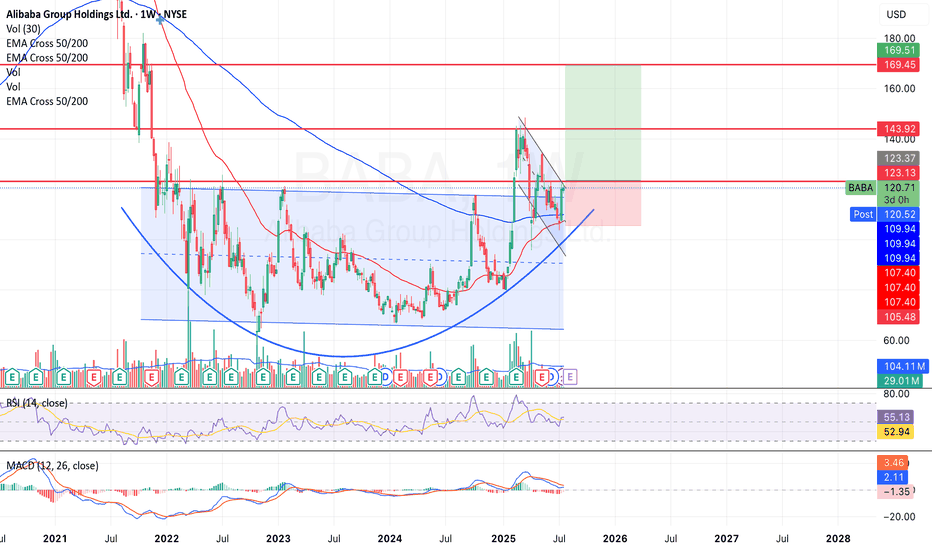

Much needed break for $BABA on the horizonI took a much needed break but not as long as NYSE:BABA has taken since 2021; swinging between ~$70 and ~$120 over the past six years.

I strongly suspect that this might have something to do with Jack Ma's speech in late 2024 that made him go 'missing' from public view

- www.wired.com .

The s

Key facts today

Alibaba has settled for $433.5 million with investors over claims of misleading them about regulatory issues tied to Ant Group, impacting its IPO and lending operations.

Alibaba's stock rose 2% following the reveal of its AI-driven Quark smart glasses, launching in China by late 2025, featuring hands-free calling, translation, and navigation.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.78 CHF

15.88 B CHF

122.19 B CHF

2.23 B

About Alibaba Group Holdings Ltd.

Sector

Industry

CEO

Yong Ming Eddie Wu

Website

Headquarters

Hangzhou

Founded

1999

FIGI

BBG007FJLZB3

Alibaba Group Holding Ltd engages in providing online and mobile marketplaces in retail and wholesale trade. It operates through the following business segments: Core Commerce; Cloud Computing; Digital Media & Entertainment; and Innovation Initiatives and Others. The Core Commerce segment comprises of platforms operating in retail and wholesale. The Cloud Computing segment consists of Alibaba Cloud, which offers elastic computing, database, storage and content delivery network, large scale computing, security, management and application, big data analytics, a machine learning platform, and other services provide for enterprises of different sizes across various industries. The Digital Media & Entertainment segment relates to the Youko Tudou and UC Browser business. The Innovation Initiatives and Others segment includes businesses such as AutoNavi, DingTalk, Tmall Genie, and others. The company was founded by Chung Tsai and Yun Ma on June 28, 1999 and is headquartered in Hangzhou, China.

Related stocks

Alibaba - A remarkable reversal!🛒Alibaba ( NYSE:BABA ) reversed exactly here:

🔎Analysis summary:

Recently Alibaba has perfectly been respecting market structure. With the current bullish break and retest playing out, there is a very high chance that Alibaba will rally at least another +20%. But all of this chart behaviour j

