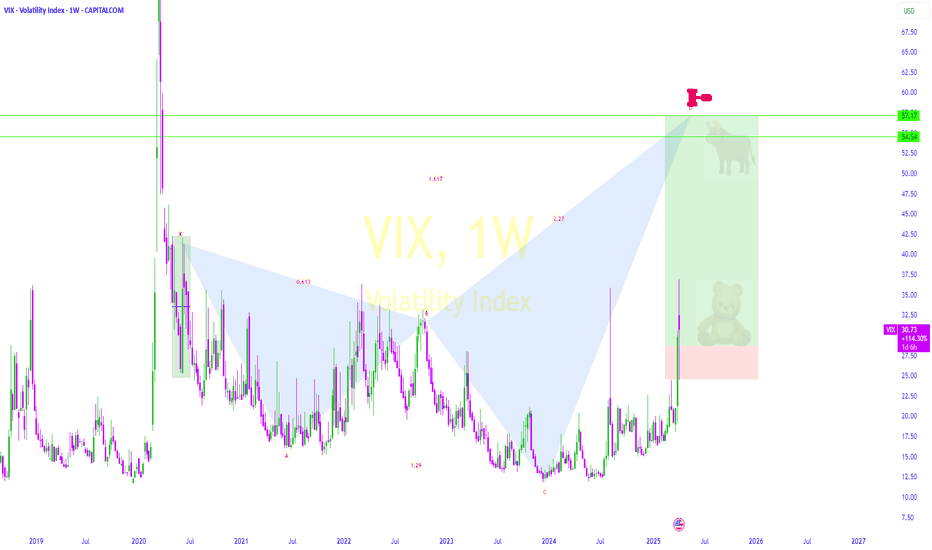

VIX, the paroxysm of fear is behind us The international equity market suffered a bearish shock between the beginning of February and the beginning of April, against the backdrop of the trade war. The trade war known as “reciprocal tariffs” initiated by the Trump Administration caused the MSCI World stock index to fall by over 20%.

Now, since the States have entered into a sequence of trade diplomacy, the equity market has rebounded and volatility has dropped one floor.

Can we say that the paroxysm of fear is behind us, based on the prism of technical analysis of the financial markets?

To answer this question, we'd like to take a look at two interesting charts.

1) Firstly, the implied volatility chart of the stocks that make up the SP 500 index, the VIX. The nickname of this index is “the fear index”. Its calculation is based on the price of call and put options on the stocks making up the SP500 index. Remember that the S&P 500 is considered the benchmark index of Western finance

2) The second chart of interest is a quantitative analysis of financial markets. Quantitative analysis of financial markets is one of the disciplines of technical analysis of financial markets, and here it concerns the percentage of SP 500 stocks above the 50-day moving average.

It is precisely the application of technical analysis to these two charts that allows us to argue in favour of a selling paroxysm reached during the first fortnight of April.

For the VIX, the fear index has been rejecting downwards since the 60 level, with a chartist “black cloud cover” structure (Japanese candlestick terminology) and a bearish resolution of the RSI technical indicator from its weekly overbought zone. This signal historically signified that the paroxysm of fear was over.

For the percentage of S&P 500 stocks above the 50-day moving average, the quantitative bullish signal is very convincing. Historically, every time this percentage has fallen below the 20% threshold in an abrupt fashion, only to rise back up again, it has signalled the final phase of the bear market, and that's what's happening again this April 2025, as you can see on the chart below.

CONCLUSION: Through the prism of technical analysis of the financial markets, a number of clues point to a paroxysm of fear reached in the first half of April. Of course, only the fundamentals and the outcome of trade diplomacy can confirm that the low point is well and truly behind us.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

VXX trade ideas

VIX – “Liquidity Pool Bounce & Reversal Setup”🟢 VIX – “Liquidity Pool Bounce & Reversal Setup”

📅 Date: April 22, 2025

⏰ Multi-Timeframe Analysis (12h, 1D, 1h, 30m, 5m)

🔎 Global Context:

The Volatility Index (VIX) is reacting to a clear institutional liquidity zone (blue area) across multiple timeframes (12h, 1D, 1h), aligning with a mean reversion move following the explosive rally earlier this month. We’re seeing multiple signs of a potential bullish reversal:

Previous lows + demand zone confluence

Multiple CHoCH (Change of Character) events on lower timeframes

Implied divergence from equities (not shown here, but inferred)

Strong rejection from the institutional block (26.345–26.600)

🔍 Technical Analysis & Justification:

📌 Wyckoff & Smart Money Concepts (SMC):

On 30m and 1h charts, we observe several CHoCH and BOS events suggesting a transition from redistribution into accumulation.

