SOLANA trade ideas

Roadmap for -60% in Crypto Alts The other day I posted the confluence of resistance patterns in alts. They are now down 10 - 25% depending how much of a gamble the bet was (My idea is if the price starts 0.00000 then there are numbers, this is probably a gamble).

Let's now map the typical downside break path. We're going to use the norms of breaks of 1.27 - 1.61 zone. 2.20 - 2.61 zone and a final target of 4.23.

These are typical things I see in trend development (be it bull or bear).

All updates to:

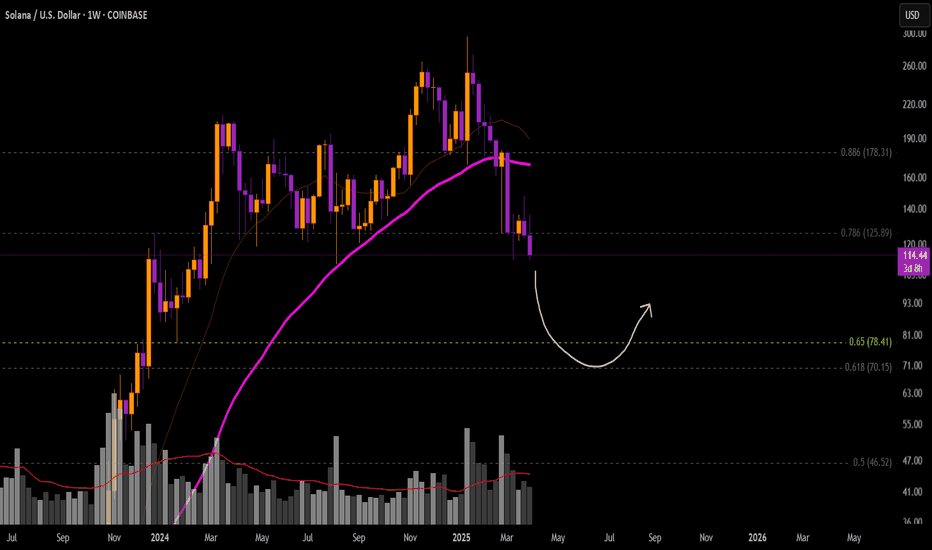

SOL in the golden pocket areaI believe that we have arrived in the golden pocket area (between 0.618 and 0.65 on the fib). This could be the most probable reversal area, however with the market turmoil, not even the lord knows. If we can hold above 96, then a reversal could be in place. DYOR and let me know what you think.

Crypto Sell-Off: Is Solana Headed for $80?Without a doubt, Solana was the hottest topic in the crypto market last year and at the start of this one—especially with the meme coin craze.

However, after peaking near $300, the price began to decline in what initially appeared to be a normal correction. But once Solana broke below the $200 mark, things turned ugly, and the price quickly dropped to the key $120 support zone—a level that held strong over the past year.

Now, it looks like Solana is on the verge of breaking below this support, which could trigger an acceleration toward $80, with the $100 psychological level as an intermediate stop.

________________________________________

Why the Downside is Likely to Continue

📉 Bulls Can’t Hold Gains – Short-term rallies are fading fast, showing a lack of real buying strength.

📉 Bearish Engulfing Candle – Yesterday’s price action printed a lower high, adding further pressure on support.

📉 $120 Breakdown Incoming? – If this level fails, expect a sharp decline toward $80.

________________________________________

Trading Plan: Selling Under $130

🔻 Sell Rallies Below $130 – Targeting a move to $80 in the medium term.

🔻 Only a Sustained Move Above $130 – Would shift Solana to a neutral stance—not bullish by any means.

For now, the bearish pressure remains, and selling rallies is the strategy to follow. 🚀

Resistance Levels in altcoins Concurrent with the indices being at major inflection points crypto has broadly also filled major inflection points.

Let's look at the different setups.

First we have SOL in the main chart. Inset is the BTC high before the 2022 bear market. Different in a few ways but both the same general idea of a nominal spike above the previous high that fits inside of a harmonic pattern.

Most of the things we're going to be looking at have extreme bullish momentum at time of writing but the patterns we're going to be looking at all forecast extreme momentum into their fills. For example, in SOL we are using a harmonic. If this was the end of a harmonic, we'd have just seen the D leg.

