Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.93 SGD

2.78 B SGD

19.54 B SGD

1.40 B

About SIA

Sector

Industry

CEO

Choon Phong Goh

Website

Headquarters

Singapore

Founded

2009

ISIN

SG1V61937297

FIGI

BBG000BFDQY4

Singapore Airlines Ltd. engages in the provision of passenger and cargo air transportation services. It operates through the following segments: Full-Service Carrier, Low-Cost Carrier, Engineering Services, and Others. The Full-Service Carrier segment includes Singapore Airlines brand with a focus on full-service passenger serving short and long-haul markets. The Low-Cost Carrier segment focuses on the Scoot brand serving low-cost passenger markets. The Engineering Services segment provides airframe maintenance and overhaul, line maintenance, technical ground handling, and fleet management services. The Others segment is involved in tour activities and selling merchandise. The company was founded on January 28, 1972 and is headquartered in Singapore.

Related stocks

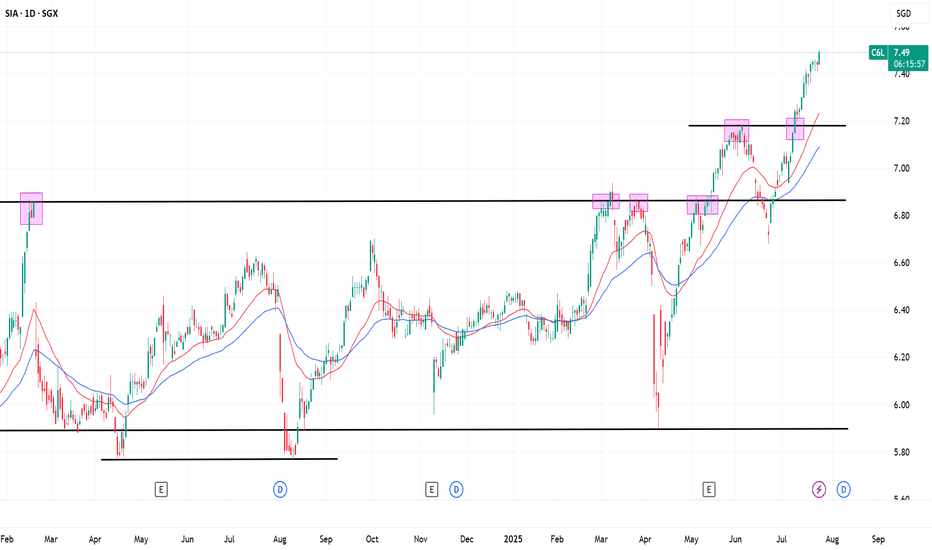

SIA Testing $6.86 Resistance Ahead of 15 May EarningsSingapore Airlines (SIA) is testing a key resistance at $6.86 as it gears up to announce its full-year results on 15 May. The drop in oil prices could give the company a boost with better margins.

If it breaks above $6.86, we might see more upside. But if it fails, a short-term dip over the next 7

Singapore Airlines (SIA) Finds Support at 5.87 After Recent DownSingapore Airlines (SIA) has experienced a notable downturn in its share price over the past weeks, reflecting broader market concerns and a prevailing negative sentiment. After this period of decline, the stock is now finding support around the 5.87 level.

We are back!! $SIA(C6L.SI) Showing sign of bottomHas been away awhile from here! Hope everyone is doing well in the stock market! Let's dive into our analysis on SIA C6L

Recent fall shows signs of volume supporting the price at the previous low in the 5 mins chart (yellow box).

With price moving slightly higher could be a sign of short term reb

SIA shows sign of price peakRecent rebound in SIA shows multiple high volume in 5 mins chart yesterday with limited price up.

This indicates the big boys are churning at the high price to creates Fear-Of-Missing-Out to retail investors to place order in.

When there are enough buyers at the lower pricing, the big boys will s

Singapore Airlines (SIA : C6L) targets $7.00 and attempts to breLong term DOWNTREND SINCE 010908

Medium term UPTREND since 111021

Short term UPTREND since 311022

Singapore Airlines is 1 of 8 component stocks supporting the rise of the STI at the start of 2023.

The long signal for this recent run started on 311022 at the price of $5.21.

$7.00 is a significant

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SINGY5137538

Singapore Airlines Limited 3.0% 20-JUL-2026Yield to maturity

4.70%

Maturity date

Jul 20, 2026

SINGY5808290

Singapore Airlines Limited 5.25% 21-MAR-2034Yield to maturity

4.70%

Maturity date

Mar 21, 2034

SINGY5391269

Singapore Airlines Limited 3.375% 19-JAN-2029Yield to maturity

4.69%

Maturity date

Jan 19, 2029

XS226002529

SINGAP.AIRL 20/25 CVYield to maturity

−81.28%

Maturity date

Dec 3, 2025

See all C6L bonds

Frequently Asked Questions

The current price of C6L is 6.82 SGD — it has increased by 0.29% in the past 24 hours. Watch SIA stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SGX exchange SIA stocks are traded under the ticker C6L.

C6L stock has fallen by −9.55% compared to the previous week, the month change is a −2.85% fall, over the last year SIA has showed a 6.56% increase.

We've gathered analysts' opinions on SIA future price: according to them, C6L price has a max estimate of 7.00 SGD and a min estimate of 5.50 SGD. Watch C6L chart and read a more detailed SIA stock forecast: see what analysts think of SIA and suggest that you do with its stocks.

C6L stock is 1.92% volatile and has beta coefficient of 0.83. Track SIA stock price on the chart and check out the list of the most volatile stocks — is SIA there?

Today SIA has the market capitalization of 20.68 B, it has increased by 2.35% over the last week.

Yes, you can track SIA financials in yearly and quarterly reports right on TradingView.

SIA is going to release the next earnings report on Nov 13, 2025. Keep track of upcoming events with our Earnings Calendar.

C6L net income for the last half-year is 2.04 B SGD, while the previous report showed 742.00 M SGD of net income which accounts for 174.39% change. Track more SIA financial stats to get the full picture.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SIA EBITDA is 4.13 B SGD, and current EBITDA margin is 21.16%. See more stats in SIA financial statements.

Like other stocks, C6L shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SIA stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SIA technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SIA stock shows the buy signal. See more of SIA technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.