The latest bearish move failed to break the weak low zone (26.345), indicating a liquidity grab trap.

📌 Fibonacci & Moving Averages:

Price touched the 78.6%–88.6% retracement from the previous bullish leg.

EMAs 8/21 (Orange/Blue) are about to cross bullish on 5m and 30m – a typical trigger for a new impulsive move.

EMA200 (White) still hovers above – likely target of the first bullish push.

📌 Volume Profile (implicit):

Most of the recent consolidation occurred in the 27.00–27.40 imbalance zone, which now acts as a magnet for price during retracement.

📌 Liquidity & Order Flow Concepts:

The 26.345–26.600 range served as a Weak Low and was swept clean – classic liquidity trap behavior.

📈 Trade Parameters:

🟢 Entry (Buy): 26.795

🔒 Stop-Loss (SL): 26.345 (below last liquidity sweep)

🎯 Take Profit 1 (TP1): 27.390 (inefficiency zone + EMA200)

🎯 Take Profit 2 (TP2): 28.150 (1h/30m order block)

🧮 Risk-Reward Ratio (RR):

TP1: ~1.6

TP2: ~3.0

📊 Confidence Level: ⭐⭐⭐⭐ (High-probability setup)

🧠 Strategic Summary:

This is a classic reversal play based on liquidity absorption and structural shift (CHoCH), supported by multi-timeframe alignment. A bullish engulfing or strong reaction inside the blue zone confirms the entry bias. If price breaks above 27.00 with volume, momentum may carry it towards 28.00+ swiftly.

⚠️ Risk Disclaimer: Trading involves risk. Only trade with capital you can afford to lose. Always manage your exposure wisely.

💬 What do you think of this setup? Do you see confluence with your strategy? Let’s discuss below! 👇

Technical Analysis of VIX Dynamics:As we predicted, the small crab (retail traders) jumped from the ocean depths (high VIX zone) but failed to break the golden resistance at 29 due to panic and stress.

Now the mother crab (institutions) is preparing to surface. If successful, this could crush the VIX and dramatically shift market sentiment - just like we originally envisioned in our crab market theory."

VIX drop before the next ZOOM upWhat we experienced last week was absolutely insane in terms of volatility. The beauty of all of this is that it's still a trend and many of these spikes are quite predictable. We all knew about the days the tariffs that were going to hit, right? Why didn't you get into UVIX when I called this out days in advance. It's fine, you will have another shot! Actually, we're in line for many many more spikes which is the great thing. Volatility is your friend!

I'll be posting weekly and will be giving away a Free trading alert that has been backtested for the last 3 years over the next week. 2025 will be awesome!

Expect VIX to drop a bit more, great to get in on the SVIX and then let's analyze the next trend and take on UVIX on the upside! This is so easy....

VIX is readying for a golden shot#vix the volatility index is consolidating in falling megaphone channel for another impulsive wave. TVC:VIX had the 1st wave when trade wars begin (But i warned you 3 months ago with VIX chart) then 2nd wave of correction in progress and when 2nd wave consolidation is done, 3rd wave far more cruel than 1st wave will set sail. Beware with your high risk positions, just a warning. Not financial advice. DYOR.

Long Strategy for VIX: Eyeing Stabilization Amid Persistent Vola

- Key Insights: The VIX has exhibited significant fluctuations over the last

week, peaking at levels above 55 before settling in the 37–40 range. This

suggests that although fear has eased, market uncertainty remains elevated.

Historically, the current environment indicates potential opportunities for

a long position if volatility trends continue to moderate. Market

participants should monitor the 32–34 support zone, as a breach below this

could signal improved sentiment and reduced risk-off positioning.

