SOLANA trade ideas

#SOLANA - Pivot Point is $154.20Date: 16-06-2025

#Solana Current Price: 156.37

Pivot Point: 154.20 Support: 150.28 Resistance: 158.15

#Solana Upside Targets:

Target 1: 162.49

Target 2: 166.84

Target 3: 171.58

Target 4: 176.32

#Solana Downside Targets:

Target 1: 145.92

Target 2: 141.56

Target 3: 136.82

Target 4: 132.08

SOLUSD – Reversal Ignition ZoneSOL printed a textbook reversal. After getting slammed down to $126, it found strong support and printed a clean stair-step rise back into $134. Momentum is solid, and higher lows are stacking. The $132.50–$133.00 region now acts as demand. If price pulls back slightly and holds, expect a measured move toward $135.50–$136.50.

Solana Next Buying Zone on WatchCRYPTO:SOLUSD is correcting the 5 waves advance from April low within a 3 waves ZigZag structure and as price slipped to a new marginal low beneath last week’s support, signaling potential weakness toward equal legs area$122 - $111 before buyers look to step in again.

Keeping an eye on reactions in this zone—could set up for a bullish reversal once demand kicks in!

Do not try to buy the dip!!!! It can go lower. My overall bias for Solana is bullish based on its fundamentals. I am a solana investor so I have been accumulating Sol and staking them. I think the price will eventually move up but at this stage I don't see anything bullish in the Solana chart. It is certainly not the buy the dip moment because I can see the price can go much lower from here. (and I can be gladly wrong on this!).

Bearish setups I see in the chart:

1) The $140.50 zone had been working as a support line since April 2025 (red horizontal line in the chart), but the price decisively broke and closed below the zone on Friday.

2) The price has been trapped in the descending parallel channel since early May. Now the price broke below the support line, it might drop further to touch the bottom parallel channel.

3) There is an unmitigated fair value gap (not very strong one) around $125-6 area and the area also was working as a strong support line for several months last year (see blue horizontal line in the chart)

4) There is a large order block at $104 zone. If the downside move is aggressive, it can wick down to this level.

5) The price is below all EMAs.6) EMA 9<14<21<55<200 - Bearish

7) MACD and RSI are deep in the bear zone and they are pointing to the downside.

8) There is a big fair value gap in the weekly chart in the $95 area.

I don't like to go short on the asset I am fundamentally bullish on, so I will just stay on the sideline and observe how the price will unfold in the next few months.

Wait for SOLSOL has been attempting to break through its current all-time high.

At present, price action is pulling back and may soon retest the long-term support trendline.

It’s best to patiently wait for SOL to reach the identified buy zone, as outlined in the chart.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

SOLANA Eyes Recovery After Retesting Monthly LowFenzoFx—Currently, SOL/USD trades at approximately $148.37, testing the previous monthly low, which aligns with a bullish fair value gap and is backed by a high-volume node area.

A close and stabilization above $149.3 can spark the uptrend. In this scenario, the next bullish target could be the $168.38 resistance.

Daily EMA 55 needs to move above EMA 200!!

