PropNex (OYY:SGX): Earnings OptimismAnalysis Forecast:

Expect to Retest Resistance at S$2.20

Analysis is For:

Swing Trading - Generate Portfolio Alpha

Supporting Technical Observations:

1. Sign of Strength (large volume on buy up day)

2. Fund Flow Index (FFI) Turned Positive

3. Stochastics Bullish reversal

Stop Loss

If Pr

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.06 SGD

40.92 M SGD

782.95 M SGD

146.11 M

About PROPNEX

Sector

Industry

CEO

Keng Seong Fong

Website

Headquarters

Singapore

Founded

1996

ISIN

SGXE65086469

FIGI

BBG00L7TWKW7

PropNex Ltd. engages in the provision of real estate services. It operates through the following segments: Agency Services, Project Marketing Services, Administrative Support Services, Training Services, and Others. The Agency Services segment relates to services rendered in the sale and lease of public and private residential and commercial or industrial properties. The Project Marketing Services segment represents services rendered in the sale of new private residential development projects for third-party property developers in Singapore as well as overseas. The Administrative Support Services segment offers use of space and other ancillary services. The Training Services segment delivers real estate related courses and training programs organized by the Group to salespersons. The company was founded by Mohamed Ismail and Tow Huat Lim in 1996 and is headquartered in Singapore.

Related stocks

OYY.SGX_Downtrend Line Breakout Trade_LongENTRY: 1.92

SL: 1.59

TP: 2.21

- ADX>20

- RSI>50,RSI<70

- Daily RS +ve

- Daily FFI +ve

- Daily MACD +ve

- Weekly RS +ve

- Weekly FFI -ve

- Weekly MACD -ve

- Reached high on 15 Jul 2021 and retracing since then.

- 6 Oct 2021 breakout of downtrend line with high volume.

- Today break above HVN and ano

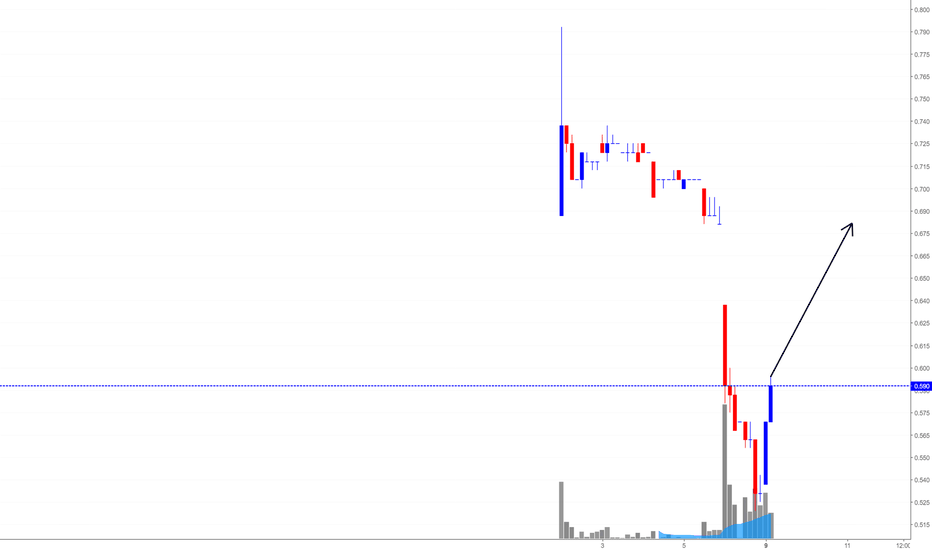

Propnex (SGX) (*Be careful with your short)PropNex

So, let's talk the immediate timeframe.

I am expecting they are going to close the gap.. $0.68 - $0.69 region is possible.

Press "Like" and "Follow".

Sonic

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute inve

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of OYY is 1.43 SGD — it has increased by 3.62% in the past 24 hours. Watch PROPNEX stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SGX exchange PROPNEX stocks are traded under the ticker OYY.

OYY stock has risen by 1.42% compared to the previous week, the month change is a 30.00% rise, over the last year PROPNEX has showed a 73.33% increase.

We've gathered analysts' opinions on PROPNEX future price: according to them, OYY price has a max estimate of 1.35 SGD and a min estimate of 1.14 SGD. Watch OYY chart and read a more detailed PROPNEX stock forecast: see what analysts think of PROPNEX and suggest that you do with its stocks.

OYY stock is 6.57% volatile and has beta coefficient of 0.58. Track PROPNEX stock price on the chart and check out the list of the most volatile stocks — is PROPNEX there?

Today PROPNEX has the market capitalization of 1.06 B, it has increased by 5.98% over the last week.

Yes, you can track PROPNEX financials in yearly and quarterly reports right on TradingView.

PROPNEX is going to release the next earnings report on Aug 19, 2025. Keep track of upcoming events with our Earnings Calendar.

OYY net income for the last half-year is 21.92 M SGD, while the previous report showed 19.00 M SGD of net income which accounts for 15.37% change. Track more PROPNEX financial stats to get the full picture.

PROPNEX dividend yield was 5.56% in 2024, and payout ratio reached 94.94%. The year before the numbers were 6.45% and 92.88% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 165 employees. See our rating of the largest employees — is PROPNEX on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PROPNEX EBITDA is 38.27 M SGD, and current EBITDA margin is 4.89%. See more stats in PROPNEX financial statements.

Like other stocks, OYY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PROPNEX stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PROPNEX technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PROPNEX stock shows the strong buy signal. See more of PROPNEX technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.