- Price Targets:

* **Next Week Targets (T1, T2)**: T1 = 43.5, T2 = 47.3

* **Stop Levels (S1, S2)**: S1 = 36.2, S2 = 34.8

- Recent Performance: Over the past week, the VIX demonstrated extreme

volatility, briefly surging above 55 early in the week, reflecting intense

fear driven by macroeconomic uncertainty and geopolitical factors. By week’s

end, it had declined to the 37–40 range as market panic subsided somewhat.

Despite this moderation, the index remains well above its historical

average, indicating ongoing caution.

- Expert Analysis: Analysts emphasize that the sharp decline from the midweek

peak signals reduced panic and a potential shift to stabilization. However,

elevated levels above 20 suggest continued risk-off sentiment, with hedging

activity still prominent among institutional investors. Current levels are

reminiscent of volatility spikes seen in major crises, often preceding

medium-term recovery in equities. Traders may expect a possible rally in

equity markets if the VIX trends lower toward the critical 32–34 support

zone, which would further confirm easing fear.

- News Impact: VIX movements this week were influenced by a mix of macroeconomic

concerns and geopolitical risks, which drove it to its highest levels since

COVID. Sentiment began to improve in the latter part of the week as the S&P

500 rebounded from oversold conditions, aligning with historical trends

where elevated fear is followed by equity recoveries. While the decline in

the VIX reflects reduced panic, market risks remain, warranting caution

amidst wider price swings.

Market Insight: VIX Index WatchHold onto your life jackets, folks! The volatility index (a.k.a. the Shark VIX) has emerged from the depths at a slippery 0.88 and is now eyeing the ominous 1.138! 📈💔

Why does that matter? Well, if it's anything like a shark spotting in the ocean, it usually means it’s about to get choppy! 🦈💥 Expect some serious splashes ahead as we ride these market waves!

So, if you prefer calm seas over shark-infested waters, it might be time to brace yourself for a fun (read: bumpy) ride! 🎢 Don’t worry; we’ll keep the floaties handy!

Swim smart, invest wisely! 🌊💸**

"When the VIX is low, look out below!""When the VIX is low, look out below!"

+

FEDs motto "Higher for longer"

=

Fed rate hikes to go: 2-3 left

it is pivot time, change of market dynamic from "bad news is good news" to "bad news is bad news".

state of economy is not good and it will start sinking in to investors and public

Path to 100 VIXI wrote this note on TVC:VIX a few days ago:

www.tradingview.com

And am now expanding it a bit more.

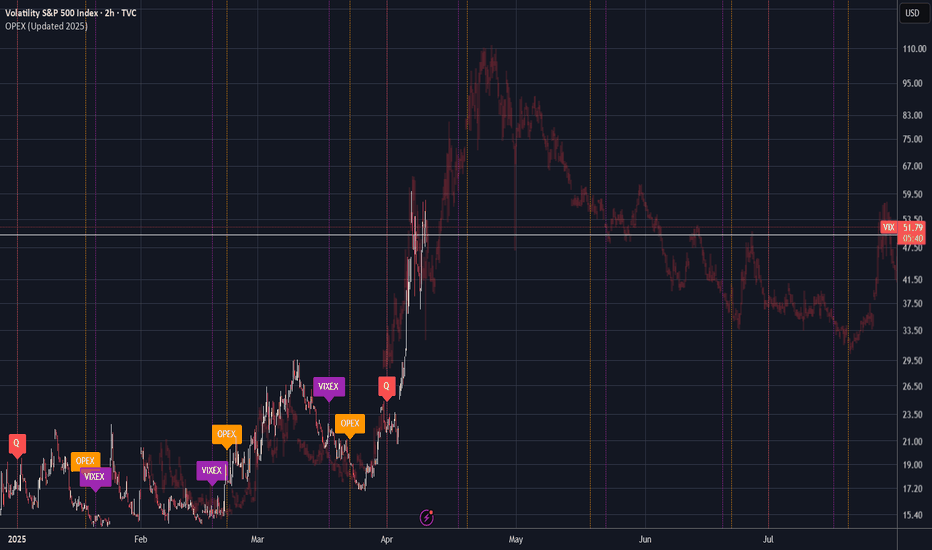

As someone who was working middle office during the original 2016 Trump Election, Brexit, during the Taper Tantrum and a few other major events - I want to lay out my principles on trading the VIX because spikes like this bring a lot of "first time" VIX traders to something that trades like NOTHING ELSE in the market.

