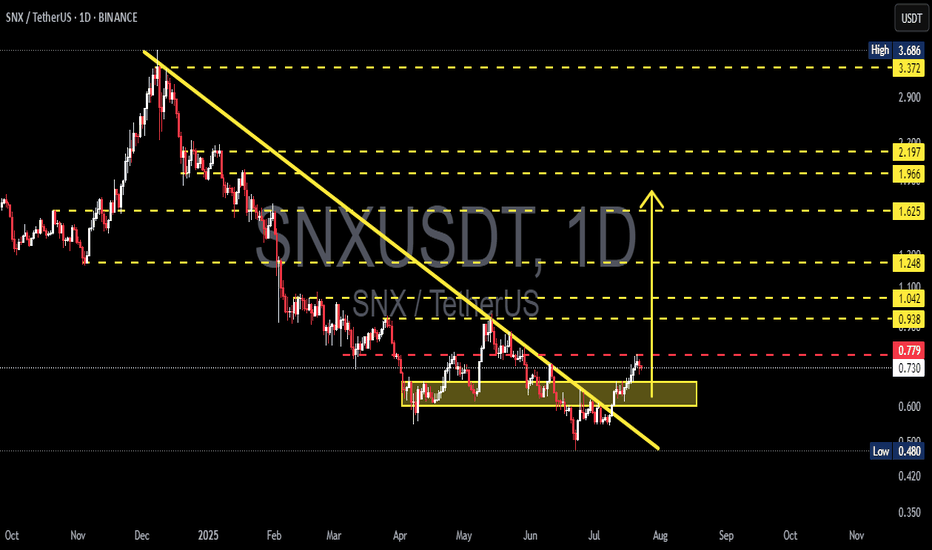

SNXUSDT Breakout Alert! Are We Witnessing the Early Stages?📌 🔍 Overview:

After months of relentless downward pressure, SNX has finally shown a strong technical breakout. The price has decisively broken above the long-term descending trendline, signaling a potential shift in structure from bearish to bullish. This could mark the beginning of a significant impulse wave to the upside.

📐 📊 Technical Structure & Key Pattern Breakdown:

🔻 Broken Downtrend Line: Price action has successfully broken above a descending trendline that has been in place since December 2024, effectively ending the bearish dominance.

🔺 Falling Wedge Pattern: A classic falling wedge has formed and recently completed with a confirmed breakout — a bullish reversal pattern that often precedes strong upside momentum.

🟨 Accumulation Zone (Base Support): The yellow box between $0.60 – $0.72 acted as a major accumulation zone and now flips into a strong demand/support area.

📈 Higher Lows Structure: The recent structure of higher lows signals a shift in market sentiment, showing early signs of accumulation and bullish interest.

✅ Bullish Scenario (Upside Continuation):

If price holds above the breakout zone and confirms strength:

🎯 Target 1: $0.938 (key horizontal resistance)

🎯 Target 2: $1.042 – $1.100 (historical resistance zone)

🎯 Target 3: $1.248 – $1.625

🎯 Target 4 (Mid-term rally): $1.966 – $2.197

🏁 Final Bullish Target (Longer term): $3.372 – $3.686

A strong continuation would require confirmation via increased trading volume and bullish momentum from the broader crypto market.

❌ Bearish Scenario (Failed Retest or Rejection):

However, if the price fails to sustain above the breakout level:

🚨 Risk of a false breakout emerges if price falls back below $0.724

🔻 Breakdown of the yellow support box could trigger a deeper correction toward:

Support 1: $0.60

Support 2 (Major Low): $0.480

This would form a classic bull trap and extend the consolidation phase.

⚠️ Validation & Risk Considerations:

Volume confirmation is key. A breakout without rising volume may lack follow-through.

Watch closely for price action in the coming days — will it hold above the breakout zone or fall back?

Strategy: Look for retest entries or enter with partial exposure, using tight risk management.

🧠 Conclusion:

SNXUSDT is at a pivotal turning point. The breakout from a falling wedge pattern combined with higher low formations is a textbook bullish reversal setup. If price holds and buyers step in, we may be witnessing the early stages of a major bull run for SNX.

#SNXUSDT #SNXBreakout #AltcoinSetup #BullishReversal #FallingWedge #CryptoSignals #CryptoTrading #ChartAnalysis #PriceAction