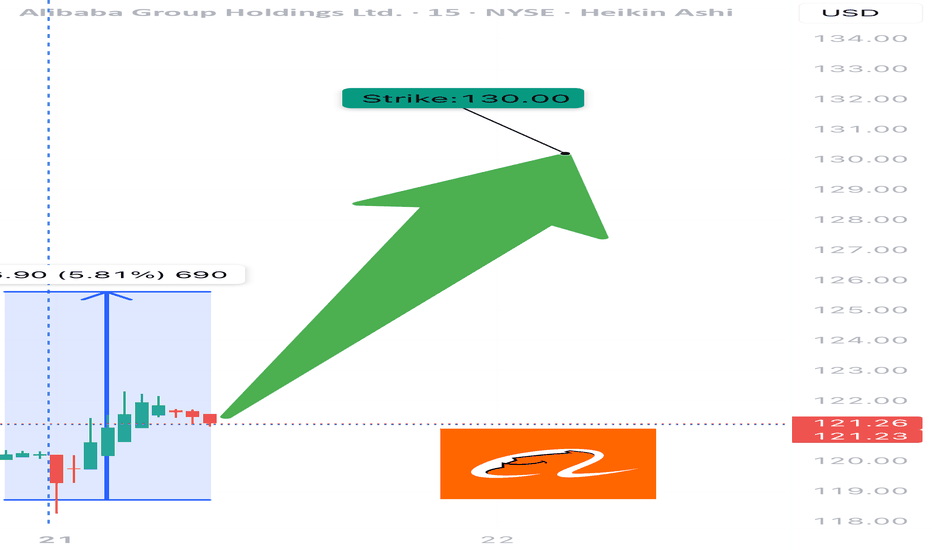

BABA WEEKLY TRADE IDEA – JULY 21, 2025

🐉 NYSE:BABA WEEKLY TRADE IDEA – JULY 21, 2025 🐉

📈 Strong RSI. Institutional Accumulation. Gamma-juiced upside.

Momentum is building — timing is key.

⸻

📊 Trade Setup

🔹 Type: Long Call

🎯 Strike: $130.00

📆 Expiry: July 25, 2025 (4 DTE)

💰 Entry Price: $0.52

🎯 Profit Target: $0.74 (📈 +42%)

🛑 Stop Lo

Long $BABA - NYSE:BABA is testing 200 SMA

- NYSE:BABA moves are explodes higher then cools then retest support then explodes higher than the last high. It's called trading with higher wavelength

-> Move 1: Started April 2024 when the trend reversal started. $68 -> $89 with around +30% then retraced $9

BABA | Long | Strong AI & Seasonality Tailwinds (July 2025)BABA | Long | Strong AI & Seasonality Tailwinds (Aug 2025)

1️⃣ Quick Insight: Alibaba is showing strong AI-driven momentum, healthy fundamentals, and positive seasonality patterns. August–December tends to be bullish, and the stock is already holding up well despite recent dips.

