VOD trade ideas

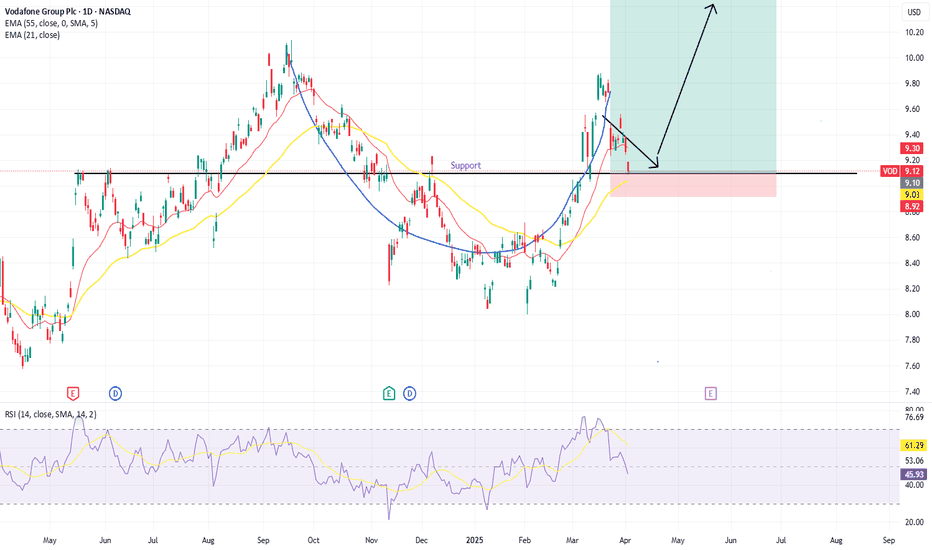

VOD - Cup and HandleThere appears to be a cup and handle pattern forming in $NASDAQ:VOD. It had strong push upward last summer and has drifted back down through the end of the year, with another strong increase back near its highs. We are now seeing a retraction following the handle portion of the pattern and today reached a significant support line. I would expect to see a little bit more consolidation in this area before we get another strong push upward. With the majority of operations occurring in Asia, Africa and Europe, this may a little safer play than the turmoil unfolding in American companies from recent tariffs.

Vodafone ended 10 year long bear ride?

After 10 years, Vodafone seems to have reach the bottom.

Long consolidation periods (yellow), and 2 downward channels led us to a rock bottom of 63GBP.

The last downward channel appears now to be broken with immediate resistance at 103 GBP.

Positive outlook as long term investment.

Breakout After multiple attempts at failing to break the blue resistance line price has closed strongly above this level today.

The catalyst for this was the release of good results, check them out for yourself.

In addition to this they have just got approval from their Spanish business for $5 billion. Ker-ching.

They have also announced a £500 million share buyback program.

Also of note is that two of the Directors have recently bought large chunks of stock.

One bought £1.5 million worth the other over £0.5 million.

Dividend yield %10.

Winner, winner, chicken dinner !

Vodafone Set to Integrate Crypto Wallets With SIM CardsVodafone ( NASDAQ:VOD ) is utilizing SIM card technology to meet the anticipated surge in demand for cryptocurrency on mobile phones. CPO David Palmer discussed how the company is advancing blockchain use on mobile devices to manage crypto transactions. He highlighted the use of Pairpoint, a brand that advances web3 and Internet of Things (IoT) services by utilising SIM card technology for blockchain-based digital wallets on mobile devices.

Palmer believes there will be 5.6 billion blockchain-based digital wallets by 2030, which will be the gateway to financial services. He highlighted the use of public blockchains like Ethereum (ETH-USD) but acknowledged regulatory hurdles. The long-term pathway is towards using public blockchains such as the Ethereum network, and with the Ethereum fork, we are starting to see that public blockchains are becoming faster and more secure.

Vodafone's digital asset broker platform, PairPoint, facilitates transactions between public and private blockchains using smart contracts for seamless integration. It acts as a middleman for large enterprises that wish to write to a public blockchain, allowing cross-chain interoperability through smart contracts.

