SOL/USD – The War Between Discount & Premium Zones Is Heating Up📈 SOL/USD – The War Between Discount & Premium Zones Is Heating Up

Posted by: WaverVanir_International_LLC

Date: July 12, 2025

Asset: Solana (SOL/USD) | Timeframe: 1D

Strategy Stack: SMC | Fibonacci | Volume Profile | Macro | Catalyst | VolanX DSS Protocol

🔍 Technical Summary

SOL is battling near the 0.5 Fib retracement (~$167), a classic inflection zone. Price is compressing within an equilibrium band bounded by $145–$175. Despite a prior break of structure (BOS) to the downside, recent CHoCH and bullish BOS patterns suggest accumulation may be underway.

Key Zones:

Support (Discount): $123.46 → $103.18 → $82.91

Resistance (Premium): $189 → $235 → $263

High-Conviction Targets:

Bullish Extension: $295 → $360 → $402

Bearish Sweep Zones: $103 → $80 (liquidity pockets)

Structure Readout:

CHoCH (Mar–Apr 2025) suggests reversal potential.

BOS (May–June 2025) confirmed demand stepping in.

Current: Price testing equilibrium mid-zone, low conviction until a clean break of $175 or a flush into $130.

🌐 Macro Context (Q3 2025)

🏦 Federal Reserve Policy

FOMC paused in June, signaling data-dependency.

Market pricing 30–50bps cut by Q4 2025.

Liquidity-sensitive assets like crypto are forward-looking, already attempting to front-run easing.

💰 Global Liquidity Shift

US M2 money supply stabilizing after 2022–2024 contraction.

Global CBs (e.g., ECB, BOJ) showing coordinated signals of easing.

Risk-on flows resurging into high-beta assets → Crypto stands to benefit on the second leg of liquidity wave.

💻 Tech/Crypto Catalysts

Solana Ecosystem rebounding on strong developer metrics, NFT integration, and institutional onboarding (Visa, Shopify integrations).

Tokenization narrative gaining momentum with TradFi firms exploring SOL-based infrastructure.

Regulatory Clarity: US & EU moving toward crypto-safe harbor legislation; positive for altcoin allocation.

⚠️ VolanX DSS Signal Matrix

Module Signal Confidence

Trend Structure Transitional (CHoCH → BOS) Moderate

Fibonacci Levels Compression (0.5–0.618) High

Volume Profile Thin above $175, HVN near $145 High

Macro Liquidity Rising global flows Moderate

Catalyst Tracker Positive (SOL-specific) Moderate

🎯 Execution Framework (2 Scenarios)

🔵 Bullish Bias (Continuation):

Entry Zone: $157–$162 (with SL below $145)

Trigger: Break + close above $175

Targets: $189 → $235 → $263

Invalidation: Daily close below $141.5 BOS zone

🔴 Bearish Bias (Rejection):

Short Zone: $175–$189

Trigger: Rejection w/ CHoCH + imbalance fill

Targets: $145 → $123 → $103

Invalidation: Clean break above $195 with volume

📜 WaverVanir Risk Advisory

This outlook is generated under the WaverVanir DSS (Decision Support System) and is shared strictly for educational and analytical purposes.

We do not manage outside capital, and none of this constitutes investment advice. All systems are probabilistic and adaptive, not deterministic.

🧠 Final Notes:

Solana is at a macro hinge point. Either the liquidity-driven expansion phase begins with force — or we get one more sweep into deeper discount zones before lift-off. With global liquidity expanding and catalysts aligning, the next few weeks will define the rest of 2025’s structure.

💬 Drop your thoughts below.

🔁 Follow @WaverVanir_International_LLC for high-conviction, system-generated macro + SMC trading insights.

🌍

SOLANA trade ideas

SULUSD Cup & HandleHi All, SOLUSD in a textbook cup & handle pattern. It might break sooner than indicated. Current price is a steal imo. Keep an eye for a strong breakout. Not financial advice. If you enjoyed the content of this analysis, please do leave a like for future updates. Lets crush this market. Be safe.

