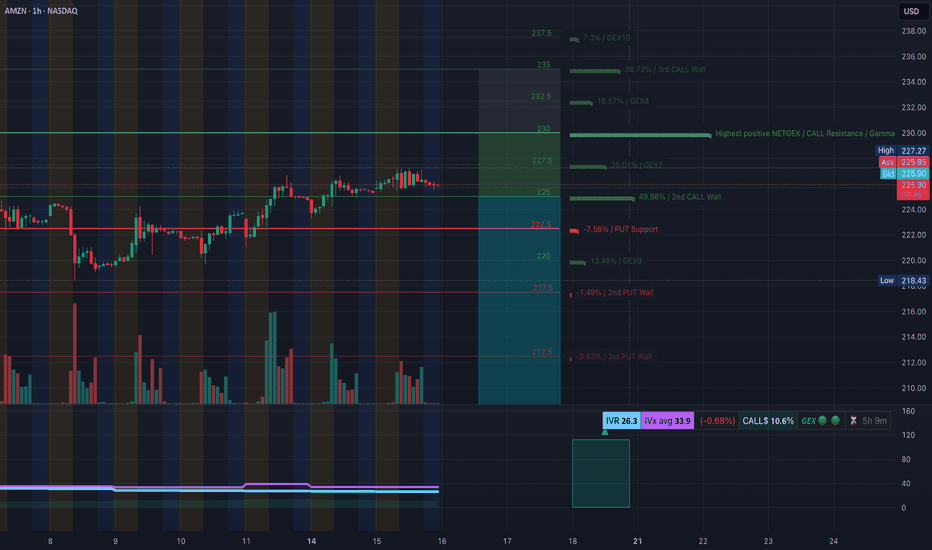

AMZN at a Crossroad! TA for July 16Options & Intraday Trading Setups to Watch This Week 🔍

🧠 GEX Analysis & Options Sentiment (Tanuki)

* GEX Sentiment: Mildly Bullish

* CALLs Volume: 10.6% → Neutral-to-Weak Bullish

* IV Rank (IVR): 26.3 → Low implied volatility rank

* IVx Avg: 33.9 → Neutral options environment

Gamma Walls / Levels to Note:

* Resistance (Call Walls):

* $230 = Highest positive NETGEX / Resistance

* $232.5 = GEX8 (18.57%)

* $235 = 3rd Call Wall

* Support (Put Walls):

* $222.5 = Strongest GEX Put Support

* $220 = GEX6 (13.48%)

* $217.5–$212.5 = Additional soft Put Walls

→ Suggested Option Plays Based on GEX:

* Bullish Scenario (above 226.5):

* Buy $230C expiring this or next week. Target resistance at $230–$232.

* Avoid heavy premium; use spreads for low IV.

* Bearish Scenario (breaks 222.5):

* Buy $220P if price loses $223 with volume confirmation.

* Add $217.5P runner if 220 breaks.

📉 1-Hour Chart Technical Setup (SMC, CHoCH, BOS)

* Market Structure:

* Still in Uptrend but showing early weakness.

* Recent CHoCH formed at 225.80 area, BOS confirmed below intraday trendline.

* Key Price Zones:

* Support Zone: 222.5–219.7 (Demand + GEX Put wall)

* Resistance Zone: 226.6–230.0 (CHoCH supply + GEX CALL wall)

* Trendline Watch: Bullish channel tested, rising diagonal support still holds.

* Breakdown Risk: Below 223 could flip structure to bearish short-term.

📊 Trading Plan Based on Price Action:

If Bullish:

* Entry above 226.6 (hold above BOS + reclaim trendline).

* Target: 230 → 232.5

* Stop-loss: Below 225.3

If Bearish:

* Entry below 223.3 with candle close.

* Target: 220 → 219.7

* Stop-loss: Above 225.5

Scalpers: Watch for liquidity sweeps at 225–226 for fast rejection or reclaim setups.

Swing traders: Wait for clean direction post-break of 230 or 222.5.

🧭 Final Thoughts:

AMZN is consolidating under gamma resistance at $230 while sitting on soft structure. Options are pricing in a neutral bias, but a breakout could cause a gamma squeeze above $230. Watch the CHoCH and BOS areas closely this week. Stay reactive — let price lead.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk responsibly.