Vodafone's digital asset broker platform followed its early experiments with peer-to-peer micro-payment transactions and later integrated its SIM card technology with blockchain, introducing interoperable 'digital identity passports'. These passports securely store private keys to digital wallets within the SIM card's hardware module. This culminated in the creation of Vodafone's Pairpoint platform, providing Internet of Things (IoT) devices with decentralized digital identities and enabling them to operate across organizational and system boundaries.

Technical Outlook

Vodafone stock ( NASDAQ:VOD ) didn't quite react to the fundamentals. The stock is trading in equilibrium to market sentiments the ratio of buyers to sellers is latent. The stock has a Relative Strength Index (RSI) of 52 which is not oversold or overbought.

Vodaphone. Golden cross on 4hr time frame.Vodafone is currently near recent lows. Recent Price action has formed a rising wedge pattern.

Looking at the 4 hour chart the 50ma has crossed above the 200ma, a golden cross.

Rising rsi is also in an uptrend.

I suspect the price will move out of wedge, my guess is it will be upwards.

Do your own research of course.

What do you think?

Vodafone Set to Sell Italian Operations to Swisscom for $8.7BVodafone Group Plc ( LSE:VOD ) has announced the sale of its Italian division to Swisscom AG for a hefty sum of 8 billion euros ($8.7 billion). This deal marks the culmination of Vodafone's European restructuring strategy under the leadership of CEO Margherita Della Valle, propelling the telecom giant toward a more focused and financially robust future.

The decision to divest its Italian unit underscores Vodafone's ( LSE:VOD ) commitment to optimizing its portfolio and unlocking value for shareholders. By distributing EUR4 billion of the proceeds from the sale through share buybacks, Vodafone aims to provide immediate returns to its investors while fortifying its financial position.

CEO Margherita Della Valle emphasized the significance of the sale, highlighting the substantial upfront cash proceeds it would generate for the company. This move aligns with Vodafone's broader strategy of debt reduction and operational streamlining, a vision articulated by Della Valle since assuming leadership in May last year.

The sale of the Italian division follows a series of strategic maneuvers by Vodafone ( LSE:VOD ), including the merger of its U.K. telecom business with CK Hutchison and the divestment of its Spanish unit to Zegona Communications for 5 billion euros. These actions underscore Vodafone's commitment to reshaping its portfolio and focusing on key markets to drive sustainable growth and profitability.

Moreover, Vodafone's ( LSE:VOD ) emphasis on expanding its business-to-business (B2B) customer base reflects its strategic pivot towards high-growth segments. With a focus on key European markets and expansion initiatives in Africa, Vodafone ( LSE:VOD ) is positioning itself to capitalize on emerging opportunities and strengthen its competitive position in the global telecommunications landscape.

The market's positive response to Vodafone's ( LSE:VOD ) strategic move is evident in the significant uptick in its American Depositary Receipts (ADR) following the announcement. This vote of confidence underscores investors' belief in the company's strategic direction and its ability to create long-term value despite the challenges of the past year.

As Vodafone ( LSE:VOD ) continues to execute its strategic initiatives and unlock value for shareholders, the telecom giant remains poised for sustained growth and success in a rapidly evolving industry landscape. With a clear focus on debt reduction, operational efficiency, and strategic investments, Vodafone is charting a course towards a brighter and more prosperous future for itself and its stakeholders.

VOD UP TO 15 / 27Vodafone's current share price is remarkably at a level not seen since 1996, presenting a unique investment opportunity. The company has demonstrated impressive financial growth, with earnings surging by 382.5% over the past year. When compared to industry standards, Vodafone's valuation metrics are significantly undervalued, evidenced by its Price-to-Earnings (P/E) ratio of only 2.1 versus the industry average of 17.4. Additionally, its Price-to-Sales (P/S) and Price-to-Book (P/B) ratios stand at 0.5 and 0.4, respectively, which are substantially lower than the industry averages of 1.3 and 1.8.

