SILVERCFD trade ideas

Silver XAGUSD is forming a bullish IB pattern The market of silver XAGUSD is in Up trend

it formed a correction wave

near the previous levels of multi bullish price action between 36 and 36,30

this market is forming an IB pattern

buy stop order must be place at the HH of the MB at the price 37.35

SL 36

TP 39

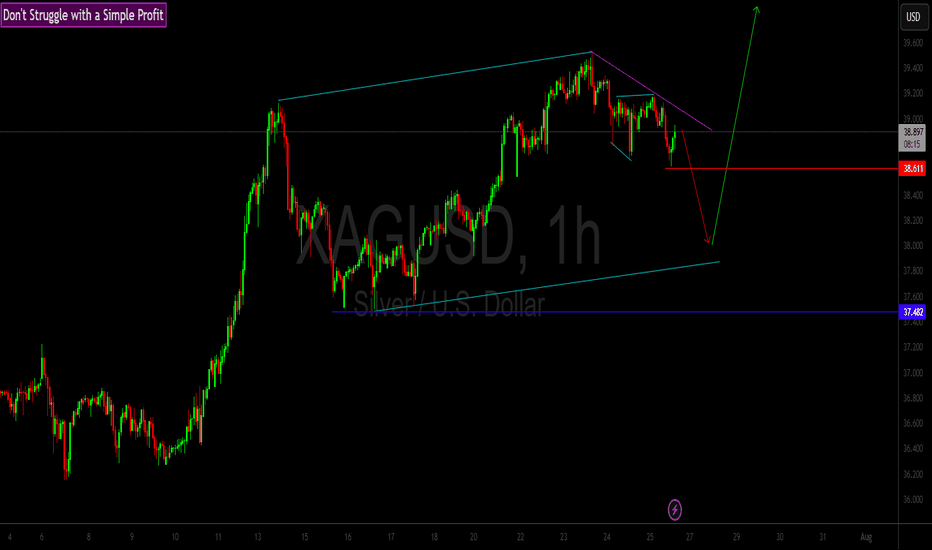

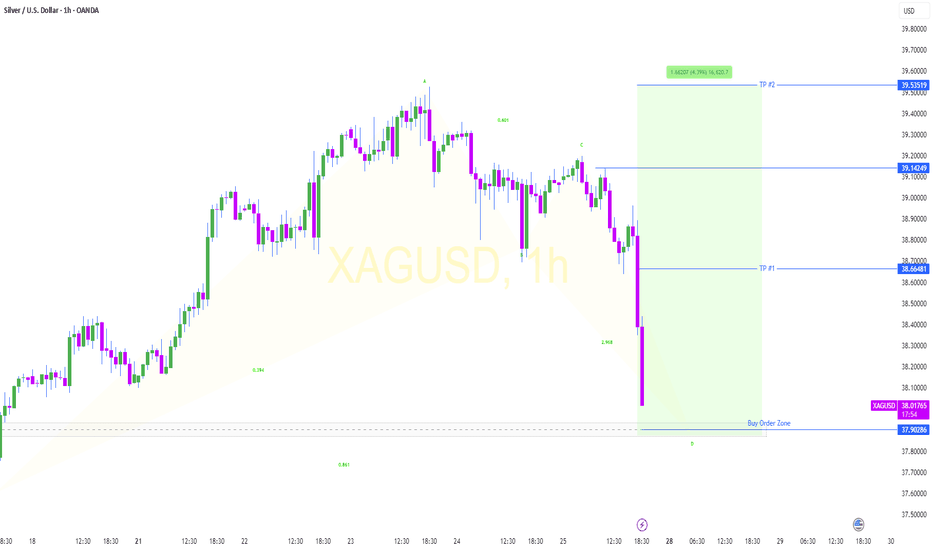

Silver Reload: Short-Term Pop or Just Noise?Our last Silver idea played out perfectly

Price wicked into support near 37.93 and bounced.

Short-term bias shifts bullish if we can reclaim 38.30, with next upside target around 38.51.

Still below the 200 MA, so we treat this as a corrective move, not a full trend shift (yet).

SILVER H9 IdeaWhen you look at silver market has actually been in an uptrend for about three years. It was sideways a couple of times, and it’s very possible that we go sideways or correctionn for the short term. But over the longer term, it goes from the lower left to the upper right, and there’s really no way to dispute that.