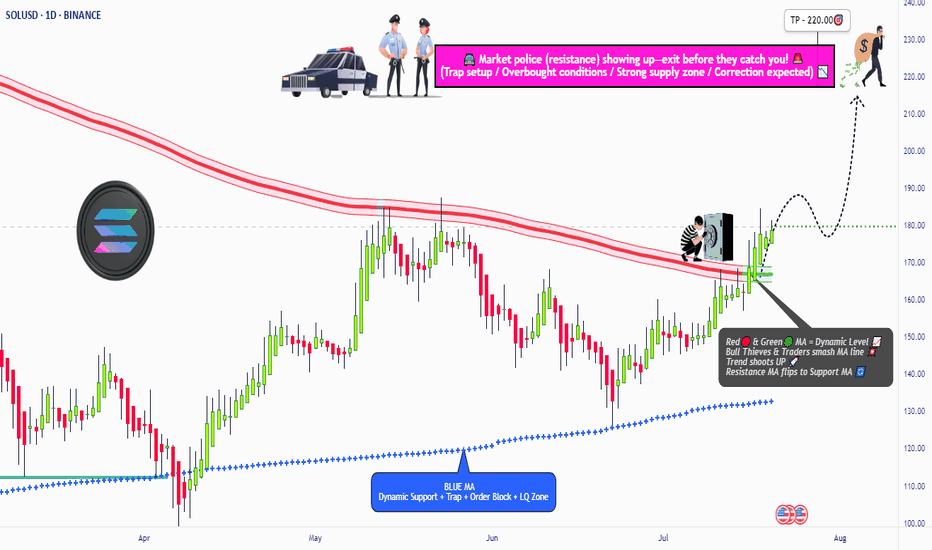

"Solana Heist in Progress! Will the Breakout Hold or Fake Out?"🔥🚨 "SOLANA HEIST ALERT: The Ultimate Bullish Raid Plan (Breakout or Fakeout?)" 🚨🔥

🌍👋 Greetings, Market Pirates & Profit Bandits!

(English, Spanish, Portuguese, French, German, Arabic—we speak MONEY.)

💎 STRATEGY BASED ON THIEF TRADING STYLE 💎

(High-risk, high-reward—steal the trend or get caught in consolidation!)

🎯 MISSION: SOL/USD (Solana vs. Dollar) CRYPTO HEIST

🐂 Direction: LONG (But watch for traps—cops & bears lurk nearby!)

🚀 Escape Zone: ATR line (High-Risk Profit-Taking Area)

⚠️ Warning: Overbought? Reversal? Police line at resistance? TAKE PROFITS EARLY!

📈 ENTRY: "THE BREAKOUT HEIST BEGINS!"

Trigger: Wait for candle close ABOVE 148.50 (MA)

Alternative Entry: Buy stop above MA OR buy limit on pullback (15m-30m TF)

🛎️ SET AN ALERT! Don’t miss the breakout—thieves strike fast.

🛑 STOP LOSS: "DON’T GET CAUGHT!"

Thief SL: 136.00 (2H Previous structure Swing Low) (Adjust based on your risk & lot size!)

⚠️ Warning: If you ignore this, you’re gambling—your loss, not mine.

🎯 TARGET: "LOOT & BOUNCE!"

🎯 167.00 (or escape earlier if the trend weakens!)

🧨 Scalpers: Only play LONG—use trailing stops to lock in gains!

📢 NEWS & RISK WARNING

🚨 Avoid new trades during high-impact news! (Volatility kills heists.

🔒 Use trailing stops to protect profits if the market turns.

💥 BOOST THIS HEIST! (More boosts = more profit raids!)

👉 Like ✅ | Follow 🚀 | Share 🔄

💬 Comment your take—bullish or bearish trap?