From a technical analysis perspective, Vodafone's stock exhibits promising signs. The monthly Bollinger bands are squeezing, indicating potential volatility and a likely breakout. The daily chart reveals a double bottom pattern, a classic bullish reversal indicator, with a recent take of liquidity at $8. Following this, the stock has moved above the 50-day Simple Moving Average (SMA) and is now pressing against the higher Bollinger band. These technical indicators, combined with the strong fundamental valuation metrics, suggest a bullish outlook for Vodafone shares.

With these factors in mind, the first price target is set at $15, with a long-term target of $27 for investors willing to hold. This analysis underscores Vodafone's potential for significant share price appreciation, driven by both its undervalued financial metrics and encouraging technical analysis indicators.

VOD Vodafone Buyout Rumors Today !!Vodafone (VOD) Surges on Speculation of Major Corporate Moves and Potential Takeover

In today`s trading sessions, Vodafone (NASDAQ: VOD) has experienced a significant uptick in share value, rising as much as 7.1% in London trading. This surge can be attributed to growing speculation and rumors circulating in financial circles, particularly from Betaville, suggesting that the telecom giant may be on the cusp of a major corporate transaction, such as a spin-off or takeover.

The rumor mill is abuzz with talk of American companies expressing interest in acquiring Vodafone. While details remain vague, it is believed that discussions are underway, fueling anticipation among investors. This potential development signifies a pivotal moment for the traditional #Vodafone company, as it attracts attention from key players in the American telecommunications sector.

Adding to the intrigue, there are whispers of a possible increase in stake by one of Vodafone's existing shareholders, indicating a growing confidence in the company's future prospects. This speculative buying interest is often seen as a positive signal among investors, contributing to the recent surge in Vodafone's stock value.

Furthermore, there are indications that Vodafone may have received a new offer for its Italian unit. This comes on the heels of the rejection of a revised offer from Iliad SA, highlighting the attractiveness of Vodafone's assets in the telecommunications market. The ongoing corporate maneuvers suggest a dynamic landscape for Vodafone, with potential strategic changes that could unlock significant value for shareholders.

In a strategic move to bolster its leadership, Vodafone has announced the appointment of Hatem Dowidar as a non-executive director, effective February 19. This appointment follows the firm's partnership with e& (Emirates Telecommunications Group) last May. Dowidar's extensive experience in the telecommunications industry, coupled with his senior roles in companies across the Middle East, Africa, and Europe, is expected to enhance Vodafone's strategic positioning and strengthen its partnership portfolio.

My short term Price Target is $10.30.

Potential Takeover at $15 - $20

VOD Vodafone and MSFT Microsoft Partnership After reaching its May 2010 level, I believe Vodafone (VOD) stock is primed for a rally! Its metrics are outstanding: Forward Dividend & Yield: 0.97 (11.09%) and PE Ratio (TTM): 2.13.

Additionally, there is a significant partnership with Microsoft (MSFT):

Microsoft initiated a 10-year strategic partnership with Vodafone (VOD) aimed at leveraging their respective strengths to create new digital and financial services tailored for businesses, especially small and medium-sized enterprises (SMEs) across Europe and Africa.

The collaboration involves the utilization of Microsoft's generative artificial intelligence (AI) to enhance Vodafone's customer experience, with the goal of delivering a more personalized and differentiated service through various channels.

The partnership seeks to expand and improve Vodafone's managed Internet of Things (IoT) connectivity platform, aiming to scale up the telecommunication company's IoT platform by connecting more devices, vehicles, and machines.

I`m considering the $9 strike price at the money Call for February 16, or the $10 call for March 15.

VOD Vodafone Group at 2010 Price Level | Potential Breakout SoonLast week, Microsoft (MSFT) initiated a 10-year strategic partnership with Vodafone (VOD) aimed at leveraging their respective strengths to create new digital and financial services tailored for businesses, particularly small and medium-sized enterprises (SMEs) across Europe and Africa.