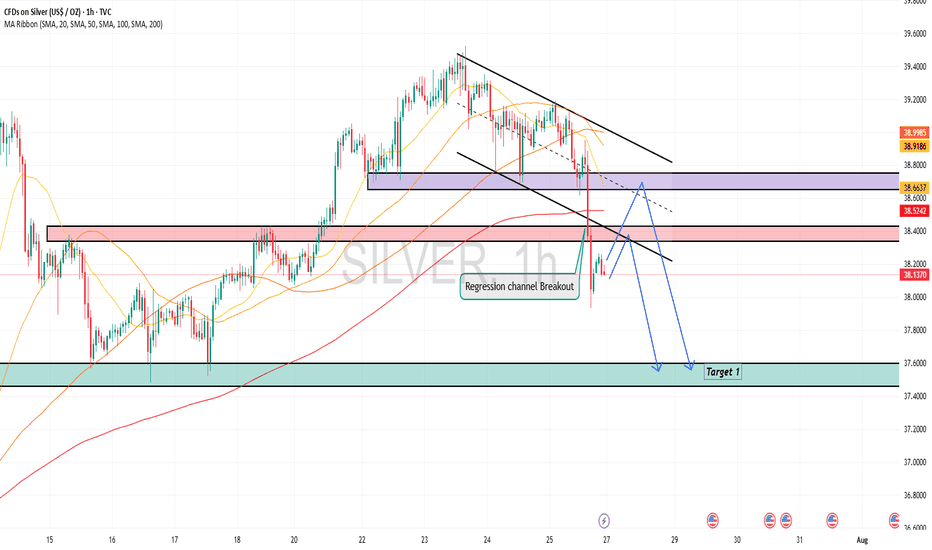

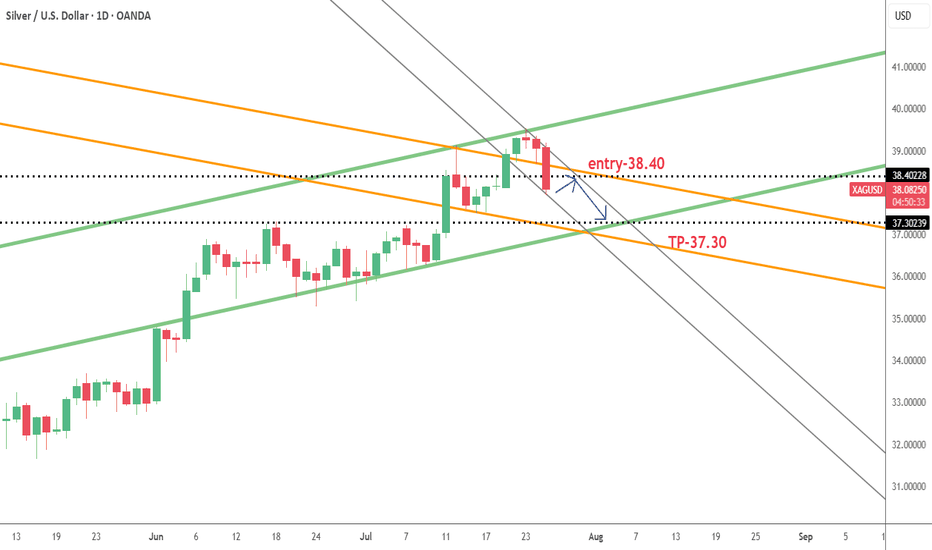

Silver is in the Bearish trend after testing ResistanceHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

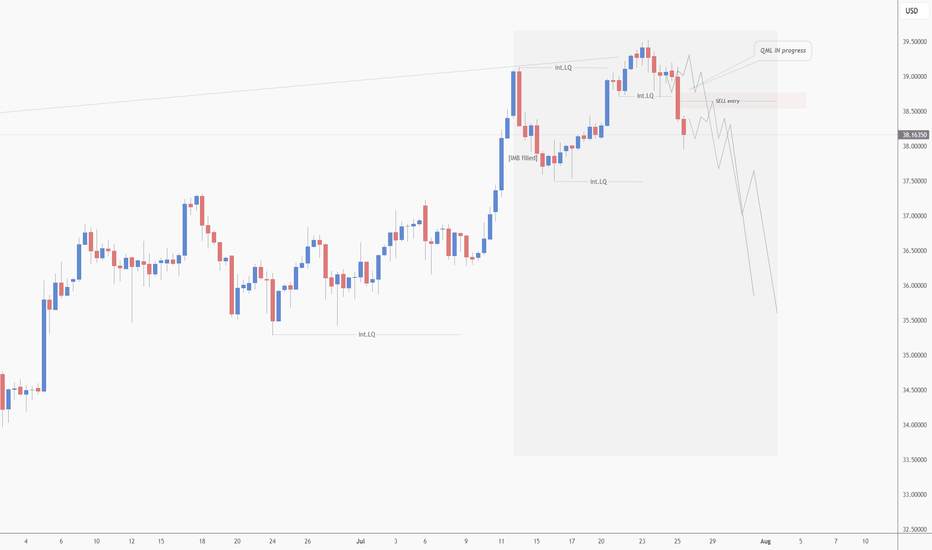

My alternate wave count for silverBelow is a slighly altered wave count for silver...it shows we have completed wave 5(yellow) which is a wave 1 (white) and are now in the process of working out wave 2 (white)...the first leg down (a) has just completed...and wave b of the ABC should start and complete over the next few days...follwed by one more low (wave c)...around the $34-$34.50 area.