SNXUSDT trade ideas

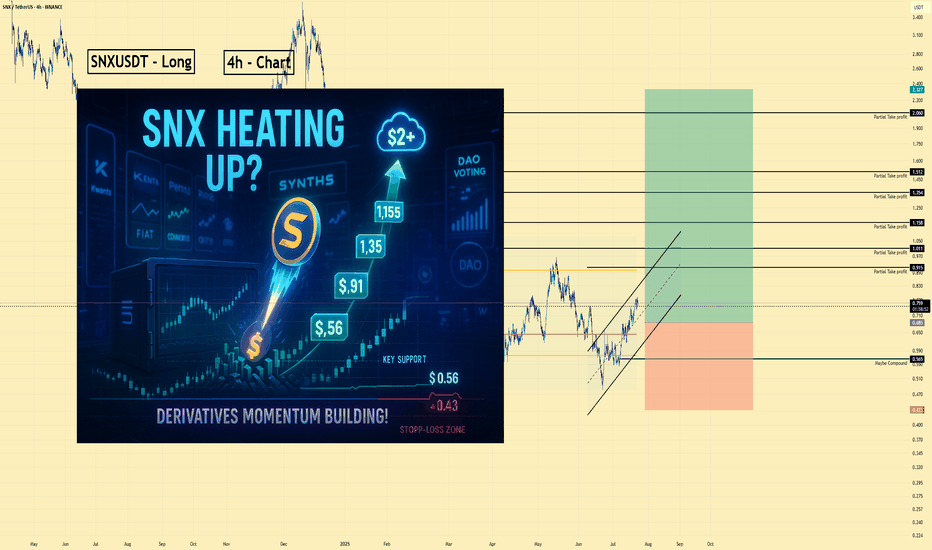

SNX/USDT | Long | Synthetic Derivatives| (July 2025)SNX/USDT | Long | Synthetic Derivatives Rebound with DAO-Driven Growth | (July 2025)

1️⃣ Short Insight Summary

SNX is showing signs of strength again with Perps V2 expanding and DAO governance maturing. With inflation removed and rewards now tied to protocol fees, real usage is starting to reflect in price. Recent gains and strong structure suggest a possible continuation.

2️⃣ Trade Parameters

Bias: Long

Entry: Current zone around $0.75–$0.77

Stop Loss: $0.43 (structural invalidation, below consolidation)

TP1: $0.91

TP2: $1.15–$1.18

TP3: $1.35

TP Final: $2.00+ (longer-term if synthetic derivatives adoption continues)

Partial Exits: At each level to reduce risk and lock in profits

3️⃣ Key Notes

✅ SNX recently gained ~17% in a week on growing DeFi activity and interest in leveraged synthetics

✅ No more inflation — staking rewards now come from real usage, making SNX more sustainable

✅ DAO governance has matured with Spartan Council and Perps V2 rollout, making the project more nimble

❌ Synthetic derivatives are complex—new users may struggle with onboarding

❌ Regulatory risk remains around derivative products and stable synthetic assets

❌ Reliance on oracle performance means smart-contract integrity is critical

4️⃣ Optional Follow-up Note

Watching for a clean breakout above $0.91. If volume confirms, I’ll consider adjusting targets upward and reviewing the setup again.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not a financial advise. Always conduct your own research. This content may include enhancements made using AI.

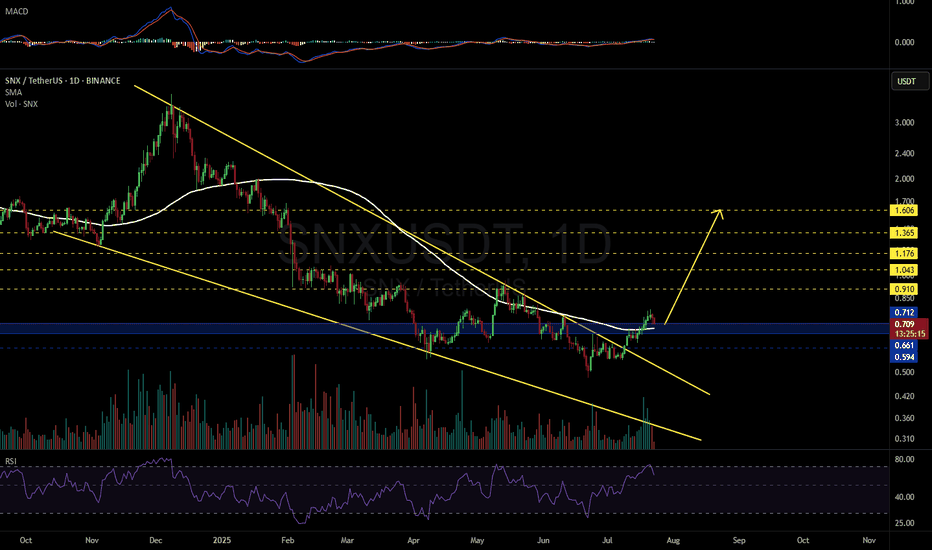

SNXUSDT 1D#SNX had a strong bullish rally after breaking out of the falling wedge. It is now in a corrective phase, and the support zone at $0.712–$0.661 is a good area to consider buying — especially since the daily SMA100 is within this zone.

In case of a deeper dip, we’ll look to buy around $0.594.

If a successful bounce occurs, the targets are:

🎯 $0.910

🎯 $1.043

🎯 $1.176

🎯 $1.365

🎯 $1.606

⚠️ Always use a tight stop-loss and practice proper risk management.