It is a hard set rule of all harmonics that the most aggressive part of the move is the D leg. Always. The defining characteristic of a D leg is exceptional momentum that builds to the point of looking unstoppable. So anything based on momentum, breaks of anything that's not the actionable fib levels, candle patterns etc - these are all annulled.

The D leg is defined by being exceptional by all momentum metrics.

I'm sure the other recurring point made against my ideas here will be the halving cycle break out and it's not being enough days yet etc etc. I still have my doubts about the efficacy of the halving thing. I need longer to determine 4 year cycles. Breakout did come right when predicted through. Well done to those who benefited from that.

My stance on the halving theory hasn't changed because

when people brought it up before I always just told them I don't care. I'm trading TA patterns. They'll get me out early if I am wrong. I'm going to make 1,000s of trades in my life - lots of them will be wrong. It's fine. Everything you can explain with the halving I can explain with fib breaks.

And it's still conspicuous to me that BTC and indices continue to move in tandem. Meaning we'd have to class the halving as coincidence or a driver of indices moves.

But none of that matters to me. The TA implications if the reversal patterns fail here are quite similar to the bulls halving forecasts. If we break we may end up agreeing on the same thing for different reasons. Or if this is just stop gaming / FOMO inducing, we should be at or very near the end of it now.

I like the fibs.

Here's some other patterns;

KEEP TRADING SIMPLE - BTCGood Afternoon,

Hope all is well. We are trading in a downtrend so please be careful, these need to be quick and calculated moves before determining if there is a reversal.

Volume is building, so is the support, this is a good spot to focus on a short term trade.

I have bought at this support level which is forming and will exit at resistance unless I see the trend hold and continue.

Have a great night.

BTC

Solana - The Bullrun Is Not Over Yet!Solana ( CRYPTO:SOLUSD ) might create another move higher:

Click chart above to see the detailed analysis👆🏻

As we are speaking Solana is sitting at the exact same level as it was about 3.5 years ago in the end of 2021. In the meantime we saw a lot of volatility and Solana is now once again retesting a major previous support level. Despite the harsh recent drop, the bullrun remains valid to this day.

Levels to watch: $120, $250

Keep your long term vision,

Philip (BasicTrading)

SOLANA LONG Bullish Testing SupportNever the less as Solana trend looks bearish(Only from the point of view of price action traders, ema traders, breakout traders) and I DONT SHARE this opinion,because I use another TA to define the trend.

Monthly VP is at 0.02%, for VP traders it is bullish( while MA tradrs say it is bearish).

The price of solan is at historical lowest point of VAL(18 month volume profile).Therefor at this point sellers and buyers dont find an accepted price .If the sellers want to push down theprice,the number of buyers reduces.This leads to a market balance,as now many imbalances have been restored.While EMA,SMA and many other indicators are lagging indicators,they react when the show is over!!!!!!,VP delivers price information real time

Also now commercials starting buying solana(COT report) while speculators selling it(Speculatorsare90% of time wrong)!

Ofcourse many would suggest that we have bearish sentiment dat,inflation, recession etc.

Fundamentlas show their impact alsotoo late. And all these information are priced in.

Ok now to my setup:

We have tested the support twice successfully. Solana can start to move in TP 1 direction.

If price reaches tp1

and continues to move ahead,this will be a good sign that Solana bulls gaining more control, while sellers start to take profit.

If TP 1 rejects,we expect that solana will fall back to support going for TEST 3.

IF SUPPORT TEST § WAS SUCCESSFUL.tHAT MEANS sOLAN CANNOT BREAK THIS SUPPORT THE MARKET STARTS TO MOVEUP QUICKLY to TP 2,3,4 and 5

If solana not successful, then it targets 115% Fibo retracement, and then 127% and so on. For us it means to wait until one of the retracement levels rejects

I buy there where others put their stops,because their stop management is planned by price action, that everyone can see.Therefor 90% of time they fail.

DO OR DIE... Sol to 70 or 300 ?Solana coluldn't hold the key level at 125 and kept testing the 112 area. With a decisive break of 112 i m looking for 70$ COINBASE:SOLUSD for next 3 weeks. With that said , if we can hold the current level i m looking for all time high retest if btc also holds its own levels. Goodluck everyone.