This is not a stock in a short squeeze, this is not a generic index.

This is like nothing you've ever traded before. In fact, I'd encourage you to take advantage of TradingView's chart options and instead look at the chart of -1*$TVC:VIX.

That alone should give you pause.

----------------------------------

So - let's start with the principles of the finance business as laid out in the masterclass which was the movie "Margin Call" .

"John Tuld: There are three ways to make a living in this business: be first, be smarter, or cheat."

1. Be First.

You are not first if you are buying above the historic average of VIX 20-21.

If you were buying CBOE:UVXY since Jan 2025, you'd be up 175% right now and likely looking to re-balance into your desired long term asset positions.

2. Be Smarter.

* Are you taking into consideration the VIXEX Cycle?

* Do you know the effect of VIXEX before or after monthly OpEx?

* Do you know the current implied volatility curve of options ON the VIX?

* Do you know that of the last 4 times the VIX has hit 50, it went on to 80+ 50% of the time after that?

* Yes, I've seen the charts going around about forward S&P X year returns but did you know that after the VIX spike to 80 in October 2008, the market (in a decreasing volatility environment) went on a further 35% decline in the next 4-5 months?

* Where is the MOVE? What are the bond indexes & bond volatility measures doing? And if you don't yet understand that equities ALWAYS reacts to what is going on in the rates / yield world... you'll find out eventually. I hope.

3. Cheat

When things start going wrong, everyone wants an easy solution.

That's why its called a relief rally. It feels like relief - the bottom is in, the worst part is over.

But that is what the really big players have the biggest opportunity to play with the day to day environment.

They know our heuristics. They encourage the formation of cargo cult style investing whether that's HODL in the cryptocurrencies or Bogleheads in the vanguard ETFs.

It's all the same and encourages you to forgot first principles thinking about things like:

1. Is this actually a good price or is it just relatively cheap to recent history?

2. Who's going to have to dilute to survive the next period of tighter lending, import costs from tariffs, or whatever the problem of the day is.

3. VIX correlation - volatility is just a description of the markets. Its not a description of the direction. There is periods where volatility is positively correlated to the price movement (like during earnings beats). Know about this and know when it changes.

4. Etc.

Some have pointed out that is more appropriately a measure of liquidity in the SPX.

When VIX is low, that means there is lots of "friction" to price movement. It means that there is tons of orders on the L2 book keeping the current price from moving in any direction too quickly.

When VIX is high, that means there is very low "friction" to price movement. It means there are very few orders on the L2 book and market makers can "cheat" by appearing to create a low volume rally and then rug pull that price movement very quickly (not via spoofing, more just dynamic management of gamma & delta hedging requirements).

Additionally - volume itself becomes deceptive. Volume is just indicating that a trade happened.

Its not telling you to what degree the spread between the bid and ask has blown out to 1x, 2x, or 5x normal and that trades are executing only at the highest slippage prices in that spread.

All of these things are considerations that the market makers can use to make a "buy the dip" situation that works heavily to their advantage.

TLDR: "If you can't spot the sucker in your first half hour at the table, then you are the sucker"

----------------------------------

So - why / when would VIX go to 100?

In 2020, its easy to forget that a culmination of things stopped the crash at -35%.

* March 17, 2020 VIXEX wiped out a significant amount of long volatility positions.

* March 20, 2020 Opex wiped out a significant proportion of the short term put positions

* March 20, 2020 Fed Reserve announced to provide "enhanced" (i.e. unlimited) liquidity to the

markets starting Monday March 23, 2020.

* April 6th, 2020 Peak of Implied Volatility (point where options "most expensive") - which meant that buyers / sellers started providing more & more liquidity following this point.

In 2025, we have yet to see:

* Any motion towards intervention from the Fed for liquidity.