SNXUSDT UPDATE

Pattern: Falling Wedge Breakout

Current Price: \$0.605

Target Price: \$0.95

Target % Gain: 60.31%

Technical Analysis: SNX has broken out of a falling wedge on the 12H chart, signaling a bullish reversal. The breakout is confirmed with strong green candles, indicating momentum buildup and a potential rally toward the target.

Time Frame: 12H

Risk Management Tip: Always use proper risk management.

SNXUSDT Tracking Final Leg of Downtrend or Reversal SetupSNXUSDT remains in a downtrend despite breaking its trendline, with price action still dipping. The current focus is on the potential completion of Wave 5, targeting the projected re-accumulation zone but this setup only activates if $0.548 support breaks.

If this level holds, a rebound could drive price toward the upside targets already outlined. On the flip side, a sudden breakout above $0.96 would invalidate the drop scenario entirely.

What’s your take on this structure? Drop your thoughts below

SNX About to Explode or Collapse?Yello Paradisers, are you watching SNXUSDT closely? Because if not, you might be missing one of the cleanest opportunities for bulls in this current market cycle. The setup is forming right at a critical decision point — and how price reacts here could define the next major move.

💎SNXUSDT is currently showing a bullish internal CHoCH (Change of Character) while trading directly inside a strong support zone. This zone isn’t just standing alone — it’s backed by the powerful 200 EMA and a well-respected support trendline. This confluence of support significantly increases the probability of a bullish bounce from this level, making it a high-reward setup for those paying attention.

💎Zooming out to the higher timeframe, the structure becomes even more interesting. SNXUSDT appears to be forming a bull flag pattern — a bullish continuation signal that often precedes explosive upside moves. When such a formation aligns with key support zones, it suggests that the market is simply consolidating before the next leg up.

💎However, traders must proceed with caution. If price breaks down and closes below the current support zone, this would invalidate the entire bullish scenario. In such a case, it’s best to step aside and wait for better confirmation rather than rushing into a compromised setup. Emotional decisions are the fastest way to ruin sound trading strategies.

🎖Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. Discipline, patience, and strategic entries will always outperform emotional trades. Stay focused, Paradisers — the opportunity will always favor those who are prepared.

MyCryptoParadise

iFeel the success🌴

#SNX/USDT#SNX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.827.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.880

First target: 0.900

Second target: 0.943

Third target: 0.977

#SNX/USDT#SNX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.711.

We are seeing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 0.744

First target: 0.765

Second target: 0.785

Third target: 0.811

SNXUSDT Bouncing from Channel SupportSNXUSDT Technical analysis update

SNXUSDT has been trading inside a clear descending channel for the last 1700 days. Recently, the price touched the lower support of the channel and is now showing signs of a bounce.

If the current momentum continues, SNX could move upward toward the upper resistance of the channel. A breakout above the upper trendline would be a strong bullish signal. Until then, the price may stay within the channel.

Price could move 100%-250% in a few months.

SNX Analysis (1D)SNX has broken an old trigger line and is also forming a CP within a channel.

We are looking for buy/long positions in the Demand zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

Is SNXUSDT About to Make a Big Move? Yello, Paradisers! SNXUSDT has shown an ideal retracement, setting up a high probability for a bullish bounce from the current support zone.

💎There’s potential for a W-pattern formation here. If the price successfully breaks out and closes candle above the resistance level, this would significantly increase the likelihood of a bullish continuation.

💎However, while a bullish move is possible, the probability at this stage is relatively low, making it a scenario worth watching but not acting on just yet.

💎If panic selling or a deeper retracement occurs, the strong support zone below may offer a favorable bounce. To increase confidence in this setup, we need to see a bullish I-CHoCH (internal change of character) on lower timeframes.

💎On the flip side, if SNXUSDT breaks down and closes candle below the strong support zone, the bullish thesis will be invalidated. In that case, it’s best to remain patient and wait for more favorable price action to develop.

🎖Always remember, Paradisers, discipline and patience are the keys to consistent profitability. Avoid making emotional decisions and stick to your strategy. The market rewards the patient!

MyCryptoParadise

iFeel the success🌴

SNX's bullish situationBINANCE:SNXUSDT

what is better than an already broken falling wedge!

The expected resistance and targets are shown on the chart!

⚠️ Disclaimer:

This is not financial advice. Always manage your risks and trade responsibly.

👉 Follow me for daily updates,

💬 Comment and like to share your thoughts,

📌 And check the link in my bio for even more resources!

Let’s navigate the markets together—join the journey today! 💹✨

SNX|USDT 1 Hour Timeframe Distribution Setup Leaving a massive liquidity in the bottom is too scary to go long. So finally market take the previous re-distribution liquidity with very low volume that is suspicious. And now I like to see price is backing down to this liquidity and then we go for long safely.

Right Now we must look for a Spring and then make a short position until it grabs all the buying limit orders.

SNXUSDT UPDATESNXUSDT is a cryptocurrency trading at $1.865. Its target price is $3.000, indicating a potential 60%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about SNXUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. SNXUSDT is poised for a potential breakout and substantial gains.