S27 trade ideas

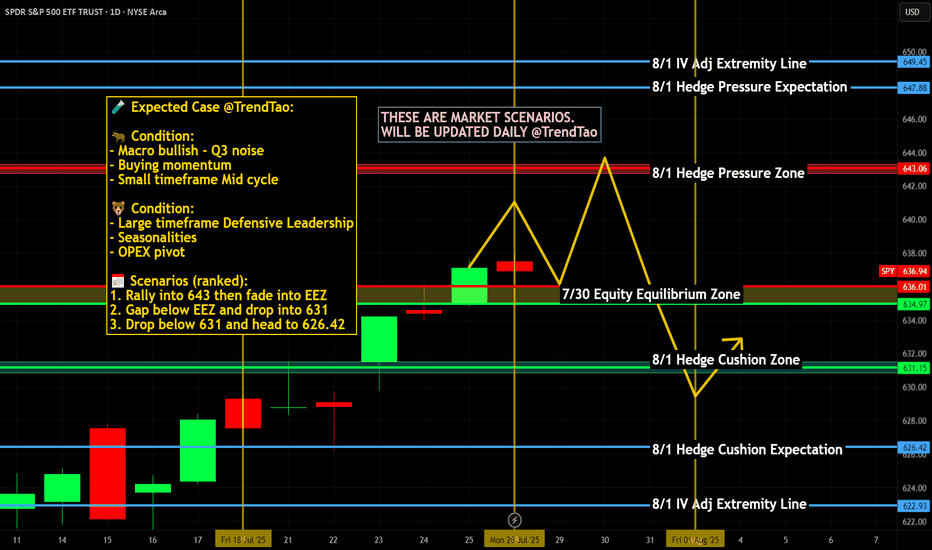

Nightly $SPY / $SPX Scenarios for August 1, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 1, 2025 🔮

🌍 Market-Moving News 🌍

📦 U.S. Imposes New Tariffs as Deadline Passes

Fresh tariffs rolled out on August 1 hitting major exporters: 25% on Indian goods, 20% on Taiwan, 19% on Thailand, and 15% on South Korea. Canadas tariff elevated to 35%, though Mexico got extra negotiation time. Global equity markets slipped modestly, led by declines in Asia-Pacific regions. AMEX:SPY futures also eased on mounting geopolitical and trade pressures.

🏦 Fed Uncertainty Mounts Despite Calm GDP

Despite robust Q2 GDP growth and a hold on interest rates this week, Fed Chair Jerome Powell faced growing unrest. Comments acknowledged downside labor risk amid trade uncertainty—investors are now assigning just a 39% chance of a rate cut in September.

📊 Key Data Releases & Events 📊

📅 Friday, August 1:

8:30 AM ET – Nonfarm Payrolls (July):

Payrolls rose by 106,000, less than June’s 147,000 but still positive. Wage growth slowed, easing inflation concerns slightly.

8:30 AM ET – Unemployment Rate:

Unemployment ticked up to 4.2%, from 4.1% in June—reflecting modest labor softness.

8:30 AM ET – Average Hourly Earnings (MoM):

Wages rose +0.2%, down from +0.4% in June, signaling wage pressure easing.

⚠️ Disclaimer:

This information is provided for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #jobs #Fed #tariffs #inflation #technicalanalysis