The collaboration involves the utilization of Microsoft's generative artificial intelligence (AI) to enhance Vodafone's customer experience, with the goal of delivering a more personalized and differentiated service through various channels.

The partnership seeks to expand and improve Vodafone's managed Internet of Things (IoT) connectivity platform, aiming to scale up the telecommunication company's IoT platform by connecting more devices, vehicles, and machines.

In recent news concerning VOD, Deputy Prime Minister Oliver Dowden intervened following the involvement of e&, the UAE’s state-controlled telecoms provider (Etisalat), which became Vodafone’s largest shareholder last year by acquiring a 14.6% stake.

As part of Etisalat's arrangement with Vodafone, CEO Hatem Dowidar was granted a seat on the board, with the option to nominate a second non-executive director if the stake increases beyond 20%. This suggests the possibility of Etisalat increasing its ownership in VOD from 14.6% to 20%.

In summary, it appears that Etisalat is inclined to boost its ownership in VOD from 14.6% to 20%.

As a result, my price target for VOD is $15.

Vodafone and Microsoft's £1.2 Billion Pact

global telecommunications giant Vodafone (NYSE: LSE:VOD ) has inked a momentous 10-year, £1.2 billion deal with tech powerhouse Microsoft. This landmark partnership is set to redefine the digital landscape, leveraging Microsoft's cutting-edge generative AI, digital, and cloud services to catapult Vodafone into a new era of customer-centric innovation.

The Vision:

The strategic alliance aims to propel Vodafone's digital transformation, with a significant focus on customer experience enhancement. Under the agreement, Vodafone will invest a staggering £1.2 billion over the next decade in harnessing Microsoft's generative AI technologies to revolutionize customer services. The collaboration is poised to create state-of-the-art chatbots that will redefine the way Vodafone interacts with its more than 300 million consumers and businesses across Europe and Africa.

Digital Evolution:

A core component of this digital evolution is the digitization of Vodafone's data centers using Microsoft's Azure cloud platform. This move signifies a commitment to operational efficiency and a seamless transition to cloud computing, allowing Vodafone to stay at the forefront of technological advancements.

Empowering SMEs:

One of the key pillars of this collaboration is the empowerment of small and medium-sized enterprises (SMEs). Vodafone and Microsoft plan to scale a new standalone Internet of Things (IoT) business by April 2024. This venture aims to provide SMEs with innovative solutions, enabling them to harness the power of IoT for enhanced operational capabilities and efficiency.

Financial Inclusion through M-Pesa:

The partnership extends beyond technological collaboration as Vodafone and Microsoft aim to expand M-Pesa, Vodafone's mobile money service, to improve financial inclusion across Africa. By leveraging Microsoft's expertise and Vodafone's established presence in the region, the collaboration seeks to provide accessible financial services to underserved communities.

Mutual Benefits:

Microsoft, in turn, will utilize Vodafone's fixed and mobile connectivity services, emphasizing a reciprocal relationship. The tech giant will also invest in Vodafone's connected devices platform, emphasizing the commitment to mutual growth and innovation.

Leadership Perspectives:

Vodafone Group CEO, Margherita Della Valle, expressed the company's bold commitment to the digital future of Europe and Africa. She highlighted the potential of the strategic partnership with Microsoft to accelerate digital transformation, particularly for SMEs, and elevate customer experiences.

Microsoft CEO Satya Nadella echoed this sentiment, emphasizing the monumental opportunities the new generation of AI unlocks for organizations globally. He underlined the joint efforts of Vodafone and Microsoft in applying cloud and AI technology to enhance the experiences of millions of people and businesses, signaling a collective commitment to innovation.

Conclusion:

Vodafone's billion-pound deal with Microsoft stands as a testament to the pivotal role technology plays in shaping the future of telecommunications. This collaboration is not merely a transaction but a visionary partnership poised to reshape the digital landscape, empower businesses, and enhance the lives of millions across continents. As Vodafone takes a bold step into the digital frontier, guided by Microsoft's expertise, the ripple effects of this transformative pact are poised to be felt far beyond the realms of the telecommunications industry.