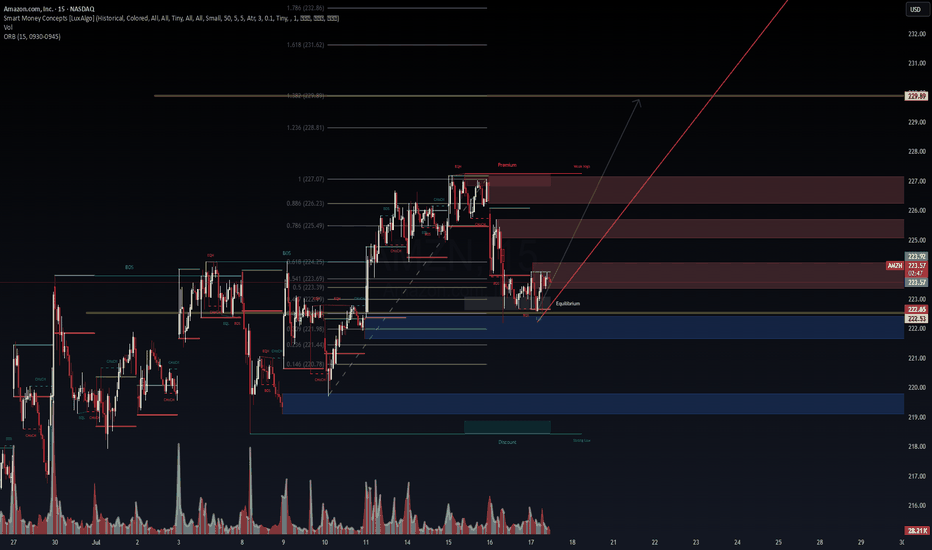

AMZN 15m – Institutional Demand Reclaim in Progress | VolanX Pro📈 AMZN 15m – Institutional Demand Reclaim in Progress | VolanX Protocol Alert

Amazon (AMZN) is staging a potential bullish reversal from a deep discount zone following a strong rejection near the 0.146–0.236 Fibonacci confluence at ~$220.78–221.44. We are now consolidating near the equilibrium zone (223) with signs of early accumulation.

📊 Technical Thesis:

Break of Structure (BOS) at 223.92 sets short-term bullish intent.

Reclaiming the ORB high and equilibrium.

Price rejected from deep demand (blue zone) and now printing EQH + BOS microstructures.

Premium liquidity sits above 227–229, with a magnet at FIB extension 1.618–1.786 = 231.62–232.86.

Volume profile shows declining sell pressure post-demand sweep.

📌 Key Levels:

Support: 222.53 | 221.44 | 220.78 (deep value zone)

Resistance: 226.23 (0.886 FIB) → 229.89 (FIB target zone)

Smart Money Premium: 226.5–229.8

🧠 VolanX Protocol Bias:

This is a long-biased setup, favoring institutional reaccumulation. If AMZN maintains above 223 with volume absorption, we anticipate a liquidity sweep through the premium zone, targeting 229.89.

🎯 Probabilistic Targeting:

60% → Retest 226.23 (EQH magnet zone)

30% → Breakout and reach 229.89 (measured move)

10% → Breakdown below 222.53 invalidates the setup

⚠️ Risk Note (VolanX Standard):

This post reflects strategic technical modeling, not financial advice. Trade your own system. View this as a signal integrity alignment, not a directive.

AMZN: Daily Trend Change with Bullish Continuation Setup

🗓 Published: June 26, 2025

📍 Ticker: NASDAQ:AMZN – Amazon.com Inc.

🕒 Timeframes: Daily & 4H

📊 Technical Bias: Bullish

📈 Trend: Higher Highs & Higher Lows

🧠 Analysis Summary

Amazon has successfully reclaimed a bullish market structure on the daily chart by forming higher highs and higher lows since late April. Price is now retesting a key support zone around $209–$212, which aligns with both horizontal support and the rising trendline.

On the 4H chart, the price is stabilizing near the trendline support, offering a high-probability long entry setup if the current structure holds.

📍 Key Levels

Price Level Description

206.28–206.42 Key support zone (invalidation area)

209.06 Local demand area

212.06 Retest level, potential entry

214.76 Local high / minor resistance

219.92 Intermediate target zone

225.22–225.29 Main bullish target / resistance

✅ Trade Setup

Entry Zone:

🔵 Long between $209.00 – $212.00 on confirmation of support

Take Profit Targets:

TP1: $214.76

TP2: $219.92

TP3: $225.22–225.29

Stop Loss:

🔴 Below $206.00 (break of structure + trendline invalidation)

Risk:Reward Potential: ~1:2.5

🔍 Confluence Factors

Daily trendline acting as dynamic support

Demand zone overlap at $209

Volume spike near base, suggesting buyer interest

Higher low formation + potential breakout of local range

⚠️ Risk Note

Only valid if price holds the $209–$212 demand area. If $206.00 is broken with strong bearish candles, the long setup is invalidated and a reassessment is required.