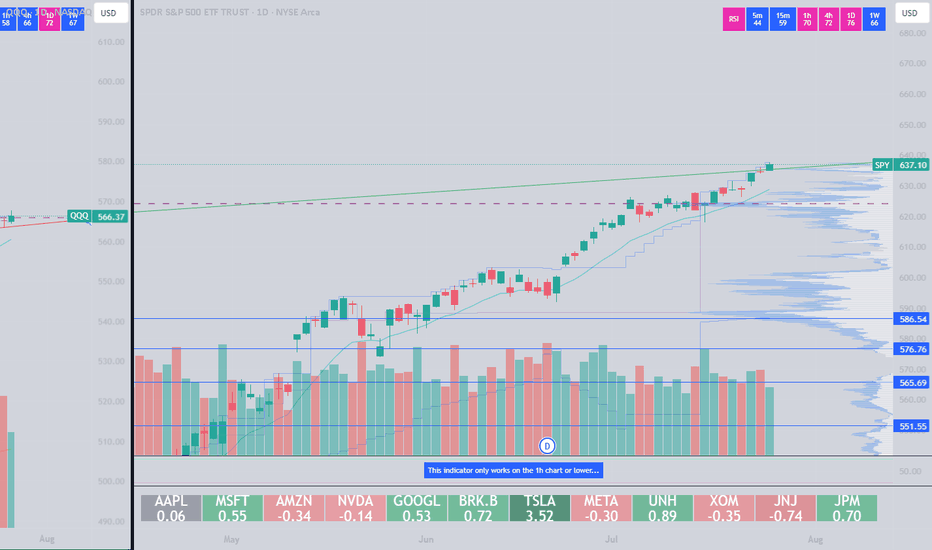

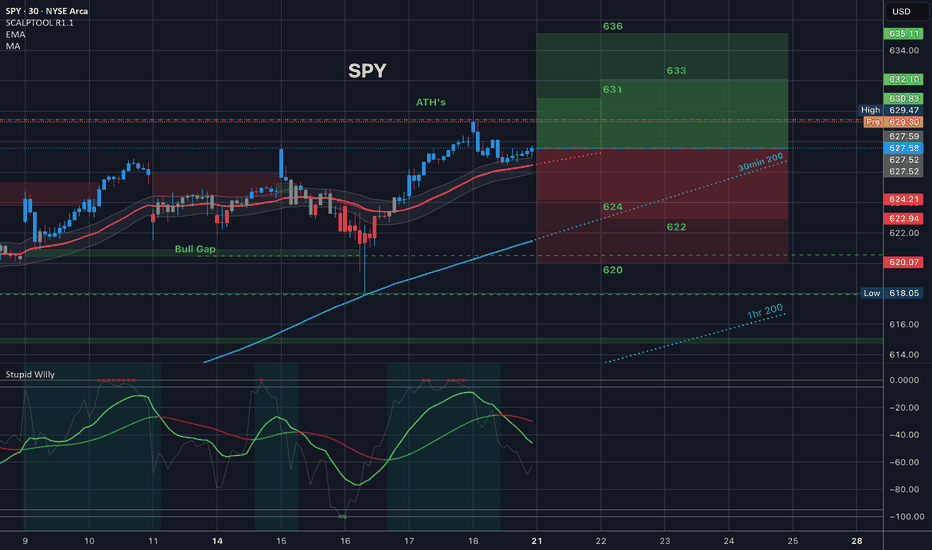

SPY at Decision Point! Gamma Walls vs. Rising Channel-Jul 28🧠 Technical Analysis (TA) – SPY Outlook

SPY is approaching a critical inflection zone near $638–$640, navigating through an ascending channel with compression in price action. This aligns with major Gamma Walls, offering both opportunity and risk. Here's the Monday breakdown using 1H, 15M, and GEX overlays:

🔍 Market Structure:

* 1H Chart shows a clean uptrend, forming a base around $637.50.

* 15M Chart reveals a consolidation zone after a Break of Structure (BOS), with a potential CHoCH below $636.65.

* Price is currently ranging inside a small supply zone and below an upper channel boundary.

🧲 GEX + Options Sentiment:

* GEX Extreme Gamma Resistance: $640–642 (strong CALL walls, potential reversal).

* PUT Wall Clusters: $634, $632, $628 (support zones on pullbacks).

* IVR: 12.4 – near low volatility.

* Put/Call $ Ratio: 51.4% Puts = Mild Bearish lean.

* NETGEX highest positive at $640 = Gamma magnet + potential resistance.

📌 Key Zones:

* Support: 636.15 → 634.42 → 633.00

* Resistance: 638.70 → 640.00 → 642.00

🟢 Bullish Scenario:

* If SPY reclaims 638.70 and breaks above channel top, watch for momentum toward 640–642, then reassess.

* 📥 Entry: 638.80+

* 🎯 Target: 640.40 → 641.80

* ⛔️ Stop: Below 636.65

🔴 Bearish Scenario:

* Failure to hold above 637.50 and break of CHoCH at 636.65 could invite pullback to 634.42 or even 632.90.

* 📥 Entry: Break & retest below 636.65

* 🎯 Target: 634.42 → 633.00

* ⛔️ Stop: Above 638.00

🔁 Scalping Levels (15M):

* Watch pink box consolidation zone (637.2–637.6) for breakout or rejection.

* Aggressive short scalp if early rejection from 638 near open.

🎯 Actionable Plan:

* Opening Above 638.70 = Lean CALLs, trail tight.

* Rejection at 638–638.5 = Look for PUTs back to 636.5/634.

* Clean break of 636.65 = Short bias opens for larger retrace.

* Gamma Squeeze possible only if > 640 holds and IV rises.

🧠 Thoughts:

SPY is coiling under macro resistance while IV remains low. Options market isn't leaning heavily bearish, but that could change if we slip below 636.65. Be mindful of the Gamma walls acting as magnets or reversion zones. This is a risk-defined week, so size down and react—not predict.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade with proper risk management.

S&P 500 Futures – Trendline Breach + AI Forecast Signals Major C📉 S&P 500 Futures – Trendline Breach + AI Forecast Signals Major Correction

VolanX Risk Engine Flags High Probability Downside

🧠 Narrative:

Markets have enjoyed a powerful uptrend off the March lows, but the structure is showing signs of exhaustion.

The ascending trendline—untouched for over two months—has now been breached.

Fibonacci levels cluster below current price, with critical demand at:

6319.25 (immediate test zone)

6179.25 (0.618 retrace)

5964.75 (macro support / VolanX institutional target)

Meanwhile, VolanX Protocol's predictive engine has shifted to a "Strong Sell" with a projected correction path clearly outlined. The 30-day price forecast (shown in red) leans toward a mean reversion toward 5842.12 by late August.

📊 Institutional Trade Plan (VolanX DSS):

Entry Zone: 6360-6380 (Confirmed breakdown retest)

Target 1: 6179.25

Target 2: 5964.75

Final Target: 5842.12

Invalidation: Close above 6480 (new highs with strength)

🔎 Risk/Reward: 3.4+

📈 Trend Deviation: 7.4%

📉 Bearish Conviction: 84.1%

📌 Key Insights:

Breakdown below trendline confirms shift in control to bears

Institutional models anticipate volatility-led selloff

Major liquidity rests below 6200 and 5960 zones

This is not the time to chase highs—risk is asymmetric

🔮 VolanX Opinion:

“Volatility expansion is near. Institutional capital is likely rotating out of risk. The squeeze has passed; now the trapdoor may open.”

This is where preparation outperforms prediction. Execute with risk logic, not emotion.

📚 #SNP500 #ESFutures #SPX #MacroTrading #SmartMoney #InstitutionalFlow #TrendReversal #Volatility #LiquiditySweep #FibonacciLevels #VolanX #AITrading #EminiFutures #WaverVanir #QuantStrategy #TechnicalAnalysis #Forecast #TradingView

Trading as a Probabilistic ProcessTrading as a Probabilistic Process

As mentioned in the previous post , involvement in the market occurs for a wide range of reasons, which creates structural disorder. As a result, trading must be approached with the understanding that outcomes are variable. While a setup may reach a predefined target, it may also result in partial continuation, overextension, no follow-through, or immediate reversal. We trade based on known variables and informed expectations, but the outcome may still fall outside them.