KEEP TRADING SIMPLE - SOLUSDGood Morning,

Hope all is well. SOL has reached a support area. Trend is showing Bullish. we had a minor break out which ended up being a fakeout/ possibly the start of another descending triangle.

Bearing volume is fading, although bullish volume is also not increasing, signalling further consolidation.

I will be waiting for further confirmation to enter a trade.

Thanks

SOL/USD Technical Analysis (March 31, 2025)🔹 Potential Scenarios:

✅ Bullish Path (Green): If the price holds above the Golden Pocket (119.89 - 121.15) and breaks 147.38, it may continue rising toward 165-176 and possibly 201-210.

❌ Bearish Path (Red): A drop below 112.40 could push the price toward 109-119, and further breakdown may lead to 78-86 or even 51-57 in extreme cases.

🔄 Neutral/Alternative Path (Yellow): If support holds but no strong breakout occurs, the price may consolidate and later move in either direction.

💡 Key Levels to Watch:

Resistance: 147.38, 165-176, 201-210, 272+

Support: 119-121 (Golden Pocket), 112.40, 78-86, 51-57

📌 Keep an eye on price reactions at these levels to confirm the next move.

SOL/USD 4H ChartHi everyone, let's look at the 4H SOL to USD chart, in this situation we can see how the price broke out from the local uptrend line at the bottom.

Let's start by defining the targets for the near future that the price has to face:

T1 = 131 USD

T2 = 136 USD

Т3 = 145 USD

Т4 = 151 USD

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = 122 USD

SL2 = 115 USD

SL3 = 107 USD

If we look at the RSI indicator we can see how the indicator has dynamically gone up despite the price not moving much, but here we can see that there is still room for a potential attempt to grow.

Solana Ready to Soar? Key Entry for a Big Move!Hi traders! Analyzing Solana SOL/USD on the 1H timeframe, spotting a potential entry:

🔹 Entry: 126.31 USD

🔹 TP: 139.82 USD

🔹 SL: 112.95 USD

SOL is bouncing off a key trendline support, signaling a potential bullish move. RSI is recovering from oversold levels, and if momentum continues, we could see a push toward 139.82 USD. Keep an eye on price action!

⚠️ DISCLAIMER: This is not financial advice. Trade responsibly.

Further downward momentum for SOLWith the failed attempt to breach the bearish resistance, it takes us back to the downward trend tunnel, and with the Sell signal triggering on the daily, I believe we could see a further retracement to around the 107-113 area. The RSI also just crossed itself, which further supports my belief. Let me know what you think! DYOR

SOLUSD Solana Bullish Change: LongAs I published yesterday the bearish trade setup,shortly before reaching the profit target,I have closed it manually and updated below the trade idea in the comment section,to inform you. Because of bullishness of tech,and weaker USDolalr, now crypto,specially Bitcoin, Solana and Eth following Tech: Bullish.

Important:

177.93 (red line9 IS MAJOR RESISTANCE: AND PROTECTED TWICE BY THE EBARS;WHO CONTROL THAT REGION:

Once broken Solana can climb higher to 228-244. If not, we will face sudden fast drop down, and possible midterm bearish sideways:

aS IT WILL BE THE THIRD ATTEMPT OF sOLANA TO BREAK THIS MAJOR RESISTANCE; IF NOT SUCCESSFULLY; WE CAN ESTIMATE BEARISH SIDEWAYS8sALAMI DOWNRUN).

Also it will be possible,that in April 2025 because of Trumps tariffs, the market participants

will liquidate their positions immediately,capital outflow.

Currently as Godl and silver also bearish,check my other ideas, the bullish trendchange is cinfirming.

Neverthe less I mad 4 different setups and profit targets,to help ya making better decisions.

Additionally expect the unexpeted:If the market conditions change before your profittarget reached,take that profit and prepare for the other direction.

Volatility and many unexpected events awaiting us.

I,for my part,ignore news, even what Trump says,and just focus to the chart, because it tells exactly when then market starts to change its direction.So I recommand ignoring the hype and news, but being focused on what the market and price does:The market is always right!

Have a nice day.