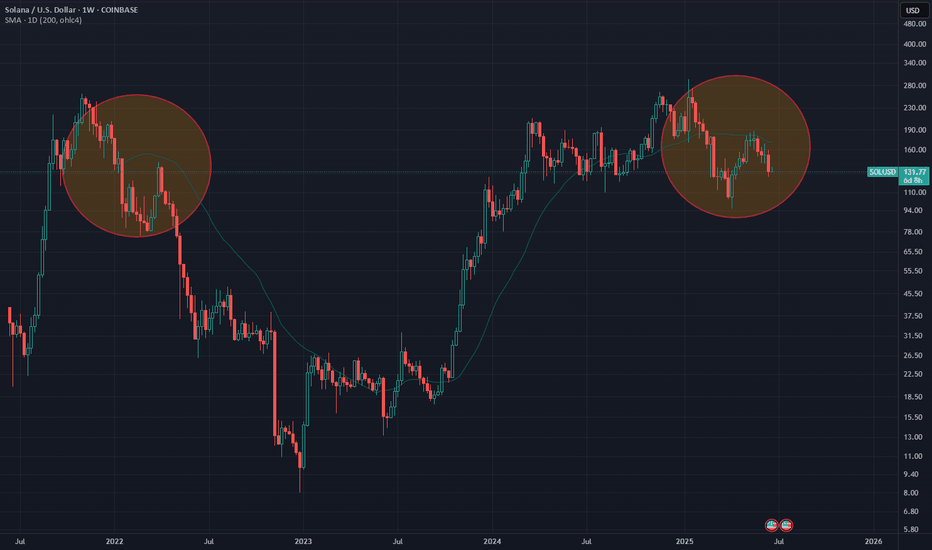

My general bias for Solana is bullish. However, the current setup is very similar to the setup in Feb-Apr 2022 before Solana started a macro bear trend. (see blue rectangular box)

I am still waiting for a long trade opportunity. I am not looking for a short trade. I just need to sit tight and see how the price is going to unfold in the next few months in the daily chart.

The 2022 setup (see blue rectangular box in the chart):

1) EMA55 crossed below EMA 200 on 16th Feb 2022. (red vertical line in the chart)

2)The price found the temporary floor around $80 and sharply moved above both EMA55 and

200. (see light blue rectangular box)

3) It was the dead cat bounce. It was the beginning of the macro down trend.

4)The price spent months and months under $40 in 22 and 23, however, the price eventually

broke above both EMA 55 and 200 and when EMA55 crossed above EMA 200 in Oct

2023 (red vertical line in the chart), the macro bull trend started.

The current setup (see orange rectangular box in the chart):

1) EMA 55 crossed below EMA 200 on the 4th March 2025.

2) The price moved down to $95 area and sharply moved above both EMA 55 and EMA200. However, it failed to stay above them.

3) The price has been oscillating between $140 and $18. The price is still below EMA55 and EMA200. (see orange rectangular block)

In order to start a strong bull trend,

1) the price needs to close and stay above EMA 55 and EMA200.

2) EMA 55 needs to cross and stay above EMA 200. EMA55>EMA200

3) MACD and RSI need to enter the bull zone.

EMA55 and EMA200 do not cross easily (I mean decisively cross). It only happened three times since 2022, however, when they cross, the price moves very aggressively in one direction.

I think Solana is bullish fundamentally. I am not suggesting it is going to start the macro bear cycle. I am pointing out the price is still not showing a clear direction. From a technical analysis point of view, it might take some time before the trend forms. For now, it is only testing my patience!

Solana: Still bullish about this cryptoHello,

I see the current price is at a great value price for Solana investors. The market has corrected by over 22% over the recent 36 days. The MACD is also showing signs of bullish zero crossover further reinforcing that the price is at a good place for bullish investors to begin coming in.

We urge investors who would like exposure to this coin to consider entering at the current price. Please have your stop loss below the trendline and your short-term target at $191.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SOL/USDT Rejected at Key Fib Zone – Bulls’ Last Stand at SupportRecap and Bias

The short-term bullish “orange” bounce scenario from the previous analysis failed to materialize. Solana’s price was rejected near 150, printing a lower high, and has since dropped back into the mid 140s. This confirms that the recent rally was a dead-cat bounce rather than a trend reversal.

The updated bias is cautiously bearish. This stems from rejection at resistance, weakening momentum, and a deteriorating volume profile. Unless price reclaims the 148 to 150 zone with strength, the bears remain in control. Only a decisive breakout above that level would shift the short-term outlook back to bullish.

Macro Context

Global risk sentiment remains fragile. The sudden escalation between Israel and Iran in early June, including reports of missile strikes, sparked a flight to safety. Solana’s rally quickly reversed, with price dropping over 15 percent since June 11.

Other geopolitical flashpoints also continue to weigh on investor confidence. The protracted war in Ukraine and ongoing disruptions in Red Sea trade routes have fueled broader market caution. This is contributing to periodic risk-off moves and spikes in volatility across both traditional and crypto markets.

On the economic side, uncertainty around US monetary policy is adding to pressure. Although May inflation cooled slightly, investors remain cautious ahead of upcoming Fed decisions. Crypto assets have traded weakly into these events, reflecting a wait-and-see approach.

