Buy, hold, and let those sweet returns melt in your portfolio!Guys, we all know the sector rotational for consumer defensive is now rebounded

regardless the sector rotation or tariffs noise, agribusiness and sugar remains an essential commodity in our daily life.

There are strategies that Wilmar has taken for the past 3 years. We have seen the share price is being strongly supported at SG$3.03.

Given the essential nature of sugar, Wilmar’s strategic positioning, strong financials, and resilient consumer demand, this could be an opportune time to buy and hold for long-term gains.

🗝️ Key Investment Considerations:

Strong Technical Support – Wilmar’s share price has consistently held above SG$3.03, indicating a solid support level.

📙 Fundamental Strength – The company has a wide economic moat, benefiting from its integrated agribusiness model.

💰 High Insider Ownership – With a 74.7% stake held by major investors, management has significant “skin in the game.”

SGX:F34

📌 Investment Call: Buy & Hold (24-36 months)

🎯 Target Price: SG$4.46

💰 Potential Upside: 33%

📈 Dividend Yield: ~5.13% (TTM)

Wilmar International (stock symbol: F34.SI) dividend yield (TTM) as of March 27, 2025 : 5.13%

Average dividend yield, last 5 years: 4.1% (including 2024)

W Chart - crossing above zero line for MACD indicator

F34 trade ideas

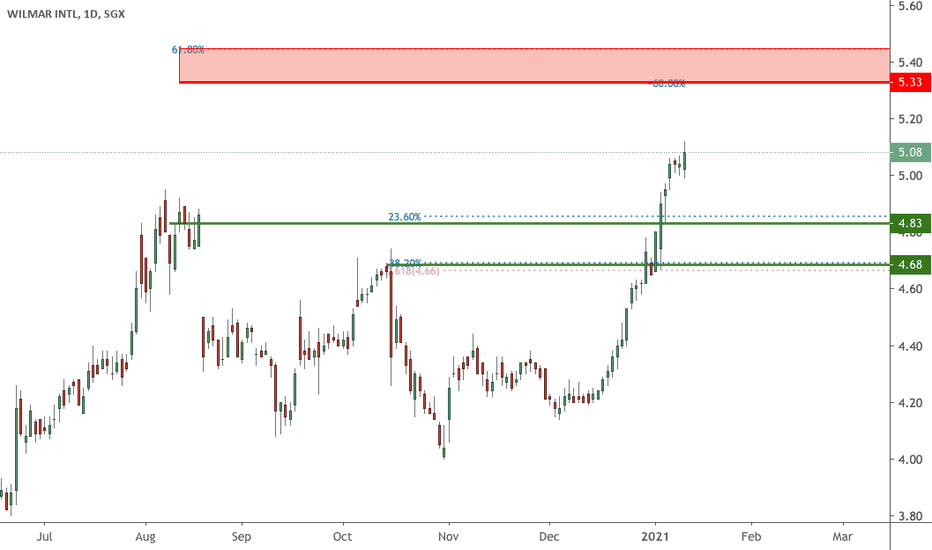

Selling in Wilmar International is almost done .....At least I think so........haha

It has dropped almost 27% from its peak at 5.64 and the price has gone south ever since. By drawing the support line and the channel where the current price is forming, we can exercise slightly more patience before picking up this stock.

This wait could be days or weeks or even months. Meanwhile, you can better deploy your capital elsewhere. Again, what suits my style may not be suitable for you since I do not know your investment objective, reason for picking up Wilmar International ,etc.

Please do your own due diligence

[Analysis] Wilmar, consolidating but...Wilmar, the big cap (at least by Singapore's standard) agriculture/soft commodity counter on SGX. This is the only option you have on SGX unless you want exposure to the more manipulated or less diversified businesses like IndoAgri, Bumitama Agri, Golden Agri, etc...

Yet, compared to its US counterparts like Archer Daniel Midland or Bunge Limited, Wilmar is severely underperforming.

4.00 has been a long-term support since Oct 2020 which act as a launchpad for a rally to 5.64

Wilmar rallies from 4.00 again in Dec 2121, but this time, it only reaches 4.89. This is a hit of a lower high.

Since June, the price is now consolidating again at 4.00. Its earning euphoria rally on 05 Aug 2022 was stopped dead in its track. This is not surprising as selling has been seen at 4.20-4.30 as early as May.

This resistance at 4.20-4.30 may be hard to break. Between this resistance and the support at 4.00, this is an extremely narrow range to play. Price may get stuck within this area until the sell side or buy side takes over. 4.00 is the crucial support level if you are looking to buy.

If the price breaks down below 4.00, bulls should be careful.

If you want to play soft commodities, US have better options and they perform better

WILMAR- Super Bullish Trend Coming ?

Wilmar's food business is revolving around agriculture products which includes soy bean crushing, wheat flour milling, crude palm oil in both upstream and downstream sides, & sugar plantation & distribution network.

With all the rising commodities for all these products above with the rising food prices across the world, seems imminent that the upcoming profit going to be fantastic.

not surprise super bullish cycle is brewing for agriculture products commodities and this should drive Wilmar profit and share price high up .

F34 (Wilmar Int) - SGX - Bullish PredictionHumbled, we would like to thanks for your support who has already liked, commented and followed us.

Your support, strengthens us, to help in analyzing the market.

Do not be hesitant to send us message, if u have question, or any request for stock analysis.

F34 (Wilmar Int) - SGX - Bullish Prediction

Riding on the China Wave I recently took a small position in this company after having missed a good entry at 3.40 some months back.........

Read this article here

If you understand the Chinese food culture, you would then know that cooking oil is a necessary ingredient in many cuisines. What's not to like, it has a reputable brand name that many households are using (another sticky point that I like).

4.37 is a relatively strong support and yesterday plunge was a good entry for those who are keen to consider going long.

STI Wilmar F34 seeks $4.54 to resume uptrendWilmar resumed its uptrend LT in July 2019.

Multiple buy signals MT and ST were issued on 270720 and 250920 @$4.41-$4.46

PIVOT : $4.54

Buy at the break and hold above $4.54

Target ATH of $7.29

Stop Loss $4.36

A break of $4.36 will negate the ST buy signal and test $4.04

Wilmar - Half Empty or Half Full?Wilamr gapped down a hefty 10% after a major shareholder announced that it was planning to pare it's stake amounting to about 2.68% of the issued share capital (a large sum of about $500m). It traded as low as 4.31 before rebouding a little to about 4.37 now.

There are a confluence of 3 supports between 4.35-4.38 region (a horizontal support, trendline support as well as 50% fib retacement here). Could be worthwhile to test some longs here for an eventual rise to 4.75 (gap fill). Initial Stop Loss @ 4.29. Should we get stopped out, I will relook it as it approaches the 61% fib retracement level @ 4.20.

Disclaimer: This is just my own analysis and opinion for discussion and is not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance. Thank you.