Therefore each individual trade should be viewed as a random outcome. A valid setup could lose; an invalid one could win. It is possible to follow every rule and still take a loss. It is equally possible to break all rules and still see profits. These inconsistencies can cluster into streaks, several wins or losses in a row, without indicating anything about the applied system.

To navigate this, traders should think in terms of sample size. A single trade provides limited insight, relevant information only emerges over a sequence of outcomes. Probabilistic trading means acting on repeatable conditions that show positive expectancy over time, while accepting that the result of any individual trade is unknowable.

Expected Value

Expected value is a formula to measure the long-term performance of a trading system. It represents the average outcome per trade over time, factoring in both wins and losses:

Expected Value = (Win Rate × Average Win) – (Loss Rate × Average Loss)

This principle can be demonstrated through simulation. A basic system with a 50% win rate and a 1.1 to 1 reward-to-risk ratio was tested over 500 trades across 20 independent runs. Each run began with a $50,000 account and applied a fixed risk of $1000 per trade. The setup, rules, and parameters remained identical throughout; the only difference was the random sequence in which wins and losses occurred.

While most runs clustered around a profitable outcome consistent with the positive expected value, several outliers demonstrated the impact of sequencing. When 250 trades had been done, one account was up more than 60% while another was down nearly 40%. In one run, the account more than doubled by the end of the 500 trades. In another, it failed to generate any meaningful profit across the entire sequence. These differences occurred not because of flaws in the system, but because of randomness in the order of outcomes.

These are known as Monte Carlo simulations, a method used to estimate possible outcomes of a system by repeatedly running it through randomized sequences. The technique is applied in many fields to model uncertainty and variation. In trading, it can be used to observe how a strategy performs across different sequences of wins and losses, helping to understand the range of outcomes that may result from probability.

Trading System Variations

Two different strategies can produce the same expected value, even if they operate on different terms. This is not a theoretical point, but a practical one that influences what kind of outcomes can be expected.

For example, System A operates with a high win rate and a lower reward-to-risk ratio. It wins 70% of the time with a 0.5 R, while System B takes the opposite approach and wins 30% of the time with a 2.5 R. If the applied risk is $1,000, the following results appear:

System A = (0.70 × 500) − (0.30 × 1,000) = 350 − 300 = $50

System B = (0.30 × 2,500) − (0.70 × 1,000) = 750 − 700 = $50

Both systems average a profit of $50 per trade, yet they are very different to trade and experience. Both are valid approaches if applied consistently. What matters is not the math alone, but whether the method can be executed consistently across the full range of outcomes.

Let’s look a bit closer into the simulations and practical implications.

The simulation above shows the higher winrate, lower reward system with an initial $100,000 balance, which made 50 independent runs of 1000 trades each. It produced an average final balance of $134,225. In terms of variance, the lowest final balance reached $99,500 while the best performer $164,000. Drawdowns remained modest, with an average of 7.67%, and only 5% of the runs ended below the initial $100,000 balance. This approach delivers more frequent rewards and a smoother equity curve, but requires strict control in terms of loss size.

The simulation above shows the lower winrate, higher reward system with an initial $100,000 balance, which made 50 independent runs of 1000 trades each. It produced an average final balance of $132,175. The variance was wider, where some run ended near $86,500 and another moved past $175,000. The drawdowns were deeper and more volatile, with an average of 21%, with the worst at 45%. This approach encounters more frequent losses but has infrequent winners that provide the performance required. This approach requires patience and mental resilience to handle frequent losses.

Practical Implications and Risk

While these simulations are static and simplified compared to real-world trading, the principle remains applicable. These results reinforce the idea that trading outcomes must be viewed probabilistically. A reasonable system can produce a wide range of results in the short term. Without sufficient sample size and risk control, even a valid approach may fail to perform. The purpose is not to predict the outcome of one trade, but to manage risk in a way that allows the account to endure variance and let statistical edge develop over time.

This randomness cannot be eliminated, but the impact can be controlled from position sizing. In case the size is too large, even a profitable system can be wiped out during an unfavorable sequence. This consideration is critical to survive long enough for the edge to express itself.

This is also the reason to remain detached from individual trades. When a trade is invalidated or risk has been exceeded, it should be treated as complete. Each outcome is part of a larger sample. Performance can only be evaluated through cumulative data, not individual trades.

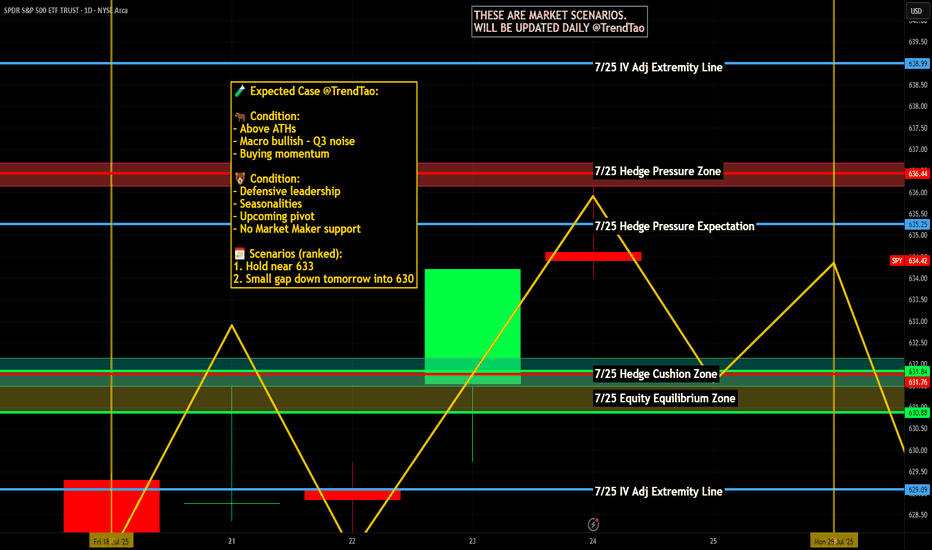

Weekly $SPY / $SPX Scenarios for July 28–August 1, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 28–August 1, 2025 🔮