Taken together, this geopolitical and macroeconomic backdrop is driving elevated short-term volatility and a higher risk premium in the crypto space. In this context, market participants are increasingly hesitant to take large directional bets without a clear catalyst.

One such catalyst may be the potential approval of a Solana ETF. Optimism has grown, with prediction markets now placing the likelihood of approval near 76 percent by late July. If approved, this could be a game-changing event that re-rates SOL’s medium-term valuation and breaks it out of its current downtrend.

Until then, traders should remain cautious and assume headline risk is elevated.

Multi-Timeframe Technical Outlook

Daily and 4H Trend

The high timeframe structure shows a clear downtrend. Lower highs and lower lows are intact. A double top formation from May broke down cleanly. Most recently, Solana was rejected at a key Fibonacci confluence zone around 149 to 151, which included the 0.618 retracement, the 20-day SMA, and a well-defined supply zone.

After that rejection, SOL has traded along the lower Bollinger Band with increasing volatility. The 20 SMA is now acting as dynamic resistance. All major trendlines have broken.

2H, 1H, and 30m Perspective

Shorter-term charts show SOL attempting to base near 143 to 145 support. Several oversold RSI conditions have triggered bounces, but these have lacked momentum. Harmonic pattern recognition shows that a bearish Deep Crab completed near 152, which marked the local top.

Currently, price remains pinned below descending trendlines and the 1H 20 EMA. Bullish momentum has yet to reappear in any meaningful way.

Key Technical Factors

Resistance: 149 to 151

This zone holds multiple levels of confluence. It includes the 50 to 61.8 percent retracement of the last swing, a 1.272 Fib extension, the 20-day SMA, and prior supply. The rejection at 151.7 was sharp and decisive. Unless price reclaims this zone, it remains a ceiling.

Support: 142 to 145

This is the last meaningful support zone holding price up. It is the neckline of a 12H Head and Shoulders pattern and the base of a previous multi-week range. It also coincides with the lower bound of a prior rising channel. The 50-day MA and 0.236 Fib retracement are also near this zone. If this area breaks, sellers will likely target 130 to 135 next.

Momentum: RSI 14 with MA Overlay

Daily RSI rolled over from above 70 with bearish divergence as price topped. RSI is now below its MA across all timeframes, reflecting negative momentum. On the 4H chart, RSI dipped below 30 and remains weak despite minor relief bounces. Lower timeframes show early divergence but no confirmed reversal signals.

Trend Structure

Price continues to make lower highs and lower lows. The 200-day MA was lost weeks ago. The 50-day is now flattening near 140. A death cross recently printed on the 12H chart, confirming bearish short-term pressure.

Volume and PVT

Volume favors the bears. PVT is in decline, showing more volume on down days than up days. The rally to 150 occurred on weak volume, while selloffs continue to show increasing size. This signals distribution, not accumulation.

Harmonic Patterns

A bearish Deep Crab pattern completed at the recent high. No bullish harmonics are confirmed yet. Traders should monitor the 130 to 125 zone for potential bullish completion patterns like a Gartley or Bat. If those form with oversold signals, they could mark the bottom.

Green Scenario: Bullish Breakout Path

Bias

Only valid on confirmed breakout

Trigger

Break and hold above 150. Ideally, an hourly close above 150 or daily close above 152 confirms the move.

Confirmation

Rising volume, RSI reclaiming 50, and a PVT uptick. A retest of 148 to 150 from above would reinforce the breakout.

Targets

First target is 155, which aligns with the 12H 50 EMA.

Second target is 162 to 165.

Extended targets include 170 to 180 and eventually the 200 psychological level if ETF news hits.

Stop Loss

Below 147 or back inside the 143 zone would invalidate the breakout and suggest a failed move.

Logic

If bulls reclaim 150 with strength, this would invalidate the lower-high structure. Shorts would begin covering and momentum could quickly shift. Breakout entries should focus on confirmation and volume expansion.

Red Scenario: Bearish Breakdown Continuation

Bias

Default scenario

Trigger

Clean break below 142. Daily close under 140 confirms the H and S neckline break.

Confirmation

Failing retests of 142, rising sell volume, and RSI staying suppressed. Price action showing impulsive red candles validates the move.