💬 Do you think AMZN will reclaim $225 by earnings? Let me know your outlook!

🚀 Stay patient, follow price structure, and manage your risk properly.

Rendon1

AMZN Sitting on a Key Launchpad – What’s Next? for July 14🧠 GEX Analysis & Option Strategy:

* Gamma Wall / Resistance: $225

* Next Major Call Walls: $227.5 → $230 → $235

* Call Side Dominance: 13.3% Calls, low IVR at 27.4, IVx avg 38.9

* Put Support: $217.5 / $213.5

* GEX Bias: Mildly bullish bias above $225 — price is floating at Gamma Wall.

🟢 Bullish Option Play:

* Scenario: A breakout above $227.5 could ignite a gamma squeeze to $230–$235.

* Strategy:

* Buy AMZN 230C (7/19 or 7/26 expiry) on breakout above $227.6

* Stop: Break below $224

* Target: $230 → $234

* Lower IV makes calls cheaper; strong momentum + low IV = favorable R/R.

🔴 Bearish Hedge:

* Scenario: Rejection at $227.5 and fall below $224 zone

* Strategy:

* Buy AMZN 220P or 217.5P (7/19 expiry) if price breaks below $224.

* Target: $217 → $213

* Only valid if we break structure below trendline and BOS flips.

📈 1-Hour Chart Technical Outlook (Smart Money Concepts):

* CHoCH → BOS → Retest is confirming bullish structure.

* Price broke out of prior range (purple box around $224–$225).

* Current Setup: Minor pullback to the OB or top of range ($224.5–$225) is underway.

* Structure favors retest long entries unless we break the ascending trendline.

Key Levels:

* Support Zones:

* $224.50 (retest demand/OB)

* $222.26 (ascending trendline + structure confluence)

* Resistance Targets:

* $227.5 → $230 → $232.5 (GEX targets)

📌 Long Setup:

* Entry: $224.6–$225 (on OB retest)

* Stop: $222.25

* Target: $230–$232.5

* Confirmation: Look for bullish candle at the retest zone

⚠️ Bearish Scenario:

* If price fails $224 and breaks structure at $222.25, anticipate reversal into $219.70–$217 zone. Watch price reaction there for potential swing support.

🧭 Thoughts & Summary:

* AMZN has triggered a clean BOS and now consolidates just under a GEX breakout level.

* The next move will likely be decided early in the session — either a strong push through $227.5 → gamma ramp toward $230+, or failure and fade back toward $222–$219.

* Call buyers may find a good breakout play while keeping tight stops under the OB.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

Real Sellers Vs Passive Sellers AMZNHello I am the Cafe Trader.

I was fortunate enough to get an editors pick, and I wanted to expound on how I came to those conclusions.

In this video we talk about passive sellers vs aggressive sellers and how we identify them. Also why it's important to identify these players in the market. This will help give you depth and help you get really good pricing in the markets.

Hope you enjoy the voiceover, Feel free to take a look at the previous article that this was pulled from on my profile.

Please share a boost if you enojoyed, and consider following for more.

Until next time! Happy Trading!!

@thecafetrader

AMZN HEADING INTO AUG 25'SHORT AMAZON

Amazon is current going to retest all time highs.

I want amazon again for a buy in the $209-218 range.

I don't think see Amazon below $208 again.

Going to fail on retest of ATH right now and cool off, bring rsi down back to 50-60 Zone, before consolidating for a break of the all time highs to close out the year.

Amazon always shines in Q4 with Holidays, so expect a great close to the year, but it's an overbought stock right now. (isn't it always??...lol)