2️⃣ Trade Paramete

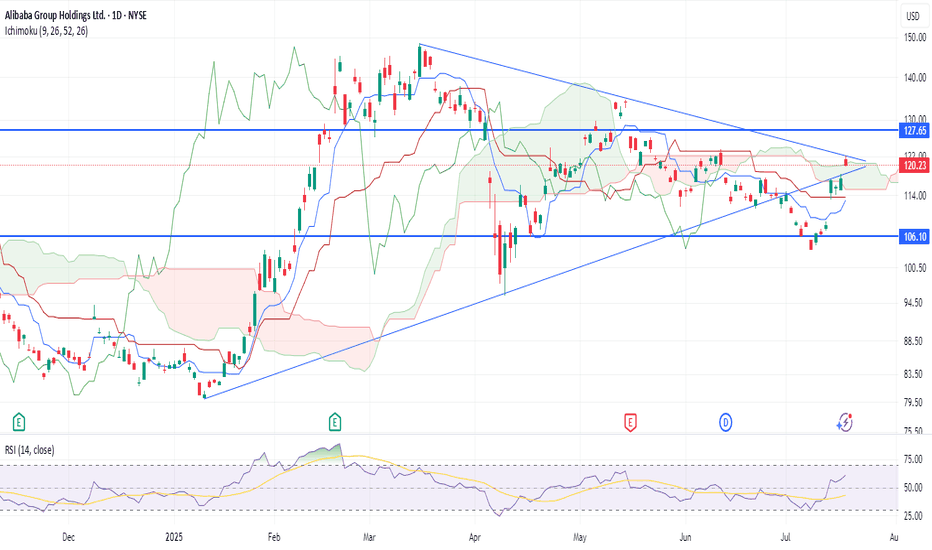

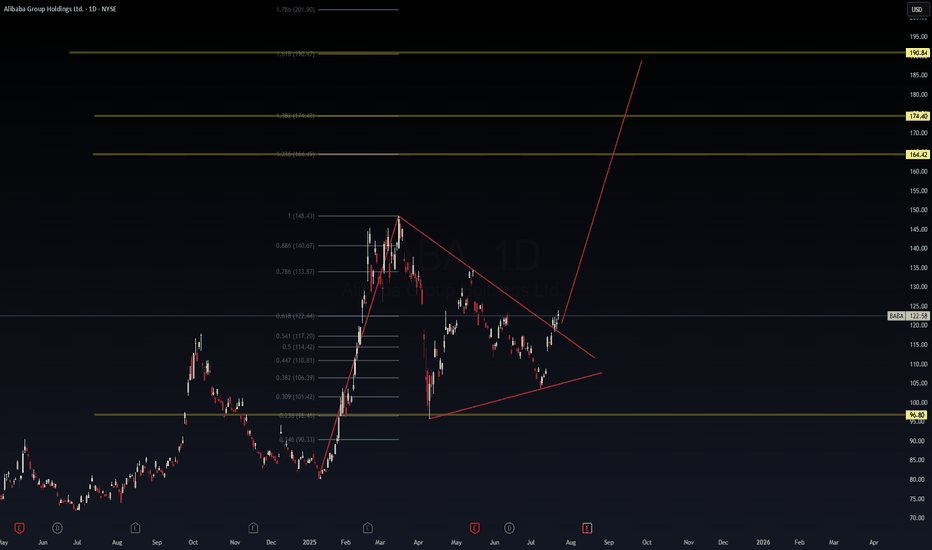

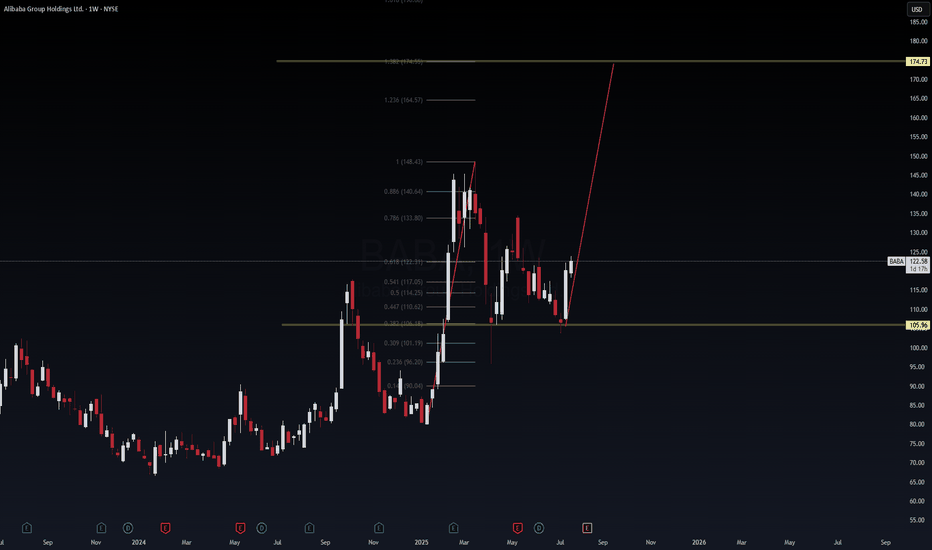

$BABA Breakout Imminent – Triangle Compression Ending, Fib .....📈 NYSE:BABA Breakout Imminent – Triangle Compression Ending, Fib Confluence Targets Set

After weeks of coiling inside a converging triangle, Alibaba ( NYSE:BABA ) just broke above the downtrend line with conviction. The structure and Fibonacci extensions point toward an explosive leg up—possibly

BABA | Weekly VolanX Setup📈 BABA | Weekly VolanX Setup

WaverVanir International LLC | July 24, 2025

Alibaba is bouncing off a key institutional demand zone at 105.96, reclaiming the .382 Fibonacci level with strong bullish conviction. This weekly structure sets the stage for a macro Fibonacci extension run toward 174.73 — a

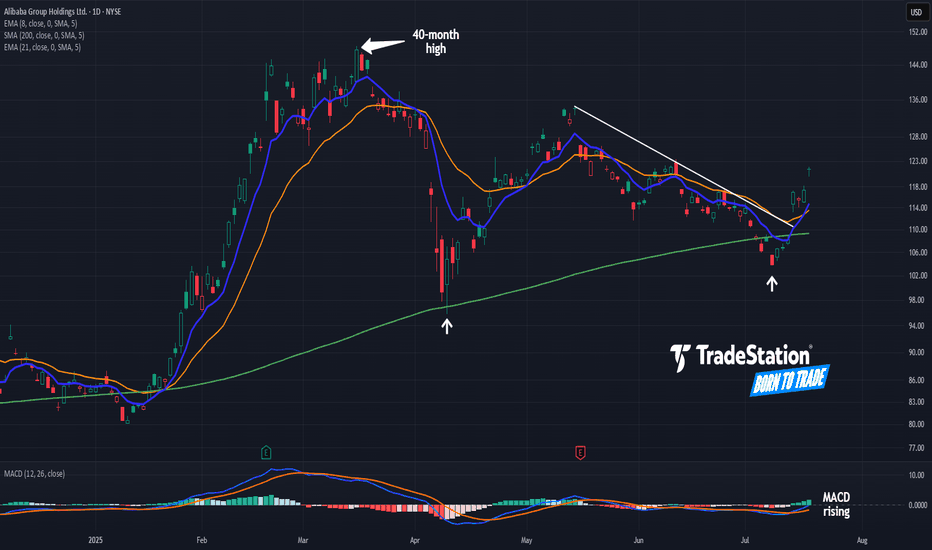

BABA: triangle with tensionOn the weekly chart, BABA has already formed a golden cross - price is above both MA50 and MA200, confirming a bullish trend shift. The stock is now approaching the upper edge of the symmetrical triangle and the key resistance at $122, which also aligns with the 0.5 Fibonacci level.

The numbers ins

Alibaba Breaks a TrendlineAlibaba began 2025 with a big rally. Now, after a long pullback, some traders may see further upside in the Chinese tech giant.

The first pattern on today’s chart is the pair of higher lows (marked with white arrows) along the rising 200-day simple moving average. Those may reflect the development

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where BABA is featured.