Targets

First target is 130 to 135.

Second target is 115 to 120.

Final measured move would project into the 100 to 110 zone if trend acceleration continues.

Stop Loss

Any reclaim of 145 to 148 would likely invalidate the breakdown and trap late sellers.

Logic

If this support fails, shorts will press. Bounces will likely be sold into. Traders can enter on the break or the first failed retest of 142. Consider scaling out near 135 and trail stops from there.

Strategy Summary

Current Bias

Leaning bearish unless bulls reclaim 150

Key Levels

148 to 150 is breakout zone

142 to 140 is breakdown zone

Trading Strategy

Range traders can play 144 to 150 but must be nimble

Breakout traders should wait for confirmation above 150

Breakdown traders can short under 140 with stops over 145

Risk Management

Volatility is elevated. Trade smaller size. Use tight stops and trail them. Wait for confirmation, not anticipation. Watch ETF news closely. If delayed, expect continued weakness.

SOLUSD – Eroding Support, Soft Fade ModeSolana rejected from just above $150 and has been sliding gradually. Price is forming a descending channel, and intraday momentum remains weak. Support near $145 is being tested frequently, suggesting that buyers are losing strength. Expect either a breakdown below $145 or a bounce that will be critical to determine next direction. Short-term traders may look to fade rallies toward $148.50.

Solana bag holders could soon be under pressureSOL prices are getting squeezed, and the price appears stuck in a descending triangle pattern, with a 20% downside potential if key levels break. Weighing on prices are the US economic slowdown and the Israel-Iran war. On the flip side, we may soon hear from the US government, with the President’s Working Group on Crypto expected to release their report before 22 July.

What’s your take on SOL? Will bullish or bearish forces prevail?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Solana (SOLUSD) 4H Analysis – Rejection From Demand ZoneSolana is showing strong signs of accumulation after tapping a key 4H demand zone. Price is now stabilizing above $146 and may be preparing for a bullish push toward key resistance levels.

📌 Key Technical Highlights:

🔸 Strong Demand Zone – $146.92 to $140.00:

This orange zone has served as a launchpad in the past, and recent bullish rejection suggests buyers are active again.

🔸 Mid-Range Resistance – $165.70:

A previous flip zone and potential short-term target. If SOLUSD holds above $146, this level is likely to be tested again soon.

🔸 Major Supply Zone – $183.18:

This level marks a strong overhead resistance from previous highs. A break above $165 would bring $183 into focus.

🔄 Current Market Behavior:

SOL recently formed a double-bottom structure at demand.

Price is now pulling back slightly after a short-term bounce.

If buyers defend the $146 level again, expect a new wave toward $165.

🎯 Trade Setup:

Buy Zone: $146–$150

TP1: $165

TP2: $183

Stop Loss: Below $140

🧠 Insights:

With market sentiment gradually improving across altcoins, Solana is looking primed for a relief rally. A breakout above $165 would invalidate the lower high structure and confirm a trend reversal on the 4H chart.

---

💬 What’s your take on SOL this week? Bullish or still cautious? Drop your thoughts below 👇

📍 Don’t forget to follow for real-time crypto setups and insights!

#Solana #SOLUSD #CryptoTrading #TechnicalAnalysis #FrankFx14 #PriceAction #DemandZone #BullishSetup #LuxAlgo #Altcoins #TradingView

SOL/USDT at Key Inflection Point – Breakout or Rejection?Solana (SOL) is trading at a pivotal zone where price structure, harmonic patterns, and key technical indicators converge. This setup outlines three potential scenarios, guided by fib levels, auto trendlines, and momentum indicators.

Orange Scenario (Moderate Bullish):

Price has recently bounced off the 0.618 Fibonacci retracement (~$149.50), suggesting short-term bullish momentum. However, the orange path indicates a likely move toward resistance around $153–$154.50, where previous structure and upper Bollinger Bands align. Without strong confirmation (e.g., volume spike or RSI breakout), this area may reject further upward movement and trigger a reversal.

Green Scenario (Confirmed Bullish Breakout):

A decisive break and close above $154.50, supported by increasing volume and RSI holding above 60, would signal a breakout continuation. In this case, price may target $158 to $160, completing the bullish harmonic projection and extending the current trend structure.

