FTSE 100 holding above support on the dailyFTSE 100 has risen on the Trump announcement of tariff pause and JD Vance announcing there could be a US/UK trade deal. The UK markets seem to like this news.

The index is also holding above the daily.

Keeping an eye and if it closes on the daily above this support level I’ll be opening a position.

UK100 trade ideas

Bullish rise?UK100 has bounced off the pivot which acts as a pullback support and could rise to the 1st resistance which aligns with the 78.6% Fibonacci retracement.

Pivot: 7,969.75

1st Support: 7,696.99

1st Resistance: 8,465.81

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

FTSE 100The FTSE 100, like its global peers, has been caught in the crosswinds of rising volatility over the past fortnight. Let’s break down the key levels to watch, the indicators helping to make sense of the current backdrop, and how the recent sell-off has played out beneath the surface at the sector level.

Daily Timeframe: Shift in Momentum

The sharp sell-off on Friday 4th April marked a clear turning point in the momentum dynamics for the FTSE 100. The index cut cleanly through its 200-day moving average, and the rebound that followed has been weak in comparison. The bounce recaptured less than half the ground lost, which tells us that dominant momentum on the daily chart now tilts firmly in favour of the bears.

It’s worth anchoring a VWAP to the March highs. This gives us a running view of how short-term bullish momentum is faring relative to the longer-term downtrend—and helps frame any intraday strength in the broader context of a weakening trend.

UK100 Daily Candle Chart

Past performance is not a reliable indicator of future results

Sector Snapshot: Rotation to Safety

There’s been a marked shift in sector leadership recently, with risk-on areas falling out of favour and defensives starting to find their feet.

Energy, Healthcare and Materials have led the downside. These are typically sectors that perform when investors are in a more optimistic mood, so the move away from them hints at rising caution across the board.

In contrast, Utilities, Consumer Staples and Real Estate have all shown resilience. As the outlook for rates softens and the broader environment becomes more risk-off, capital is rotating into more stable, yield-oriented sectors—suggesting investors are starting to prioritise defence over growth.

1 Month UK Sector Snapshot

Past performance is not a reliable indicator of future results

Hourly Timeframe: Trading the Inflection Points

Zooming in to the hourly chart, the previous week’s high and low stand out as key levels to work with. They now serve as clear reference points for support and resistance, helping to shape short-term swing setups.

Market harmonics can also offer a useful guide here. Taking the low-to-high move from Wednesday’s recovery and projecting that from Thursday’s swing low creates a potential reversal area. This projection lines up with the anchored VWAP from the daily timeframe, giving us a neat confluence zone where a short-term reversal could take shape.

UK100 Hourly Candle Chart

Past performance is not a reliable indicator of future results

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

FTSE INTRADAY oversold bounce back capped at 8224The FTSE 100 Index remains in a bearish structure, with recent price action confirming a break below the prior consolidation zone, indicating potential for further downside.

Key Resistance: 8224 – former support turned resistance, aligning with the intraday consolidation area.

Support Levels:

7760 – near-term target if bearish momentum continues

7645 and 7522 – medium to long-term downside objectives

An oversold bounce may occur, but unless price breaks and closes above 8224 on the daily chart, the bearish outlook remains intact.

Conversely, a confirmed breakout above 8224 would invalidate the bearish bias and open the path to test 8305, with 8460 as a secondary resistance.

Conclusion

The FTSE bias is bearish below 8224. Watch for a rejection at that level to confirm downside continuation. A daily close above 8224 would shift the outlook to bullish.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Two reasons to sell FTSE Right NOWWe are seeing some reasons to sell FTSE right now.

1) The daily trend is down.

2) H4 is pointing down, but the price is above the MA

3) There are two patterns to sell at the current level

4) 8165 is the last weeks high that will be a good resistance

Hoping for a test of last week's lows.

FTSE100 Bearish continuation below 8224The FTSE 100 Index remains in a bearish structure, with recent price action confirming a break below the prior consolidation zone, indicating potential for further downside.

Key Resistance: 8224 – former support turned resistance, aligning with the intraday consolidation area.

