RTX hitPrice hit the RTX sell signal in yesterday's trade and subsequently dived back down to the opening level. That followed today with an opening around yesterday's close.

PPMs are down for the day but predicted to see some buying back over the next 2 days or so. After all, we did already hit low fib target 1.

So is the selling over? Judging by the PPM outlooks, I would think there would be 1 more push to the downside before we get over this selling phase. But only time will tell.

ES3 trade ideas

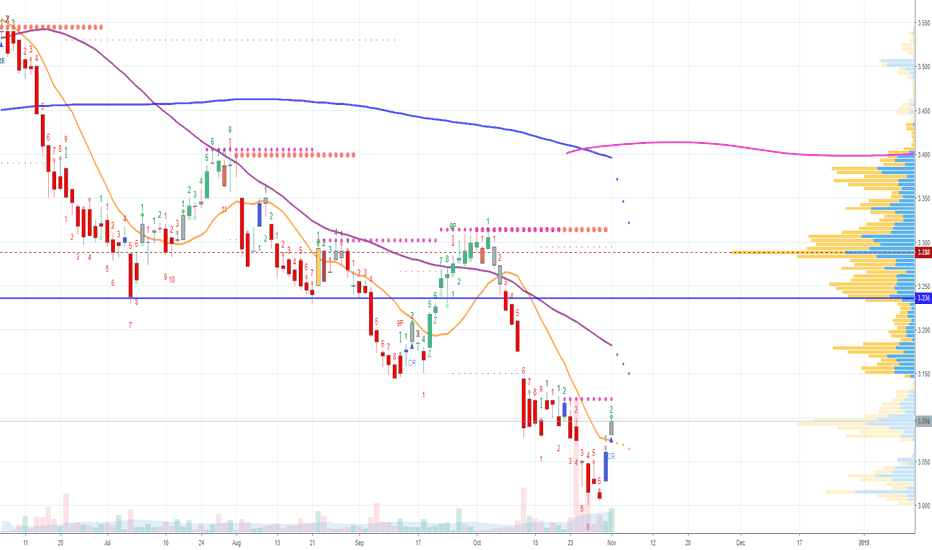

Short STI $ES3 the only clown in [global] town leftThe Straits Times Index seems to be lagging into bounces recently, Nikkei and SHCOMP has already bounced into their targets and are consolidating whereas the Singapore index has yet to find proper footing. At this moment the STI has gapped open and is heading straight into its 3W resistance at 3076. With little to no real support it is a prime short opportunity.

Intention: Short $ES3 @ 3.118 corresponding STI @ 3075

SL: ES3 @ 3.127

Caution: The Singapore market and STI is notorious for illiquidity and thus, traders must watch out for liquidity traps. Opportunities might be present but liquidity might not.