Red Scenario (Bearish Breakdown):

Failure to hold the $148–$149 zone would validate the bearish harmonic pattern. If confirmed, this breakdown opens room toward lower support zones at $142.50 and $136, especially if PVT weakens further and RSI dips below 50. Downside pressure would likely be amplified by the prevailing downward trendline.

Indicators Used:

Bollinger Bands (BB 20, 2)

Relative Strength Index (RSI 14) with moving average overlay

Price Volume Trend (PVT)

Auto-generated trendlines

Harmonic Patterns (ABCD and XABCD)

Fibonacci retracement and extension levels

Bias:

Neutral at the moment. Awaiting confirmation via price reaction at key support and resistance levels.

Strategy Outline:

Bullish if price breaks and holds above $154.50 (targets: $158–$160)

Bearish if price breaks below $148 (targets: $142.50 / $136)

Short-term scalping opportunity within $149–$153.75 zone pending further clarity

*This analysis is for informational and educational purposes only and does not constitute financial or investment advice. Trading cryptocurrencies involves significant risk and may not be suitable for all investors. Always conduct your own research and consult with a licensed financial advisor before making trading decisions. The author is not responsible for any losses incurred from reliance on this analysis.*

SOL/USDT at Key Inflection Point – Breakout or Rejection? Part 2Solana (SOL) is trading at a pivotal zone where price structure, harmonic patterns, and key technical indicators converge. This setup outlines three potential scenarios, guided by Fibonacci levels, auto trendlines, and momentum indicators.

Green Scenario (Confirmed Bullish Continuation)

A sustained hold above $155, especially if followed by a breakout through $156.50 with rising volume, would confirm the green path. This scenario reflects short-term bullish momentum strengthening, as RSI remains near 60 and PVT continues to climb. If confirmed, price may extend toward $160, with secondary targets in the $165–$172 range, aligning with the upper ascending trendline and harmonic extension.

Orange Scenario (Sideways-to-Bullish Consolidation)

This scenario becomes increasingly likely if SOL remains range-bound between $153.50 and $157.80. This consolidation zone overlays the 50–61.8% Fibonacci levels, Bollinger Band basis, and several key trendline intersections. With RSI holding in the 55–65 range and PVT stable, this setup would favor re-accumulation before another breakout attempt. Price action above $155 continues to support this scenario as the base case.

Red Scenario (Bearish Breakdown)

A breakdown below $153.50, especially if followed by a breach of $150 on high sell volume, would invalidate the bullish thesis. This scenario opens downside risk toward $147.35 and potentially $144.00–$140.00. RSI would likely drop below 50, and a flattening or declining PVT would confirm distribution. This path aligns with the broader red trendline and would indicate a rejection of the recent bullish breakout.

Indicators Used:

Bollinger Bands (BB 20, 2)

Relative Strength Index (RSI 14) with moving average overlay

Price Volume Trend (PVT)

Auto-generated trendlines

Harmonic Patterns (ABCD and XABCD)

Fibonacci Retracement and extension levels

Bias:

Short-term bullish if price holds above $155. Market structure, RSI, and PVT favor upward continuation or consolidation. A break below $153.50 would shift the bias toward neutral or bearish.

Strategy Outline:

Bullish if price breaks and holds above $156.50

Targets: $160 / $165 / $172

Bearish if price breaks below $150.00

Targets: $147.35 / $144.00 / $140.00

Scalping opportunity in the $153.50–$157.80 zone while awaiting directional confirmation

**This analysis is for informational and educational purposes only and does not constitute financial or investment advice. Trading cryptocurrencies involves significant risk and may not be suitable for all investors. Always conduct your own research and consult with a licensed financial advisor before making trading decisions. The author is not responsible for any losses incurred from reliance on this analysis.**

SOLUSD 1D Chart Review1. Main Trend

Downward Channel: Price moving in wide, downward channels (black trend lines), which means that the medium and long term remains bearish.

The upper trend line is a strong dynamic resistance, the lower one – support.

2. Key Horizontal

Resistance (Resistance):

$168.32: Strong resistance level, which it has responded to many times in the past.

$183.55: Another important resistance, confirmed by historical highs.