Support Levels:

7760 – near-term target if bearish momentum continues

7645 and 7522 – medium to long-term downside objectives

An oversold bounce may occur, but unless price breaks and closes above 8224 on the daily chart, the bearish outlook remains intact.

Conversely, a confirmed breakout above 8224 would invalidate the bearish bias and open the path to test 8305, with 8460 as a secondary resistance.

Conclusion

The FTSE bias is bearish below 8224. Watch for a rejection at that level to confirm downside continuation. A daily close above 8224 would shift the outlook to bullish.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

UK100 - ANOTHER ROUND OF ENTRYTeam, last week and this week we were correct about Trump's plan on tariff,

Market dump and pump

but last night, we expect the pull back from profit taking

The current price is 7864 is considered a buy with support

Remember to set your stop loss

Target at 7915-25 - 30% volume reduce

Target at 7945-50 - another 30% volume reduction

and above that is 40%

FTSE 100 bearish continuation below 7770The FTSE 100 Index remains in a bearish structure, with recent price action confirming a break below the prior consolidation zone, indicating potential for further downside.

Key Resistance: 7770 – former support turned resistance, aligning with the intraday consolidation area.

Support Levels:

7522 – near-term target if bearish momentum continues

7463 and 7400 – medium to long-term downside objectives

An oversold bounce may occur, but unless price breaks and closes above 7770 on the daily chart, the bearish outlook remains intact.

Conversely, a confirmed breakout above 7770 would invalidate the bearish bias and open the path to test 7900, with 7940 as a secondary resistance.

Conclusion

The FTSE bias is bearish below 7770. Watch for a rejection at that level to confirm downside continuation. A daily close above 7770 would shift the outlook to bullish, targeting 7900+.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE UK100 Rebound: Navigating Fragile Markets & Resistance Zone📊 FTSE 100 Recovery in Focus: The FTSE 100 has bounced back 📈 after a sharp sell-off, showing signs of recovery. Here's a breakdown of the key points to consider:

📉 Recent Performance: After a steep 4.4% drop on Monday, the FTSE 100 rebounded by 1.9% (+144.29 points) to 7846.37. This recovery mirrors improved global market sentiment 🌏, with indices like the Nikkei 225 surging 6% 🚀 (source: Evening Standard).

🌍 Market Sentiment: Analysts warn that the recovery remains fragile ⚠️, with risks of volatility stemming from geopolitical tensions and trade concerns. However, bargain-hunting investors 🛒 have supported the rebound by targeting undervalued stocks.

📈 Technical Levels: The FTSE 100 is climbing from multi-month lows, with momentum suggesting a potential test of resistance levels. But the rally's sustainability hinges on broader market sentiment and key economic data 📊 (source: Saxo Group).

🧐 Analyst Views: While the recovery is promising, some experts caution it could be a "dead cat bounce" 🐱, where the rally fizzles out if negative news arises. This makes short-term trading decisions highly dependent on intraday developments.

💡 Trade Setup: With the current momentum, a buying strategy for a day trade 🎯 targeting resistance levels may be more favorable than selling at the current level. However, traders must closely monitor intraday sentiment and technical indicators to manage risks effectively.

FTSE INTRADAY bearish below 7770The FTSE 100 Index remains in a bearish structure, with recent price action confirming a break below the prior consolidation zone, indicating potential for further downside.

Key Resistance: 7770 – former support turned resistance, aligning with the intraday consolidation area.

Support Levels:

7522 – near-term target if bearish momentum continues

7463 and 7400 – medium to long-term downside objectives

An oversold bounce may occur, but unless price breaks and closes above 7770 on the daily chart, the bearish outlook remains intact.

Conversely, a confirmed breakout above 7770 would invalidate the bearish bias and open the path to test 7900, with 7940 as a secondary resistance.

Conclusion

The FTSE bias is bearish below 7770. Watch for a rejection at that level to confirm downside continuation. A daily close above 7770 would shift the outlook to bullish, targeting 7900+.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Markets in Focus: FTSE 100As global stock markets remain under pressure, we’re taking a close look at the FTSE 100 this morning.