🌍 Market‑Moving News 🌍

🏦 Fed Holds Steady, Faces Political Pressure

The Federal Reserve is expected to keep rates at 4.25%–4.50% during its FOMC meeting midweek. While rates are unchanged, political pressure from President Trump continues as calls intensify for rate cuts and questions arise over the Fed’s independence—including dissent from Governors Waller and Bowman.

📦 Trade Truce Extends & New Deal With EU

A new trade framework with the EU reduces tariffs to 15%, easing tensions. Meanwhile, U.S. and Chinese trade teams begin talks in Stockholm on Monday aiming to avoid an early-August tariff deadline.

💻 Tech and Mega-Cap Earnings Spotlight

This week features earnings from tech giants including Meta, Microsoft (Wednesday), followed by Amazon and Apple (Thursday). Markets will prioritize forward guidance around AI investments, capital expenditures, and sales trends.

📊 Key Data Releases & Events 📊

📅 Monday, July 28

No major releases

📅 Tuesday, July 29

Chicago PMI (July flash) – early indicator of regional manufacturing trends.

Global PMIs – flash readings for Europe and Asia gauge economic health.

📅 Wednesday, July 30

FOMC Rate Decision & Powell Press Conference – investors will scrutinize tone, forward guidance on rates, labor markets, and inflation.

Q2 U.S. GDP (Advance Estimate) – expected at ~1.9%, signaling rebound after Q1 contraction.

📅 Thursday, July 31

June PCE & Core PCE Indexes – Fed’s preferred inflation measure. Core PCE expected at ~2.7% YoY.

Consumer Confidence (July) – key for household spending trends.

Trade Balance (June) – provides data on U.S. import/export dynamics.

📅 Friday, August 1

July Nonfarm Payrolls, Unemployment & Wage Data – forecast for ~102,000 new jobs and ~4.2% unemployment; markets await for labor-market cooling signs.

Tariff Deadline – new tariffs loom unless trade agreements with EU, Canada, China etc. materialize by today’s cutoff.

⚠️ Disclaimer:

This summary is educational and informational only. It is not financial advice. Always consult a licensed financial advisor before making any investment decisions.

📌 #trading #stockmarket #economy #Fed #earnings #inflation #tariffs #GDP #PCE #jobs #technicalanalysis

Nightly $SPY / $SPX Scenarios for July 29, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 29, 2025 🔮

🌍 Market‑Moving News 🌍

U.S.–EU Trade Deal Sparks Optimism

The U.S. and EU signed a trade framework allowing a 15% tariff rate on most EU imports, averting harsher penalties. The S&P 500 and Nasdaq both closed at fresh record highs, supported by upbeat tech earnings sentiment—Tesla advanced on a new $16.5B AI chip deal with Samsung—while U.S.–China trade talks resume in Stockholm.

Fed Likely to Hold Rates; Political Pressure Mounts

The Fed is expected to leave its benchmark rate at 4.25%–4.50% at the July 29–30 FOMC meeting. Chair Powell faces growing political pressure from President Trump to cut rates and concerns about central bank independence remain elevated.

Trade Talks Extension to Avoid Tariff Hike Deadline

The August 1 tariff deadline looms. Markets are watching to see if trade deals with China, Canada, and the EU extend the pause or risk new tariffs. Volume in AI/chip stocks and industrials reflects sensitivity to trade developments.

📊 Key Data Releases & Events 📊

📅 Tuesday, July 29

FOMC Meeting Begins — All eyes on Fed rate decision and updated projections.

GDP (Advance Q2 Estimate) — Expected around +1.9% on signs of economic rebound.

⚠️ Disclaimer:

This summary is for educational and informational purposes only—it is not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #trade #tariffs #PCE #jobs #technicalanalysis

SPY 15-Min — Weak-High Sweep in Play• Discount BOS at 603.95 → impulsive leg to 606.7 (0.886)

• Weak high tagged at 607.16 – expecting continuation to 1.382 ≈ 608.61 then 1.854 ≈ 610.92

• Invalidation if price closes below 605.45 session VWAP band

• Targets: 608.61 → 610.92

• Risk: stop 604.9 (below 0.5 Fib)

VolanX bias remains risk-on while micro structure stair-steps above the 9-EMA channel.