Vodafone's Bold Leap into the Blockchain Realm

In a groundbreaking development, global telecommunications giant Vodafone has forged a strategic partnership with blockchain trailblazer Chainlink, marking a significant stride toward mainstream adoption of blockchain technology. The collaboration, which positions Vodafone as a node operator within the Chainlink ecosystem, not only underscores the telecom giant's commitment to innovation but also holds promising implications for the future of decentralized networks.

Embracing the Role of a Chainlink Validator

Vodafone's entry into the blockchain space as a node operator signifies a pivotal role in the security and validation of data on the Chainlink network. This move is not merely a technological integration but a testament to the increasing synergy between traditional industries and the transformative potential of blockchain. As a trusted player in the telecommunications industry, Vodafone's participation as a validator enhances the decentralization and reliability of Chainlink's oracle network – a foundational element for smart contracts to seamlessly interact with real-world data.

Unveiling New Avenues for Data-driven Innovation

The collaboration with Vodafone extends beyond securing the blockchain – it opens doors for Chainlink to explore new frontiers in data utilization. With Vodafone's extensive reach and access to vast amounts of real-world data generated by the telecommunications industry, Chainlink gains a valuable resource to enhance its Oracle services. This partnership allows for the extraction of network performance metrics and user behavior data, empowering smart contracts with more accurate and diverse information.

Fortifying Decentralization and Resilience

Chainlink's emphasis on decentralization receives a substantial boost with Vodafone's entry as a node operator. By contributing to the distributed nature of the network, Vodafone plays a key role in preventing a single point of failure and mitigating the risks associated with malicious activities. The collaboration not only enhances the security and reliability of Chainlink's Oracle infrastructure but also positions Vodafone as a crucial player in the ongoing evolution of decentralized technologies.

Ripple Effect on Chainlink's Credibility and LINK Token Dynamics

Beyond the technical advancements, the partnership with Vodafone significantly elevates Chainlink's credibility. Vodafone's global presence and established reputation in the telecommunications industry bring an added layer of trust to Chainlink's network. This boost in credibility is expected to attract a broader audience, including users, developers, and enterprises, fostering increased adoption of LINK – Chainlink's native token.

The Potential Impact on LINK Token Price

The collaboration with Vodafone introduces a compelling dynamic for LINK token holders. With Vodafone operating as a node on the Chainlink network, the demand for LINK tokens may witness a substantial increase. As Vodafone engages with various functions within the ecosystem, the heightened demand for LINK could positively impact its price dynamics, potentially paving the way for a retest of monthly highs above $18.

Looking Ahead: A Paradigm Shift in Blockchain Integration

Vodafone's bold venture into the blockchain realm through its partnership with Chainlink represents a paradigm shift in the integration of decentralized technologies into mainstream industries. As other enterprises observe the success of this collaboration, a chain reaction may unfold, further propelling the adoption of blockchain solutions and contributing to the ongoing evolution of the digital landscape.

In conclusion, NASDAQ:VOD strategic partnership with Chainlink not only solidifies its commitment to innovation but also marks a historic milestone in the convergence of traditional industries and cutting-edge blockchain technologies. As the collaboration unfolds, the potential for increased adoption, utility, and positive impacts on the LINK token's price dynamics positions Vodafone as a trailblazer in shaping the future of decentralized networks.

Vodafone Hopes Sale Of Spanish Unit Will Ring In Turnaround Two decades ago Vodafone was riding high, pulling off a blockbuster takeover with its 2000 acquisition of German rival Mannesmann in a deal worth £113bn. Now the UK-based telecoms group is making headlines for its retreat, after announcing this week it will exit Spain, one of its main European markets, selling its business there for up to €5bn to a fund founded by two former Virgin Media executives. The retrenchment represents both a humbling for the telecoms group and what investors hope signals a fresh start following years of a languishing share price.

Price Momentum

VOD is trading near the bottom of its 52-week range and below its 200-day simple moving average. Investors have been pushing the share price lower, and the stock still appears to have downward momentum.