$218.85: Further resistance with an interval obligation.

$248.30: Very strong, long-term resistance (far from the current price for now).

Support (Support):

$144.23: actually occurs close to this support – very level.

$130.99: Another potential level where price could look for a rebound.

$114.74: Strong support, last bastion of bulls near March/April low.

3. Price action (Price action)

Last candles emitted pullback from downtrend line and down to support area of $144.23.

that any attempt to grow above trend line is limited by sellers.

$144.23 level currently existing short-term support - its loss may be available in case of $131 or possibly existing.

4. Indicator

Stochastic RSI (at the bottom of the chart):

Stochastic RSI indicator stated that airlines (blue and orange) were in power (overbought) in recent devices, but suddenly started to turn down.

Currently occurs in neutral zone, however application of protection (oversold). In case of threat occurrence now, it may suggest risk of attack, but it is not yet decided.

It is worth noting whether to go to the area of 20 and start turning back - in case of a necessary necessity.

5. Scenarios for the days

Bullish (growth):

Maintaining support at 144.23 USD and hitting the downtrend line (around 160-165 USD).

Breaking the trend line and resistance at 168.32 USD will give a signal to load in the area of 183-218 USD, but for the tenth time it seems to be less important, attention given the market structure.

Bearish (fall):

Breaking support at 144.23 USD and closing below on the daily candle - the next target to 131 USD, and then 114 USD.

The downtrend channel is still working against the bulls.

6. Summary

Main trend: downtrend.

Price: Close to support, but the risk of you leaving a big one.

Key horizontals: $144.23 (short-term support), $168.32 (main resistance).

Stochastic RSI: Heading towards oversold zone, but not yet giving a clear conclusion about a breakout.

Recommendation: Observe the application of price at $144.23 and the behavior of Stochastic RSI. In case of a breakout - it is possible that they will occur.

Boom📉 SOLUSD Reversion Entry – Capturing the Recovery

This chart shows a textbook example of how the ELFIEDT RSI + Reversion Strategy can help identify panic-driven lows and offer early reversal signals for a clean intraday recovery.

⸻

🟢 Signal Breakdown:

1. Sharp Drop into Oversold Territory

Solana (SOLUSD) experienced a large, fast selloff, breaking multiple support levels and triggering a flush in price. This type of move often represents emotional or news-driven liquidation — perfect for statistical reversion setups.

2. First “UP” Signal Printed at the Low

The strategy fired a buy signal just as price reached peak selling pressure:

• Price closed well below the lower volatility band

• RSI reached an extreme oversold zone

• The reversal candle marked the turning point

3. Second “UP” Signal on Confirmation

A follow-up signal printed one candle later, offering traders a second chance to enter the reversal with RSI already starting to recover upward.

4. Bounce Followed Shortly After

Price rallied from the lows, recovering several dollars in value and offering a strong mean reversion trade with limited downside risk.

⸻

✅ How Traders Could Have Used This Setup:

• Wait for the first “UP” label to print on a fast drop — especially after a vertical move like this

• Confirm with RSI turning up from deeply oversold conditions

• Use the low of the signal bar as your stop

• Target previous minor support/resistance or the moving average reversion zone as your first TP

⸻

💡 Why This Worked:

The trade worked well because:

• It was a statistical outlier move (rare volatility event)

• Volume and momentum exhaustion were confirmed by RSI

• The script visually identified the moment where price had likely stretched too far

⸻

This is exactly what the ELFIEDT strategy is designed for — catching those high-stress extremes where most traders panic, but structured reversion logic finds opportunity.

SOLUSD AnalysisFollowing the recent geopolitical tensions between Israel and Iran, we saw a sharp sell-off, which broke down from a key support zone. Currently, price action is consolidating within a rising wedge (bearish structure) on declining volume.

The trend remains bearish overall. I expect a potential relief bounce toward the $150 zone, where multiple EMAs and the edge of the Ichimoku cloud could act as resistance. If rejected there, my first downside target is $136 a key horizontal level from previous structure.

Keep in mind: this move is heavily news-driven, so headlines could continue to impact price action significantly.

RSI is still below 50 and struggling to break trendline resistance, which supports the bearish bias.