O39 trade ideas

OCBC further price decline? www.tradingview.com

Looking for alternative interpretations!

Money Flow Index: 33.24, small room for further decline. Might also be biased towards 27th May distribution volume ex dividend. (Uncertain)

CMF: - 0.29 as of 29th May. Major sell off unlikely, limited room for major demand declines (Uncertain)

Moving Averages: Likely for 14 day SMA to cross under 50 day SMA (Bearish)

Fib Retracement: Resistance at 9.07 (38.2%) remains untested, period selected from 20th Feb to 23rd March for Fib Levels (Bearish)

MACD: MACD line crossed under Singal Line, unlikely to break above the 0 line into positive territory soon (Bearish)

Side note, Bollinger Bands look to be tightening, may have stronger price action soon, hopefully to lower price levels!

End May Events:

- Rising U.S-China Tensions over HK security legislation

- Protests emerging across U.S, George Floyd incident

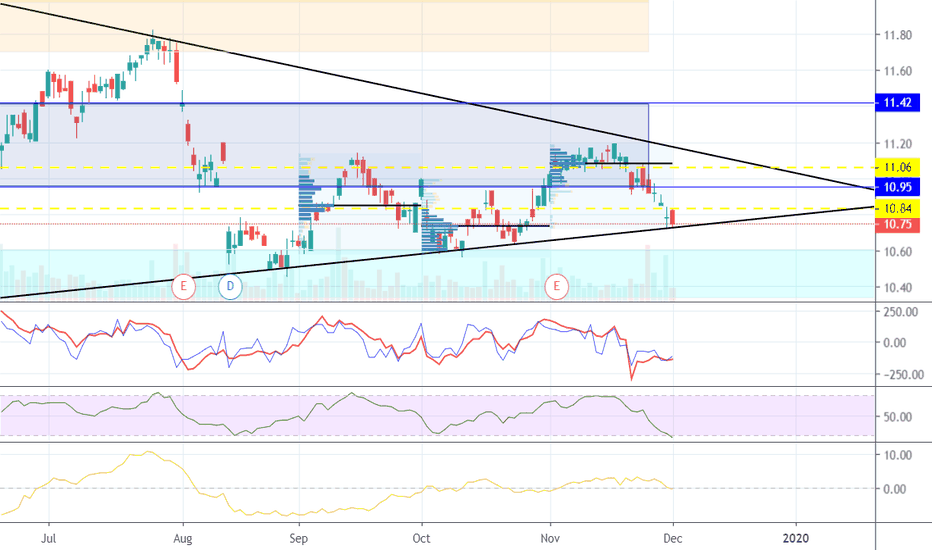

OCBC - Rising wedge!Consider it a Rising wedge or a flag/pennant (on longer timeframe). Both in my view are bearish formations in current context. Look out for the breakdown of the wedge. Target should be recent low atleast.

However, I also see a cup and handle formation, therefore, bets off if the recent high is taken out and goes above the wedge formation.

Disclaimer: Not a recommendation to buy or sell.

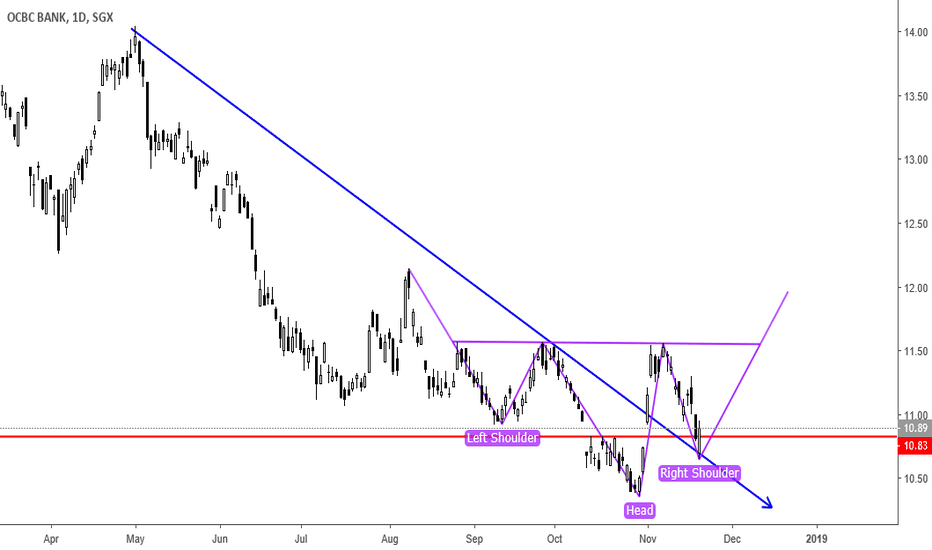

OCBC Bank - time to nibble?The banks have been selling off due to a lower interest rate environment which now gives rise to the opportunity for some short or swing trade at smaller risk levels.

OCBC Bank hit into a long term trendline support as well as a med term horizontal support this morning and is now bouncing off these supports. I will be going long with a stop just below this morning's low of 9.35 and is looking to take partial profit at the gap close 10.20 or swing for higher with trailing stops.

Disclaimer: This is just my own analysis and opinion for discussion and is not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance. Trade safe! Thank you.

OCBC - SL @ 2ATRLaggard Stock among the 3 local Singapore Banks: DBS, OCBC and UOB.

Cleared the 1st hurdle (above moving average, cloud and downtrend resistance line). '

Will it be able to clear 2nd hurdle (maintain above the 1st hurdle, clear the 11.19 level and the next downtrend resistance line)?

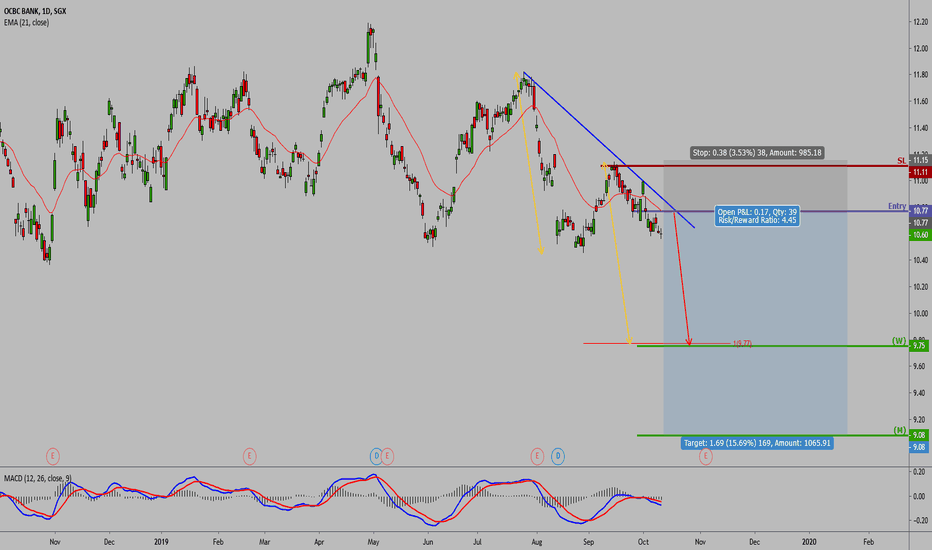

OCBC [1-3 weeks view]SHORT OCBC

Entry: 10.77

TP1: 9.75

TP2: 9.08

SL: 11.15

Market holding below natural moving average and descending trendline resistance.

MACD in bearish territory

Trade safe guys! Feel free to reach out to me if anything!

Cheers

**Trading is a high risk activity. Follow my personal calls at your own discretion. Always do your own due diligence and analysis. I do not take any responsibility for your losses**