The index continues to trend lower and is now approaching key long-term support levels:

🔹 200-week moving average: 7,671

🔹 55-month moving average: 7,510

Typically, these levels might offer a platform for stabilisation — but the technical damage is evident. The five-year uptrend from the 2020 low has been decisively broken, with former support around 8,200 likely to act as a formidable resistance on any rebound.

The pace of recent sell-offs adds to the concern. While we’ll be watching closely to see if buyers defend these key levels, I’m not overly optimistic given current momentum.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

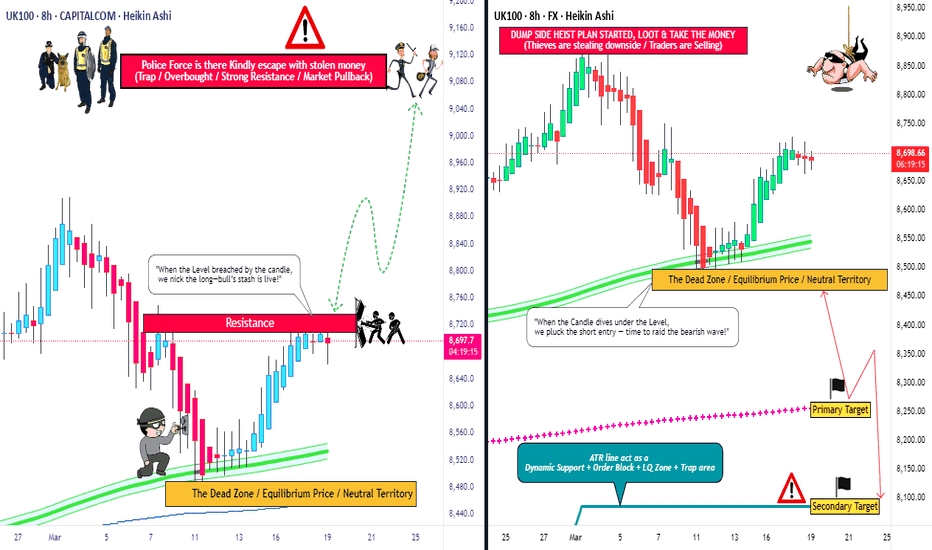

UK100 "FTSE 100 INDEX CASH" Heist Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the UK100 "FTSE 100 INDEX CASH" market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸"Take profit and treat yourself, traders. You deserve it!"💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 8760

🏁Sell Entry below 8450

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 8600 (swing Trade Basis) for Bullish Trade

🚩Thief SL placed at 8700 (swing Trade Basis) for Bearish Trade

Using the 4H period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers : TP 9080 (or) Escape Before the Target

🏴☠️Bearish Robbers : Primary TP - 8250 (&) Secondary TP - 8100 (or) Escape Before the Target

UK100 "FTSE 100 INDEX CASH" Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

POTENTIAL SHORT TRADE SET UP FOR UK100Analysis: Utilizing chart patterns, highs & lows, and impulses & corrections, the focus is on identifying a continuation corrective structure following a breakout.

Entry: The price approached the previous upper zone of a HTF ascending structure with an ascending structure on the mid time frame (MTF), then plummeted from the swing high area signaling a bearish shift, and formed another bearish continuation-like pattern on the LTF. We shall be looking for an entry with a small bearish continuation structure here targeting the lower bound of the HTF ascending structure

Expectation: A downward move is anticipated.

⚠️ Reminder: Conduct your own analysis and implement proper risk management, as forex trading carries no guarantees. This is a high-risk endeavor, and past performance does not predict future outcomes. Trade responsibly!

FTSE trend change capped at 8460The FTSE 100 continues to exhibit bearish sentiment, in line with the prevailing downtrend. Recent price action confirms a breakdown below the previous consolidation zone, reinforcing downside pressure.

Key Level: 8460

This level marks the former intraday consolidation area and now acts as critical resistance. A near-term oversold bounce toward this level is possible.