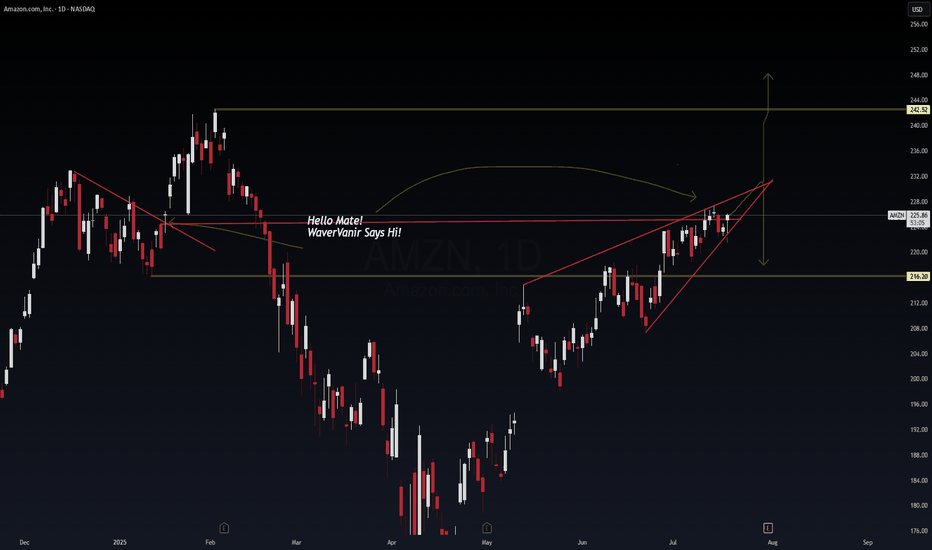

AMZN – Wedge Complete, Decision Imminent📦 AMZN – Wedge Complete, Decision Imminent

Price action has carved out a clean rising wedge into a known inflection zone. The top of this formation aligns with a macro breakdown level from Q1—likely to attract both breakout chasers and smart sellers.

📍 Key Levels:

Bull Break Target: $242.52

Bear Breakdown Target: $216.20

Decision Point: ~$228

This is a textbook volatility pocket. WaverVanir's DSS signals suggest we're nearing exhaustion. Watch for confirmation before positioning.

⚙️ VolanX Protocol – Predictive AI meets Market Structure.

#AMZN #WaverVanir #VolanX #SmartMoney #TradingView #NASDAQ #WedgePattern

AMZN Near Critical Pivot AMZN Near Critical Pivot – Option Traders, Watch These GEX Levels Carefully!

🧠 GEX Analysis for Options Trading:

Amazon is sitting right below its Gamma Wall at $225, which aligns with the highest positive NETGEX, suggesting a significant resistance zone. There's a clear call wall stack at $227.5 and $230, with GEX values ramping up between $223.5 to $232.5, pointing to a possible squeeze if price starts reclaiming the $222.5–$225 range. However, the current rejection confirms short-term hesitation.

* Put Support builds around $215, with the PUT wall at $212.5 and heavy GEX defense at $217.5.

* Current GEX sentiment leans slightly bullish (📗), but with only 9.8% calls and IVR/IVX at 3.1/3.5, the market seems cautious—no extreme positioning or imbalance.

* IV is relatively low, which means option premiums are cheap—ideal for debit spreads or directional calls if price starts reclaiming $222.

🟢 If price breaks back above $222.5 with volume, consider long calls targeting $225–$230.

🔴 If it breaks down below $217.5 with momentum, puts toward $215 or even $212.5 become attractive.

📉 1-Hour Chart Technical Outlook:

Price structure has clearly shifted bearish following a confirmed CHoCH (Change of Character) beneath a previously bullish zone around $223–$224. There's been a break of trendline support, and price is currently consolidating just above the $217.5–$218.75 key support zone, which aligns with HVL and GEX defense.

* Previous BOS and CHoCH zones have now flipped into supply, and unless bulls reclaim $222.5, rallies may be sold into.

* A liquidity sweep could develop toward $215 or $212.5 before any rebound.

* Volume spike on the drop shows seller aggression. Reclaiming the broken OB (purple box) could flip bias back short-term bullish.

🟢 Scalp Long above $220.5 toward $222.5–$224 if buyers step in on reclaim.

🔴 Scalp Short below $217.5 targeting $215–$213.

⛔ Stay out in the chop zone between $218–$220. Let the market show its hand.

🎯 Key Trade Suggestions:

* Call Option: Break/retest $222.5 → Buy $225C / $230C (Jul 12/19 expiry)

* Put Option: Break $217.5 → Buy $215P / $212.5P (Jul 12/19 expiry)

* Spread Idea: If long bias confirmed, $222.5/$227.5 call debit spread offers low IV play

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

AMAZON STRONG UPTREND|LONG|

✅AMAZON is going up

Now and the stock made a bullish

Breakout of the key horizontal

Level of 220$ and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AMZN Coiled at Key Gamma Level! Trade Setup Inside📊 GEX (Options Sentiment) Analysis – AMZN

* Current Price: $223.20

* Gamma Wall (Call Resistance): $225 – Highest Net GEX, significant resistance zone.

* CALL Walls: Stack from $225 → $230 → $232.5 → $235

→ Suggests upside resistance builds fast; option sellers may try to cap the rally here.