* Any motion from the significant fundamental investors (we're not close to an attractive P/S or P/E on most stocks for Buffett & Co to start buying)

* Any significant motion from companies on indicating strategies about capital raises, layoffs, or other company level liquidity reactions.

* Any "reset" of options in either volatility or hedging. Numbers below as of April 9, 2025:

- SPY 2.8M Put OI for April 17

- VIX 3.5M Call OI for April 16

Just an example but maybe IF we see those clear and NOT get re-bought for May Opex... we might be ready to call a top here at 50 VIX.

Otherwise.... we're just at another stop on the path to 100.

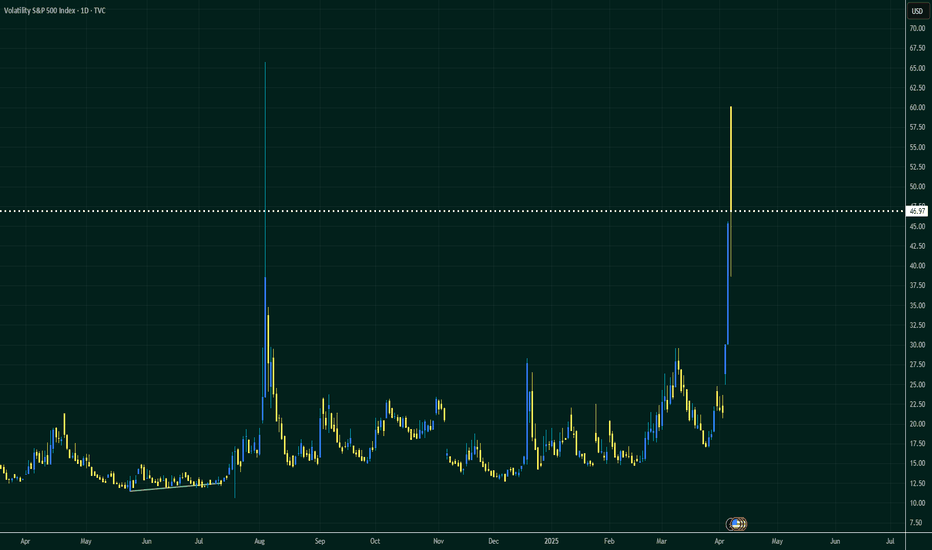

VIX - Extreme fear in the market: a unique opportunity?Extreme fear in the market: a unique opportunity?

An analysis of the most significant

VIX spikes (1987-2025) and subsequent stock market performance.

The VIX (Volatility Index) is an indicator that reflects the level of fear or uncertainty in the market based on expectations of volatility in the S&P 500 Index.

The VIX's 118% surge from April 4 to April 7, 2025 was the fifth largest 3-day surge in market history.

This surge 🚀 reflects the high level of uncertainty that has developed in the markets.

It is very difficult to make informed investment decisions during such periods.

But we can rely on historical patterns.

After the 20 largest VIX spikes, the S&P 500 Index has consistently delivered exceptional returns:

- After 1 year: 16.5% (vs. 12% in normal periods)

- After 3 years: 45.9% (vs. 39.5% in normal periods)

- After 5 years: 83.0% (vs. 74.4% in normal periods)

The difference in returns over the 4 years is 10.2% above average.

Over the past 40 years, there has only been one negative return (the 2007 spike before the financial crisis), while most extreme fear events have become outstanding buying opportunities. For example, the August 2011 spike was followed by an impressive 117% return over the next five years.

When market panic reaches extreme levels, institutional capital typically steps in against retail sales, setting the stage for stronger long-term growth. History shows that these moments of maximum fear often represent optimal entry points for patient investors.

It is essential to realize that historical patterns do not always hold true in the future. Each crisis has unique characteristics and causes that can lead to different outcomes.

These statistics provide good mathematical expectations, not guarantees.

This has always been the case in the market, and proper handling of math expectations and risk management are the foundations of profitable strategies.

Best regards EXCAVO

_____________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

VIX Option Flow Signals Volatility Spike A massive wave of institutional option activity is pointing toward an upcoming surge in volatility—and likely a pullback in equities even more. Here's what the VIX flow is telling us:

🧠 Key Takeaways:

🔺 Aggressive Call Buying on VIX

Heavy blocks on VIX 22–42.5 calls, with most trading at the ask, signaling urgency.