Bearish Scenario:

A rejection from 8460 would confirm resistance and likely resume the downtrend. Downside targets include 8200 as the first support, followed by 8090 and 8000 over the medium to long term.

Bullish Alternative:

A confirmed breakout and daily close above 8460 would shift the outlook to neutral-to-bullish. In that case, upside targets include 8550 and 8600.

Conclusion:

The technical bias remains bearish below 8460. Price action around this level will be key in determining the next directional move. A failure to reclaim 8460 keeps the downside in focus, while a breakout above it would challenge the bearish view.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

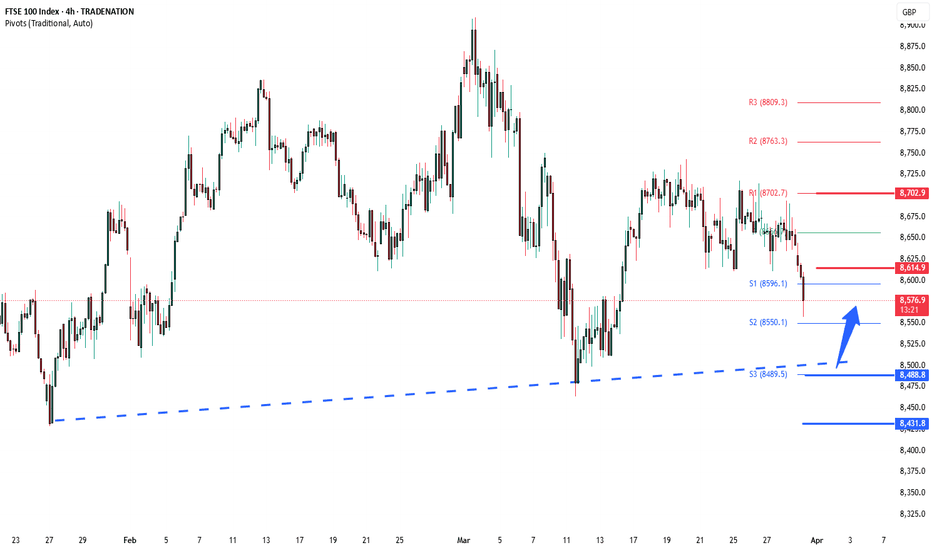

FTSE corrective pullback ahead of tariff announcementTrend Overview:

The FTSE 100 remains in a prevailing uptrend, with recent price action reflecting a corrective pullback towards a previous consolidation zone, now acting as a support level.

Key Levels:

Support: 8550 (key level), 8490, 8430

Resistance: 8614, 8655, 8700

Bullish Scenario:

A pullback to 8550, followed by a strong bullish reversal, could confirm the support level and signal further upside momentum. A breakout above 8614 may open the way toward 8655 and 8700 in the longer term.

Bearish Scenario:

A daily close below 8550 would weaken the bullish outlook, increasing the likelihood of a retracement towards 8490, with 8430 as the next downside target.

Conclusion:

The FTSE 100 remains bullish above 8550, with potential upside targets at 8614, 8655, and 8700. However, a break below 8550 could shift momentum to the downside, targeting 8490 and 8430. Traders should watch price action near 8550 for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE Forms Bullish Hammer at Mini-Range SupportThe FTSE 100 daily rolling futures formed a bullish hammer candle at the lower edge of its mini-range yesterday. But before the bulls get carried away, there are a few cautionary signals to consider.

FTSE 100 Follows the Price Action Playbook So Far in 2025

The FTSE 100 has been a textbook example of price action trading this year, with breakout moves, clean retests, and trending phases that have given traders plenty to work with. January kicked things off with a breakout from key resistance, quickly followed by a classic retest of the broken level. February saw the bulls take charge, pushing the index higher in a strong trending move.

Then came March, when the rally hit a wall at swing resistance. The failure to break through led to a significant retracement, taking the FTSE back down to the volume-weighted average price (VWAP) anchored to the December lows. This pullback set the stage for the next phase: sideways consolidation, with the index settling into a relatively small ‘mini-range’.