🚀 Next heist coming soon… Stay tuned, bandits! 🤑

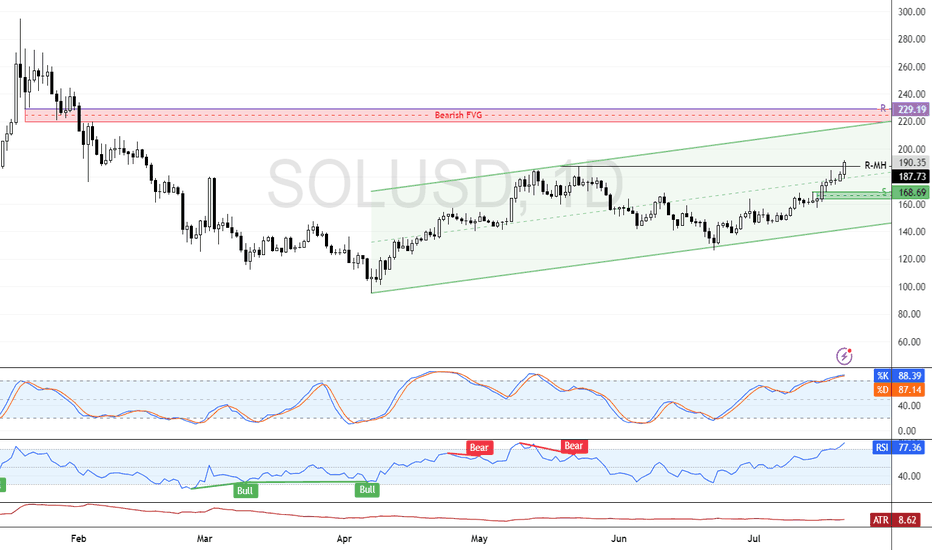

SOL Triangle Breakout + Fib Confluence – Aiming for $190+Solana (SOLUSD) just broke out of a multi-month triangle on the 8H chart, signaling a potential reversal and continuation toward previous highs.

Key Highlights:

🔹 Break of Structure (BOS): Price broke through descending resistance, flipping momentum in the bulls’ favor.

🔹 Fibonacci Confluence: Bounce came cleanly from the 0.5–0.618 zone ($129–$140), adding high-probability support.

🔹 Triangle Apex Break: Consolidation is over — the arrow is launched.

🔹 Targeting Previous Highs: $185–$190 range is in sight, with historical resistance marked.

🔹 Risk Defined: Stop idea near the previous low and triangle base (~$115).

⚠️ Watch for confirmation candle closes and volume follow-through — the move is just beginning.

SOL/USD in Clear Downtrend – Short Setup in PlayHi traders! , Analyzing SOL/USD on the 30-minute timeframe, price is currently moving within a defined descending channel, respecting lower highs and lower lows. A recent rejection from the channel top suggests continuation to the downside.

🔹 Entry: 150.09

🔹 Take Profit (TP): 145.47

🔹 Stop Loss (SL): 154.51

The price failed to hold above the 200 EMA and has resumed its downward trajectory. The RSI shows a recent bounce from overbought levels, supporting the bearish momentum. This short setup offers a favorable risk-reward ratio within the context of the broader downtrend.

A clean rejection at resistance and confirmation of the trendline add confluence to this trade idea. Keep an eye on the 145.47 zone, where buyers may attempt to defend the support.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.

SOLUSD – Snapped Back FastSOL broke down hard from $154 into $146 before staging a V-shaped rebound. After reclaiming $151, price surged back into $153+ and is now consolidating near highs. Short-term trend is strong, but $153.80–$154.20 is a key resistance zone. Above it opens door to $156+. Break below $151 = caution.

"SOL/USD BULLISH HEIST! Steal Profits Like a Pro"🏆 "SOLANA HEIST ALERT! 🚨 Bullish Loot Ahead – Thief Trading Style (SOL/USD)" 🏆

💸 Steal Profits Like a Pro – Day/Swing Trade Plan 💸

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

Hola! Bonjour! Hallo! Marhaba! 🤑 Dear Thieves & Trend Snipers, the SOL/USD vault is WIDE OPEN! Time to execute the heist with precision.

🔥 THIEF TRADING MASTER PLAN 🔥

🎯 Mission: LONG SOLANA (Escape Near Blue ATR Line)

⚠️ Danger Zone: Overbought | Consolidation | Bear Trap Ahead

🏆 Rule: "Take Profit & Treat Yourself – You’ve Earned It!" 💪💰

📈 ENTRY STRATEGY (The Heist Begins!)

"SWIPE THE BULLISH LOOT!" – Enter at any price, but smart thieves use:

Buy Limit Orders (15-30min timeframe)

Swing Low/High Pullbacks for optimal entry

DCA/Layering Strategy (Multiple limit orders for max loot)

🛑 STOP-LOSS (Escape Plan)

📍 Thief SL: Below nearest low (Daily MA @ $160.00)

⚠️ Adjust SL based on: Risk tolerance, lot size, & DCA layers.

Pro Tip: Tighten SL if market flips bearish!

🎯 TARGETS (Profit Escape Routes)

🎯 Main Take-Profit: $220.00 (or exit earlier if momentum fades)

🧲 Scalpers: Only LONG! Use trailing SL to lock gains.

💰 Big Bank Thieves: Go all-in. Smaller Raiders: Join swing traders.

📰 WHY SOLANA? (Fundamental Boosters)

Bullish Momentum (Tech + Sentiment Driving Price)

Macro Trends, On-Chain Signals 👉 Check Liinkss 🔗

Intermarket Analysis: Crypto & equities syncing for gains!