Educational only – not financial advice

#SPY #SMP500 #OrderFlow #Fib #VolanX #WaverVanir

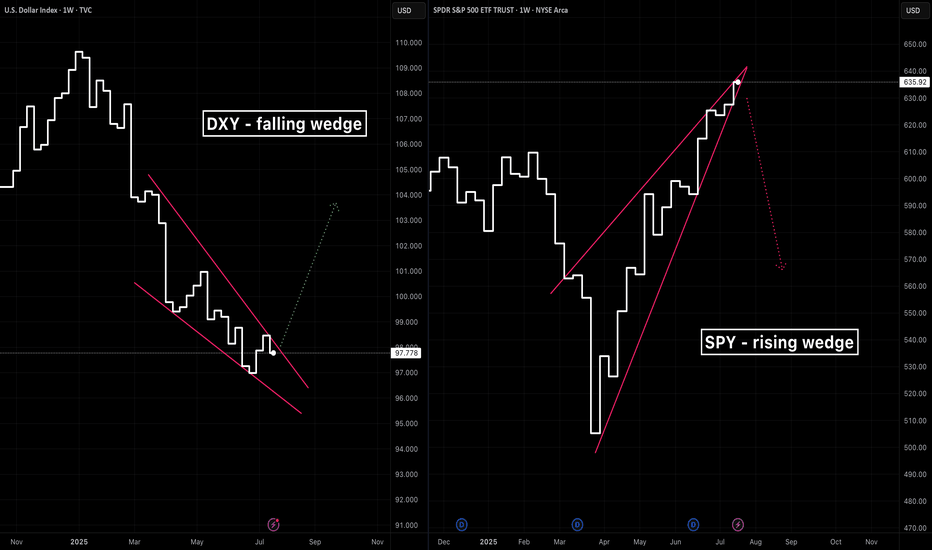

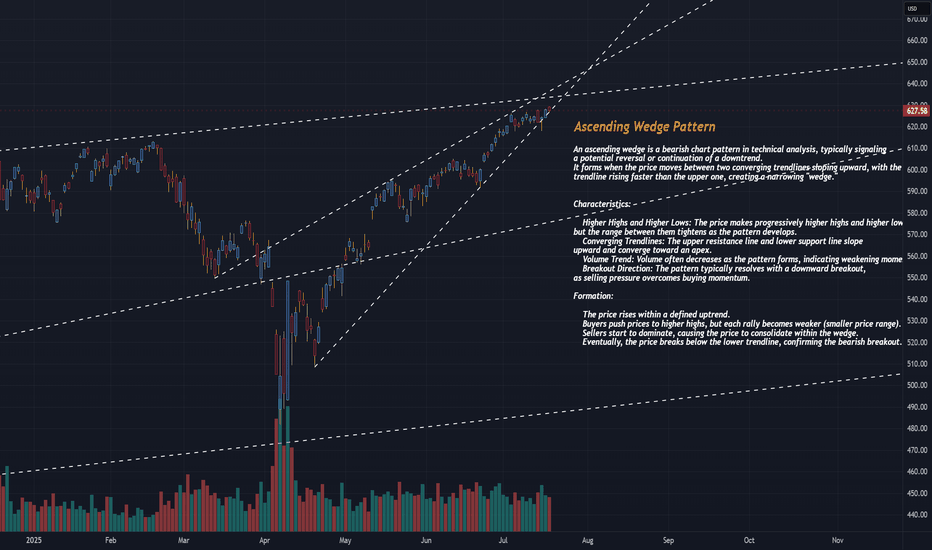

A tale of two wedgesIn early 2025 we’ve seen two classic wedge patterns on two of the market’s most watched charts: a falling wedge on the U.S. Dollar Index ( TVC:DXY ) and a rising wedge on the S&P 500 ETF ( AMEX:SPY ). Alone each tells its own tale—but together they sketch a tug‑of‑war between a fading dollar and resilient equities.

The Falling Wedge on DXY

A falling wedge in a downtrend signals waning bearish momentum and often precedes a bullish reversal once price breaks the upper trendline.

The Rising Wedge on SPY

A rising wedge in an uptrend is classically a bearish reversal pattern —a breakdown below the lower trendline confirms sellers are gaining control.

A Converging Reversal

Given the well‑known inverse correlation between the dollar and most assets, it’s noteworthy that both asset classes are flashing signs of a reversal. Taken together that makes a compelling argument.

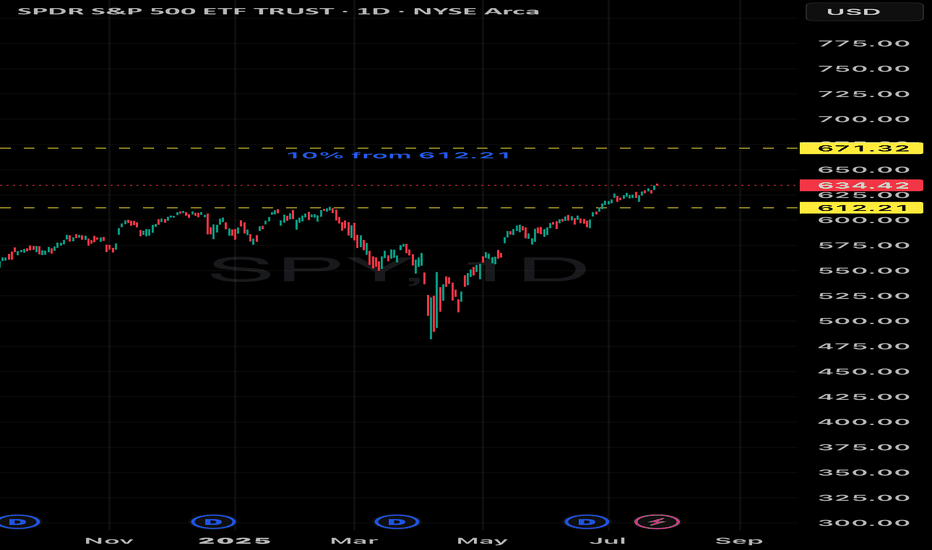

SPY – Explosive strength above resistancePrice extends well above the 50-day EMA and pierces through the upper Bollinger Band, highlighting strong bullish momentum. RSI stands at 76, confirming overbought conditions, while MACD remains firmly positive.