Standout trades include:

1,407x April 22C @ $10.73 – $1.51M

2,535x May 60C @ $1.55 – $394K

5,770x April 40C @ $2.95 – $1.7M

📅 Short- to Mid-Term Focus

Expiries are clustered around April 16 and May 21, suggesting a volatility spike is expected within the next 1–6 weeks.

💵 Big Premiums Paid

Multiple trades between $500K and $1.7M, indicating strong conviction or heavy portfolio hedging.

📉 Minimal Put Activity

Very few puts being bought on VIX, signaling no expectations for volatility to fall.

📊 What This Means for Markets (SPY/QQQ)

This type of flow usually precedes a market correction, a macro catalyst, or event risk. Whether it's CPI, earnings season, or geopolitical flare-ups—institutions are bracing for turbulence.

🔮 Prediction:

Expect a spike in the VIX and downward pressure on major indices like SPY and QQQ in the coming 1–3 weeks.

This flow doesn’t lie—smart money is prepping for a move.

VIX Clips 60 as Market Volatility and Tariff UncertaintyThe VIX Clips 60 as Market Volatility and Uncertainty Surge on Tariff Announcement

The CBOE Volatility Index (VIX), often dubbed the “fear gauge,” surged past the 60 threshold this week—the highest level since August 5, 2023—as markets reacted violently to an unexpected announcement by the U.S. President regarding global tariffs. The sharp rise in the VIX, which measures market expectations of 30-day volatility, underscores the profound uncertainty now gripping investors, with the Dow Jones Industrial Average plummeting over 1,000 points and the S&P 500 entering correction territory. The trigger? A sweeping tariff policy unveiled by the administration on Liberation Day, a symbolic holiday marking a shift in economic strategy, which has sent shockwaves through global markets.

The VIX at 60: A Sign of Extreme Fear

The VIX typically hovers around 15-20 under normal conditions, reflecting moderate uncertainty. However, readings above 30 indicate heightened anxiety, and levels above 50 are rare, historically occurring during major crises like the 2008 financial collapse or the 2020 pandemic sell-off. This week’s spike to 60 marks a dramatic escalation, signaling a market gripped by fear. Analysts attribute this to the suddenness and scale of the President’s tariff announcement, which caught investors off guard after a period of relative calm.

The Liberation Day Tariff Announcement

On Liberation Day—a holiday commemorating historical freedoms—the administration announced a 25% tariff on a broad range of imports from key trading partners, including China, the EU, and others, effective immediately. The move, framed as a “national economic security initiative,” aims to curb perceived trade imbalances and protect domestic industries. However, its immediate impact has been severe:

Scope and Speed: The tariffs apply to $500 billion in goods, targeting sectors like semiconductors, automotive parts, and consumer electronics. The abrupt implementation, with no prior warning or negotiation, has left businesses scrambling to adjust supply chains.

Political Context: The announcement coincided with domestic political tensions, including debates over inflation and job creation. The White House argued the tariffs would “level the playing field” for American workers, but critics warned of retaliation and inflationary pressures.

Market Chaos: Sectors Under Siege

The tariff shockwave rippled across asset classes:

Equities: The S&P 500 fell 2+% on Monday, its worst single-day drop since March 2020. The Nasdaq, heavily weighted in tech stocks reliant on global supply chains, plunged over 5%.

Sectors: Semiconductor firms like Intel and AMD tanked, while automakers such as Ford and Tesla declined sharply.

Expert Analysis: A Volatility Tipping Point

Historical Parallels and Economic Risks

The current volatility mirrors past crises:

2008 Financial Crisis: The VIX hit 80 as Lehman Brothers collapsed, but the current crisis stems from policy, not financial contagion.

2020 Pandemic Sell-Off: The VIX spiked to 82 as lockdowns paralyzed economies, but today’s uncertainty is self-inflicted.

However, the tariff-driven uncertainty poses unique risks:

Inflation: Higher import costs could push inflation back above 4%, complicating the Fed’s rate-cut path.

Global Growth: The World Bank warns that trade wars could shave 2% off global GDP by 2025. Emerging markets, reliant on exports, face currency crises.