⚠️ TRADING ALERTS (News & Risk Control)

🚨 News = VOLATILITY! Avoid new trades during major releases.

🔒 Protect Running Trades: Use trailing stops to secure profits.

💥 SUPPORT THE HEIST! (Boost & Win Together) 💥

🔥 Hit the "LIKE" & "BOOST" button to strengthen our Thief Trading Squad!

🚀 More Heist Plans Coming Soon – Stay Tuned! 🤑🎉

📌 Reminder: This is NOT financial advice – DYOR & manage risk!

Solana/Ethereum Pair Flipping?$SOL/ CRYPTOCAP:ETH ratio may soon decline as Ethereum shows relative strength. ETH's new upgrade on scaling solutions and DeFi dominance could outpace Solana's momentum. Watch for ETH outperformance! #Crypto #Ethereum #Solana

Chart pattern is now showing a classic Elliot wave bearish ending diagonal pattern which will be confirmed when ratio breaks back below the prior all time high of 2022

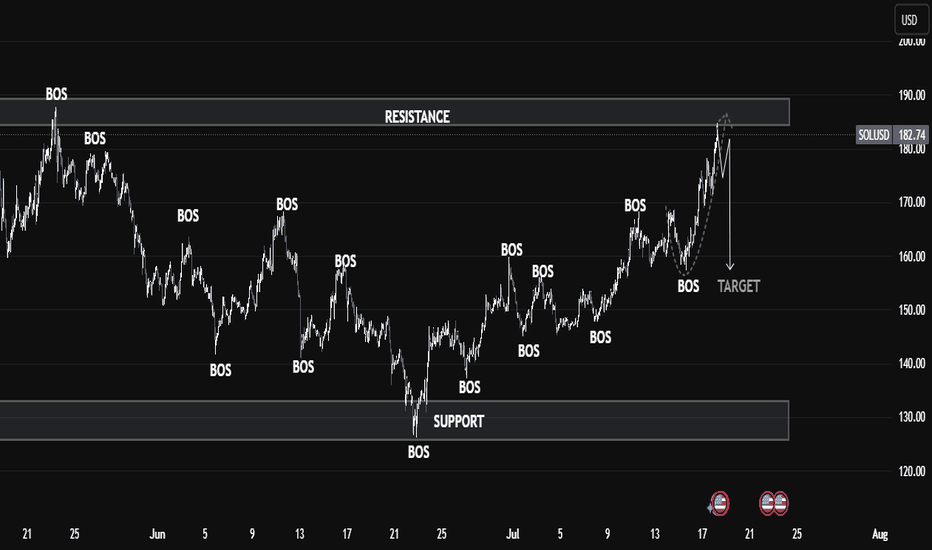

SOLANA Smart Money Breakdown 🔍 SOLANA (SOL/USD) Technical Analysis – July 18, 2025

Solana (SOLUSD) is currently reacting to a major resistance zone around the $185–$190 level, as shown in the chart. Price has rallied strongly from the support area near $130, breaking several market structures (BOS – Break of Structure) on its way up.

🧠 Smart Money Insight:

Multiple BOS events indicate strong bullish momentum that pushed price into a premium zone.

Current price action shows exhaustion near resistance, suggesting possible distribution.

🧱 Key Levels:

Resistance Zone: $185 – $190

Support Zone: $125 – $135 (untapped liquidity beneath)

Target Zone: $155 – $160 (where liquidity likely rests)

⚠️ Expectation:

A potential short-term retracement or pullback is expected toward the target area, as indicated by the downward arrow.

This aligns with a classic liquidity sweep setup, where smart money often engineers a false breakout before reversing.

📌 Conclusion:

If SOL fails to close strongly above the resistance zone, it could signal a reversal pattern toward lower support, offering an opportunity for short-term swing traders.