However, this week brought a bit of drama. Yesterday’s price action seemed to have broken the mini-range to the downside as market sentiment soured over Donald Trump’s impending tariff announcement, set for Wednesday. With fears of sweeping trade measures hanging over the market, the FTSE looked poised for a deeper move lower.

A Bullish Rejection—But Bulls Should Stay Cautious

Just when it looked like the bears might take control, the FTSE 100 daily rolling futures made a late-session comeback. During the final two hours of the UK trading session, buyers stepped in and pushed prices back up. The bullish momentum continued during the latter half of the US trading session, allowing the futures to close back within the mini-range and forming a bullish hammer candle in the process.

This bullish hammer is significant for a few reasons. Firstly, it represents a clear rejection of lower prices, suggesting that the market is not ready to break down just yet. Secondly, the location of the candle adds weight to the signal. Not only does it reinforce the integrity of the mini-range, but it also marks yet another bounce from the VWAP anchored to the December lows—a level that has been a key support point throughout the recent consolidation.

However, it’s essential to keep a level head here. One notable point of caution is that the hammer pattern only formed on the FTSE rolling futures, not on the underlying cash market, which closed at 4:30 UK time. This discrepancy raises a question about how much weight to give the signal.

Additionally, the nature of the consolidation itself hints at a potential problem for the bulls. Tests of the bottom of the mini-range have been far more frequent than attempts at the top, hinting at underlying weakness. While the bullish hammer is an encouraging sign, the pattern of repeated downside tests suggests that sellers remain active.

The FTSE 100’s ability to maintain its ground in the face of potential US tariffs will be the key to watch this week. If the hammer candle holds and the bulls can push prices higher, it could signal a more sustained move back towards the range highs. However, if the downside pressure resumes, it may well prove to be a false dawn.

UK100 Daily Candle Chart

Past performance is not a reliable indicator of future results

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

UK100 - Short Term Sell Idea Update!!!Hi Traders, on March 20th I shared this idea "UK100 - Expecting The Price To Drop Lower Further"

I expected the price to drop lower further. You can read the full post using the link above.

Price dropped lower as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

FTSE100 corrective pullback supported at 8550Trend Overview:

The FTSE 100 remains in a prevailing uptrend, with recent price action reflecting a corrective pullback towards a previous consolidation zone, now acting as a support level.

Key Levels:

Support: 8550 (key level), 8490, 8430

Resistance: 8614, 8655, 8700

Bullish Scenario:

A pullback to 8550, followed by a strong bullish reversal, could confirm the support level and signal further upside momentum. A breakout above 8614 may open the way toward 8655 and 8700 in the longer term.

Bearish Scenario:

A daily close below 8550 would weaken the bullish outlook, increasing the likelihood of a retracement towards 8490, with 8430 as the next downside target.

Conclusion:

The FTSE 100 remains bullish above 8550, with potential upside targets at 8614, 8655, and 8700. However, a break below 8550 could shift momentum to the downside, targeting 8490 and 8430. Traders should watch price action near 8550 for confirmation of the next directional move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE100 INTRADAY sideways consolidation supported at 8594The FTSE 100 equity index is exhibiting bullish sentiment, reinforced by the prevailing uptrend. The recent intraday price action appears to be a corrective sideways consolidation, potentially forming a Bullish Flag continuation pattern, which typically precedes a continuation of the upward momentum.

Key Trading Levels:

Support Level: The critical support level to watch is 8,594, marking the previous consolidation price range.

Upside Targets: A corrective pullback from current levels, followed by a bullish bounce from the 8,594 level, could pave the way for an upward move toward the next resistance levels at 8,729, followed by 8,798 and 8,853 over a longer timeframe.

Alternative Bearish Scenario:

A confirmed loss of support at 8,594, with a daily close below this level, would invalidate the bullish outlook. In such a case, the index could experience further retracement, with potential downside targets at 8,539 and 8,465.

Conclusion:

While the current sentiment remains bullish, traders should closely monitor the 8,594 support level. A successful bounce could reaffirm the bullish momentum, targeting higher resistance levels. Conversely, a break and close below this support would signal a shift in sentiment, suggesting a deeper corrective move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.