The ongoing move leaves the EMA50 at 608 and the Fibonacci pivot at 607—both now acting as key support levels. With R1 at 620 already surpassed, the next potential resistance zone lies in uncharted territory beyond 636.

Volume has decreased by over 20%, which tempers the move slightly and should be monitored closely.

As long as price holds above 620, the bullish scenario remains valid.

Watch for any sudden spike in volume or a drop back below 636 as a possible shift signal.

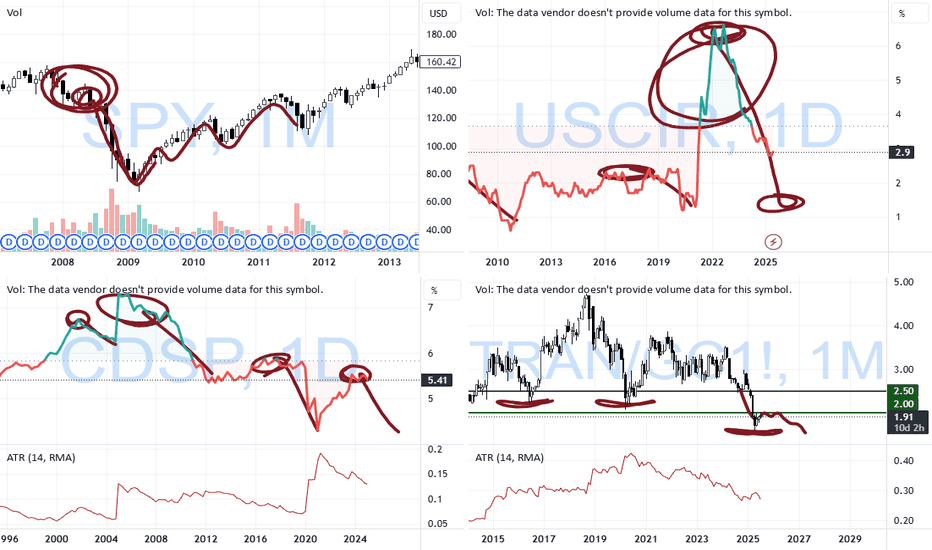

July 21 Special Update : Metals, SPY & More. What's Next.This special update is to highlight why I continue to believe traders should stay very cautious of this rally in the SPY/QQQ/BTCUSD.

Underlying economic data suggest that this is one big speculative rally following the April Tariff collapse.

And, the economic data I see from my custom indexes suggests the markets are moving into a very volatile and potentially dangerous topping pattern.

As I've stated many times in this video. I'm not saying the markets have topped and you should SELL EVERYTHING. I'm suggesting this market is extremely over-valued in terms of the underlying risk factors at play and the very clear data that suggests the markets are already in a recessionary price trend.

You may ask, "How can the markets continue to rally like this in a moderate recession?".

The answer is simple.

All bubbles end with a super-speculative phase. This phase is where everyone piles into a euphoric attempt to ride the rally higher.

It happened in the late 1990s. It has happened again through the 2000-2005+ housing bubble. Heck, it has occurred in the collectors market over the past few decades where people spent fortunes on the "hottest items" (think Beanie-Babies) only to find out they bought at the height of the bubble.

That is why I continue to urge traders to remain cautious and to withdraw profits from this speculative rally phase. Protect your investment capital immediately and consider the risks associated with the information I share in this video.

I'm not trying to scare anyone. I'm just trying to be realistic in terms of what I see in my data and why I believe now is the best time to MOVE TO SAFETY.

My data suggests that the markets are about to enter a fragile and potentially dangerous pullback phase. If you want to ride it out - go for it.

Otherwise, prepare for significant volatility over the next six months or more.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

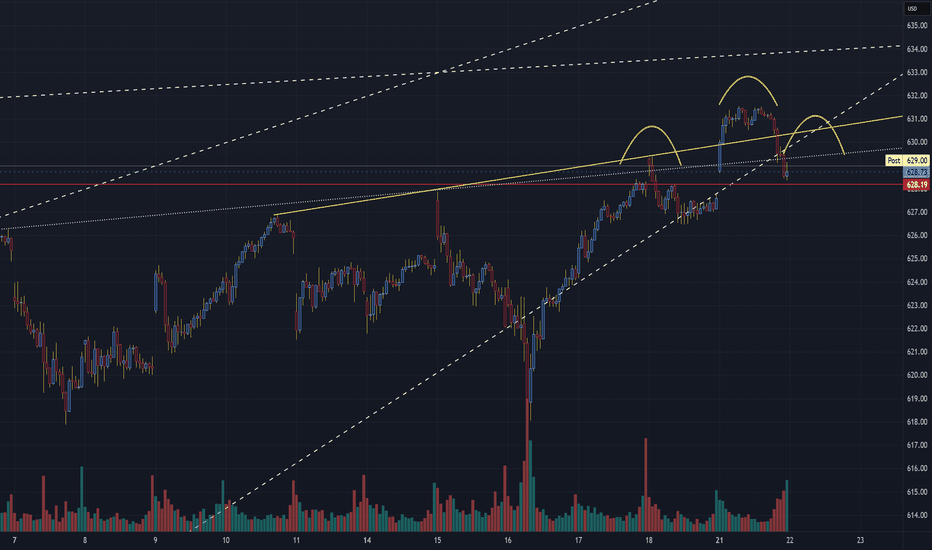

SPY Forming A Bearish Head and Shoulders PatternSPX Technical Update – Bearish Watch

Chart Focus: S&P 500 Index (30-Min Chart)

Date: July 21, 2025

🧠 Pattern Watch: Classic Head & Shoulders Formation

A clear head and shoulders pattern has emerged on the short-term 30-minute chart, signaling a potential bearish reversal after the recent uptrend.