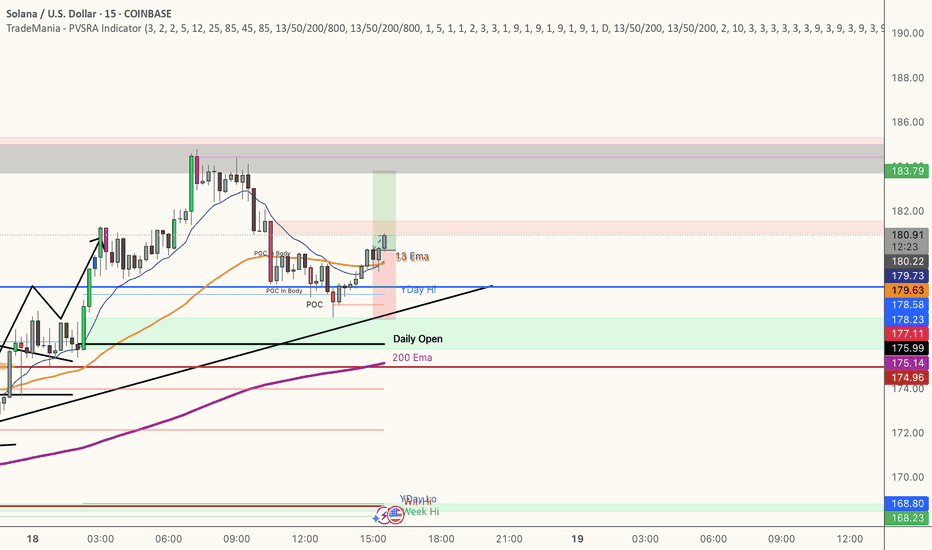

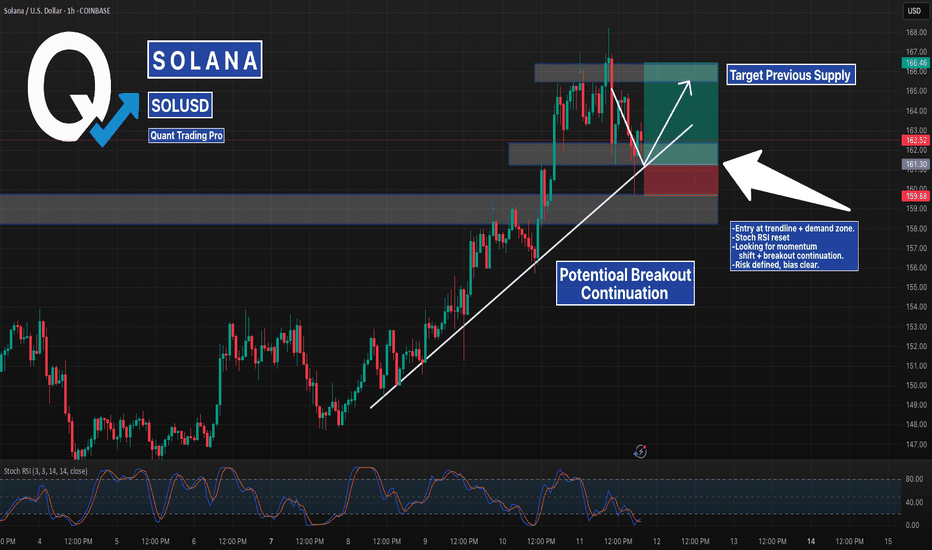

Solana Bounce Setup – Trendline + Demand Zone ConfluenceSOL is testing a confluence zone between rising trendline support and a key demand block around $161–$162. This zone has acted as a springboard for the last leg up and now overlaps with a full Stoch RSI reset on the 1H timeframe.

If price holds this structure, a continuation toward the previous supply zone at ~$166 is in play. Breakdown below $159.68 would invalidate the setup.

📉 SL: Below structural low

📈 TP: Prior high / liquidity zone

📊 Watching candle structure for entry confirmation

#SOLUSD #Solana #PriceAction #TrendlineSupport #CryptoSetup #QuantTradingPro #TradingView