Looking Ahead: Can Calm Return?

Markets may stabilize if the administration signals flexibility. Potential pathways include:

Negotiations: A G20 summit in September offers a venue for de-escalation, though diplomatic progress is uncertain.

Policy Reversal: If tariffs are delayed or narrowed, the VIX could retreat. However, the President’s rhetoric suggests a hardline stance.

Corporate Adaptation: Companies might pivot to domestic suppliers, but such shifts take years, prolonging volatility.

Conclusion: A New Era of Uncertainty

The VIX at 60 marks a pivotal moment. Markets are now pricing in not just the immediate tariff impact but a broader shift toward protectionism and policy-driven instability. For investors, the path forward is fraught with uncertainty. While short-term volatility may ebb with reassurances, the long-term consequences—trade wars, inflation, and geopolitical friction—could redefine global economics for years.

With Liberation Day’s tariffs reshaping the landscape, one thing is clear: the era of low volatility is over. The question now is whether policymakers can navigate this new turbulence—or if markets will remain hostages to fear.

Don’t Get Trapped! Today’s Market Could Make or Break YouMarket Meltdown or Setup for Generational Wealth? What Traders Need to Know Today 🔥📉

As of April 7, 2025, global financial markets are experiencing significant volatility following the announcement of new tariffs by President Donald Trump. U.S. stock futures indicate a sharp decline at the market open:

* S&P 500 Futures: Down approximately 4.5%.

* Dow Jones Industrial Average Futures: Down around 4%.

* Nasdaq-100 Futures: Down more than 5%.

In such a turbulent environment, traders should exercise heightened caution. Here are some strategies to consider:

1. Prioritize Capital Preservation: Increased volatility can lead to unpredictable market movements. It's advisable to reduce position sizes and set strict stop-loss orders to manage potential losses.

2. Avoid Impulsive Decisions: Rapid market changes can tempt traders into reactive decisions. Stick to your pre-defined trading plan and avoid making trades based on short-term market noise.

3. Stay Informed: Keep abreast of ongoing developments related to trade policies and economic indicators. Reliable news sources and official statements can provide crucial insights that may impact market conditions.

4. Consider Defensive Assets: In times of market downturns, some investors shift towards traditionally safer assets like government bonds or gold. Assess if incorporating such assets aligns with your risk tolerance and investment strategy.

5. Evaluate Long-Term Positions: For long-term investors, market corrections can present opportunities to acquire quality assets at reduced prices. However, ensure that any new positions are in line with your overall investment goals and risk profile.

Given the current market instability, it's essential to remain vigilant and disciplined. Consulting with a financial advisor can also provide personalized guidance tailored to your individual circumstances.

Go Long on VIX as Market Fear Peaks with Trade Tensions

-Key Insights: The VIX has surged to 45.31, the highest level since the COVID

crash, signaling extreme fear in the markets. With trade tensions between the US

and China intensifying and economic fears prevailing, market volatility remains

high. This environment presents a potential opportunity to go long on VIX as

investors seek protection from downside risks.

-Price Targets: Based on current analysis, set price targets for VIX as follows:

- T1: 50

- T2: 55

- S1: 43

- S2: 42

These targets account for continued volatility with potential upside in VIX as

market fear sustains.

-Recent Performance: The VIX's recent performance highlights a significant surge

correlating with increased market volatility. The index has climbed sharply from

previous levels as investors react to negative market drivers, including

indiscriminate selling across various asset classes like stocks, gold, and

cryptocurrencies.

-Expert Analysis: Analysts show cautious optimism in the medium term due to the

heightened volatility but remain wary about immediate long-term entries. Current

market fears pivot around US-China trade tensions, which analysts believe are

central to sustained volatility. Opportunities for day trading are emphasized,

but experts advise prioritizing risk management strategies.

-News Impact: The ongoing trade war between the US and China, alongside

geopolitical developments and a lack of immediate response from central banks

like the Federal Reserve, continues to drive market uncertainty. Declines in

commodities like crude oil and copper underscore economic fears, with the VIX

reflecting this sentiment. Investors are advised to stay vigilant and adjust

strategies according to evolving market conditions.