* PUT Wall Support: Cluster at $215 → $212.5 → $210

* GEX Sentiment:

* GEX: ✅ (Green)

* IVR: 32.2 | IVx Avg: 35.6

* CALLs Positioning: Low (5.9%), moderate skew

* Interpretation:

Price pinned near $225 likely due to gamma forces. Any close above could trigger a quick gamma chase toward $230–232+. But failure = fast fade back to $215 support.

📌 Options Strategy Suggestion:

* Bullish Setup: Wait for break/close > $225. Consider vertical debit spreads (e.g., 225c/230c) for limited risk.

* Bearish Rejection: If AMZN gets stuffed at $225 again, short-term PUT spreads toward $215 are viable (e.g., 222p/215p).

🕐 1-Hour Price Action + SMC Intraday Trade Plan

* Structure:

* BOS → CHoCH → Sideways in tight range between $223–224.50

* AMZN is consolidating inside a tight breaker block zone under $225.

* Uptrend channel still valid with higher lows holding.

* Support: $221.88 → $218.75

* Resistance: $224.66 → $227.12

* Bias: Neutral to mildly bullish unless $221 fails.

🔍 Intraday Trade Scenarios

1. Breakout Play (Bullish):

* Trigger: 1H candle closes above $224.66 with volume

* Entry: $225.10

* Target: $227.10 → $230

* Stop: $222.80

2. Fade Play (Bearish):

* Trigger: Break below $221.88 with CHoCH

* Entry: $221.60

* Target: $218.75 → $217.00

* Stop: $223.40

Watch the box: AMZN is stuck in a decision zone. Don't chase. Let it break first.

Final Thoughts:

AMZN is coiled tightly beneath its Gamma Wall. A clean break could trigger aggressive movement either way, so position sizing and stop discipline are critical. Avoid overtrading inside the box.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trade responsibly and manage your risk.

Amazon I Strong Bullish Outlook Welcome back! Let me know your thoughts in the comments!

** Amazon Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

AMZN Gamma Setups + Trade Plan for July 7📡 GEX-Based Option Trading Analysis

Amazon (AMZN) shows bullish option flow into next week. The GEX map highlights the following:

* Highest Net GEX sits at 225, acting as a strong magnetic price level / resistance zone.

* There’s a Call Wall cluster at 225–230, which could cap short-term upside unless we break through with strong momentum.

* IVR: 27.5 — moderately elevated, giving decent premium for calls.

* Calls: 8.8% vs. Puts: neutral – bullish skew with gamma support underneath.

* Support zone: 215–213 (GEX floor + HVL + PUT wall).

* A break above 226 opens doors to a potential squeeze into 230–232.

🟢 Trade Idea for Options:

* Directional Bullish Bias above 223.

* Consider buying July 12th 225C or vertical 223/230C debit spread for a lower risk play.

* Use tight stop if price fades below 219.75.

📈 1-Hour Chart Technical Setup

From the 1H chart:

* AMZN broke structure (BOS) above 223 and reclaimed the trendline.

* Price has broken out of the previous supply zone (highlighted in purple) and is retesting it now.

* 9/21 EMA shows bullish crossover; price holds above trendline with rising volume.

* Strong support confluence around 219–221 from CHoCH, EMA, and structure lows.

* Bias remains bullish continuation as long as price holds 221.60–222.

🧠 Scalping Plan (Intraday):

* Long setup: Look for retest entry at 223.00 or 222.50, stop below 221.50, target 225.60, then 227.50.

* Avoid chasing if price gaps above 226. Wait for retrace back into structure.

* Bearish invalidation only below 219.

🎯 Final Thoughts:

* AMZN is entering a gamma-rich zone. Watch 225 reaction — breakout could spark a run to 230+.

* Options look primed for bullish plays. Chart structure supports a breakout continuation.

* Trade with tight stop-losses, especially ahead of CPI next week.

This analysis is for educational purposes only and does not constitute financial advice. Always manage risk and do your own research.

AMAZON Will Keep Growing! Buy!

Hello,Traders!

AMAZON is trading in an

Uptrend and the stock made

A breakout and retest of the

Key horizontal support

Of 218$ and is going up again

So we are bullish biased

And we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

APPLE: 1st 1D Golden Cross in 2 years just formed.Apple is bullish on its 1D technical outlook (RSI = 67.490, MACD = 1.760, ADX = 17.850) and yesterday it started forming the first 1D Golden Cross in more than 2 years. This signals the extension of the 2nd major bullish wave of the 3 year Channel Up. The previous one made an incredible extensino to +78.49%. That gives us the target to work with for the rest of the year. The trade is long, TP = $290.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##