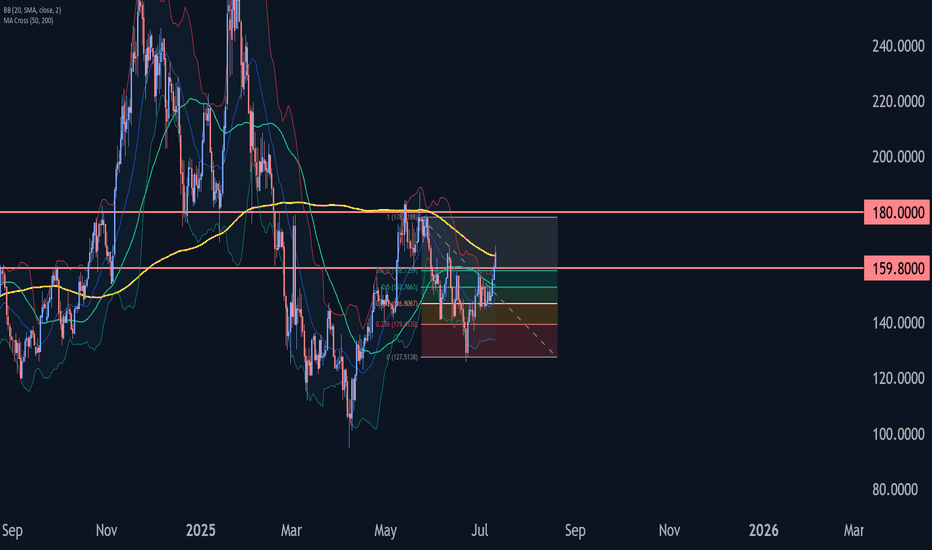

Solana Wave Analysis – 11 July 2025- Solana broke resistance zone

- Likely to rise to resistance level 180.00

Solana cryptocurrency recently broke the resistance zone between the resistance level 159.80 (which has been reversing the price from the start of June) and the 61.8% Fibonacci correction of the ABC correction (2) from May.

The breakout of this resistance zone should accelerate the active impulse waves 3 and (3).

Given the strongly bullish sentiment seen across the cryptocurrency markets today, Solana can be expected to rise to the next resistance level 180.00.

LONG - I am going to add more position when this happensI currently have a small size of long position but I am planning to add more (please see my previous article for my first trade set up), but I am waiting for a certain set up to come up:

Daily:

1) all momentum indicators are entering the bull zone, so there is a plenty of room to move to the upside.

2) The candle has crossed and closed above both EMA 21 and 55, but EMA 200 is currently working as a resistance.

3) EMAs have not crossed and lined up for the bull trend - 21> 55> 200

4H:

1) EMA55 has finally crossed above EMA200!! But when they cross, the price very often has a decent pull back before taking off.

2) Stochastic and RSI are already in the overbought territory which tells me the pull back is likely to happen.

The chart is looking really good for the bull but I am going to wait for the price to retrace to Fib0.5-0.618 zone (see blue rectangular box in 4h chart).

If the price rebounces from that zone and momentum indicators reset to move to the upside, I am prepared to go big on long.

$SOL | Triple Top or Launchpad?Macro to Micro Context:

SOL is now testing a third rejection in the upper 153s, forming a textbook triple top just under a multi-month descending trendline and major Fib resistance. This ceiling has held firm since late June, despite higher lows grinding up from below. Price is now squeezed tightly between compressing demand and stacked supply, with volatility contraction apparent across the board.

The structure is coiling hard but momentum and volume must confirm resolution before positioning aggressively.

Structural & Momentum Breakdown:

Resistance Layering (Reinforced):

Triple Top: Price has repeatedly failed to break above the upper 153s.

Fib Overlap: 50%–61.8% retracement range aligns with both trendline resistance and OB stack.

Order Block Stack: Resistance from mid-153s to low-154s is now reinforced across timeframes (30M → Daily).

Momentum Shifts:

RSI Divergence: Lower highs on RSI across 2H/1H, despite flat or slightly higher price.

PVT Flattening: No fresh accumulation during recent tests.

Volume Decline: Progressive volume deterioration on each retest distributional tone building.

Demand Shelf:

Key demand and support range from low-150s to mid-151s has held through three separate dips.

This is the immediate pivot zone — lose it and vacuum effect likely down into the upper 140s.

Updated Trade Plan:

Rejection Short Setup:

Entry: Breakdown through mid-151s with confirming sell volume.

Stop: Above low-154s to account for potential deviation wicks.

TP1: Upper 148s (first OB cluster).

TP2: Mid-146s (Fib + minor support).

TP3: Low 140s (macro demand + wedge base).

Bear Confirmation: RSI breakdown + volume expansion + OB flips into resistance.

Breakout Setup (Only on Clear Validation):

Entry: Strong candle close above low-154s with breakout volume.

Stop: Below low-151s — invalidation of reclaim.

TP1: Upper 157s (Fib zone).

TP2: Low 160s (swing high area).

TP3: Upper 160s (macro breakout expansion).

Bull Confirmation: RSI > 62 on 2H, strong PVT rise, and flip of local OB into demand.

Risk Warning:

Triple tops near macro resistance are high-risk unless clearly broken. This zone is overloaded with historical rejection. Don't front-run the breakout — volume will show you who's in control.

Closing Thoughts:

With a confirmed triple top now visible, SOL is facing its most important rejection zone in weeks. Bulls must reclaim with strength or this becomes a clean setup for rotation into the mid to low 140s. Patience and confirmation are key here. Keep risk asymmetric.