I do not expect a move below $34 due to all the support on the chart at this level (look left and you will see that the $34 was a major prior resistance zone...when resistance is broken it becomes support.

If this count is the correct one (again it is my alternate to the one posted previously), it meas a bit more patience is required over the next few weeks...before we see a major move up (above $50) will start.

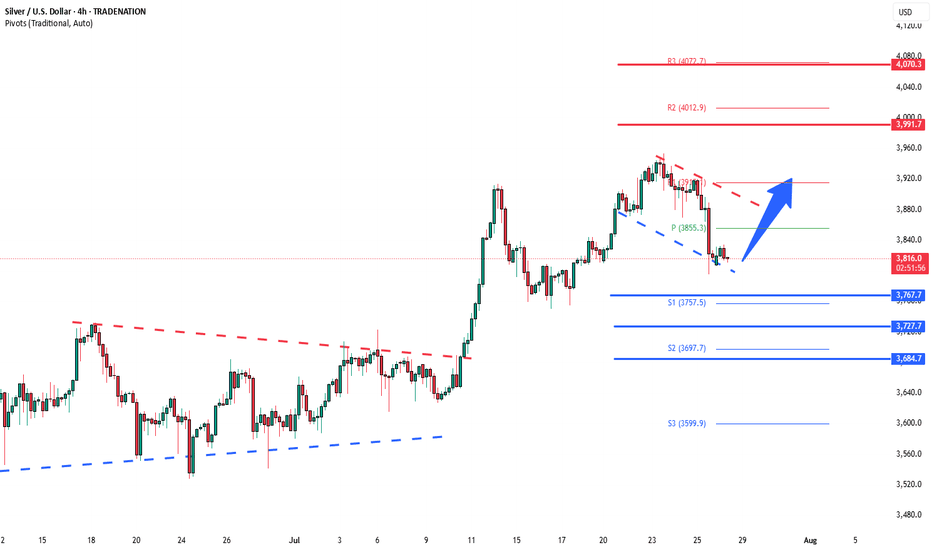

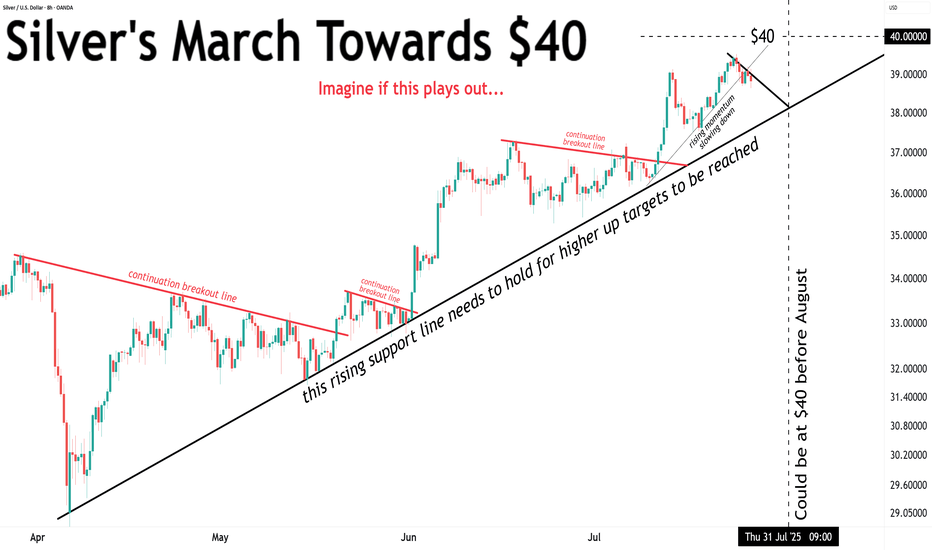

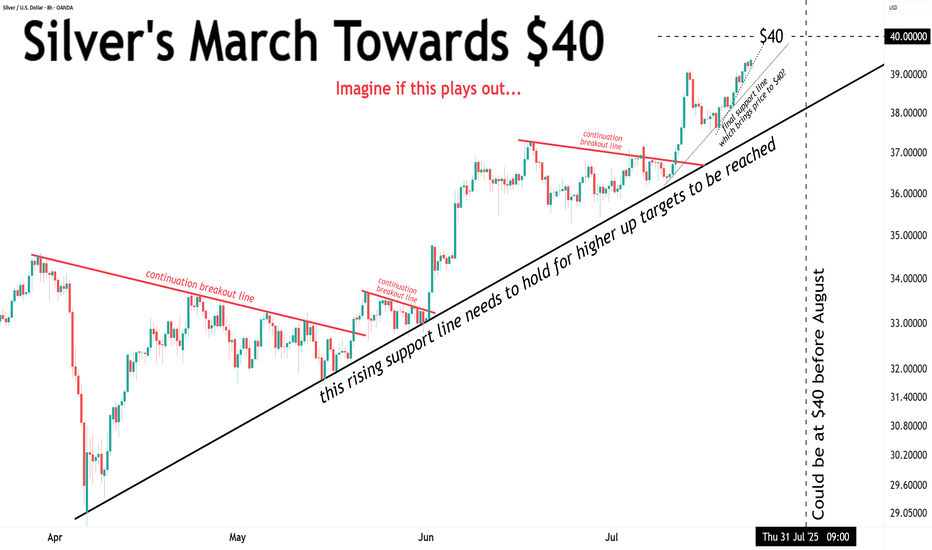

Silver bullish flag developingThe Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 3686 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 3686 would confirm ongoing upside momentum, with potential targets at:

3814 – initial resistance

3865 – psychological and structural level