Left Shoulder: Around 630.75

Head: Peaked near 633.00

Right Shoulder: Capped just under 631.00

Neckline: Sits near the 628.75–628.20 zone, marked by a yellow upward-sloping trendline and tested support.

📉 Bearish Breakdown in Play

The price has now broken below the neckline zone at 628.75 with increasing volume — an early confirmation of a bearish break.

The break beneath the rising wedge support and neckline suggests increased downside risk in the near term.

🧭 Technical Levels to Watch

Key Level Type Action

633.00 Resistance (Head) Likely capped unless strong reversal

631.00 Resistance Right shoulder, overhead rejection

628.75 Neckline Support (Broken) Bearish trigger zone

628.20 Intraday support Final support test (now resistance)

625.50 Initial Target Breakdown projection

622.75 Lower Support Measured move target zone

📌 Measured Move Projection:

A break of ~4.5 points from head to neckline projects a target near 624–625 in the near term.

📊 Volume Profile Note

Volume expanded on the neckline break, supporting the validity of the pattern.

Recent bars show a rise in selling pressure as bulls failed to reclaim above 630 after the breakdown.

🔍 Summary Outlook

Bearish Bias: Valid while below 628.75 neckline resistance.

Invalidation Zone: A sustained close above 631.00 would invalidate the bearish pattern.

Watch for Retest: Any bounce into 628.75–629.25 could act as a retest and fade opportunity.

📆 Next Steps:

Short-term traders should monitor price action around 625.50 and 622.75 as the most likely zones for support. Watch for further confirmation with broader index weakness or macro catalysts.

SPY CONTINUES IN AN ASCENDING WEDGE PATTERNThe SPDR S&P 500 ETF Trust (SPY) is currently exhibiting an ascending wedge pattern on the 30-minute chart, a bearish technical pattern that often signals a potential reversal or selloff when confirmed. Below, I’ll explain the ascending wedge pattern, identify key levels to watch for a potential selloff, and provide context based on recent market sentiment. Since I cannot view the real-time chart, I’ll base the analysis on the characteristics of an ascending wedge and recent posts on X that discuss SPY’s price action, ensuring a critical approach to the data.

What is an Ascending Wedge Pattern?

An ascending wedge (or rising wedge) is a bearish chart pattern formed when the price consolidates between two upward-sloping trendlines that converge over time. The upper trendline (resistance) connects higher highs, and the lower trendline (support) connects higher lows, creating a narrowing price range. This pattern typically indicates that bullish momentum is weakening, as buyers are pushing prices higher but with diminishing strength, often leading to a breakdown below the lower trendline.

Key characteristics of an ascending wedge include:

Converging Trendlines: Both the support and resistance lines slope upward, with the support line often steeper than the resistance line.

Decreasing Volume: Trading volume typically declines as the pattern forms, reflecting reduced buying conviction. A spike in volume often accompanies a breakout or breakdown.

Bearish Implication: In an uptrend, the ascending wedge signals a potential reversal to the downside. In a downtrend, it may act as a continuation pattern, but the bearish bias remains.

Breakout Confirmation: A convincing break below the lower trendline, preferably with increased volume, confirms the bearish reversal. A retest of the broken support (now resistance) may occur before further declines.

The pattern typically forms over 3–4 weeks but can appear on shorter timeframes like the 30-minute chart, making it relevant for intraday or short-term traders.investopedia.comen.wikipedia.org

SPY’s Current Ascending Wedge on the 30-Minute Chart

Given that SPY is in an ascending wedge on the 30-minute chart, we can infer the following based on recent posts on X and general technical analysis principles:

Pattern Context:

The ascending wedge suggests SPY has been making higher highs and higher lows in a tightening range, indicating a potential exhaustion of the bullish trend.

Recent posts on X (e.g., @AskPerplexity on July 16, 2025) noted a rising wedge in SPY with a breakdown through the lower trendline, suggesting bearish momentum. Another post (@YakshuMadaan on July 15, 2025) mentioned a wedge breaking below 6220, targeting 6050 on the S&P 500 index ( SP:SPX ), which correlates to SPY levels around $605–$610.

Key Levels to Watch:

Lower Trendline (Support): The critical level to monitor is the lower trendline of the wedge, which connects the higher lows. A decisive break below this level (e.g., a close below on the 30-minute chart with strong volume) signals a bearish breakdown and potential selloff. Based on recent X posts, this level may have been around $622 (equivalent to ~6220 on SP:SPX ) recently, but you should confirm the exact level on the current chart.

Upper Trendline (Resistance): The upper trendline connects the higher highs and acts as resistance. If SPY fails to break above this level, it reinforces the bearish bias. This could be near recent highs, potentially around $630–$635, depending on the chart’s progression.

Support Zones Post-Breakdown: If the lower trendline breaks, key support levels to watch include:

$590–$600: A post on X highlighted this as a major support zone based on volume profile analysis, likely corresponding to a prior consolidation area or gap fill.

$605–$610: Another post suggested a target of 6050 on SP:SPX , translating to roughly $605–$610 for SPY, aligning with a significant retracement level.

Retest Level: After a breakdown, the price may retest the broken lower trendline (now resistance). For example, if the breakdown occurs at $622, a retest could see SPY rally back to $622–$625 before resuming the decline.ig.com

Volume and Indicators:

Volume: Look for declining volume as the wedge forms, followed by a spike on the breakdown to confirm the move. Low volume during the wedge suggests waning bullish momentum.xs.com

Relative Strength Index (RSI): An RSI above 70 near the upper trendline or showing bearish divergence (lower RSI highs while price makes higher highs) strengthens the case for a selloff.xs.com

Moving Average Convergence Divergence (MACD): A bearish crossover (MACD line crossing below the signal line) near the upper trendline can confirm weakening momentum.xs.com

Potential Selloff Triggers:

A close below the lower trendline on the 30-minute chart, especially with a spike in volume, is the primary trigger for a selloff. For example, a break below $622 (if that’s the current support) could initiate a move toward $605–$610 or lower to $590–$600.