3920 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 3686 would weaken the bullish outlook and suggest deeper downside risk toward:

3645 – minor support

3590 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 3686. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

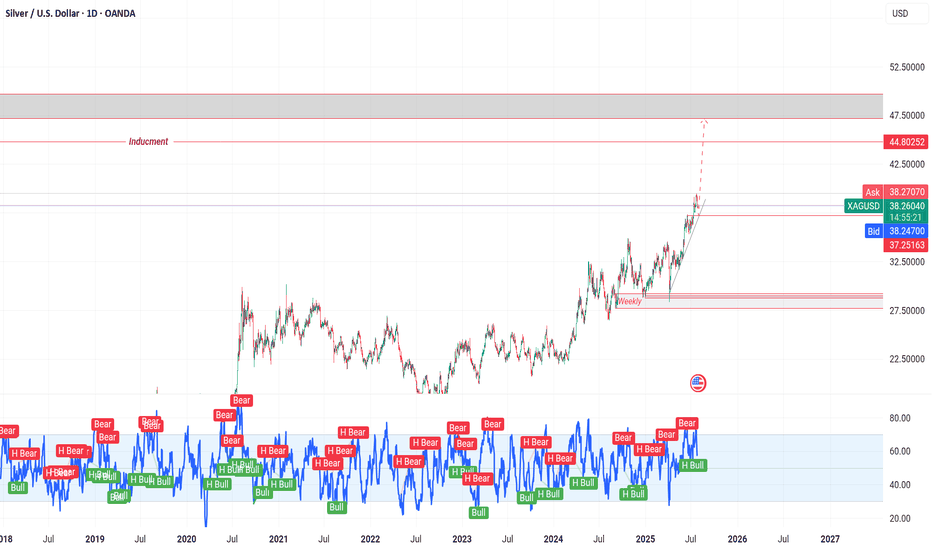

XAG/USD on high time frame

"Hello, for investors in XAG/USD, the $37 zone appears to be a low-risk area for buying. Both technical and fundamental analyses suggest that the price is likely to move higher towards $48."

If you require further insights or have additional information to discuss, feel free to share!

SILVER My Opinion! SELL!

My dear friends,

Please, find my technical outlook for SILVER below:

The price is coiling around a solid key level - 37.026

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 36.725

Safe Stop Loss - 37.189

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SILVER: Local Bullish Bias! Long!