A failed retest of the broken trendline (e.g., SPY rallies to $622–$625 after breaking down but fails to reclaim the trendline) would confirm bearish continuation.

Broader Market Context: Recent X posts suggest market concerns about macroeconomic factors (e.g., interest rate fears, policy shifts) could amplify a selloff, especially if technical levels break.

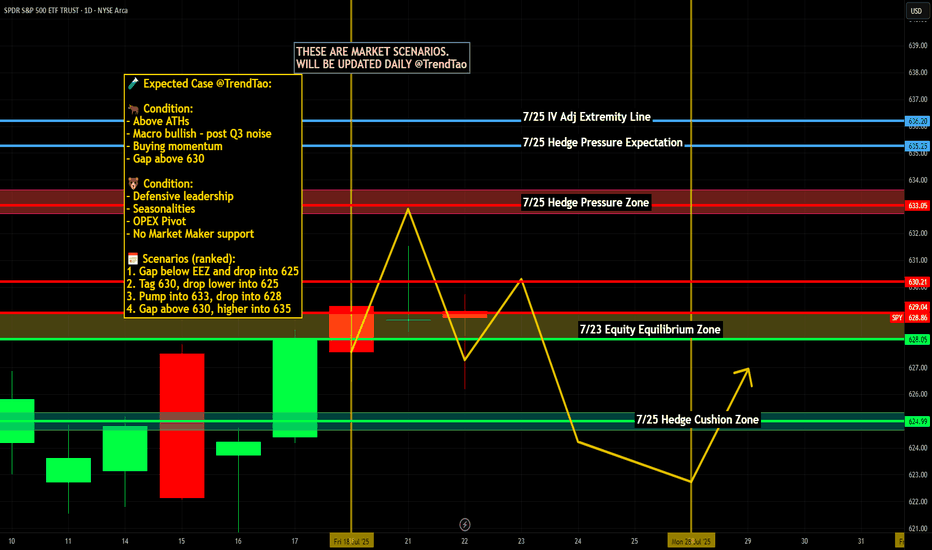

Nightly $SPY / $SPX Scenarios for July 25, 2025🔮 Nightly AMEX:SPY / CBOE:SPX Scenarios for July 25, 2025 🔮

🌍 Market‑Moving News 🌍

🏔️ Copper Market Flashpoint

Following President Trump’s announcement of steep copper tariffs (15–50% range), U.S. copper futures surged, then sharply reversed. Inventory arbitrage between CME and LME markets surged, distorting pricing dynamics and triggering concern over metal market stability.

🇪🇺 EU–China Summit Signals Trade Reset

EU leaders concluded their 25th summit with China, fostering deeper economic and strategic ties. Observers expect follow-up on mutual trade agreements, particularly regarding tech and sustainability sectors.

🌍 EM Equity Rally Consolidates Gains

Emerging markets continue to outperform global equities in 2025—with MSCI EM up ~18% vs. S&P 500. Analysts highlight strong opportunities in AI/fintech stocks in China and Latin America, suggesting further rotations out of U.S. markets.

📊 Key Data Releases & Events 📊

📅 Friday, July 25:

8:30 AM ET – Durable Goods Orders (June):

Forecast shows a sharp drop (~–10%), following a ~16% gain in May—signaling possible cooling in business-related equipment purchases.

10:00 AM ET – U.S. Imports of Steel Products (June):

Trade-data release monitoring steel flows amid evolving tariff frameworks.

All Day – Corporate Earnings Reports:

Companies such as First Financial Bancorp (FFBC), HCA, AON, Charter, and others report earnings. Outlooks may influence small- to mid-cap sentiment.

⚠️ Disclaimer:

This report is for educational and informational purposes only—not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #data #earnings #commodities #EM #technicalanalysis

Nightly $SPY / $SPX Scenarios for July 23, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 23, 2025 🔮

🌍 Market-Moving News 🌍

📈 Morgan Stanley Stays Bullish

Morgan Stanley reaffirmed its optimistic view, forecasting the S&P 500 will reach 7,200 by mid‑2026. They cited strong earnings and anticipated rate cuts as key drivers, though warned of risks from rising Treasury yields and tariff-related cost pressure

📉 Inflation Debate Reignites

A renewed debate is underway regarding whether tariffs are "transitory" or persistent inflation drivers. Treasury counselor Joseph Lavorgna argued tariff impacts will be one-off, while others caution long-term price pressures may persist, complicating Fed policy directions

🏛️ Calls for Fed Reform Intensify

Treasury Secretary Scott Bessent suggested structural reforms to the Federal Reserve could have greater long-term impact than removing Chair Powell, highlighting ongoing concerns over central-bank governance amid political criticism

💳 Investors Shift to Corporate Bonds

As equity valuations have surged, investors are reallocating toward investment-grade corporate bonds, reducing credit spreads to the tightest levels since 1998—a sign of elevated risk appetite balanced with caution

📊 Key Data Releases & Events 📊

📅 Wednesday, July 23:

(No major U.S. economic releases)

Market focus remains on tech earnings (Tesla, Alphabet) and Fed signals following Tuesday’s Powell address.

⚠️ Disclaimer:

This information is for educational/informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor before making investing decisions.

📌 #trading #stockmarket #economy #tariffs #Fed #earnings #corporatebonds