My dear friends,

Today we will analyse SILVER together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 36.920 will confirm the new direction upwards with the target being the next key level of 37.150 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

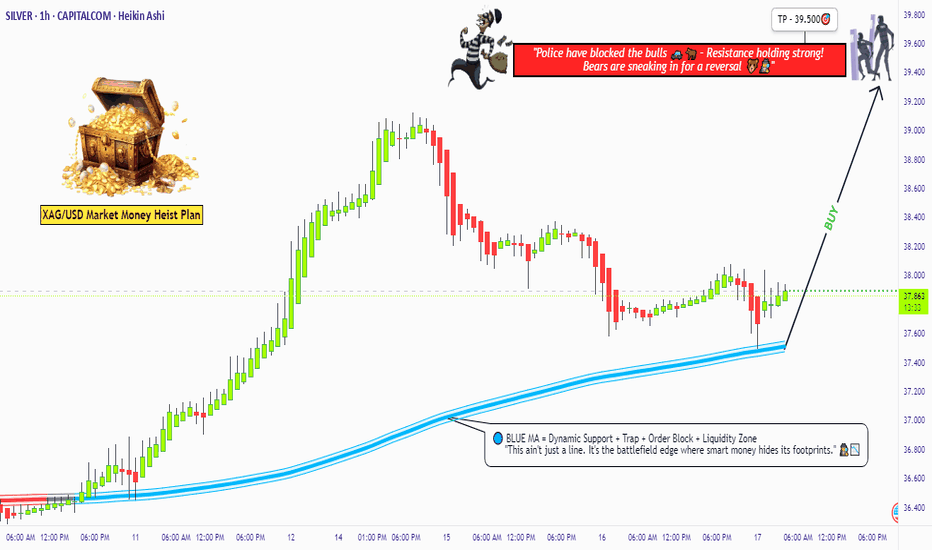

"XAG/USD: Pirate’s Treasure Trade! Bullish & Loaded"🚨 SILVER HEIST ALERT! 🚨 XAG/USD Bullish Raid Plan (Thief Trading Style) 💰🎯

🌟 Attention Market Pirates & Profit Raiders! 🌟

🔥 Thief Trading Strategy Activated! 🔥

📌 Mission Brief:

Based on our elite Thief Trading analysis (technical + fundamental heist intel), we’re plotting a bullish robbery on XAG/USD ("The Silver Market"). Our goal? Loot profits near the high-risk resistance zone before the "Police Barricade" (bear traps & reversals) kicks in!

🚨 Trade Setup (Day/Swing Heist Plan):

Entry (📈): "The vault is open! Swipe bullish loot at any price!"

Pro Tip: Use buy limits near 15M/30M swing lows for safer pullback entries.

Advanced Thief Move: Layer multiple DCA limit orders for maximum stealth.

Stop Loss (🛑): 36.900 (Nearest 1H candle body swing low). Adjust based on your risk tolerance & lot size!

Target (🎯): 39.500 (or escape early if the market turns risky!).

⚡ Scalper’s Quick Loot Guide:

Only scalp LONG!

Rich thieves? Go all-in! Broke thieves? Join swing traders & execute the plan slowly.

Use trailing SL to lock profits & escape safely!

💎 Why Silver? (Fundamental Heist Intel)

✅ Bullish momentum in play!

✅ Macro trends, COT data, & intermarket signals favor upside!

✅ News-driven volatility? Expect big moves!

⚠️ WARNING: Market Cops (News Events) Ahead!

Avoid new trades during high-impact news!

Trailing stops = Your best escape tool!

💥 BOOST THIS HEIST!

👉 Hit LIKE & FOLLOW to strengthen our robbery squad! More lucrative heists coming soon! 🚀💰

🎯 Final Note: This is NOT financial advice—just a thief’s masterplan! Adjust based on your risk & strategy!

🔥 Ready to Raid? Let’s STEAL Some Profits! 🏴☠️💸

👇 Drop a comment & boost the plan! 👇

#XAGUSD #SilverHeist #ThiefTrading #ProfitPirates #TradingViewAlerts

(🔔 Stay tuned for the next heist!) 🚀🤫

The biggest cup&handle of all times: silver targets $50The data suggests a cup&handle:

Cup was between 1980-2011

Handle is still in progress and probably may finish by 2025 or earlier.

For the short run: a re-test of low re-accumulation range of $23 can be seen.

The next mid-term target will be $25.

Final target will be $50.

So how many times has silver touched or broken $40?So how many times has silver touched or broken $40?

ONLY TWICE !!!

• 1980 – short spike

• 2011 – brief sustained rally

Didn’t end well either time, both marked the end of bull markets.

But this time?

No mania. Just stealth. Silver’s quietly moving up.

Bullish Continuation on Silver. 4 Areas To TargetWhen we last visited Silver we were looking at a Bullish Daily Chore opportunity. That opportunity played out nicely and now that we've officially violated the most recent structure high, it should be relatively smooth sailing to our next level of structure from back in 2011.

I say relatively, because the most conservative target area is right above current price, but don't worry, because in this video we'll discuss how there will still be plenty of trading opportunities, even if you choose to wait for a sign after that initial level.

If you have any questions or comments, please leave them below. Also, if you want to share your analysis that's always helpful for the community.

Akil